September 4, 2012

Flatline: U.S. Retirement Savings

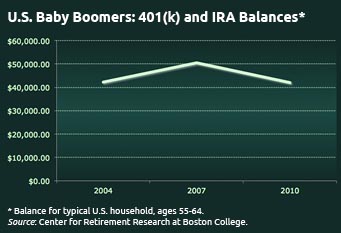

Baby boomers’ balances in 401k and IRA accounts have barely budged for most of the past decade.

In 2004, the typical U.S. household between ages 55 and 64 held just over $45,000 in their tax-exempt retirement plans. Plan balances for people who fell in that age group in 2007 rose but settled back down after the biggest financial crisis in U.S. history. In 2010, they were $42,000, a few bucks lower than 2004 balances.

These are among the reams of sobering data contained in the Federal Reserve’s 2010 Survey of Consumer Finances released in June. The $42,000 average balance is for all Americans – it includes the more than half of U.S. workers who do not participate in an employer-sponsored savings program.

There’s more bad news buried in the SCF: the value of other financial assets such as bank savings accounts dropped in half, to $18,000. And hardship withdrawals from 401(k)s have increased, to more than 2 percent of plan participants, from 1.5 percent in 2004.

There’s more bad news buried in the SCF: the value of other financial assets such as bank savings accounts dropped in half, to $18,000. And hardship withdrawals from 401(k)s have increased, to more than 2 percent of plan participants, from 1.5 percent in 2004.

So, where did all that wealth created by the longest economic boom in U.S. history go? The 2008 financial collapse didn’t help. But we can also blame the baby boom culture. Click here to read a year-ago article that examines the cultural reasons for the troubling condition of our retirement system.

To receive a weekly email alerts about new blog posts, click here.

There’s also Twitter @SquaredAwayBC, or “Like” us on Facebook!Learn More

August 7, 2012

Gilded Age: Pride in Excess

The flaunting of wealth that marked the Gilded Age is difficult to grasp. Forbes reports there are currently 425 U.S. billionaires, the most in any country. They tend to live in cocoons, flinching when the media write about their vast homes or other trappings of wealth.

But Newport Rhode Island’s Gilded Age mansions were built for the express purpose of showcasing the unprecedented fortunes accumulated during the new industrial age. Summer residents paraded in their finery during afternoon carriage rides and held lavish parties for hundreds – sometimes thousands – on the grounds of their seaside homes, which replicated the castles that wealthy Americans saw during their European vacations. [On Aug. 16-19, The Preservation Society of Newport will host a weekend of carriage rides.]

Enjoy this photo tour of The Breakers and Marble House! Newport’s most spectacular homes were built by two grandsons of the steamship and railroad magnate “Commodore” Cornelius Vanderbilt.

Arial View of The Breakers, Newport, Rhode Island:

Cornelius Vanderbilt II introduced his “summer cottage” to high society with a 1895 debutante party for daughter Gertrude, officially putting his $75 million fortune on grand display. …Learn More

June 19, 2012

Is 62 Dead (as a Retirement Age)?

![grave_62[2]](https://squaredawayblog.gnaritas.com/wp-content/uploads/2012/06/grave_622-271x361.jpg) Life expectancy rises. Wages stagnate. Retirement accounts shrink. Guaranteed monthly pensions are an endangered species.

Life expectancy rises. Wages stagnate. Retirement accounts shrink. Guaranteed monthly pensions are an endangered species.

The average U.S. age for men retiring from work has gradually increased to 64. Yet age 62 continues to be held out as the popular standard, perhaps because that’s Americans’ marker for Social Security eligibility.

Is retirement at age 62 destined be a casualty of dovetailing medical, financial, economic and even political trends? Many baby boomers are already postponing retirement into their mid- or even late 60s. One study found that claiming Social Security at 62 is becoming less popular, a trend that is expected to continue despite the hardships of the Great Recession.

“I don’t think it’s dead, but its health has eroded,” Chuck Miller, a Chicago communications consultant who specializes in retirement, said about age-62 retirement in this country.

Wisconsin’s failed recall election for Governor Scott Walker suggested growing U.S. voters’ disdain for generous pensions and early retirement ages, even as Europeans protest government proposals to raise public employees’ retirement ages. Rhode Island has already raised its employee retirement age to 67, from 62 previously. And voters in San Jose just approved measures to scale back public worker pensions that included an increase in the retirement age.

Squared Away readers, where do you stand? Have you or will you retire at age 62? Tell us about your situation or your theories!Learn More

June 14, 2012

Progress Stalls for Young Adults

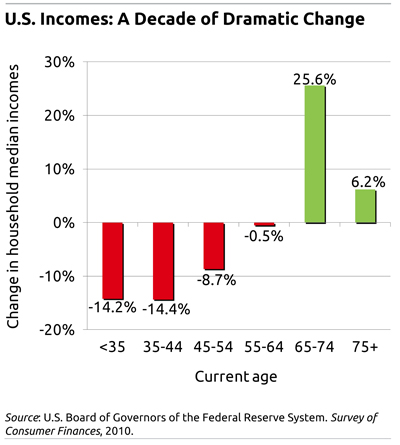

The promise of America is progress, but that progress stalled for the youngest generation: U.S. workers under age 45 earned dramatically less than workers who were that same age a decade ago, the Federal Reserve Board’s latest survey shows.

