May 21, 2013

Few Boomers Catch Up on 401(k) Saving

Only 13 percent of older workers take advantage of the “catch-up” contributions to their retirement accounts permitted by the IRS for anyone over 50, according to new data provided by Fidelity Investments.

This is hardly surprising, since prior research has estimated that only about 10 percent of all workers are contributing the maximum $17,500 per year that everyone, regardless of age, is allowed to contribute under IRS guidelines for 2013. Since the vast majority never reach that cap, the “catch-up” 401(k) contribution enacted to encourage people to save more when they hit their 50th birthday – an additional $5,500 per year – is largely irrelevant to them.

But the catch-up contribution data, which Fidelity culled from its 401(k) client database representing some 12 million workers, are yet another reminder of a fundamental problem with the U.S. retirement system: Americans simply are not saving enough to ensure their financial security in old age.

In short, members of the Me Generation don’t seem to be doing a great job of taking care of Me. …Learn More

May 7, 2013

Retirement Countdown: Sheila Downsizes

Sheila Taymore could not afford the $2,200 mortgage and home equity loan payments, the enormous heating bills, and the repairs – so many repairs – on the home she’d owned for decades.

But selling it was emotional: she and her first husband had raised two sons in that house in the seaside town of Swampscott, north of Boston. Her decision to move was triggered by a recent divorce and came about two years after the death of her mother.

“I walked around and cried and said, ‘Who cares about this house?’ I make all this money, and all my money was going towards my house,” said Taymore, a Comcast Cable salesperson – last year was her best year ever.

She is like millions of U.S. baby boomers struggling, often imperfectly, to prepare financially for their imminent retirement. Wall Street may tout investment savvy as critical to ensuring a comfortable old age, but less lofty decisions can be more helpful to those with too little savings and too few working years left to make it up.

Taymore is also planning to delay her retirement to age 70. That will give her a larger monthly check from Social Security and fewer years of retirement to pay for. That was an easy call, she said, because “I just love my job.”Learn More

April 25, 2013

Student Debt Binge: How Will It End?

This recent Huffington Post headline captured the march of shocking data about our growing societal burden: “12 Student Loan Debt Numbers That Will Blow Your Mind.”

Here’s a sample:

- The student debt balance has hit $1 trillion and is still rising – it is now exceeded only by mortgage balances, according to the Federal Reserve Bank of New York;

- Student debt is held by 26 percent of households headed by someone between the ages of 35 and 44, and 44 percent of under-35 households, and it’s concentrated in poorer households, according to the Pew Research Center;

- 80 percent of bankruptcy lawyers said student loans were driving more clients through their doors for relief.

It remains unclear where this era of student debt is taking society. Sure, college graduates will bring in another $1 million in earnings over a lifetime. But anyone who’s thought about it can’t help worrying this nationwide borrowing binge may end badly.

To help those grappling with how to pay for the fall semester, feeling the emotional fallout of debt, or trying to understand the larger issues, Squared Away pulled together some relevant blog posts published over the past 18 months.

Click “Learn More” below to read more. …Learn More

April 2, 2013

Video: Why Stock Investors Defy Logic

The Standard & Poor’s 500 stock index has climbed steadily and surpassed its 2007 peak last week, and even sluggish European markets are showing signs of life as investors rush back in.

This interregnum between the collapse of global financial markets in 2008-09 and the next bubble – whenever and wherever that may occur – is a good time to reconsider investor behavior.

In this video, Ben Jacobsen, a finance professor at Massey University in New Zealand, discusses behavioral economics, market panics, and “strange” and inexplicable behavior.

“Most people,” Jacobsen concludes, “have a great difficulty assessing risk and what risk is.”

Check out another blog post about research confirming that people tend to rush in when the market is rising and pay dearly for stocks and then sell in a panic after experiencing large losses. Morningstar data also indicate that long-term investors have better returns if they buy and stay put.Learn More

March 28, 2013

Store, Online Browsing Can Be Dangerous

Impulse purchases – new spring clothes or an expensive dinner out – can create a rush. But a few minutes of pleasure can blow a hole in the budget for a month. If it’s chronic, it can eat into savings for a down payment or retirement.

The reason for these rash decisions is obvious: see it, want it. But for people who want to better understand – and prevent – their impulse buys and remain on budget, FinCapDev, which is hosting an online competition for a financial literacy app, recently posted a reading list of three research papers that explain why we can’t resist buying stuff.

