September 12, 2019

Social Casinos: Stay Far, Far Away

This report about online casinos is incredible.

The PBS Newshour reports that these gambling websites – for poker, roulette and slots – are able to target people who are the most vulnerable to gambling addiction. The video features a site that assigns VIP status to encourage vulnerable customers to keep playing.

That’s not the only problem. Customers pay real money to buy chips to gamble or cover their losses on the gambling site. But when the customer wins, the website “do[es]n’t pay real money. They only…give you virtual chips to continue to play on their apps,” said a Dallas woman who said she lost $400,000 while gambling online.

Only 1 percent of Americans are gambling addicts, so the problem, while very serious for them, is not widespread. However, in the video, Keith S. Whyte of the National Council on Problem Gambling said that online social casinos are far more addictive than brick-and-mortar casinos.

Whyte said these social casinos are not regulated. The social casino profiled in the video said that it strives “to comply with all applicable standards, rules and requirements.” …Learn More

July 11, 2019

Video: Retirement Prep 101

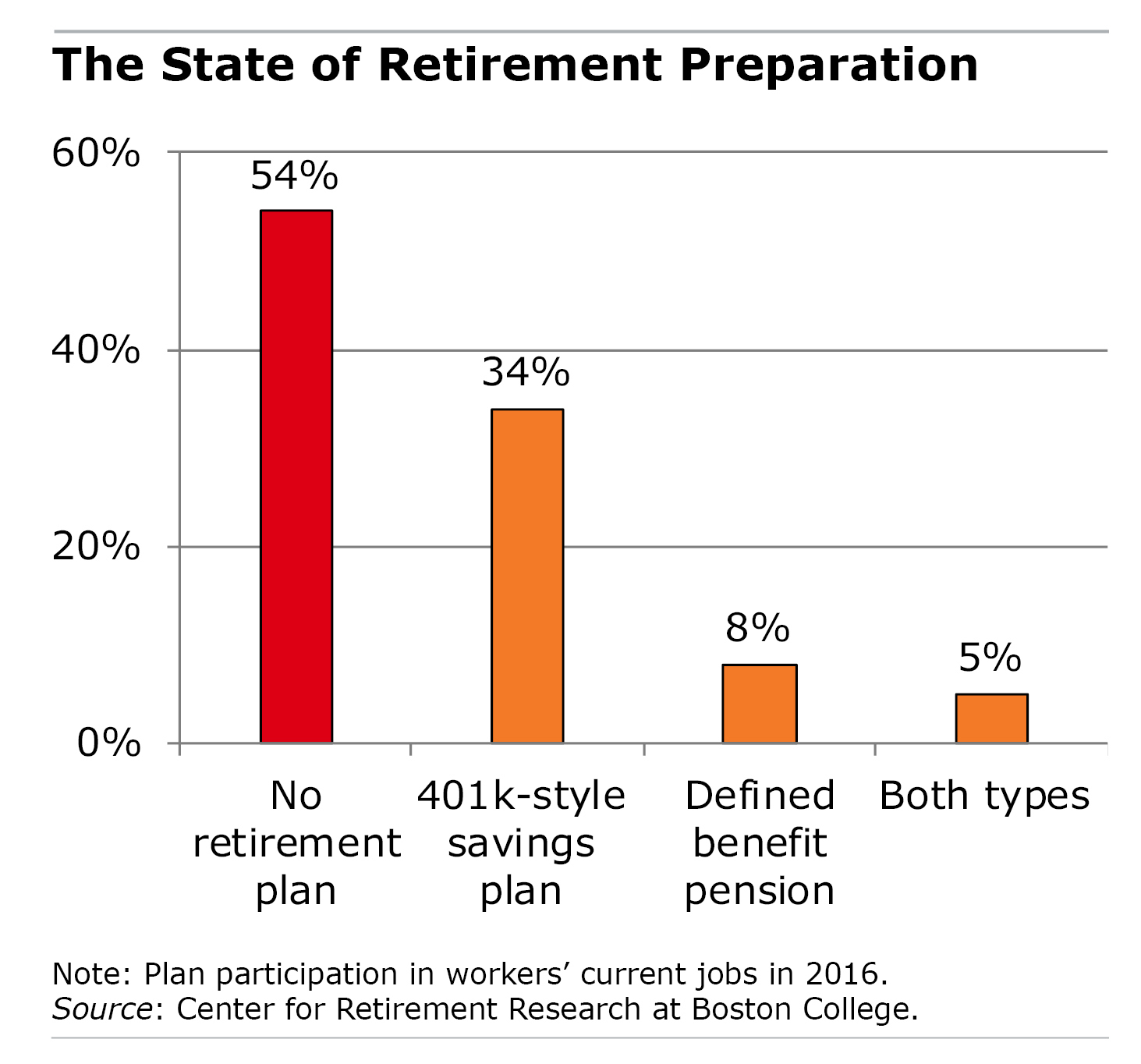

Half of the workers who have an employer retirement plan haven’t saved enough to ensure they can retire comfortably.

