November 14, 2013

Will Millennials Be Ready to Retire?

As he logged on to his online 401(k) retirement account, Jordan Tirone, a 25-year-old insurance underwriter, explained the mental accounting behind his 5 percent contribution.

He pays $300 a month to live with his mother so he can pay off student loans. Nevertheless, a regular paycheck from his Hartford, Conn., employer is finally giving him some financial stability. “I’m feeling like I’m gaining some traction,” he said.

Spontaneously, he clicks his mouse and increases his contribution to 6 percent of his salary.

Although it can be difficult to focus on a retirement that is still 40 years away, many young adults like Tirone try very hard to save. But are they doing enough? A lot of evidence suggests they’re not, either because they can’t afford to, refuse to, or don’t know what to do.

Adults in their 20s and early 30s, in a recent survey of 401(k) participants by Brightwork Partners LLC, predicted they would have to rely on their personal savings for half of their income in retirement.

Adults in their 20s and early 30s, in a recent survey of 401(k) participants by Brightwork Partners LLC, predicted they would have to rely on their personal savings for half of their income in retirement.

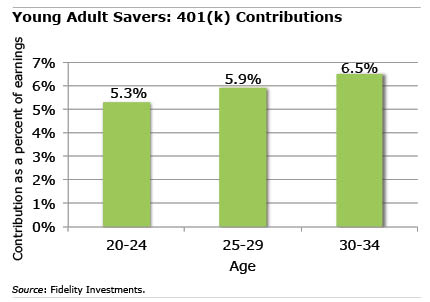

Their 401(k) contributions don’t square with their expectations. Data on retirement plans administered by Fidelity Investments show that adults in their late 20s contribute 5.9 percent to their 401(k)s; by their early 30s, that increases to 6.5 percent.

But a typical 25-year-old who wants to retire at age 67 should contribute anywhere from 10 percent to 12 percent of his pay, according to various estimates. … Learn More

October 31, 2013

Fraud Scares Off Stock Investors

The evidence is clear: fraud causes investors to shed their shares of stock.

When the stock market is booming, fraud swirls unnoticed beneath the frothy surface. Only when the market busts, as it did in the fall of 2008, are allegations of fraud and financial shenanigans exposed to the public.

When they are, and rattled investors realize what has taken place, they decrease their stock holdings – whether they own shares in any of the fraudulent companies or not – according to researchers in Stockholm and at the University of Minnesota.

Their study analyzed changes in equity holdings among U.S. households in response to more than 700 Securities and Exchange Commission charges and other reports of fraud from 1984 through 2009. The researchers focused on investors state by state, based on the assumption that allegations of fraud at local companies were more visible and would be more likely to affect an investor’s decisions. They also controlled for economic effects, which can influence investors’ decisions.

Their findings are:

- Reports of fraud in a given state made investors in that state less likely to hold stocks. …

October 3, 2013

Compulsive Spender? Blame Your Parents

There’s a bright line between an impulse purchase and compulsive spending.

When something new catches her eye, the impulsive buyer snaps it up and enjoys the splurge. There is no such enjoyment for the compulsive buyer. The act of buying temporarily alleviates her anxiety but she inevitably feels guilt or regret.

A new study explores the childhood experiences that lie at the root of why some people – women more than men – develop these damaging spending problems, which can lead to enormous debts and derail plans to save for the future.

The specific goal of the study, based on surveying 327 college students, was to shed light on the emotional pathways that can lead to compulsive buying, explained researcher Anil Mathur, a marketing professor at Hofstra University. The experiences the researchers associated with this behavior include disruptive family lives, more controlling parents, and teens who seek out peers to support their spending. …Learn More

October 1, 2013

Dementia Prevention

There are now two reasons to postpone retirement.

The financial reason has been covered repeatedly in this blog: working longer increases a retiree’s savings and monthly Social Security income, while shortening the number of retirement years that their savings will have to fund.

If that doesn’t convince you, here’s the other reason: working longer may prevent dementia.

That’s the conclusion of a study on nearly 430,000 French retirees. After analyzing their health and insurance records, the researcher determined that each additional year an older worker remained in the labor forced further reduced the risk of being diagnosed with various forms of dementia, including Alzheimer’s disease. …Learn More

September 17, 2013

Workers Struggle Day to Day

There’s a growing concern that working people aren’t saving for the future, but the reality is that many of them can barely get by in the here and now.

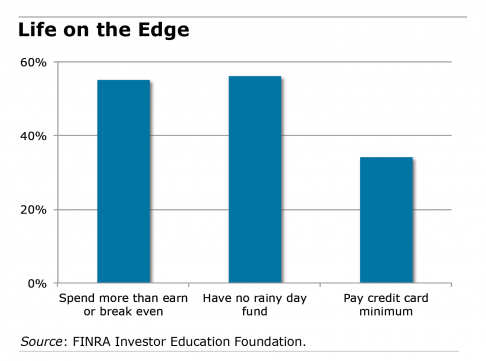

A sizable minority of Americans say they are spending more than they earn, have overdue medical bills, or pay only the minimum on their credit cards. These were among the findings in the 2012 National Financial Capability Study (NFCS) conducted by the FINRA Investor Education Foundation, its second survey to illuminate the day-to-day financial issues facing average working people.

Pulling together $2,000 may seem like only a modest challenge for someone with good pay and benefits. But 40 percent of the people surveyed also indicated they would be hard-pressed to find that much money if they needed it, according to a September report on the NFCS survey.

FINRA identified indicators of what it called the “financial fragility” of the average American:

FINRA identified indicators of what it called the “financial fragility” of the average American:

• More than half of those surveyed were in a poor position to save: 19 percent spend more than they earn, and 36 percent just break even.

• More than half have no rainy day fund and live paycheck-to-paycheck. …Learn More

August 20, 2013

What’s Your ‘Money Script’?

Our subconscious often stands in the way of our conscious efforts to save for college, prepare for the future, or spend what we’ve saved once we retire.

Some psychologists and financial planners believe these roadblocks are rooted in an individual’s “money script” – the story about money that we’ve told ourselves repeatedly since childhood. They’re typically passed down from our parents, extended family, or culture, and they are extremely difficult to change.

Writing in the Journal of Financial Planning, two experts in financial psychology, Bradley Klontz and Sonya Britt, presented their research associating three specific money scripts to poor financial behavior. Their study was based on a survey of 422 individuals who were largely middle-aged, white, and highly educated.

Click on a money script in one of the boxes below to read their descriptions of each one, excerpted from the November JFP article, to see if any apply and to learn how they affect the way we relate to money.

The researchers found that one person can hold multiple scripts, and these scripts can even contradict each other. …Learn More

August 15, 2013

Students Tell Their Tales of Debt

Click on each of the four photographs above to hear from the students, Kathleen Buckingham, Preston Davis, Michael McCormack, and Kelly McGowan.

Nastasia Peteuil, who paid very little for her college education in France, was shocked by how much students in this country are borrowing and by the crushing financial pressures this creates.

While taking graduate journalism courses at the University of Massachusetts in Amherst last spring, she persuaded four classmates to narrate their personal stories, which she documented on film in four short profiles.

What makes Peteuil’s profiles so powerful is that they convey, in real time, how these young adults begin to realize what their debt will mean to their lives and career choices.

Squared Away has written about the financial consequences of college loans after graduation – on buying one’s first house, on retirement, and even on graduates’ love lives.

But, as Peteuil has dramatized, the consequences begin prior to graduation day.Learn More