March 29, 2012

Mortgage Refi Dilemma: 15 or 30 years?

My mortgage broker is a patient man.

I kept changing my mind, because this refinancing was about so much more than whether to go with a 15- or a 30-year fixed rate. Now that the loan is about to close, I worry that I made the wrong decision.

As a baby boomer, all financial decisions suddenly spin around retirement. Many boomers now own their homes free and clear. I am not one of them, and it seems critical to get this refinancing right, since mortgage interest rates may not hit these historic lows again for a long time. For this reason, and because house prices have plummeted, the 15-30 dilemma may prove important for cash-strapped, first-time homebuyers too.

“I don’t think [rates] are going to race up in the next 6 months, or even year and a half, but things are definitely headed upwards,” predicted Susan Honig, owner of Veritana Financial Planning Inc. in Burbank, Calif. “And after that I think rates are going to fly.” …Learn More

March 21, 2012

Bracketology Simulates Stock Picking

Odds, outliers, random – such terms are batted around like gnats among the economists and statisticians here at the Boston College research center that sponsors this blog. Recently, we tossed around some parallels between the art of NCAA Basketball Bracketology and picking stocks or actively managed mutual funds.

Here’s our Final Four:

- A fresh printout of an unscrawled bracket is like a new pool of money to invest – it engenders the hope of winning big. The thrill can give way to defeat — very suddenly.

- Admit it: Most people fill in their bracket winners without doing any research on the teams they’re selecting. (And who reads a prospectus?)

- A team (or stock) on a winning streak is a prime candidate for losing – and it takes only one in the single-elimination championship.

- Past performance is not a reliable predictor of playoff results. Remember the 2011 NCAA basketball champion? UConn lost last week. And I won’t even mention the Duke Blue Devils.

Send in your own ideas to Squared Away! To do so, click “Learn More.”Learn More

March 20, 2012

Buy, Hold and Be Happy?

When an investor selects a mutual fund that’s hot, it usually backfires.

Morningstar Inc. generated the evidence for Squared Away: it essentially analyzed returns for two types of investors in the nation’s 25 largest fund companies – from PIMCO, Fidelity Investments and Vanguard Group on down. Using fund flow and performance data, it compared returns to a theoretical investor who stayed put for an entire decade to the returns that investors in funds actually experienced, given that they move into and out of funds.

Morningstar Inc. generated the evidence for Squared Away: it essentially analyzed returns for two types of investors in the nation’s 25 largest fund companies – from PIMCO, Fidelity Investments and Vanguard Group on down. Using fund flow and performance data, it compared returns to a theoretical investor who stayed put for an entire decade to the returns that investors in funds actually experienced, given that they move into and out of funds.

Investors earned 3.8 percent per year, on average, over the decade ending Dec. 31, 2011, the Chicago fund tracker said. If they had stayed put, they would’ve earned 5.3 percent. The results were not equal, because some of us make brilliant moves but more of us make dumb moves, such as buying high and selling low.

The gap – 1.5 percentage points – “is bigger than [fund] expense ratios,” said Don Phillips, Morningstar president of fund research. Investors “really hurt themselves that much.”

To be fair to 401(k) investors, their inertia is great. Those who select funds from employer-run plans typically buy and hold. But more money – about $1 trillion more – sits in Individual Retirement Accounts, where investors are more likely to trade on their own or to have brokers or advisers recommending new funds, whether motivated by their own commissions or their clients’ goals.

To try to improve returns, Phillips listed three types of funds investors should avoid: …Learn More

February 7, 2012

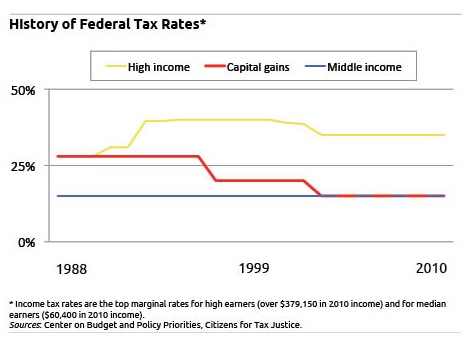

Taxing Behavior

Taxes, politicians and economists say, can either encourage or discourage human behavior. This chart landed on my desk, so I thought I would share it.