This 17-minute video might be just the ticket for them.

Kevin Bracker, a finance professor at Pittsburg State University in Kansas, presents a solid retirement strategy to workers with limited resources who need to get smart about saving and investing.

While not exactly a lively speaker, Bracker explains the most important concepts clearly – why starting to save early is important, why index funds are often better than actively managed investments, the difference between Roth and traditional IRAs, etc.

Some of his figures are somewhat different than the data generated by the Center for Retirement Research, which sponsors this blog. But both agree on this: the retirement outlook is worrisome.

Some of his figures are somewhat different than the data generated by the Center for Retirement Research, which sponsors this blog. But both agree on this: the retirement outlook is worrisome.

The Center estimates that the typical baby boomer household who has an employer 401(k) and is approaching retirement age has only $135,000 in its 401(k)s and IRAs combined. That translates to about $600 a month in retirement.

Future generations who follow Bracker’s basic rules should be better off when they get old. …Learn More

July 3, 2019

Happy Independence Day!

Here’s the back story to your barbecued chicken and grilled hamburgers.

On July 4, 1777, Philadelphians marked the first anniversary of independence from the British with a spontaneous celebration. Future president John Adams described the ships parading on the Delaware River that day as “beautifully dressed in the colours of all nations.” In the aftermath of the Civil War, freed slaves turned the Fourth into a celebration of their emancipation.

If you have the day off from work, thank Congress for declaring the Fourth a federal holiday in 1870. Enjoy! …Learn More

March 12, 2019

How Does Your Wealth Compare?

Depressing or eye-opening?

An online tool tells you where you stand financially by stacking up your net worth against other Americans.

The calculator compares a family’s net worth – financial and other assets minus debts – with all other U.S. families. Homeowners can choose to include the value of their home equity in their total net worth – or not.

Older people have had more time to accumulate wealth, so the rankings are based on the age of the household’s primary wage earner. The comparison is made with 2016 data from the Federal Reserve Board’s triennial Survey of Consumer Finances, which is the gold standard for personal financial data.

Since family – not individual – data are being compared, people who live alone are at a disadvantage. They will be measured against households with more than one person working and accumulating assets.

The calculator is on the DQYDJ financial blog written by a computer programmer and a financial professional. The validity of the results was confirmed by an economist formerly with the Center for Retirement Research, which sponsors this blog.

It might be fun to find out how you’re doing. But use this online tool at your own risk! …Learn More

February 12, 2019

Check Out Our Retirement Podcasts

Thousands of baby boomers retire every day and sign up for Social Security. Yet the payroll tax that funds their benefits is being levied on a shrinking share of workers’ aggregate earnings.

You might not know this but inequality and growing U.S. trade with China are among the forces that are behind this trend, Gal Wettstein explains in a new podcast about his research for the Center for Retirement Research (CRR).

This is the latest in a series of podcast interviews in which CRR researchers talk about their work on issues related to work, aging, and retirement. The podcasts are hosted by yours truly.

Others explore how motherhood reduces women’s Social Security benefits, the limited impact of cognitive decline on older workers, and the disparate impact of the same retirement age on different types of workers.

The podcasts – “CRR essentials” – are available in iTunes and online on the Center’s website. …Learn More

January 3, 2019

Here’s What Our Readers Liked in 2018

We’re kicking off 2019 with our periodic review of the most-read articles over the past year, based on the blog traffic tracked by Google Analytics.

Judging by the comments readers leave at the end of the blog posts, baby boomers are really diving into the nitty-gritty of preparing themselves mentally and financially for retirement. Financial advisers also frequently comment on Squared Away, and we hope some of our web traffic is because they’re sharing our blog with their clients.

Last year, Squared Away received recognition from other media. The Wall Street Journal recommended us to its readers for the blog’s “wonderful mix of topics.” The Los Angeles Times picked up our article, “Why Retirement Inequality is Rising.” MarketWatch published our posts about how pharmacists can help seniors reduce their prescription drug prices and about a Social Security reform to reduce elderly poverty.

The most popular blogs in 2018 fall into five categories:

The Big Picture

How Social Security Gets Fixed Matters

Future ‘Retirees’ Plan to Work

Just Half of Americans Enjoy Bull Market

Personality Influences Path to Retirement

How and When to Retire

Know About the 401(k) Surprise

How Retirees Can Negotiate Drug Prices

Work vs Save Options Quantified

What’s a Geriatric Care Manager Anyway?

Geriatric Help Eases Family Discord

Retirement Pitfalls

Retirees Get a 401(k) Withdrawal Headache

Social Security Mistakes Can Be Costly …Learn More

December 20, 2018

Merry Christmas and Happy New Year!

Be safe during the holidays, whether you’re traveling across town or across the country to enjoy your family and friends.

We’re taking a break too at the Center for Retirement Research. This blog will return on Thursday Jan. 3 with a roundup of our readers’ favorite articles in 2018. …Learn More