July 14, 2015

Avoid Medicare Enrollment Mistakes

Mistakes made during initial Medicare enrollment can be costly.

Someone with on-the-job health care coverage who enrolls at age 65 may be paying Medicare premiums unnecessarily. Even worse, retirees who sign up too late incur a penalty for life.

“If you’re actively working, that’s the only reason you can enroll late in Medicare” without paying the penalty, Medicare trainer Andy Tartella says in the above video, “The ABCD’s of Medicare,” produced by the Centers for Medicare and Medicaid Services (CMS), an agency of the U.S. Department of Health and Human Services.

Medicare has been around for exactly 50 years. But enrolling in the program is a new experience for every single American who turns 65. To navigate Medicare enrollment and the alphabet soup of Medicare programs, the following are other video tutorials produced by the federal government and other reliable sources – links are embedded at the end of the title: …Learn More

July 2, 2015

Top Blog Topics: Financial Ed, Retirement

It’s customary every six months for Squared Away to round up our readers’ favorite blogs. The following were your top picks during the first six months of 2015, based on an analysis of online page views.

To stay current on blog posts in the future, click here to join a once-weekly mailing list featuring the week’s headlines on Squared Away.

Retirement is a perennial favorite among readers. But the top 10 list below also includes blogs about financial education and knowledge of the U.S. retirement system, longevity, and the hardships specifically faced by older workers: …Learn More

June 23, 2015

Longevity-Promoting Gadgets Are Here

The “longevity economy” (i.e., aging baby boomers seeking long lives) meets “the quantified self” (tracking everything we do online) in the above video about technologies that help aging boomers stay fit.

The PBS video shows off some of the products being developed to cater to an enormous market of some 100 million Americans over age 50, who are spending about $7 trillion per year. Products include a treadmill desk, technology that reveals sleep patterns, and fitness watches measuring everything from blood pressure to how many steps are walked daily.

One issue not mentioned is the privacy around health matters that boomers sacrifice when their every move and personal health metric is a digital data point stored in the cloud. Younger Americans are comfortable about disclosing their private lives online, but are boomers willing to go this far in the name of health and longevity? Learn More

June 18, 2015

Planning for a Centenarian’s Life

Americans have been labeled everything from the Greatest Generation to Generations X, Y, and Z. Are you ready for the Centenarian Generation?

The number of 100-years-olds has roughly doubled over the past two decades to more than 67,000 – mostly women – and the U.S. Census Bureau predicts it will double again by 2030. Just think about the implication of living for a century: retirement at, say, 65 means 35 years of leisure.

This is unappealing to some, unaffordable to many, and it impacts us all.

“We’ve added these extra years of life so fast that culture hasn’t had a chance to catch up,” Laura Carstensen, director of Stanford University’s Center on Longevity, said during a panel discussion at a recent Milken Institute Global Conference in Los Angeles. The best use for a additional 20 or 30 years of life isn’t, she said, “just to make old age longer.”

Granted, the Milken panelists – all privileged and accomplished baby boomers – are removed from the financial and other challenges facing most older Americans. But they have thought deeply about longevity and its consequences.

The following is a summary of their musings on how we might adjust to the coming cultural tilt toward aging:

- Young people need to be more engaged in the issue of increasing U.S. life expectancy, because it will affect Generation Z far more than it has today’s older population. To engage his son’s interest in the topic, Paul Irving, chairman of the Milken Institute’s Center for the Future of Aging, said he introduced the concept of 80-year marriages. “That started a conversation,” he said. …Learn More

June 11, 2015

Get a Truly Free Credit Report

These federal government resources should be helpful to Squared Away readers ranging in age from 20 to 70:

Free credit report: Young adults in particular may not be aware they’re entitled to a free credit report from one of the major credit rating agencies. To ensure the report truly is free, click and follow the links to an outside source recommended by the Federal Trade Commission. To file a paper request or ask for a report by telephone, try the federal Consumer Financial Protection Bureau’s website.

New U.S. Social Security Administration blog: The agency started a new blog last month to provide important benefit information under various programs. Here’s a sample of three useful articles on the blog:

- Replace dog-eared Medicare cards online via your individual Social Security account. If you don’t have an online account, get one here.

- See one example of the large increases in pension benefits that come with delaying when one claims benefits. …

May 26, 2015

Video: College Borrower’s Remorse

Parents should watch this video with their college-bound children.

The young adults featured in “Voices of Debt” have one thing in common: a lack of understanding of the financial implications of debt at the time they were taking out their student loans. So it’s critical that parents start this conversation early with their children.

The compelling video, produced by Manhattan ad agency The Field, speaks for itself. Similar videos can be found here.Learn More

May 21, 2015

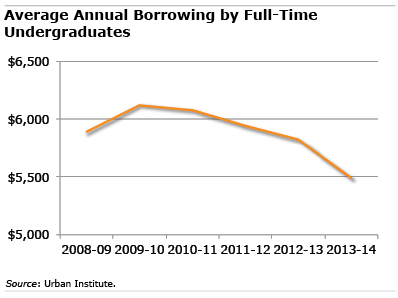

Students Borrowed Less in 2013-14

Here’s actually some good news about student debt: borrowing by undergraduates is now declining.

Here’s actually some good news about student debt: borrowing by undergraduates is now declining.

Annual borrowing by all full-time undergraduates peaked at $6,122 per student in the 2009-10 academic year and fell to $5,490 by 2013-14, according to the Urban Institute’s new report, “Student Debt: Who Borrows Most? What Lies Ahead?”

For its shock value, the media toss around the $1.2 trillion figure – the total of all U.S. student loans outstanding. The institute provides a more refined look at student debt by diving into U.S. Department of Education data to learn who tends to borrow the most and why.

The findings are summarized here: …Learn More