The capital gains tax rate has declined sharply over the past 14 years. The marginal tax rate for high-income individuals has plotted a very different course than the marginal rate for the middle class.

What does this chart say to you?

Please post a comment by clicking below, on “Learn More.” …Learn More

January 24, 2012

Young Adults Adrift in E-Spending Ocean

Collectibles purchased online range from Russel Wright dinnerware (shown here) to songs and video. Source: backhomeagainvintage.

Credit cards and malls are so yesterday.

Young adults move easily among an array of online payment and shopping options unimaginable a decade ago: PayPal, Groupon, telephone bill payment, smartphone apps that pay for store purchases, online retailers galore, automatic bank payments, and online gift cards.

Technology is moving fast: Amazon recently released an app called “Flow” that will recognize a product — from a book to a jar of Nutella — and then send the price, user reviews and a “Buy It Now” option to your smartphone.

It’s time to take stock of how easy it has become to overspend and how difficult saving is for young adults weaned on e-transactions.

“When it doesn’t feel like money, people don’t treat it like money,” said Priya Raghubir, a professor at the New York University Stern School of Business, neatly summing up her 2008 paper, “Monopoly Money: The Effect on Payment Coupling and Form on Spending Behavior.”

It’s extremely hard for young adults to change their behavior, “because they aren’t used to any other way of paying,” said Raghubir, 48, who remembers the old paper-transaction days when cash was king and checks were reserved for the big purchases…Learn More

January 12, 2012

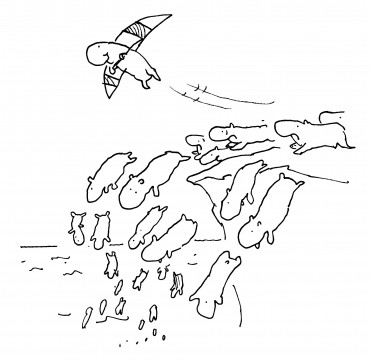

Present and Future Selves Do Battle

Squared Away keeps hammering away at this point in various ways, because it seems so central to our financial well-being: we can’t fully relate to our future selves, which makes it difficult to save money.

This is the psychologist’s take on what mainstream economists would call “discounting” the future – that is, the future is less important than what’s going on today. Buying a new pair of shoes or an ice cream cone is a lot more fun than saving money for a future utility bill or a distant retirement date.

In this humorous Ted video, London Business School professor Dan Goldstein explains that all humans are engaged in an “unequal battle” between our present self (the consumer) and our distant self (the saver).

“The future self doesn’t even have a lawyer present,” he said. Goldstein entertains as he proposes ways to intervene in our inner battle.Learn More

January 5, 2012

The Mathematics of Longevity

Thanks to modern medicine, Americans’ longevity increased by 30 years during the 20th Century. During that time, the retirement age plunged, a byproduct primarily of a prosperous post-World War II economy.

An urgent need to squeeze more retirement money out of fewer years of work is now bearing down on the baby boom generation. But we haven’t adapted our lives or plans to fill in that yawning gap. Retirement today can last 20, even 30 years. The challenge of funding retirement is greatest for women, who earn less than men and live longer.

Steve Sass, my colleague at the Center for Retirement Research (CRR) at Boston College, encourages people to think about it this way and proposes a solution. For someone who works 40 years, retirement could last 20 years. That’s a 2-to-1 ratio of work-to-retirement years – with that ratio, it’s tough to make the financials work. It’s even harder if one’s retirement lifestyle will be based on those larger, late-career paychecks.

For those who have a job, consider what happens by adding five years of work. The work-to-retirement ratio is a “more manageable” 3-to-1, said Sass, who is co-author, with CRR Director Alicia Munnell, of “Working Longer: The Solution to the Retirement Income Challenge.”

That’s not all. Instead of retiring at age 62, an additional five years of work results in 44 percent more in your monthly Social Security check.Learn More