December 5, 2019

College Graduates Cope with Money

College upperclassmen and recent graduates have a lot on their minds. One thing they don’t always like to think too hard about is money.

But Maggie Germano, a financial coach, encourages them to get things out in the open and talk about it. At a recent personal finance session here at Boston College, she answered students’ questions about their credit ratings, student loans, and how to avoid spending money they do not have.

Here are the five best tips from Germano, a 2009 graduate of the State University of New York in Fredonia. She now lives in Washington D.C.

Pay attention. The first step to getting control of one’s finances is to pay attention to them, she said. Not dealing with credit card bills and student loan statements doesn’t make the problems go away. “The opposite is true: the more you pay attention, the more in control you’ll be,” she said.

Get a credit rating – or fix it. The key is to have a credit card but use it judiciously. Germano advises young adults to get what’s known as a secured credit card with a low spending limit – say $500. Secured credit cards typically require users to put up a cash deposit. To slowly establish a sound credit history, spend no more than 30 percent of the card’s limit and pay it off at the end of each month.

Student loans are hard work. Germano said that, after she graduated, her rent and student loan payments equaled all of her income. She signed up for the federal government’s income-based repayment program. In this program, the government reduces the payments to reflect the low incomes many recent graduates are earning at the start of their careers. Germano said she paid off her $26,000 loan balance off about four years ago.

The secret to not overspending. She learned this trick from a client. Set up two separate checking accounts. One account is for paying monthly bills – rent, Netflix, electricity – and the payments are deducted automatically. For all other spending, use a second account with a debit card and “don’t touch” the money in the first account. Using a debit card for discretionary expenses makes it easy to keep track of how much is left to spend each month – maybe it’s better to walk than take another Uber.

“It’s very human to want new things, be social, and spend money you’ve never had before,” she said. So put “systems into place that will prevent [that] from getting out of control.” …Learn More

