July 18, 2013

Amid Recovery, Part-Time Jobs Still High

One segment of the U.S. labor force sheds light on the continuing struggle to find work: part-time employees who want a full-time job but can’t find one.

One segment of the U.S. labor force sheds light on the continuing struggle to find work: part-time employees who want a full-time job but can’t find one.

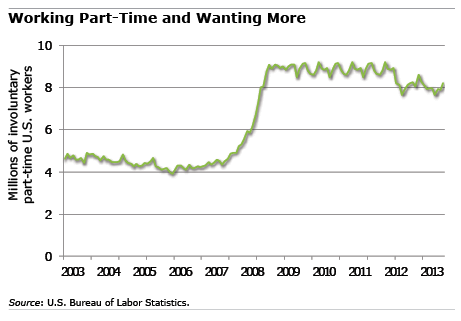

The U.S. unemployment rate has drifted down during the economic recovery. But the number of people the Department of Labor calls “involuntary part-time” roughly doubled during the recession to 8 million and still remains stuck at this much higher level.

Millions of Americans work part-time because they want to, but this involuntary part-time workforce is one more gauge of the slack labor market and lingering pain three years after the Great Recession officially ended. The Labor Department counts part-timers as involuntary if they can’t find a full-time job or if they work part-time for economic reasons, say a construction worker who doesn’t have enough projects to keep busy. …Learn More

June 11, 2013

Too Many Homeowners Still Underwater

With house prices rising smartly, homeowners should be celebrating. Right?

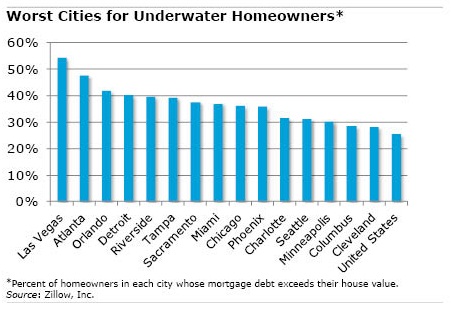

Wrong. To be sure, a 10 percent jump in house prices in the first quarter, compared with a year earlier, pushed more people out of the red and into the black. But one in four U.S. homeowners with a mortgage still has “negative equity:” the mortgage exceeds the value of the home, according to new data from Zillow.

These 13 million U.S. homeowners will need more price appreciation before they can feel that the housing-market downturn of the previous decade is truly over.

Negative equity is prevalent not just in obvious places like Las Vegas, once the poster child for the go-go real estate market that went bust. The painful aftermath lingers in Chicago and Minneapolis, where about one in three owners has negative equity.

Seattle, Cleveland, and Baltimore also each have a larger share of owners in negative territory than the national average.

Seattle, Cleveland, and Baltimore also each have a larger share of owners in negative territory than the national average.

Zillow computes a second, broader measure of underwater homeowners. It adds together people with negative equity and those who have some equity, though not enough to pay a real estate agent and related costs to sell their house and move. When this second group is included, the share of home borrowers in a financial bind increases to 44 percent, from 25 percent, Zillow said. …Learn More

June 4, 2013

Earnings Growth: Better at the Top

U.S. inequality can be measured two ways – by wealth or by earnings. Either way, most working Americans are losing out.

It’s the 1920s again for the richest 1 percent of Americans, and a recent analysis of the wealth gap illustrates why they’re able to live like the fictional Jay Gatsby, portrayed by Leonardo DiCaprio in the new movie, “The Great Gatsby.”

The value of their wealth rises and falls with the stock market. But since the 1960s, they have consistently held 33 percent to 39 percent of the wealth owned by all Americans, including their stock, mansions, commercial real estate, and businesses, according to economist Edward Wolff at New York University. In 2010, the last year examined by Wolff, the richest 1 percent’s share was 35 percent – that was before the Dow flew past 15,000.

The U.S. wealth gap is enormous, partly because most Americans have little wealth to speak of. Most people instead gauge their financial well-being by the size of their paychecks, and income inequality is rising sharply.

