August 1, 2019

A Proposal to Fill Your Retirement Gap

David and Debra S. both had successful careers. In analyzing their retirement finances, the couple agreed that he should wait until age 70 to start his Social Security in order to get the largest monthly benefit.

But he wanted to sell his business at age 69 and retire then, so the North Carolina couple used their savings to cover some expenses over the next year.

Waiting until 70 – the latest claiming age under Social Security’s rules – accomplished two things. In addition to ensuring David gets the maximum benefit, waiting guaranteed that Debra, who retired a few years ago, at 62, would receive the maximum survivor benefit if David were to die first.

Other baby boomers might want to consider using this strategy. As this blog frequently reminds readers, each additional year that someone waits to sign up for Social Security adds an average 7 percent to 8 percent to their annual benefit – and these yearly increments spill over into the survivor benefit.

Delaying Social Security is “the best deal in town,” said Steve Sass at the Center for Retirement Research, in a report that proposes baby boomers use the strategy to improve their retirement finances.

Here’s the rationale. Say, an individual wants a larger benefit. Instead of collecting $12,000 a year at age 65, he can wait until 66, which would increase his Social Security income to $12,860 a year, adjusted for inflation, with the increase passed along to his wife after his death (if his benefit is larger than his working wife’s own benefit). The cost of that additional Social Security income is the $12,000 the couple would have to withdraw from savings to pay their expenses while they delayed for that one year.

Social Security is essentially an annuity with inflation protection – and the payments last as long as a retiree does. So the $12,000 cost of increasing his Social Security benefit can be compared with cost of purchasing an equivalent, inflation-indexed annuity in the private insurance market. An equivalent insurance company annuity for a 65-year-old man, which begins paying immediately and includes a survivor benefit, would cost about $13,500. …Learn More

June 27, 2019

Widows: Manage Your Grief, Finances

Kathleen Rehl’s husband died in February 2007, two months after his cancer diagnosis. She has taken on the mission of helping other widows process their grief, while they slowly assume the new financial responsibilities of widowhood. Rehl, who is 72, is a former financial planner, speaker, and author of “Moving Forward on Your Own: A Financial Guidebook for Widows.” She explains the three stages of widowhood – and advises women to take each stage at their own pace.

Question: Why focus on widows?

Rehl: After a husband dies, and whether it’s unexpected or a long-lingering death, there is a numb period. Some widows refer to it as “my jello brain” or “my widow’s brain.” It’s a result of how the body processes grief. The broken heart syndrome is actually real. After a death, the immune system is compromised, and chronic inflammation can happen. It’s hard to sleep at night and there can be digestive difficulties. Memory can be short, attention spans weakened, and thinking downright difficult. You’ve got this grief, and yet the widow might think, “What do I have to do?” The best thing she can do initially is nothing.

Q: Why nothing?

Rehl: I talk about the three stages of widowhood: grief, growth, grace. At first, she’s so vulnerable that if she’s making irrevocable decisions immediately, they may not be in her best interest. The only immediate things she might need to do are file for benefits like Social Security and life insurance and make sure the bills are still being paid. All widows need to take care of these essential financial matters. But major decisions should be delayed. I knew one widow whose son said, “Move in with us.” That would’ve been a really bad decision, because she didn’t get along with the daughter-in-law, and it would’ve introduced another type of grief – loss of place, loss of friends. Then her son got a job in Silicon Valley and moved away.

Or a widow deposits her life insurance in the bank, and a helpful teller says, “I think Fred in our wealth management department down the hall can see you because you need to do something with your money.” Fred sells her a financial product she doesn’t understand, and two or three months later, when she’s coming out of her grief, she thinks, “What did I buy?” One widow came to me who had locked her money into a deferred annuity that wasn’t going to pay out for years, and she needed the money now.

Q: With most women working today, aren’t they better equipped than previous generations of widows to handle the finances? …Learn More