November 26, 2019

The Art of Persuasion and Social Security

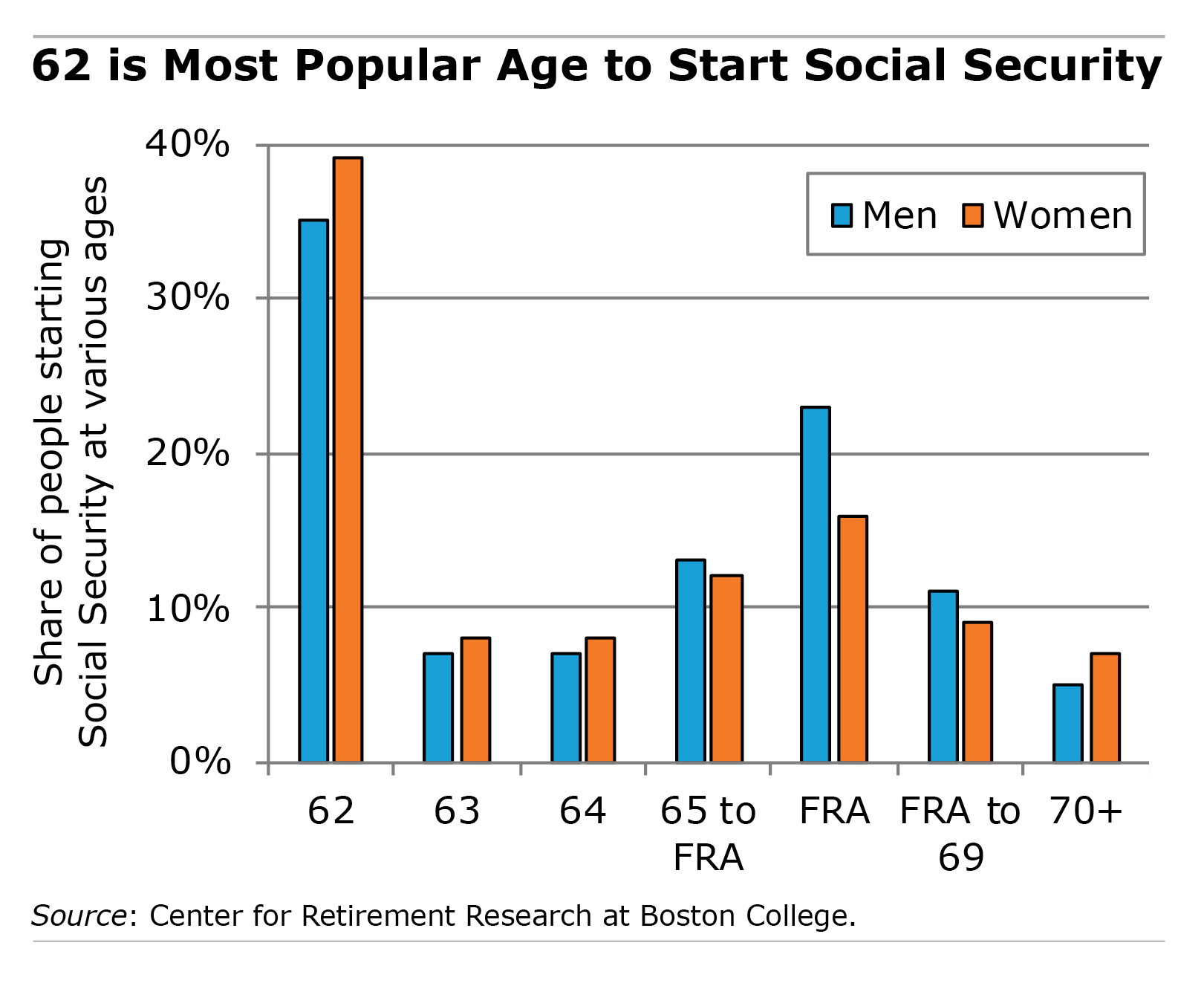

Retirees could get substantially more in their Social Security check if they would just wait longer – up to age 70 – to sign up.

But only a tiny fraction of workers make it to 70, and more than a third get the minimum monthly benefits because they start them as soon as the program allows, at 62. A Bocconi University professor and three UCLA professors have set about trying to change minds by testing 13 ways of encouraging older workers to hold off and lock in a larger Social Security check.

But only a tiny fraction of workers make it to 70, and more than a third get the minimum monthly benefits because they start them as soon as the program allows, at 62. A Bocconi University professor and three UCLA professors have set about trying to change minds by testing 13 ways of encouraging older workers to hold off and lock in a larger Social Security check.

The techniques, which they tried on various groups of workers between ages 40 and 61, ranged widely in approach. But two of the most successful tests had one thing in common: participants were asked to engage in a little reflection about the personal impact of choosing when to start receiving their Social Security. This approach departed from the more common strategy of trying to influence people by feeding them financial or other information.

Everyone began the same way: they saw a table showing how much more they would receive from Social Security for each year after 62 that they delayed. One of the most effective tests was an exercise in self-reflection. The participants were asked to list “their own reasons” for how delaying would help them personally. Only after this step did they list the reasons to start their benefits at a younger age.

The order of these requests was intentional and intended to counteract the tendency by most people to focus on their short-term desires. This group reported that they intended to sign up 10 months later than the control group, which wasn’t exposed to the test, according to the study conducted for the Retirement Research Consortium. …Learn More

October 17, 2019

What if Medicare Paid Your Dentist?

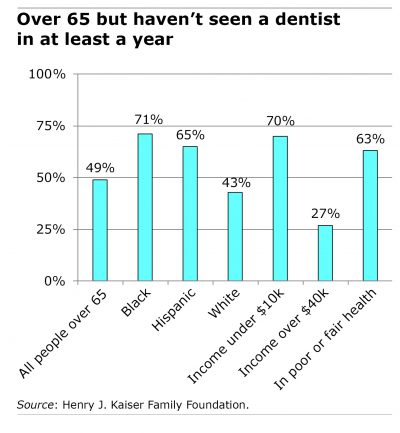

Two out of three U.S. retirees do not have dental insurance. Their basic choice is paying their dentist bills directly or, if they can’t afford it, forgoing care.

Two out of three U.S. retirees do not have dental insurance. Their basic choice is paying their dentist bills directly or, if they can’t afford it, forgoing care.

A new report analyzes the pros and cons of one potential solution to this pervasive problem: adding dental coverage to Medicare. Several bills that have circulated in Congress, including the Seniors Have Eyes, Ears, and Teeth Act of 2019, would do just that.

This approach recognizes that teeth and gums have everything to do with one’s health, said Meredith Freed, a policy analyst for the Kaiser Family Foundation’s Medicare policy program. Elderly people with loose or missing teeth have difficulty eating nutritious but hard-to-chew foods. Gum disease, left untreated, increases the risk of cardiovascular disease, and diabetes, which is increasingly prevalent, makes people far more prone to gum disease.

Oral health care “has a significant impact on people’s happiness and financial well-being,” Freed said. Dental coverage under Medicare would “improve their quality of life.”

But a proposal to do this would face an uphill climb in Congress. Medicare is already under-funded. Dental care would only add to the program’s rising costs. Retirees do have another option: about two-thirds of the Medicare Advantage plans sold by insurance companies offer dental benefits. …Learn More

September 5, 2019

Social Security: the ‘Break-even’ Debate

Our recent blog post about the merits of delaying Social Security to improve one’s retirement outlook sparked a raft of comments, pro and con.

In the example in the article, a 65-year-old who is slated to receive $12,000 a year from Social Security could, by waiting until 66 to sign up for benefits, get $12,860 a year instead. By comparison, it would cost quite a bit more – about $13,500 – to buy an equivalent, inflation-adjusted annuity in the private insurance market that pays that additional $860 a year.

The strategy of delaying Social Security “is the best deal in town,” said a retirement expert quoted in the article.

