December 19, 2013

Readers’ Favorite Stories in 2013

The blog posts that attracted the most readers this year provide a window into what’s on their minds. The 2013 articles shown below were the most popular, based on unique page views by Squared Away readers.

We’ll return Jan. 2 with more coverage of financial behavior. Please click here to begin receiving our once-per-week alerts with the week’s headlines – and happy holidays!

To find each article, links are provided at the end of the headlines:

An historical perspective on the U.S. money culture:

Oldest Americans are Lucky Generation

More Carrying Debt into Retirement

The financial challenges facing our youngest workers:

Retirement Tougher for Boomer Children

Student Loans = No House, No New Car

Help with your imminent retirement:

Reverse Mortgages Get No Respect …Learn More

December 10, 2013

Compare Your Retirement to Peers

How are your retirement plans going? If you’re a conservative Generation Y investor, are you in the mainstream? Baby boomers, how many in your generation are planning to retire at the same age you do?

Compare yourself with your peers in this cool interactive quiz developed by the Boston mutual fund company, Fidelity Investments.

Click here to check it out.

As you answer each question, you can compare yourself with your peer group’s answer to that same question, based on a prior survey for Fidelity by the polling company, Gfk. Your peer group is determined by your income and your generation – baby boomer, Generation X and Generation Y. Fidelity also provides useful information and tips with each question. …Learn More

November 26, 2013

Happy Thanksgiving

Thank you readers for continuing to support our blog, which was recognized this week by Jean Chatzky of AARP.

We’ll return next Tuesday with more coverage of financial behavior.Learn More

November 21, 2013

CFPB Guidance for Financial Consumers

The Consumer Financial Protection Bureau is kicking into gear to help consumers safely navigate the increasingly complex world of financial products.

The Consumer Financial Protection Bureau is kicking into gear to help consumers safely navigate the increasingly complex world of financial products.

The federal agency in recent weeks has released information for homebuyers and for seniors seeking financial advisers. It also accepts complaints about a growing list of financial products.

Homebuyers Seeking Help:

Individuals can search CFPB’s website for experienced home-buying counselors, by state. These counselors are approved by the U.S. Department of Housing and Urban Development.

To find a counselor, click here.

Seniors Seeking Financial Advisers: To help protect older Americans from poor financial advice, CFPB has created a handy guide to help them find a trustworthy adviser. The guidance includes the right questions to ask and the importance of proper certification. …Learn More

November 4, 2013

Affordable Care Act: Who Gets What

The Henry J. Kaiser Family Foundation just released an excellent interactive slide show explaining how the Affordable Care Act addresses the various health insurance and financial challenges facing 47 million uninsured Americans.

Kaiser divided the uninsured into 10 groups – 28 million part-time workers, 8 million adults in their early 20s, and 3.5 million self-employed people, among others – with details about the specific provisions pertaining to each.

There’s a lot of detail here, so focus on the profiles that interest you most. Advance through the slides by clicking the arrow at the bottom of the screen. To return to the home page, click the “house.” …Learn More

October 29, 2013

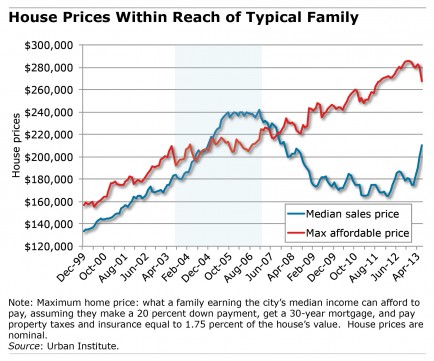

Homes More Affordable – For How Long?

There was a silver lining in the recent housing market collapse: prices dropped to more affordable levels for American families who didn’t already own.

Buying still isn’t easy. It’s become more difficult to qualify for a mortgage from banks and other lenders that have tightened up their credit qualifications. But the following chart, which also appears on page 11 of a chartbook released by the Urban Institute’s new Housing Finance Policy Center, shows the dramatic improvement in home affordability in the wake of the market’s recent downturn.

The blue line shows actual house prices over time – that’s the median, or middle, price for every single home sold nationwide in a given year. The red line shows the maximum a typical family can afford, assuming they put down 20 percent and get a 30-year mortgage at the prevailing interest rate, which is currently about 4.1 percent.

The blue line shows actual house prices over time – that’s the median, or middle, price for every single home sold nationwide in a given year. The red line shows the maximum a typical family can afford, assuming they put down 20 percent and get a 30-year mortgage at the prevailing interest rate, which is currently about 4.1 percent.

During the credit bubble, the blue price line surged above the maximum, putting a new house out of reach for many more families. Post-crash, that relationship reversed, making homes more affordable again.

But affordability still varies greatly, depending on where you live. … Learn More

October 17, 2013

Video: Mutual Funds or Designer Shoes?

Prithi Gowda’s animated video was one of two winners in a competition among New York University film school students and alums to produce a video that would turn young adults on to mutual funds. The winners were awarded a trip to Monaco to premier their work.

The filmmaker practices what she preaches in this short animation, “Frenemies.” Gowda’s freelance work as a website designer and videographer for Wall Street firms has allowed her to build up “a nice, comfortable savings.” Investing, she said, has given her the freedom to start her own company, 21st Street Projects in Manhattan.

“I just feel strongly the world could be a much better place if people really understood how to deal with their finances,” Gowda said.Learn More