May 2, 2019

Retiring Can Strain Food Budgets

More than 10 percent of the nation’s retirees struggle with hunger.

New research offers one explanation: when people retire and give up a regular paycheck, they sometimes adjust to having less income by reducing their food intake.

After retiring, the men in the study ate 17 percent less protein, which becomes more important as people age. Their total calorie intake also dropped 19 percent, and their Vitamin E consumption fell 16 percent, on average, according to researchers at the University of Michigan and University of Delaware. The retirees also cut back on several other nutrients.

This contradicts previous studies, which had failed to uncover a link between diet and retirement income. Skeptical of the findings, the researchers did an exhaustive study that used various types of analyses and several datasets to follow male heads of households from employment through retirement. They controlled for race, education, household size, and health.

They consistently found, across several data sources, that a drop in income reduces food intake. In fact, the effect was so large that it exceeded the impact of another dramatic financial event: unemployment among working-age people.

Although a small minority of seniors are threatened by hunger, it’s a serious problem. …Learn More

April 25, 2019

Do Couples Save Enough for Two?

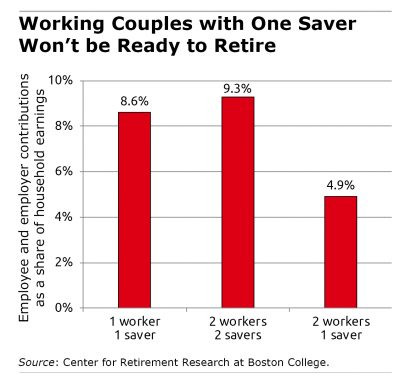

Since only about half of all private sector workers currently have access to an employer 401(k) plan, it’s not at all unusual for spouses who are both working to have only one saver in the family.

When that’s the case, is the person who is contributing to the employer retirement plan saving for two? The answer is definitely not, concludes a new study by the Center for Retirement Research.

When that’s the case, is the person who is contributing to the employer retirement plan saving for two? The answer is definitely not, concludes a new study by the Center for Retirement Research.

The challenge for couples living on two paychecks is that they have to save more money to maintain their current lifestyle after they retire. But households with two earners and only one saver end up saving less than others – only about 5 percent of the couple’s combined incomes, compared with more than 9 percent when both spouses are working and saving, the study found.

Couples who rely on a lone saver need that person to pick up the slack. Employers could help them if they considered the employee’s family situation when setting a 401(k) contribution rate in plans that automatically enroll workers. …Learn More

April 16, 2019

Dementia is a Threat to Managing Money

The perils of aging generally escalate around 75, and they are becoming more pervasive as more Americans live to very old ages.

One of these perils – declining cognitive ability – often creates financial problems. A new study that summarized the research on this side of the retirement equation identified the financial fallout from dementia.

Currently, dementia afflicts roughly a quarter of seniors in their early 80s. And geriatricians and demographers have predicted for years that dementia will become a serious societal problem in the future as the tsunami of baby boomers reach older ages.

The first sign of deteriorating financial skills might be forgetting to pay a bill. But when severe dementia sets in, the vast majority completely lose their ability to manage their finances and risk making big mistakes, such as losing money in a fraudulent investment scheme.

Another concern is retirees’ growing reliance on 401(k)s for more of their income. Increasingly, they are grappling with the complicated question of how much money to withdraw each year from their 401(k) accounts – this is difficult for anyone but virtually impossible for people with dementia.

Fortunately, most of them get assistance managing their finances. But the seniors who don’t get help face potentially grave repercussions, such as having difficulty affording food, housing and medical care.

Managing money is not the only financial risk posed by dementia. A more serious issue is the potential need for a lengthy stay in a nursing home, which will be addressed in a future blog post. …Learn More

March 27, 2019

Elderly Report Financial Abuse by Kids

A son uses his elderly mother’s ATM card at casinos and liquor stores or takes her to the bank to withdraw money from her account.

A woman reports that her sister stole thousands of dollars’ worth of jewelry from their mother, who suffers from dementia.

An elderly couple assigns power of attorney to their son, only to watch him sell their house and spend the proceeds he was supposed to use to create a living space in his home for his parents.

News accounts like these are rare. But reports about financial abuse of the elderly are increasing. The problem lurks largely in the shadows, because parents view it as a private family affair and are loathe to file a police report, says Julie Schoen, attorney and deputy director of the National Center on Elder Abuse (NCEA) at the University of Southern California.