June 20, 2019

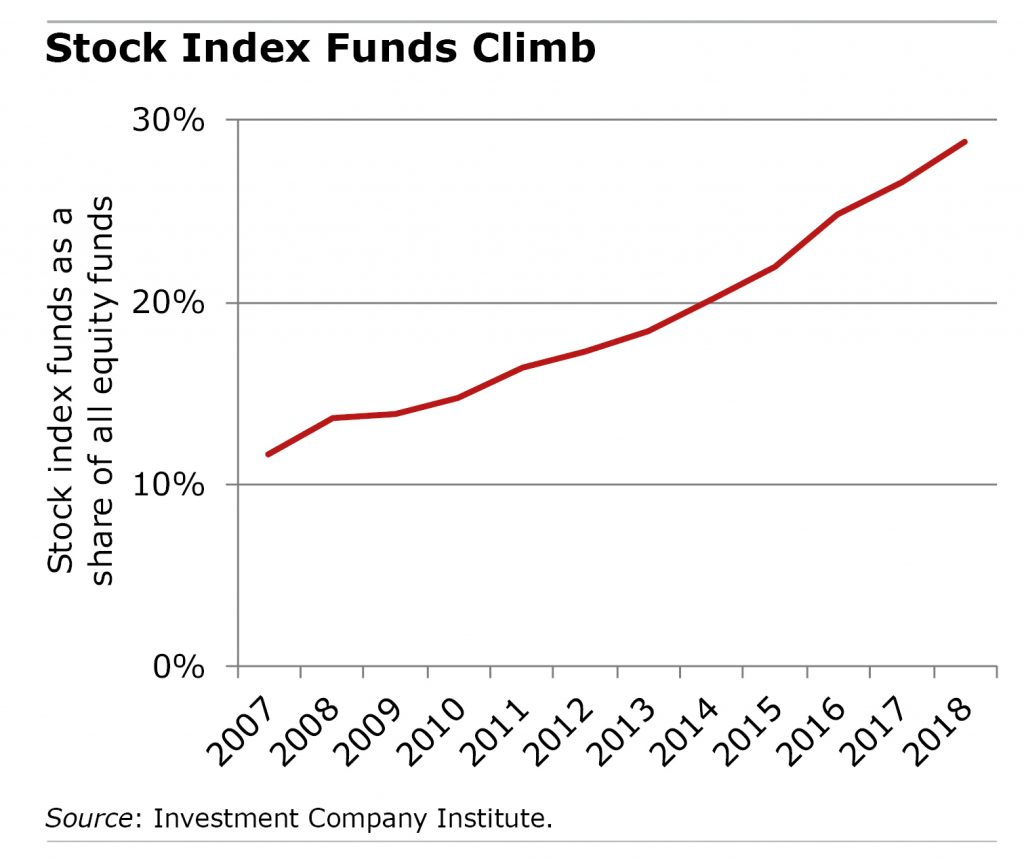

Index Fund Rise Coincides with 401k Suits

Employee lawsuits against their 401(k) retirement plans are grinding through the legal system, with mixed success. Many employers are beating them back, but there have also been some big-money settlements.

This year, health insurer Anthem settled a complaint filed by its employees for $24 million, Franklin Templeton Investments settled for $14 million, and Brown University for $3.5 million.

More 401(k) lawsuits were filed in 2016 and 2017 than during the 2008 financial crisis, and the steady drumbeat of litigation could be affecting how workers save and invest. For one thing, the suits have coincided with a dramatic increase in equity index funds, according to a report by the Center for Retirement Research. Last year, nearly one out of three U.S. stock funds were index funds, double the share 10 years ago.

Some see this change as positive. Many retirement experts believe that the best investment option for an inexperienced 401(k) investor is an index fund, which automatically tracks a specific stock market index, such as the S&P500. Federal law requires employers to invest 401(k)s for the “sole benefit” of their workers, and index funds usually charge lower fees and carry less risk of underperforming the market than actively managed funds – two issues at the heart of the lawsuits.

Some see this change as positive. Many retirement experts believe that the best investment option for an inexperienced 401(k) investor is an index fund, which automatically tracks a specific stock market index, such as the S&P500. Federal law requires employers to invest 401(k)s for the “sole benefit” of their workers, and index funds usually charge lower fees and carry less risk of underperforming the market than actively managed funds – two issues at the heart of the lawsuits.

To avoid litigation – and to comply with recent regulatory changes – employers are also becoming more transparent about the fees their workers pay to the 401(k) plan record keeper and to the investment manager. This transparency may have had a beneficial effect: lower mutual fund fees, which translate to more money in workers’ accounts when they retire. The average fund fee is about one-half of 1 percent, down from three-fourths of 1 percent in 2009, according to Morningstar.

In short, these lawsuits appear to be changing how people invest and how much they pay in fees for their 401(k)s. …Learn More

June 13, 2019

Adult Foster Care a Solution in Oregon

Nursing homes are usually at the bottom of people’s list of places for their parents. A workable and little-known alternative is available in many states: adult foster care.

This PBS video about Oregon’s program features a suburban Portland woman, Carmel Durano, who provides 24-hour care in her home for five elderly people, including her mother. Durano has been a good solution for Steve Larrence’s 99-year-old mother. He feels comfortable with Durano and lives in the same neighborhood, so he can walk over anytime to talk to his mother.

“You don’t feel like you’re in an institution. You feel like you’re living with a family,” Larrence said in the video.

Durano is part of a network of more than 1,500 adult foster care programs in Oregon. Many of them care for more than one senior. Durano, a Filipina immigrant, got involved 30 years ago, because she had three young boys at the time and wanted to stay home for them.

Foster care is much cheaper than nursing homes. And, like nursing homes, state Medicaid programs often pay for the at-home caregivers. But though adult foster care is not immune to cases of abuse, Paula Carder, an expert on aging and dementia at Portland State University, said the Oregon program generally delivers “a high level of care.”

