September 20, 2011

Fraud Victims Can Be Profiled

Which profile describes the most common victim of investment frauds like Bernie Madoff’s?

a. Tech-savvy young adult

b. Man over 50 earning high income

c. Elderly widow on fixed income

Widow, you say? That’s the stereotype, said Laura Carstensen, founder of Stanford University’s new Research Center on the Prevention of Financial Fraud.

“The old woman who’s demented and living on her own, and the guy who knocks on her door and sells her the policy – that does exist, but it doesn’t represent older people,” she said. Older people who have a history of long-standing relationships are often better at determining who they can trust, she said.

The correct answer is b: Man over 50 earning high income.

Fraudsters feed successful men’s egos by appealing to their investment savvy, enticing them to get into a deal others might not understand. By building up their egos, a fraudster ensures that the victim isn’t thinking clearly when he agrees to invest, said Doug Shadel, a member of the Stanford Center’s board who co-authored the AARP Foundation National Fraud Victim Study.Learn More

September 1, 2011

Painless Personal Finance

I keep bumping into Tim Maurer’s videos – he’s an active tweeter – and decided to share the fun. This Baltimore financial planner’s clients include a lot of 30-somethings, so he produced a series of humorous 90-second videos that knock down the barriers to understanding the basics of various personal finance topics.

With many people either returning from or heading out on vacation this week, he suggests in this video how to eliminate the anxiety around spending money on trips.

But a couple of Maurer’s funniest videos include “The Bias of Life Insurance Agents in 90 Seconds or Less” and “How to Spend $1 million at Starbucks in 90 Seconds or Less.” At a time of historically low mortgage interest rates, a new video may be of interest to pre-retirees: “Pay off the Mortgage in 90 Seconds or Less.” Learn More

August 23, 2011

How to Grill Your Stockbroker

Stockbrokers and financial advisors typically focus on the mechanics of investing – the dividend, the strategy, or past performance. When they do, investors often become overwhelmed by the conversation.

To break through that and improve their comfort level, investors should instead focus on the more important issue at hand: the credentials and character of the person peddling those investments, said Tamar Frankel, a law professor at Boston University.

“I want to shift the focus from what is being sold to who sells it,” she said.

An expert in financial regulation and fiduciary law, Frankel’s latest research examines the role of trust in various professional relationships, including the relationship between a broker or advisor and his or her client or potential client.

Frankel’s basic premise is that no question is a stupid question. Since brokers and investment advisors are not regulated by the same fiduciary standards that govern, say, employer pension funds, investors must protect themselves.

That can be difficult to do when the broker is throwing around unfamiliar terms. She recommends investors come armed – with questions – to their meetings with brokers. She has put together a deceptively simple list of questions. If the broker refuses to answer a question – his or her right – then the investor has already learned something important.

Here are three of Frankel’s 15 questions and her thinking behind them.

Question: “Are you a registered investment advisor, registered broker dealer, or both?”

Rationale: Frankel’s message here is: assume nothing. Investors should be certain that the investment advisors or brokers being considered meet the professional standards established by their own profession. Even better, check out their credentials beforehand but ask the question anyway. …

Learn More

August 16, 2011

‘Finglish’ Is the Problem

All the headlines about “financially illiterate” Americans miss something important. The language financial professionals use can be incomprehensible.

In this humorous video, David Saylor, whose job is basically “word consultant” for Invesco Van Kampen Consulting, walked around downtown Chicago and asked people to define industry terms such as “dollar-cost averaging” and “beta.”

One person got one answer right. (After watching the video, readers may need to consult Saylor’s glossary, below.) Even a seemingly simple concept – “transparent fees” – was misinterpreted. It means that fees are fully disclosed but was interpreted to mean “invisible.”

No wonder people are confused by the “Finglish” – financial English – thrown around by their mutual-fund companies, 401(k) managers, and other investment professionals, Saylor said.

His work also explores the subtle distinctions people make when the industry attempts to use familiar terms, such as “guarantee” or “nest egg.” …

NWNE Heard On The Street from Center for Retirement Research on Vimeo.

