July 5, 2018

Boomer Bulge Still Impacts Labor Force

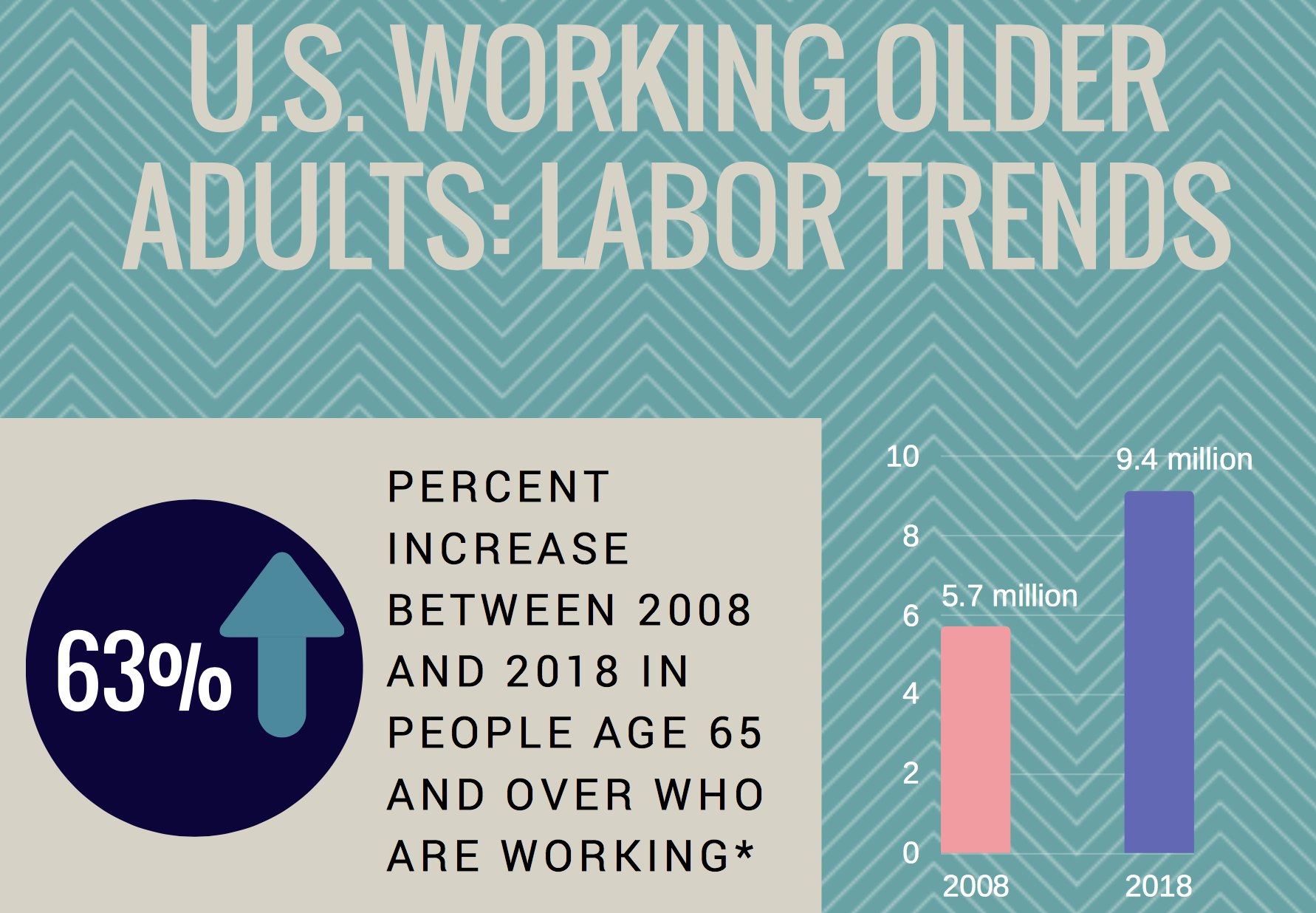

A theme runs through the infographic below: aging baby boomers are still a force of nature.

Created by Georgetown University’s Center for Retirement Initiatives, the infographic uses demographic data to show that boomers remain important to the labor market even as they grow older.

More than 9 million people over 65 work – a steep 65 percent increase in just a decade.

Two things primarily explain this increase. One reason is hardly surprising: the post-World War II baby boom that created the largest generation in history also created the largest living adult population (though Millennials will soon catch up).

On top of this, baby boomers are working longer for myriad reasons – among them, better health, inadequate retirement savings, and more education – which drives up their participation in the labor force.

To see boomers’ other impacts on work, click here for the entire infographic.

July 3, 2018

Readers Like a Travel Twist on Finances

Two of our readers’ favorite articles so far this year connected difficult bread and butter issues – personal finance and retirement – with a far more pleasant topic: travel.

The most popular blog profiled a Houston couple scouting locations for a dream retirement home in South America, which has a lower cost of living. Another well-read blog was about Liz Patterson, a young carpenter in Colorado who built a $7,000 tiny house on a flat-bed trailer to radically reduce her expenses – so she could travel more.

The downsizing efforts of 27-year-old Patterson inspired several older readers to post comments to the blog about their own downsizing. “From children’s cribs and toys in the attic, to collectible things from my parents’ 70-year marriage!” Elaine wrote. “Purging has been heart wrenching and frustrating and long overdue!”