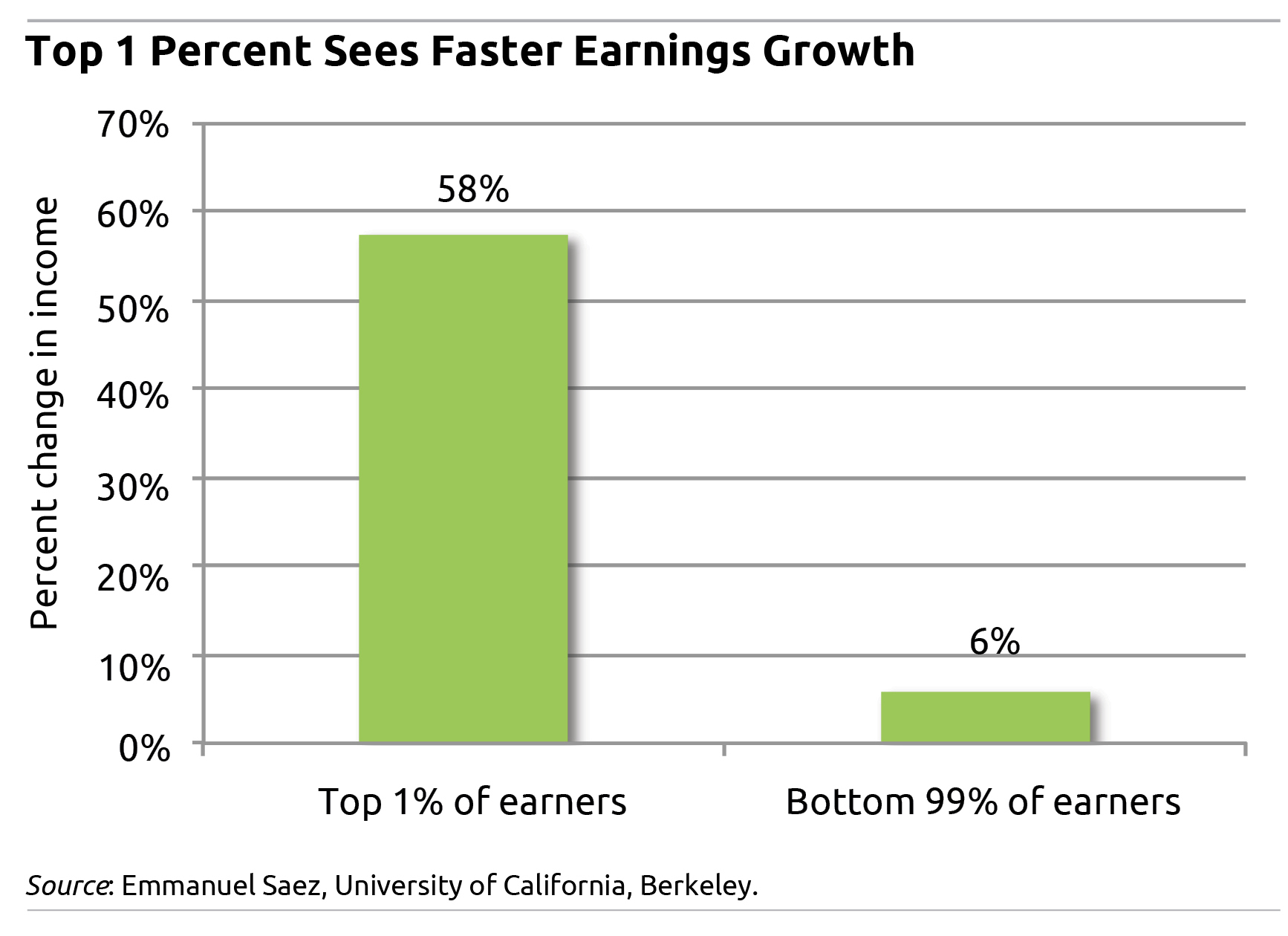

Between 1993 and 2011, the earnings of the top 1 percent of U.S. earners grew by nearly 58 percent, after adjusting for inflation. Earnings include salaries, bonuses, stock options, dividends, and capital gains on stock portfolios. That far outpaced the 6 percent rise for the rest of U.S. workers during the same 18-year period, according to a new analysis by economist Emmanuel Saez at the University of California, Berkeley. …Learn More

Between 1993 and 2011, the earnings of the top 1 percent of U.S. earners grew by nearly 58 percent, after adjusting for inflation. Earnings include salaries, bonuses, stock options, dividends, and capital gains on stock portfolios. That far outpaced the 6 percent rise for the rest of U.S. workers during the same 18-year period, according to a new analysis by economist Emmanuel Saez at the University of California, Berkeley. …Learn More

May 28, 2013

Aussie Employer Mandate Fuels Saving

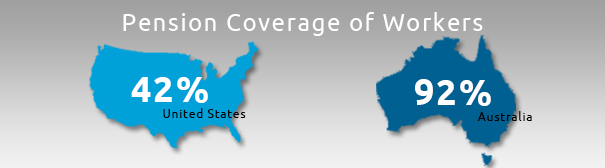

Consider this: 92 percent of Australian workers have 401(k)-style plans, while less than half of Americans have any kind of pension coverage on their current job.

This yawning disparity exists, because the Australian government requires employers to contribute 9 percent of each worker’s earnings to a personal account, which participants invest much like a 401(k). Under reforms to Australia’s system, employer contributions will rise gradually until 2020 – to 12 percent.

