April 9, 2020

Social Security Tapped More in Downturn

It happened after the 2001 and 2008-2009 recessions, and it will happen again. Some older workers who lose their jobs will turn, in desperation, to a ready source of cash: Social Security.

In the wake of a stock market crash like the one we just experienced, baby boomers’ first inclination will be to remain employed a few more years to make up some of the investment losses in their 401(k)s. But as the economy slows and layoffs mount, that may not be an option for many of the unemployed boomers, who will need to get income wherever they can find it.

Age 62 is the earliest that Social Security allows workers to start their retirement benefits. In 2009, one year after the stock market plummeted, 42.4 percent of 62-year-olds signed up for their benefits, up sharply from 37.6 percent in 2008, according to the Center for Retirement Research (CRR).

Social Security is a critical source of income even in good times. One out of two retirees receives half of their income from the program, and they can also count on it when times get tough.

But the financial cost of starting Social Security prematurely is steep, because it locks in a smaller monthly benefit for the rest of the retiree’s life. For those who can wait, the size of the monthly check increases an average 7 percent to 8 percent per year for each year claiming is delayed up until age 70.

Unfortunately, the people who claimed Social Security early in the wake of the 2001 recession had fewer financial resources to begin with – namely, their earnings were lower, they had less wealth, and they were less likely to have a spouse to fall back on – according to the CRR study.

“These simple characteristics suggest that those hardest hit by recessions are most likely to use Social Security as an income-insurance policy,” the researchers concluded. …Learn More

March 19, 2020

People on Disability Use Payday Loans

Taking out a high-cost payday loan is an act of desperation, and people on federal disability are some of the biggest users.

Nearly 6 percent of households under 66 and on disability use payday loans, compared with 4 percent of the general population, according to Haydar Kurban at Howard University, who did the analysis for the Retirement and Disability Research Consortium.

The financial vulnerability of disability recipients was starkest in the months after the 2008-2009 recession, when their use of payday loans spiked to 22 percent. The rate of borrowing also rose at the time for the general population but by much less.

Disability benefits under the federal Supplemental Security Income (SSI) program average about $900 a month. To eke out a living, people on disability try to supplement their income with food stamps, Medicaid, some work, or housing assistance from the government or a family member – and some use payday loans to raise quick cash. (A small share of people in this study are not disabled but receive SSI to supplement their Social Security benefits.)

Despite the very low incomes of the disability beneficiaries, they are attractive customers for payday lenders, Kurban said, because the benefit checks provide extra assurance the loans will be repaid. …

March 17, 2020

Privilege in the Age of the Coronavirus

I appreciate how privileged my husband and I are that we are able to remain in our home, where we feel fairly safe.

He is a retired Boston high school teacher. I have a good job that also provides me with some degree of flexibility when needed, and my boss didn’t resist, because of my autoimmune condition, when I asked to work at home early last week.

A young couple in my condo building with a new baby fled last weekend to a relative’s house in rural Connecticut, where the husband will be able to telecommute to his high-paying job in Boston.

Yes, our 401(k)s are getting pummeled. But this national crisis is immediate and far more consequential for the millions of Americans who must work even in a pandemic. Workers have two concerns, and they are intertwined: health and money.

Think about the first responders, service-industry workers, or post office employees who are in contact with the public, constantly exposing themselves and, as a result, their families to the coronavirus.

Low-income people are also very vulnerable. Research shows that they are less healthy for reasons ranging from less access to employer health insurance to higher rates of smoking and obesity. Diabetes is more pervasive in low-income populations too.

Yet public health officials tell us that people with underlying conditions are far more vulnerable to getting seriously ill if they contract the virus – and these are the same people who usually don’t have the luxury to telecommute. Many low-income workers also live in crowded conditions, often with older relatives in fragile health.

Many workers are grappling with the realization that the economy is starting to slow down – and they will be the first to feel it. Consider the cleaning ladies or dog walkers whose clients are asking them not to come to the house this week or the servers at the restaurants shutting down in Manhattan, Massachusetts, Illinois, and across the nation. …Learn More

February 25, 2020

Have You Misplaced a Retirement Plan?