- One study has confirmed that store browsers actually are vulnerable to impulsive purchases, because the act of browsing through a store’s merchandise produces positive feelings. “It is a state of high energy, full concentration, and pleasant engagement,” researchers wrote in a 1998 paper that is probably relevant to online browsing. Can you relate? …

March 19, 2013

2008-09: Investors Really Did Sell Low

Repeated loud warnings by financial advisers fail to reverse the human tendency to panic when the market plunges and to rush in after it’s gone up.

Withdrawals from 401(k)s and IRAs surged between 2001 and 2003 after high-tech stocks declined, but the money went back in in 2005 through 2007 after the S&P500 index had soared nearly 27 percent in 2003 and 9 percent in 2004, according to new research by Thomas Bridges, a graduate student in economics, and Professor Frank Stafford, for the University of Michigan Retirement Research Center.

“They think I have $500,000, and if I don’t take it out now it’s going to be $50,000. It’s a panic mentality,” said Stafford, who was surprised by what they found.

Withdrawals increased again after the 2008-2009 market collapse pummeled investors stock portfolios. The Michigan researchers found they withdrew their retirement savings for a variety of reasons, but primarily to pay mortgages and medical bills and also to make major home repairs.

His take on these grim findings: “These are the guys from Main Street trying to figure out Wall Street, and they can’t do it.”Learn More

February 19, 2013

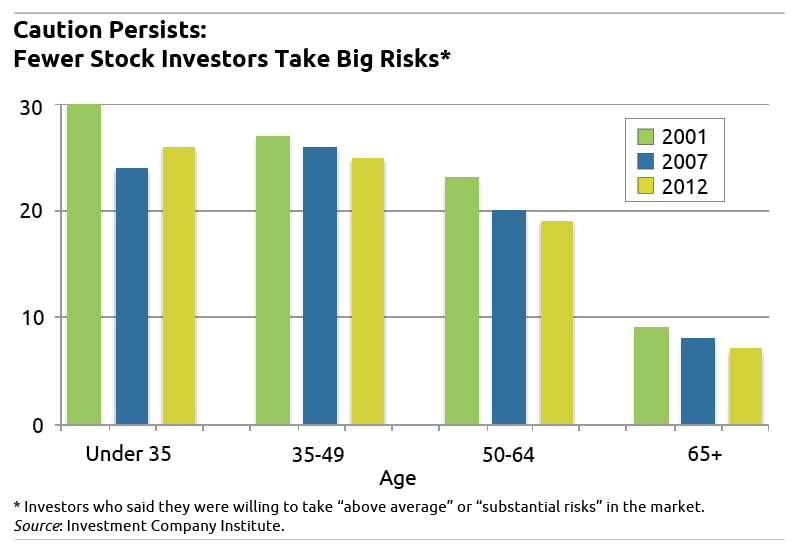

Boomers Still Cautious About Stocks

Mutual fund investors poured some $17 billion into domestic equity funds in January, reversing 2012’s trend, according to the Investment Company Institute (ICI), an industry trade group.

But it’s too early to declare that fund investors have fully recovered from the 2008 market collapse, even as the bullish S&P500 stock market index flirts with its 1,565 all-time high reached on October 9, 2007.

Fund investors surveyed by ICI still remain less willing than they were prior to the big bust to take what the survey questionnaire calls “above-average or substantial risks” in their investments.

This trend cuts across most age groups, from 40-somethings to retirees. The exception is the under-35 crowd: 26 percent identified themselves as being in these higher-risk categories, slightly more than the 24 percent who did back in 2007.

This trend cuts across most age groups, from 40-somethings to retirees. The exception is the under-35 crowd: 26 percent identified themselves as being in these higher-risk categories, slightly more than the 24 percent who did back in 2007.

But boomers nearing retirement and current retirees burned in the 2008 market collapse keep paring back their risk profiles. Older investors are moving “from capital appreciation to capital preservation,” said Shelly Antoniewicz, an ICI senior economist. Even 35-49 year olds, who still have two to three decades of investing ahead of them, are not quite back to where they were earlier in the decade when they were more willing to take risks in the stock market.

“What we have seen historically is that there is a relationship between stock market performance and inflows into equity funds. When the stock market goes up, we tend to get larger inflows into equity funds,” she said. “What we’ve noticed in the past two to four years is this historical relationship has gotten weaker.” …Learn More