Aaron Smith, a reader, doesn’t agree. “It will take 14 years to make that ($12,000) up. Sorry but I’ll take the $12k when I’m in my early 60s and can actually enjoy it,” he said in a comment on the blog.

Smith is making what is known as the “break-even” argument, which is behind a lot of people’s decisions about when to start collecting their Social Security.

But other readers point out that the decision isn’t a simple win-loss calculation. The benefit of getting a few extra dollars in each Social Security check – between 7 and 8 percent for each year they delay – is that it would help retirees pay their bills month after month.

This is a critical consideration for people who won’t have enough income from Social Security and savings to maintain their current standard of living after they stop working – and 44 percent of workers between 50 and 59 are at risk of falling short of that goal.

One big advantage of Social Security is that it’s effectively an annuity, because it provides insurance against the risk of living a long time. So the larger check that comes with delaying also “lasts the rest of your life,” said Chuck Miller, another reader. …Learn More

August 29, 2019

Prevent Life Insurance Surprises

Angela Mahany was completely in the dark about how complicated her late husband’s finances had become.

Dick Mahany, in a loving effort years ago to make sure she would be set financially when he died, had borrowed money from a whole life insurance policy that had built up a cash balance to buy a term life insurance policy payable at his death. But when he used up the whole life policy’s value, he had to come up with enough cash to pay the premiums for both policies.

Angela discovered her husband had been doing this just a few months before he passed away in February 2017. By then, he was suffering the effects of Agent Orange exposure during the Vietnam War and could not help her figure out how to pay the premiums.

“When I was all of a sudden responsible for the finances, it blew my mind,” Angela Mahany, 73, said.

Her finances were far more complicated than the circumstances most people can expect to face when they become widowed. But being uninformed about the life insurance is not unusual.

“A husband wants to be in control, and he’ll take care of things,” said Paul Brustowicz, a former insurance agent and a grief counselor at his church. “The problems occur when he does not tell his wife about everything or what’s been done. Of course, this can also happen to a widower, if his wife handles the finances.”

Brustowicz recalled one woman who walked into the insurance company where he used to work and informed the receptionist that she could no longer afford the premiums on her deceased husband’s life insurance. The clerk looked up her policy number and confirmed her suspicion about the widow: rather than owe any money, she had $25,000 in death benefits coming to her. “The wife had no idea,” Brustowicz said. …Learn More

August 20, 2019

Modifying a Retirement Plan is Tricky

Employers beware: changing your retirement plan’s design can have unfortunate, unintended consequences for your employees.

That’s what happened to the Thrift Savings Plan (TSP) for federal workers, says a new study by a team of researchers for the NBER Retirement and Disability Research Center.

Like many private-sector savings plans, the $500 billion TSP – one of the nation’s largest retirement plans – has automatic enrollment. Federal employees can make their own decision about how much they want to save and, in a separate decision, how to invest their money. But if they don’t do anything, their employer will automatically do it for them.

In 2015, the TSP changed its automatic, or default, investment from a government securities fund to a lifecycle fund invested in a mix of stocks and bonds with the potential for higher returns than the government fund. However, the employer did not change the plan’s default savings rate for workers – 3 percent of their gross pay. (The government matches this contribution with a 3 percent contribution to employees’ accounts.)

After the TSP switched to the lifecycle fund, the new employees at one federal agency – the Office of Personnel Management – started saving less, the researchers said.

This probably occurred because, in passively accepting the TSP’s new lifecycle fund – a more appealing option than the old government securities fund – they were also passively accepting the relatively low default 3 percent contribution.

Employees seem to “make asset and contribution decisions jointly, rather than separately,” the researchers concluded. …Learn More

August 15, 2019

Walk? Yes! But Not 10,000 Steps a Day

A few of my friends who’ve recently retired decided to start walking more, sometimes for an hour or more a day.

Becoming sedentary seems to be a danger in retirement, when life can slow down, and medical research has documented the myriad health benefits of physical activity. To enjoy the benefits from walking – weight loss, heart health, more independence in old age, and even a longer life – medical experts and fitness gurus often recommend that people shoot for 10,000 steps per day.

But what’s the point of a goal if it’s unrealistic? A Centers for Disease Control study that gave middle-aged people a pedometer to record their activity found that “the 10,000-step recommendation for daily exercise was considered too difficult to achieve.”

Here’s new information that should take some of the pressure off: walking about half as many steps still has substantial health benefits.

I. Min Lee at Brigham and Women’s Hospital in Boston tracked 17,000 older women – average age 72 – to determine whether walking regularly would increase their life spans. It turns out that the women’s death rate declined by 40 percent when they walked just 4,400 steps a day.

Walking more than 4,400 steps is even better – but only up to a point. For every 1,000 additional steps beyond 4,400, the mortality rate declined, but the benefits stopped at around 7,500 steps per day, said the study, published in the May issue of the Journal of the American Medical Association.

More good news in the study for retirees is that it’s not necessary to walk vigorously to enjoy the health benefits. …Learn More