For Americans 35 through 44, the median household income – the income that falls in the middle of all earners – was $53,900 in 2010. That’s 14 percent less income than in 2001 when households in the 35-44 age bracket were earning $63,000, according to the Fed’s Survey of Consumer Finances released Monday. For young adults in the under-35 age bracket, median income fell to $35,100 in 2010, from $40,900 for that group in 2001.

The median income also declined, by nearly 9 percent, for Americans in their peak earning years, 45 through 54, to $61,000 in 2010 from $66,800 in 2001. [Incomes for all years are in current dollars.]

The sharp decline in real incomes, especially for young adults, occurred in a decade bracketed by the high-tech bubble of early 2000 and the jobless recovery of 2010 from the financial crisis. Without further analysis, it’s difficult to pinpoint precise explanations for the patterns. But the reasons vary depending on the age bracket being analyzed.

For the youngest workers, incomes may be lower if many are extending their college educations – high school and college graduates face the lowest level of employment ever recorded.

Learn More

June 7, 2012

Enough to Make You Dizzy

Some of Michael Najjar’s images transport people to the precarious heights of the Andes mountain range in Argentina. Others focus attention on the severe cliffs over which a mountain can slide.

Using photographs taken during his climb to the summit of Mount Aconcagua, Najjar used the computer to manipulate the images of surrounding mountain ranges to track the paths of the world’s stock market indexes over the past three decades.

Inspired by his ongoing interest in technology, he attempted to evoke the impact of algorithmic trading on stocks and options trading, which carves out some market peaks and valleys. “I wanted to do something extremely physical to rematerialize what has become invisible,” Najjar said in a recent telephone interview from his Berlin studio.

Before Squared Away reveals which photograph the artist himself believes depicts Europe’s precarious financial and economic situation, click here to make your own decision. …Learn More

June 5, 2012

College Loans: A Punitive System?

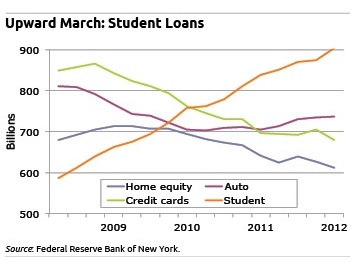

News emerging on several fronts points to what increasingly looks like a student-loan system stacked against young adults fresh out of college.

The Federal Reserve Bank of New York last week said college debt outstanding surged to a record $904 billion – the figure, from a new and improved Fed data set, was higher than had previously been thought. What was also noteworthy was that the central bank said a $300 billion spike in college debt since 2008 has occurred during a time other U.S. households slashed $1.5 trillion from their loan balances in a massive, post-recession belt tightening.

The Federal Reserve Bank of New York last week said college debt outstanding surged to a record $904 billion – the figure, from a new and improved Fed data set, was higher than had previously been thought. What was also noteworthy was that the central bank said a $300 billion spike in college debt since 2008 has occurred during a time other U.S. households slashed $1.5 trillion from their loan balances in a massive, post-recession belt tightening.

Student loan debt “continues to grow even as consumers reduce mortgage debt and credit card balances,” Fed senior economist Donghoon Lee said.

Washington is the first place to look for one Kafkaesque aspect of the college loan system. Politicians are engaged in brinksmanship over whether to allow the expiration of a temporary interest rate reduction for the Stafford Loan program put in place in 2007. This would cause the rate to double, returning to its previous level of 6.8 percent.

That’s a nice interest-rate spread for the federal government, which currently pays historic lows of about 1.5 percent on 10-year U.S. Treasury Bonds and 2.5 percent for 30 years. Even taking into account the sky-high default rate on student loans, is 6.8 percent a fair price for recent graduates to pay? …Learn More

May 24, 2012

Wanna Live Forever, Huh?

Mark Wexler (right), director of the documentary “How to Live Forever,” with fitness celebrity Jack Lalanne.

Immortality hasn’t been this hot since Ponce de Leon searched for the fountain of youth in 16th Century Florida.

The evidence: Captain Jack Sparrow (a.k.a. Johnny Depp) searched high and low for it in “Pirates of the Caribbean” Part IV last summer. Meanwhile, U.S. beaches were littered with the polka dot cover of “Super Sweet Sad Love Story” about a dystopian Manhattan, where longevity had to be earned. Mark Wexler’s documentary, “How to Live Forever,” was a bizarre-funny send up of baby boomers’ search for their fountains of youth. And time – not money – was the currency in the Justin Timberlake vehicle, “In Time.” Another Twilight vampire movie on the way…

This spring, Jane Fonda is promoting her new book, “Prime Time,” about what she calls the “third act” of life as more Americans are increasingly healthy into their 70s, 80s, even 90s. Not to put a damper on things, but can we afford our third act if we’re not Jane Fonda?

Noting the 30-year increase in U.S. longevity over the 20th century, she said it is ushering in a lifestyle “revolution.” But an index produced by the Center for Retirement Research, which funds this blog, indicates that we won’t have enough income to afford it. This regularly updated retirement index shows that nearly half of U.S. households with boomers in their early 50s are “at risk” of not having enough money for retirement.

Are you ready for your glorious third act? Or will it be more like the explorer’s quest? Pure myth.

Learn More