October 20, 2011

Calculate Your Retirement Health Costs

Mid- and late-career professionals staring into their futures, eyes glazed, often don’t have a clue how much their health care will cost them during retirement.

Few pre-retirees know how many holes exist in Medicare coverage. One MetLife survey this year found that 42 percent of pre-retirees age 56 to 65 believe, incorrectly, that their health coverage, Medicare or disability insurance will pay for their long-term care. Such knowledge gaps make it virtually impossible for most people to take a stab at tallying their total costs, out of pocket, for Medicare, Medigap, and private premiums and copayments over years of retirement.

Retiree healthcare is “the elephant on the table,” said Dan McGrath, vice president of HealthView Services outside Boston. The omission amounts to hundreds of thousands of dollars per retiree.

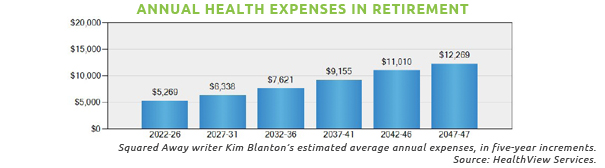

Calculators that estimate retiree health expenses are scarce, according to a 2008 AARP brief. But HealthView’s calculator, recently upgraded, estimates total out-of-pocket health expenses, which are tailored to an individual’s specific medical traits – diabetes, cholesterol, blood pressure etc. – and health habits – smoking, exercise etc.

Squared Away readers can obtain a free trial by emailing McGrath at dmcgrath@hvsfinancial.com. …Learn More

September 22, 2011

Squared Away : A Review

Since going live in May, Squared Away has posted articles about everything from saving for retirement to educating children and young adults.

Fall officially starts tomorrow, so it’s a good time to review where we’ve been. These are among the articles that got the most responses from readers or that we thought were especially worth repeating. The link to the article is at the end of each description.

Mobilizing to Plan for Retirement

- Baby boomers are paralyzed when it comes to retirement planning.

- Cultural and economic forces are behind why baby boomers can’t retire.

Reaching Young People

- Financial success begins with self-control and marshmallows.

- Teaching young adults about compound interest may persuade them to save.

Helping Low-income People

September 15, 2011

Colleges Help Students with Finances

With more college graduates piling up debts, an increasingly popular program on campus is trying to help them stay out of trouble.

More than 600 colleges are now enrolled in the National Endowment for Financial Education’s (NEFE) online program, so they can offer free assistance to four-year and community college students. CashCourse is a sort of private-label personal finance program: each academic institution puts its logo and school colors on NEFE’s online package of cash- and debt-management tools, tips, and workshops.

More than 600 colleges are now enrolled in the National Endowment for Financial Education’s (NEFE) online program, so they can offer free assistance to four-year and community college students. CashCourse is a sort of private-label personal finance program: each academic institution puts its logo and school colors on NEFE’s online package of cash- and debt-management tools, tips, and workshops.

The University of California, the University of Texas, Purdue University, and State University of New York are among the schools posting NEFE’s materials to their websites or customizing financial programs to meet their students’ unique needs.

“We want every school to figure out what works for them,” said Ted Beck, NEFE’s chief executive.

Student Debt

Leticia Gradington, program director for Kansas University’s program, said it’s not unusual for students to have $20,000 to $30,000 in college loans and credit card debts.

“You’ve got students every day who are worrying about how they’re going to pay their debt back,” she said. If students can learn just how expensive the debt is before they borrow, “They pay more attention to it.” …Learn More

August 18, 2011

App Promotes Retirement Saving

The impact of today’s purchasing decisions on how much money you’ll have years from now, in retirement, can be abstract. Putnam Investments’ new iPhone app does the math for you.

This Putnam video uses the example of an HDTV that costs $1,738: save that money instead and earn an additional $44.18 per month in retirement. That’s enough for a dash to the grocery store or an evening at the movies.

Putnam’s senior Web executive, David Nguyen, called it a “smart app,” because it allows users to tailor the assumptions that drive the calculations. For example, the app takes into account the user’s age, and it assumes the money not spent will earn investment income until you’re 65 years old (that targeted retirement age can also be changed). The investment returns mirror the individual returns for each user’s asset allocation.

Phone apps are proliferating, and there are lots of cool new ones for every financial need and age group, including children. Putnam’s app is pretty popular. The Boston mutual fund company said about 1,000 people have downloaded its new PriceCheck&Save application from Apple’s iPhone store since its June 6 release.

Unfortunately, it’s available only to those whose 401(k)s are managed by Putnam, though the company is working on an unrestricted app.

If Putnam doesn’t, someone else surely will.Learn More

August 2, 2011

Online Calculator Takes On Annuities

Not all financial calculators are created equal.

That’s what Fidelity Investments hopes baby boomers will conclude about its “Income Strategy Evaluator,” which may be the first online calculator that proposes how individuals should invest their nest egg to ensure it will last through retirement.

There are numerous calculators online to help working individuals tally how much money they will need to accumulate for their retirement, including “Target Your Retirement,” which was created by Boston College’s Financial Security Project, this blog’s host.

But the strategy for withdrawing from that nest egg during retirement “is very different than the accumulation discussion,” said Chris McDermott, Fidelity’s senior vice president of financial planning. That discussion requires individuals to answer the questions, “What do you want and how much can you get out of your assets?” …Learn More

July 20, 2011

There’s an App for That Child!

Susan Beacham’s company has sold nearly one million of its piggy bank with four slots – for spending, saving, donating, and investing. She has now developed an iPhone application based on the iconic pig.

Children who use the clear blue piggy bank like to watch their money clink to the bottom of one of the four separate sections in the pig’s innards. Beacham has developed an entire curriculum around the four choices. The Money Savvy Pig has been adopted as a teaching tool by more than 200 Chicago public schools and by school systems in Seattle, North Dakota, Europe, and elsewhere.

The idea behind the game app, called “Savings Spree,” is the same: to help children “strengthen the muscle of choice and, therefore, their self-regulation and self-control,” said Beacham, chief executive of Money Savvy Generation Inc., a small, mission-driven company employing four people. …

June 2, 2011

D2D Lures Traffic to Video Games

The secret to D2D’s success in luring players to its financial video games starts with the $150,000 it spends to design each game with MIT researchers and an award-winning Web designer.

But the Boston non-profit puts just as much emphasis – and an undisclosed amount of funding from The Wal-Mart Foundation – into distributing the games.

D2D has used an e-mail blitz to 100,000 community college students in Indiana and hosted game competitions in city neighborhoods in Massachusetts, Florida, Texas, New York, and Maryland. It partners with large employers, financial companies, state governments, and the military – organizations it recruits to promote the games to its employees, clients, or members. New products aimed at distribution include Spanish-language games and apps for the iPad and Droid.

D2D’s five games have attracted a combined total of 106,000 unique visits since the first and most popular one, Celebrity Calamity, came out a year ago. That’s not quite in league with, say, Disney, which has had 750,000 visitors to its Great Piggy Bank Adventure and an Epcot exhibit in Orlando backing it up, according to T. Rowe Price, the mutual fund company that collaborated with Disney on the game. …Learn More