Wouldn’t it be nice to find some money sitting in a long-forgotten retirement account somewhere?

It’s not hard for workers to lose track of an old account as they move from employer to employer, often across state lines. Each state government keeps a repository of unclaimed property – most have been doing this since the 1980s – and residents and former residents can check online through a simple name search in the state’s unclaimed-accounts database.

But not everyone takes the trouble to search for the money or is even aware it exists. So billions of dollars have accumulated nationwide in various types of unclaimed accounts, including retirement plans, insurance policies, trusts, and brokerage and bank accounts – so much so that firms have sprung up that will do the legwork required for individuals to claim their money. But little has been known about how much sits idle in unclaimed retirement accounts.

A new study estimates conservatively that about $38 million, accumulated over many years in some 70,000 retirement savings plans nationwide, had not yet been claimed in the states’ property accounts as of 2016. Most of these are 401(k)-style plans but they also include IRAs and pension checks.

The average account value is only about $550. But the largest ones are anywhere from $5,000 to $13,000, which could be meaningful to retirees who are struggling financially. …Learn More

February 6, 2020

Can’t Afford to Retire? Not All Your Fault

Three out of four members of Generation X wish they could turn back the clock and get another shot at planning for retirement. One in three baby boomers say don’t think they’ll ever be able to retire.

“Overwhelmingly, Americans are stressed about their current – and future – financial situation,” the National Association of Personal Financial Advisors said about these new survey results.

Regrets about not planning and saving enough are enmeshed in our thinking about retirement. But it is really all your fault that you’re not getting it done?

The honest answer to that question is “no.” There are big gaps in the U.S. retirement system that make it very difficult for many to carry the responsibility it places on workers’ shoulders.

I predict some of our readers will send a comment into this blog saying, “I worked hard and planned and am comfortable about my retirement. Why can’t you?”

Granted, we should all strive to do as much as possible to prepare for old age, and many people have made enormous sacrifices in preparation for retiring. The hard truth is that some people are much better-positioned than others. Obvious examples include a public employee with a pension waiting for him at the end of his career, or a well-paid biotechnology worker with an employer that contributes 10 percent of every paycheck to her retirement savings account. These workers frequently also have employer-sponsored health insurance, which limits their out-of-pocket spending on medical care. This leaves more money for retirement saving than someone who pays their entire premium and has a $5,000 deductible.

Sure, we could all do a better job of planning out our careers when we’re first starting out. But my husband, as a Boston public school teacher, started accruing pension credits before he could’ve imagined ever getting old. He recently retired, and his pension, accumulated during 27 years of teaching, is making our life a lot easier.

Sure, we could all do a better job of planning out our careers when we’re first starting out. But my husband, as a Boston public school teacher, started accruing pension credits before he could’ve imagined ever getting old. He recently retired, and his pension, accumulated during 27 years of teaching, is making our life a lot easier.

