April 1, 2021

What the Research Can Tell us about Retiring

It’s difficult to envision what life will look like on the other side of the consequential decision to retire.

But research can help demystify what lies ahead – about the decision itself, the financial challenges, and even the taxes. Readers understand this, as evidenced by the most popular blog posts in the first three months of the year.

Here are the highlights:

The retirement decision. The article, “Retirement Ages Geared to Life Expectancy,” attracted the most reader traffic. Myriad considerations go into a decision to retire. But a sense of whether one might live a long time – because of good health or simply seeing that parents or neighbors are living unusually long – is a compelling reason to postpone retirement either to remain active or to build up one’s finances to fund a longer retirement.

A recent study found that as men’s life spans have increased, they have responded by remaining in the labor force longer, especially in areas of the country with strong job markets and more opportunity. This is also true, though to a lesser extent, for working women.

The planning. The second most popular blog was, “Big Picture Helps with Retirement Finances.” It described the success researchers have had with an online tool they designed, which shows older workers the impact on their retirement income of various decisions. When participants in the experiment selected when to start Social Security or how to withdraw 401(k) funds, the tool estimated their total retirement income. If they changed their minds, the income estimate would change.

The tool isn’t sold commercially. But it’s encouraging that researchers are looking for real-world solutions to the financial planning problem, since the insights from experiments like these often make their way into the online tools that are available to everyone.

The taxes. It’s common for a worker’s income to drop after retiring. So the good news shouldn’t be surprising in a study highlighted in a recent blog, “How Much Will Your Retirement Taxes Be?” Four out of five retired households pay little or no federal and state income taxes, the researchers found. But taxes are an important consideration for retirees who have saved substantial sums. …Learn More

March 26, 2020

Money Shame Surfaces in Tough Times

It’s easy to overlook the emotions that swirl around money. But they often come to the surface when our financial security is thrown into question.

The spread of the coronavirus has kicked Americans’ financial anxieties into high gear, a Kaiser Family Foundation poll found last week. More than half of the workers who were surveyed fear they will lose income when their workplace is closed or their hours are reduced.

Reduced income is hitting low-wage, part-time and hourly workers hardest and fastest. But even among people with more financial resources, more than half are concerned they’ll have to dip into retirement savings or college funds.

Even when financial problems stem from events that are outside of an individual’s control, a feeling of shame can take over. Shame is the thread running through three TED videos that explore the emotions around money.

With economists increasingly predicting a recession in the wake of the virus, it might be useful to keep in mind the insights and coping mechanisms discussed by the speakers in these videos.

Shame is that “intensely painful feeling or experience of believing that we are flawed … based on our bank account balances, our debts, our homes, or our job titles,” Tammy Lally explains in the first video.

Lally, a financial coach, believes her brother was driven to suicide by his shame about his bankruptcy filing earlier that same day. She said she was judgmental at first but, after encountering financial problems of her own, came to a better understanding of the intense pressures her brother was feeling.

Lally’s and her brother’s shame around money was rooted in their childhood, she said: the siblings learned from their parents that money would make them happy. “We internalized that into the money belief that our self-worth was equal to our net worth.”

As the coronavirus pummels the stock market and slows the economy, many workers are feeling under enormous financial pressures. But Thasunda Duckett, who runs the consumer division of a major bank, said in a second video that people only compound the pressures when they blame themselves.

“We have a fraught relationship with money, because it comes with judgment,” she said.

Duckett and Lally both recommend one thing people can do if they’re experiencing money issues. To overcome some of the shame and anxiety requires letting the burden go by talking openly with others about money – you will quickly learn that you are not alone.

“Money can no longer be a taboo topic,” Lally said.

In 2007, a year before the financial crisis hit, Elizabeth White, a Harvard Business School graduate and one-time international consultant, was tumbling into “economic freefall.” …Learn More

February 13, 2020

Romance Frauds are Hiding in Plain Sight

Romance scammers follow a predictable script.

Find a willing person on social media or a dating website. Use the information she’s posted online to befriend her and then win her affection. Ask her for a loan for an urgent matter and promise to pay it back. After the money is wired, ply the victim for more money while promising to meet in person – a plan that never seems to pan out.