State regulations require caregivers to be certified annually, pass background screenings, and submit to surprise home safety checks and interviews with the adults in their care.

This may be at least a partial solution to the growing problem of an aging population. …Learn More

May 23, 2019

Student Loan Payments Linked to 401ks

Student loans or the 401(k)?

Young adults have a tough time finding the money for both. Unless they work for Abbott Laboratories.

Employees who put at least 2 percent of their income toward student loan payments will qualify for Abbott’s

5 percent contribution to their 401(k) account – without the worker having to put his own money into the 401(k).

From the company’s point of view, it’s an innovative recruitment tool – and it worked for Harvir Humpal, a 2018 biomedical engineering graduate of the California Polytechnic State University in San Luis Obispo. He joined Abbott’s northern California office in February.

Humpal said his student loans weighed on him after graduation. “It’s very empowering that Abbott is willing to tackle an issue that’s near to my heart,” said the 24-year-old, who works on medical devices used in heart transplants.

He estimates he will pay off his $60,000 student loans about four years early and save $7,000 in interest – without completely sacrificing his retirement savings.

As the cost of college continues to rise and U.S. student loan balances hit $1.5 trillion, an increase in the number of private and even government employers offering student loan assistance is a response to the growing financial burden. An Abbott survey found that 87 percent of college students and 2019 graduates want to find an employer offering student loan relief.

The magnitude of the problem “forces us to focus on our employees’ greatest needs and how we, as an employer, can help them,” said Mary Moreland, an Abbott vice president of compensation and benefits. …Learn More

May 14, 2019

20,000 Savers So Far in New Oregon IRA

About a third of retired households end up relying almost exclusively on Social Security, because they didn’t save for retirement. Social Security is not likely to be enough.

![]() To get Oregon workers better prepared, the state took the initiative in 2017 and started rolling out a program of individual IRA accounts for workers without a 401(k) on the job. The program, OregonSaves, was designed to ensure that employees, mainly at small businesses, can save and invest safely.

To get Oregon workers better prepared, the state took the initiative in 2017 and started rolling out a program of individual IRA accounts for workers without a 401(k) on the job. The program, OregonSaves, was designed to ensure that employees, mainly at small businesses, can save and invest safely.

Employers are required to enroll all their employees and deduct 5 percent from their paychecks to send to their state-sponsored IRAs –1 million people are potentially eligible for OregonSaves. But the onus to save ultimately falls on the individual who, once enrolled, is allowed to opt out of the program.

More than 60 percent of the workers so far are sticking with the program. As of last November, about 20,000 of them had accumulated more than $10 million in their IRAs. And the vast majority also stayed with the 5 percent initial contribution, even though they could reduce the rate. This year, the early participants’ contributions will start to increase automatically by 1 percent annually.

The employees who have decided against saving cited three reasons: they can’t afford it; they prefer not to save with their current employer; or they or their spouses already have a personal IRA or a 401(k) from a previous employer. Indeed, baby boomers are the most likely to have other retirement plans, and they participate in Oregon’s auto-IRA at a lower rate than younger workers.

Despite workers’ progress, the road to retirement security will be rocky. Two-thirds of the roughly 1,800 employers that have registered for OregonSaves are still getting their systems in place and haven’t taken the next step: sending payroll deductions to the IRA accounts.

The next question for the program will be: What impact will saving in the IRA have on workers’ long-term finances? …Learn More

May 7, 2019

Social Security Benefits Stump Workers

A majority of workers do not know a crucial piece of information about their retirement: how much married couples can expect to receive from Social Security.

The program will one day be the most important source of income for millions of Americans. But they showed their lack of understanding of how benefits work in a recent survey by researchers at RAND.

A previous blog covering the same survey reported on workers’ poor knowledge of the survivor benefit for widows. This blog focuses on the other benefit for couples: the spousal benefit.

Social Security works a little differently for a married couple than for a single worker, whose future benefit check will simply be determined by his or her earnings history.

For the highest-earning spouse in a working couple – usually the husband – the size of his monthly check is also based on his past earnings. But his wife’s benefit is complicated. If she didn’t work, the rules entitle her to a spousal benefit equal to half of her retired husband’s benefit. If she did work, her benefit is based on her work history – with an exception. If her benefit is less than half of her husband’s, Social Security increases her monthly check to half of his check.

Only one in three of the people surveyed understood how this works, probably partly because of the complexity.

Most workers also had misconceptions about other aspects of the program. For example, only about one in four knew that a couple must be married for more than a year for the lower-paid person to receive the spousal benefit. If a couple has divorced, the lower-earning ex-spouse gets the spousal benefit only if the marriage lasted more than 10 years. Again, just one in four workers knew this important rule.

Couples of all ages should know the rules about a program they will rely on – no retirement plan is complete without this information. …Learn More