August 9, 2011

Widowed Advisor Strives to Help Others

The death of a husband is frightening and overwhelming. These feelings are magnified for women who relied on their husbands to handle the household finances.

Florida financial planner Kathleen Rehl’s new book, “Moving Forward On Your Own: A Financial Guidebook for Widows,” gently guides widows through this daunting task.

Florida financial planner Kathleen Rehl’s new book, “Moving Forward On Your Own: A Financial Guidebook for Widows,” gently guides widows through this daunting task.

The author’s professional experience over the years has naturally “morphed” into her interest in helping her “widowed sisters,” through this book, she said. And her credentials are all relevant: Ph.D. in education, CFP certification, and recent widow. Her husband died of liver cancer in 2007, eleven weeks after his diagnosis.

Here’s what I like about her award-winning book: my 75-year-old mother would like it. Rehl tries to make widows comfortable that keeping their emotional priorities straight is their top priority – allowing time to grieve, making an effort to plan activities with friends and grandchildren, and growing spiritually.

Advice like this is interspersed with examining the reader’s “personal money style,” a “financial feelings survey” and brass-tacks advice like figuring out what net worth is and where the money goes.Learn More

July 28, 2011

New Product Boosts Low-Income Saving

A Connecticut non-profit is testing a new product to help low-income people overcome their particular obstacles to saving money.

Innovations for Poverty Action is recruiting participants at the District Government Employees Federal Credit Union in Washington. The effort replicates a program already up and running in New York City.

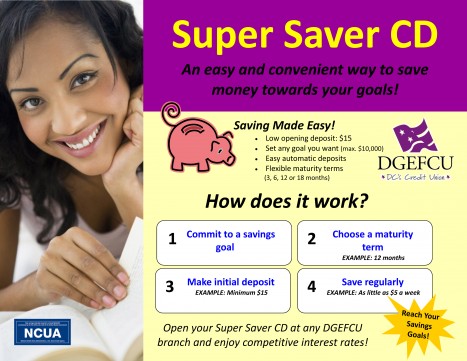

The product’s name, Super Saver CD, is a bit of a misnomer. It is a hybrid of a bank certificate of deposit and a traditional savings account. Its low minimum deposit – $15 – removes a formidable obstacle for people who can’t afford to shell out $1,000 for a CD.

The product’s name, Super Saver CD, is a bit of a misnomer. It is a hybrid of a bank certificate of deposit and a traditional savings account. Its low minimum deposit – $15 – removes a formidable obstacle for people who can’t afford to shell out $1,000 for a CD.

Innovations for Poverty Action was founded by behavioral economist Dean Karlan at Yale University, and it designed the Super Saver CD to help people to act in their own interest and save. The human behavior that drives the product’s design is that people don’t always do what they say they’ll do. So the Super Saver CD requires that people commit to regular deposits. The idea is to encourage saving regularly, a little at a time, like a savings account. But once the money is put away, it can’t be touched – that’s where a CD-style commitment comes in.

Rosa Sorto, who irons linens at a Washington laundry service for hotels and hospitals, said the program appealed to her because she can put the money away and forget about it. …Learn More

July 28, 2011

Nudge to Save Doesn’t Work

The popular strategy of automatically enrolling people in savings plans didn’t work so well among low-income people.

Researchers found that when a tax preparation service slated 10 percent of filers’ tax refunds to purchase a savings bond, many balked and opted out of the program. The likely reason: they already had plans for how they were going to spend the windfall, including a pressing need to pay bills.

Automatic enrollment in 401(k)s, a strategy pioneered by behavioral economists, is gaining popularity in U.S. workplaces, largely because it works so well: a record 51 percent of U.S. employers used auto enrollment in 2010, according to Callan Associates, a benefits consultant.

Workers can still opt out, but employers have found that most of them remained in the 401(k) plan. This is due to inertia and also because employees know that saving for retirement is the right thing to do – they just needed a push.

But an experiment by economists at Swarthmore College and the University of Virginia, published recently by the National Bureau of Economic Research, “raises questions about the power of defaults.” …Learn More