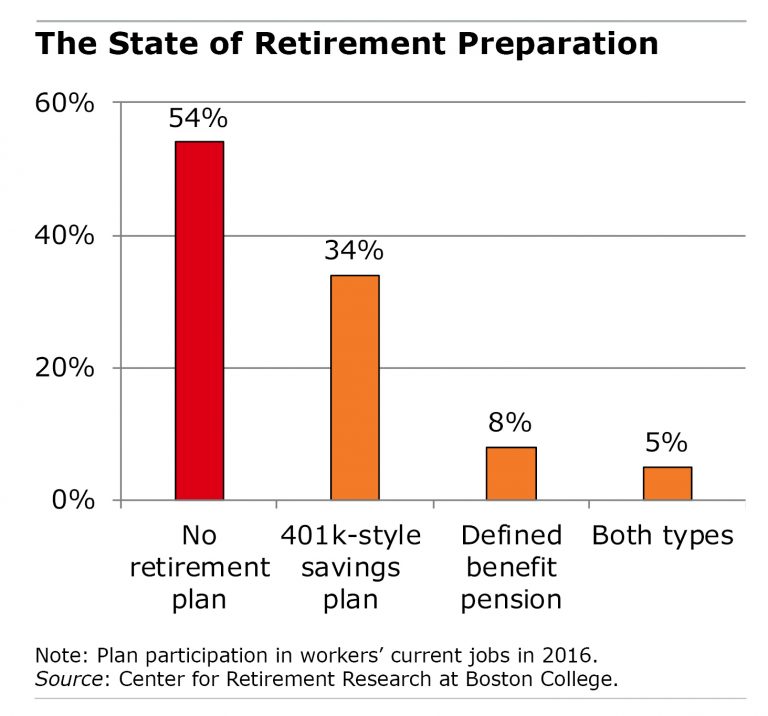

But pensions are on the wane in the private sector, and more than half of U.S. workers have neither a pension nor a 401(k) in their current job – this makes it pretty hard to save. IRAs are an option available to anyone, but human inertia makes that an imperfect solution to the problem, because people tend to procrastinate and don’t set them up. Further, working couples in which only one spouse has a 401(k) aren’t saving enough for both of them, one analysis found. …Learn More

January 30, 2020

A Cost in Retirement of No-Benefit Jobs

Only about one in four older Americans consistently work in a traditional employment arrangement throughout their 50s and early 60s. For the rest, their late careers are punctuated by jobs – freelancer, independent contractor, and even waitress – that do not have any health or retirement benefits.

Some older people are forced into these nontraditional jobs, while others choose them for the flexibility to set their own hours or telecommute. Whatever their reasons, they will eventually pay a price.

The Center for Retirement Research estimates their future retirement income will be as much as 26 percent lower, depending on how much time they have spent in a nontraditional job. During these stints, the issues are that they were not saving for retirement or accruing a pension and may have had to pay for health care out of their own pockets.

The researchers estimated the losses in retirement income to these workers by comparing them with people who have continuously been in traditional jobs with benefits. The workers in their analysis were between the ages of 50 and 62 and were grouped based on how their careers had progressed. The groups included people whose careers were primarily traditional but were interrupted by periods of nontraditional, no-benefit work, and people who spent most of their time in nontraditional jobs.

This last group lost the most: they had accrued 26 percent less retirement income by age 62 than the people who consistently held a traditional job. Who are these workers? They are a diverse mix that includes people who dropped out of high school and are marginally employed and people who are married to someone who is also employed and has benefits. …Learn More

January 14, 2020

Oddly, the Educated Pay Higher Fees

It’s smart to invest retirement savings in mutual funds that charge very low fees for one simple reason: the worker keeps more of his money and hands over less to Wall Street.

But in a study of people in their 50s and 60s who have retired or otherwise left federal employment, the people with the most education and the best scores on a standardized test were more likely to make what seems to be the wrong decision. Rather than keep their retirement funds in the government’s Thrift Savings Plan (TSP), which has extremely low fees, they transferred the money to much higher-fee IRAs operated by financial companies.

The $500 billion TSP – the world’s largest defined contribution retirement plan – is inexpensive in large part because it invests only in index mutual funds, which automatically track a variety of stock and bond market indexes and avoid the need to pay money managers to pick the investments. The annual fees for TSP’s index funds – known as expense ratios – are under 0.04 percent of the investor’s assets.

But over a 10-year period, about one fourth of the former federal employees rolled over the money saved during their careers into IRAs that typically had much higher expense ratios: 0.57 percent. On top of that, IRAs often charge additional fees for investment advice, pushing the potential total annual fees to well in excess of 1.5 percent. It’s possible that investing in an IRA could generate enough returns to make the extra fees worthwhile, but research has shown this is not the norm.

What explains the rollover decision? More educated people tend to have larger retirement account balances, raising the possibility that they were either seeking out financial advice or were targeted by advisors’ sales pitches. However, even among people with similar balances, those with more education were still more likely to roll over to IRAs.

It’s possible that they “perceive that they know what they’re doing” and want to take control of their investments “even when higher fees result,” the researchers said. …Learn More