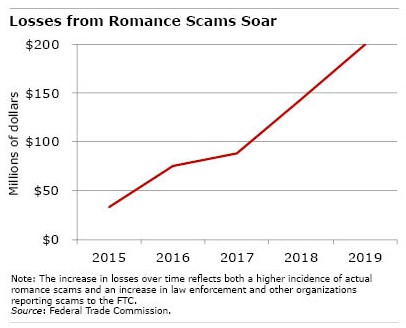

Despite the flashing red lights that say “fraud,” romance scams are becoming increasingly profitable. Last year, its victims were cheated out of more than $200 million. This is a 40 percent increase over 2018 and exceeds the losses for any other type of scam, according to the Federal Trade Commission. Middle-aged Americans, who are very active online, are the most common victims – and they’re often women. But the typical loss for someone over 70 is $10,000 – the most for any age group. Some people lose much more.

One victim, a 76-year-old widow from Rhode Island, met her alleged perpetrator while playing Words with Friends, an online word puzzle. Over a two-year period, she gave him $660,000, which required her to refinance her home, sell property in Massachusetts, and withdraw money from her bank account.

One victim, a 76-year-old widow from Rhode Island, met her alleged perpetrator while playing Words with Friends, an online word puzzle. Over a two-year period, she gave him $660,000, which required her to refinance her home, sell property in Massachusetts, and withdraw money from her bank account.

A Texan in her 50s met a man on Facebook who claimed to be a friend of a friend. He persuaded her to turn over $2 million, which she doled out slowly over time as he promised to pay her back, told her he loved her, and arranged for them to meet. They never did.

“He was saying all the right things,” she told the FBI. “I felt there was a real connection there.” …Learn More

December 31, 2019

Boomers Want to Make Retirement Work

The articles that our readers gravitated to over the course of this year provide a window into baby boomers’ biggest concerns about retirement.

Judging by the most popular blogs of 2019, they were very interested in the critical decision of when to claim Social Security and whether the money they have saved will be enough to last into old age.

Nearly half of U.S. workers in their 50s could potentially fall short of the income they’ll need to live comfortably in retirement. So people are also reading articles about whether to extend their careers and about other ways they might fill the financial gap.

Here is a list of 10 of our most popular blogs in 2019. Please take a look!

Half of Retirees Afraid to Use Savings

How Long Will Retirement Savings Last?

The Art of Persuasion and Social Security

Social Security: the ‘Break-even’ Debate

Books: Where the Elderly Find Happiness

Second Careers Late in Life Extend Work …Learn More

December 24, 2019

Happy Holidays!

Next Tuesday – New Year’s Eve – we’ll return with a list of some of our readers’ favorite blogs of 2019. Our regular featured articles will resume Thursday, Jan. 2.

Thank you for reading and posting comments on our retirement and personal finance blog. We hope you’ll continue to be involved in the new year. …

Learn More

November 27, 2019

Happy Thanksgiving to All!

Whether you’re having Thanksgiving with family or your celebration will take the form of a Friendsgiving, the staff at Squared Away and the blog’s sponsor, the Center for Retirement Research at Boston College, wish you a wonderful holiday. …Learn More

November 7, 2019

A Brighter Future for a Graying Workforce

Perceptions of older workers haven’t caught up with the reality of their increasingly prominent role in the labor force.

The federal Administration for Community Living reports that the U.S. population over age 60 has surged nearly 40 percent in just the past decade. By 2030, retirees will outnumber children for the first time in history, the U.S. Census Bureau predicts. The world population is on a similar path.

But in the face of this significant demographic shift, discriminatory views of older people persist in obvious and subtle ways. This discrimination colors coworkers’ beliefs about, among other things, older workers’ mental ability, efficiency, and competence on the job, according to one international review of studies on aging.

When people think about the future, “they fail to appreciate the potential that older workers present as workers and consumers,” Paul Irving, an expert on aging, writes in a special November edition of the Harvard Business Review exploring issues relevant to our aging workforce.

Research backs him up. Older people are living longer than past generations, which gives them more capacity to extend their work lives. They’re also generally healthier and enjoy more disability-free years, thanks to innovations like cataract surgery to restore their vision.

But ageism’s consequences are still apparent in the workplace. An Urban Institute report said that older workers, for a variety of reasons, are frequently pushed or nudged out of a long-term job at some point late in their careers. Some are forced into early retirement. And for those who do find another job, the new opportunities, while less stressful, are often a step down in terms of prestige and pay.

Irving, who is chairman of the Milken Institute’s Center for the Future of Aging, wants to chart a more hopeful path for our graying U.S. workforce, one that views it as an opportunity – rather than a looming crisis. …Learn More