Even though Aussie employers are mandated to make the contributions, economists argue, the money ultimately comes from workers – through lower wages. But U.S. workers, left on their own, have proved to be poor savers, and the fact remains that putting the onus on employers to ensure that retirees have something in savings is working better than our catch-as-catch-can system.

“Australia has been extremely effective in achieving key goals of any retirement income system,” concluded a new report by the Center for Retirement Research, which supports this blog. …Learn More

May 2, 2013

Health Reform May Impact Your Finances

Getting or keeping health insurance is central to many of the major decisions that working Americans make.

Canadian and European governments provide universal health care to their citizens, but this country has relied heavily on employers for health insurance, and only about two-thirds of them provide it. It’ll be fascinating to see how health care reform changes our decisions about work, starting a business, college, and individual finances when more Americans have access to coverage in 2014.

Research years ago established the influence of employer health insurance on the workplace. When employees are covered at work, job turnover is lower – workers know health care is a big thing to give up. There’s also newer evidence that people on the disability rolls, who receive health care as part of that federal benefit, are more likely to go back to work if they live in a state with better access to health insurance in the private market.

Retirement is another big decision driven by one’s health insurance options. Medicare eligibility at age 65 can trigger the decision, new research shows: people working for employers without any health benefits for their retirees are more likely to retire at 65, according to a paper by economists Norma Coe of the University of Washington’s School of Public Health and Matt Rutledge of the Center for Retirement Research at Boston College, which supports this blog.

“We interpret this finding as evidence that Medicare eligibility persuades people to retire, because they can begin receiving federal health coverage,” Coe and Rutledge write. …Learn More

April 18, 2013

To Live Cheaply, See the World

Adam Shepard estimates that it cost him $19,420.68 to circumnavigate the globe from October 2011 through September 2012.

It was a budget tour filled with simple pleasures and wild adventures for the failed professional basketball player and successful book author. He helped poor children in Honduras, hugged a koala in Perth, rode an elephant in Thailand, bungee jumped in Slovakia, and hung out in lots of places with Ivana, whom he met while traveling and later married (she brought only $12,000, so he paid for the food).

If he’d kept his bartending job in Raleigh, North Carolina, his car, and apartment, he estimates he would’ve easily spent more than $20,000 during that same year.

“If you wonder whether an odyssey like mine is financially realistic for you, I answer with a resounding yes,” he writes encouragingly in his new e-book, “One Year Lived,” which is being published today.

You’d have to read it to find out how he did it – and how energetic someone has to be to pull off an escapade through 17 countries. Shepard’s book is a strong reminder to those of us who burrow at our desks day after day that, as the saying goes, there’s more to life than money. …

Learn More

April 11, 2013

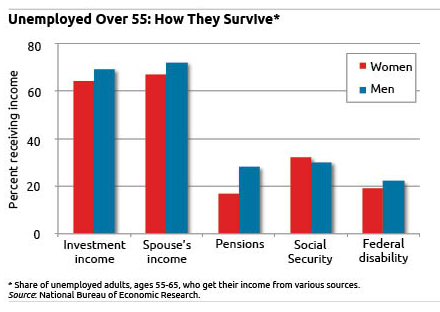

Jobless Boomers: How They Survive

Squared Away wrote about three unemployed baby boomers on Tuesday – an arts administrator, a corporate executive, and a social-services professional – who are having to scrounge for income to sustain themselves.

They are among the more than 1.5 million baby boomers caught in that painful limbo between a long and successful career and retirement – very possibly by default. All three want to get back into the labor force but may be forced to retire, because it’s more difficult for them to find employment than it is for younger workers.

While nearly half of unemployed adults between the ages of 25 and 49 were able to find work within seven months during and after the Great Recession, it took more than nine months for half of those over 50 to find a job, according to the Urban Institute, a Washington think tank. Many boomers may never find a job and will eventually retire.

“It’s different than being 35 or 45 and out of work,” said Kevin Milligan, an economics professor at the University of British Columbia. “We don’t necessarily expect these [older] people to go back to work.”

Milligan’s research last year determined that two-thirds or more of jobless Americans between ages 55 and 65 rely on their spouses for income. With only one spouse working, this creates hardships. These older households suddenly are able to save less in their 401(k)s. Milligan found that smaller numbers of boomers are also tapping their employer pensions or Social Security retirement benefits. …Learn More

Milligan’s research last year determined that two-thirds or more of jobless Americans between ages 55 and 65 rely on their spouses for income. With only one spouse working, this creates hardships. These older households suddenly are able to save less in their 401(k)s. Milligan found that smaller numbers of boomers are also tapping their employer pensions or Social Security retirement benefits. …Learn More