“People just don’t want to do that to their loved one,” said Schoen, whose organization refers victims to the National Adult Protective Services Association for help.

Financial exploitation affects at least 5 percent of older Americans. The majority is perpetrated by family members, especially adult children, say researchers. Victims’ average age is 75, and African-Americans, the poor, disabled people, and elderly people living alone are common targets.

The problem is so poorly understood that advocates are raising awareness – Elderly Abuse Awareness Day is June 15 – and encouraging people to act when they suspect an elderly acquaintance, friend, or family member is the victim of financial abuse.

One form of abuse occurs when parents sign a power of attorney allowing a child to take over their financial affairs without reading or understanding the legal document. “Power of attorney is the heartbeat of your estate plan. A lot of people have them done and have no idea it’s in there,” she said. …Learn More

February 26, 2019

Baby Boomer Labor Force Rebounds

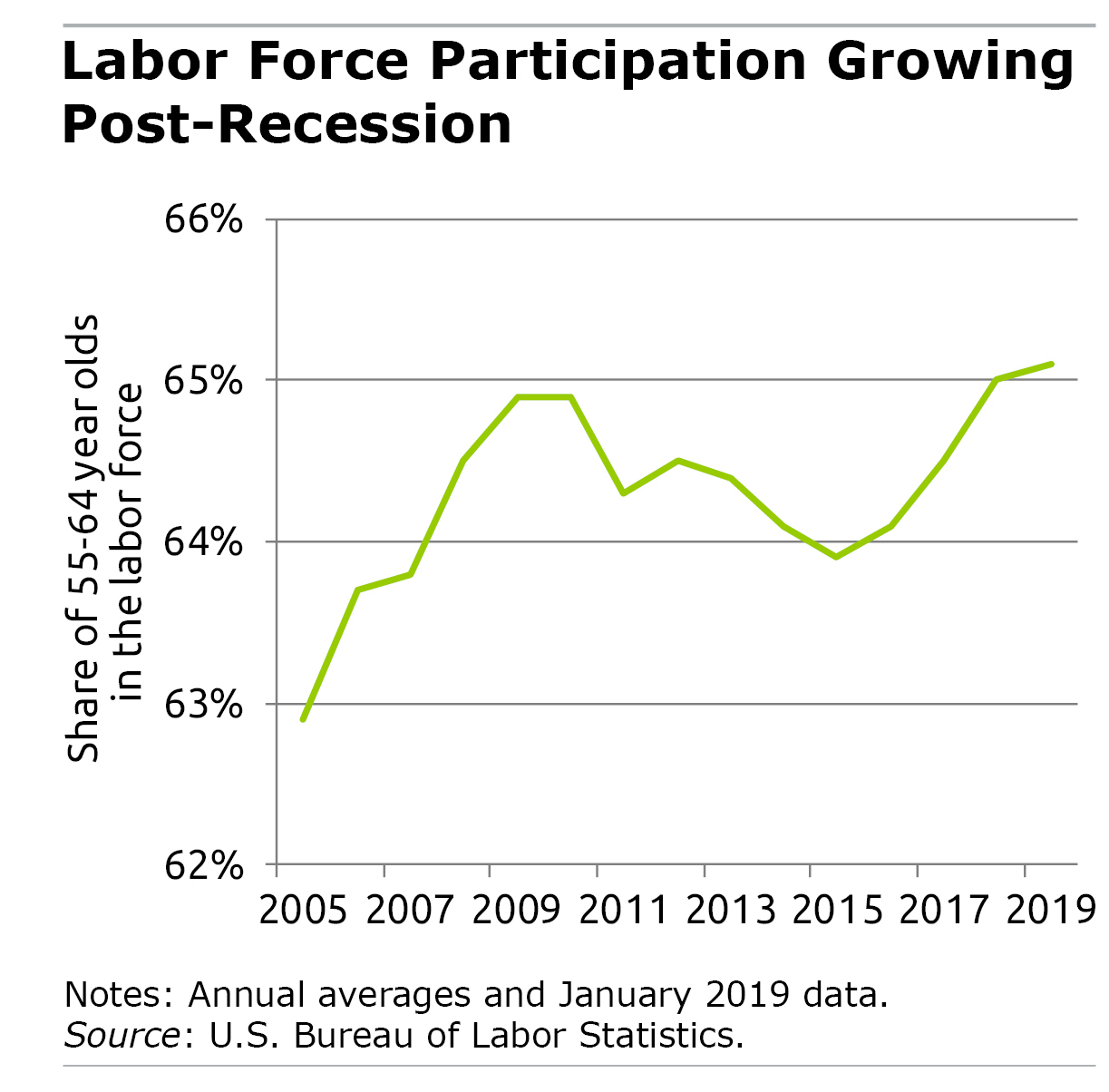

One way baby boomers adjust to longer lifespans and inadequate retirement savings is to continue working. There’s just one problem: it can be more difficult for some people in their 50s and 60s to get or hold on to a job.

But things are improving. The job market is on a tear – 300,000 people were hired in January alone – and baby boomers are jumping back in. A single statistic illustrates this: a bump up in their labor force participation that resumes a long-term trend of rising participation since the 1980s.

But things are improving. The job market is on a tear – 300,000 people were hired in January alone – and baby boomers are jumping back in. A single statistic illustrates this: a bump up in their labor force participation that resumes a long-term trend of rising participation since the 1980s.

In January, 65.1 percent of Americans between ages 55 and 64 were in the labor force, up smartly from 63.9 percent in 2015. This has put a halt to a downturn that began after the 2008-2009 recession, which pushed many boomers out of the labor force. The labor force is made up of people who are employed or looking for work.

The recent gains don’t seem transitory either. According to a 2024 projection by the U.S. Bureau of Labor Statistics, the older labor force will continue to grow. The biggest change will be among the oldest populations: a 4.5 percent increase in the number of 65- to 74-year olds in the labor force, and a 6.4 percent increase over age 75. …Learn More

January 17, 2019

Parent PLUS College Loans Can Spell Peril

A dramatic increase in 1993 in how much parents are permitted to borrow from the federal government for their children’s college is coming home to roost.

A dramatic increase in 1993 in how much parents are permitted to borrow from the federal government for their children’s college is coming home to roost.

Since then, average debt through the parent PLUS loans has more than tripled, adjusted for inflation, according to a Brookings Institution report. About one in 10 parents owe more than $100,000. And as loan balances have ballooned, the rate of repayment has slowed.

Now that the college applications have been submitted, Allan Katz, a financial adviser in Staten Island, New York, has this advice for parents contemplating their next move:

PLUS loans should be avoided “at all cost,” he said. “A big part of my practice is avoiding PLUS loans.”

His dire warning stems from the 1993 change in the law, which made it easier for parents to get into trouble. The reform increased how much parents can borrow from $4,000 per year to whatever the teenager needs to cover his or her school expenses – regardless of the institution’s cost. Total borrowing per child used to be capped at $20,000 – there is no limit today. …Learn More

December 18, 2018

Holidays with Dementia in the Family

When my grandmother was spirited away by dementia and no longer recognized me, I stopped visiting her in the nursing home.

I didn’t understand this at the time but now think that I just wanted to remember her baking lemon cream pies or waving at me as she rode around on her lawnmower cropping the lot next to her Indiana farmhouse.

I wish I could get another chance and do things better this time. Regret is hard to live with.

Psychologist Ann Kaiser Stearns views the holidays as a precious time of year to make elderly family members feel they are loved and included in the festivities.

“People respond for as long as they live to smiles, to touch, to music, to kindness, to sitting in the sun, to pumpkin pies,” Stearns, a professor of behavioral science, said in an interview.

“We just need to remember that all of that nourishes an elderly person to whatever degree they have impairments,” said Stearns, who also wrote “Redefining Age: A Caregiver’s Guide to Living Your Best Life.”

Stearns encourages people to make an extra effort to connect with a loved one over the holidays and provides some tips:

Be patient. Take the extra time to sit down with your parent, aunt, or uncle and talk to them. Encourage them to reminisce. “Don’t do something if you don’t have the time,” Stearns said.

Be present. If grandma doesn’t remember you or something that happened in the past, do not argue with her or ask, “Why don’t you remember?!” She advised that it’s better to say, “Remember grandma, it’s your granddaughter from Baltimore.” When an elderly person repeats or forgets, connect with them where they are now, even if it means going through the same conversation again.

Stir sweet memories. Stearns said that her friend’s father, a former minister, has Alzheimer’s but the friend brings him to church anyway. When Stearns’ parents were old, they used to sit happily watching the squirrels in their yard while her father smoked cigars. It’s important to repeat rituals that are uplifting and have always brought meaning to their lives. …Learn More