The following articles attracted the most interest from our readers in the first six months of 2018. Topics ranged from 401(k)s, income taxes, and Americans’ uneven participation in the stock market to geriatric care managers. Each headline includes a link to the blog. …Learn More

June 5, 2018

First-Generation ‘Imposter Syndrome’

Education is the fastest ticket to a higher income, more opportunities, and a better quality of life. But four-year college is often a tough road for the pioneering first in their families to attend.

They have at least two big disadvantages – apart from the well-known financial one. Unlike the teenagers of the highly educated professionals who usually take for granted that their children will go to college, first-generation students might not have the benefit of high expectations at home. College is outside their comfort zone, which creates psychological barriers to attending and succeeding.

A second disadvantage is that they aren’t always going to learn, through a sort of parental osmosis, to cope with higher education’s mores and attitudes or be as resilient to its challenges.

UCLA student Violet Salazar says in this video that she used to feel she didn’t fully belong, “because I am first generation or because I am Latina, and also coming from a low socioeconomic background.” She went on to organize an entire dormitory floor specifically for first-generation students to make them feel more at home. …Learn More

May 29, 2018

SNL’s Kate McKinnon and Kids on Money

Kate McKinnon has made a name as a comedienne with her wild and weird humor on “Saturday Night Live.” But she plays straight man to the kids she interviews about money.

This video, produced by the best-selling personal finance author, Beth Kobliner, is an effort to have some fun while improving financial literacy – an effort that seems aimed more at adults than children.

Justine, Ricky, and Jillian are the sugar that makes Kobliner’s sober advice about saving, jobs, debt, and credit cards more palatable – and this strategy just might be effective.

Watch for yourself.

May 22, 2018

Squared Away at Year 7

Seven years ago this month, this personal finance and retirement blog debuted. How things have changed.

For one thing, back in 2011, a lot more people were reading blogs and newspapers on their clunky desktop computers. In recognition of the now-ubiquitous smart phone – more accurately, a computer that happens to have a phone – we just redesigned how Squared Away looks on phones to enlarge the type and make the articles easier to read. Our older readers will appreciate this update.

Year 7 is also an opportunity to restate the blog’s mission, which, frankly, was not fully refined in the early years. In some ways, our mission has not changed: we continue to emphasize retirement security and personal finance, with a bent toward the evidence-based research that provides a clearer understanding of the financial, economic, and behavioral issues that are critical to a high quality of life.

We regularly report on research by scholars around the country, including studies produced by members of the U.S. Social Security Administration’s Retirement Research Consortium: the NBER Retirement Research Center in Cambridge, Mass., the University of Michigan Retirement Research Center, and the Center for Retirement Research at Boston College, which also is the blog’s home.

But it’s natural for a new publication to find its sweet spot over time, and Squared Away is no different. One theme that has emerged very clearly is that the threads of retirement saving are shot through the fabric of our financial lives.

The predicament of Millennials is an obvious example. Immediately after beginning their careers, 20- and 30-somethings – so much more than their parents and grandparents – are under the gun to save for retirements that no longer are likely to include a pension. …Learn More

May 1, 2018

Dealing with Alzheimer’s in the Family

Caregiver in a nursing home can be grueling work, but my aunt loved it. In one of life’s cruel ironies, she died soon after retiring to take care of her husband, who is developing dementia.

The great responsibility for his care fell suddenly on his children and grandchildren, and they’re struggling with it.

I texted this video to a couple of my uncle’s daughters because it provides invaluable information and insight into the myriad causes of Alzheimer’s and the unique way its symptoms manifest in each individual. It also explains why diagnosis by a physician is critical – turns out, some people appear to have dementia, but the cause of their cognitive decline isn’t Alzheimer’s and may be reversible.

The speaker, Tammy Pozerycki, owns Pleasantries, which operates adult day care centers in the greater Boston area. In 1906, Dr. Alois Alzheimer, a brain researcher, first identified and described the disease. “It’s 2018, and we have no cure,” said Pozyercki. This places the burden on caregivers to manage the disease.

Full disclosure: her presentation was sponsored by Boston College’s human resources department for the benefit of employees. This blog is based at the Center for Retirement Research at Boston College.Learn More

March 8, 2018

Retirement – Ripped from the Headlines!

When Squared Away first went live almost seven years ago, few reporters in the mainstream media wrote regularly about retirement. Things have really changed.

The Washington Post recently declared a “new reality of old age in America.” The New York Times and The Boston Globe have regular retirement writers. Even The New Yorker – the go-to read for the aging but still hip – dived in and investigated an abhorrent case involving an abused elderly woman.

Retirement is a hot topic, because some 10,000 boomers have been retiring daily for years – in fact, the media frequently cite this statistic – and an unprecedented number of the boomers who still work are thinking a lot about whether or when to stop.

This blog publishes twice a week, and I don’t have time for the in-depth investigations I did as a Boston Globe reporter. But plenty of newspaper and magazine reporters are exploring retirement issues in great detail.

Here are five of the best articles in recent months:

The New Yorker: “How the Elderly Lose their Rights”:

Metropolitan newspapers often cover local nursing homes charged with elder abuse. This lengthy article is about one government-appointed guardian’s abuse of one elderly woman. This extreme case carries a larger message: how readily some people take advantage of the most vulnerable elderly.

The New York Times: “There’s Community and Consensus. But it’s No Commune.”

Here’s some good news: rather than funnel older people into housing strictly for the elderly, multigenerational “co-housing” developments offer children of the 1960s a place to live, where they can remain engaged with younger people – and society.

The Atlantic: “This is What Life Without Retirement Savings Looks Like”:

Analyses by our research center here at Boston College find that about half of working Americans should have enough money to retire. But the other half of retirees will rely solely on their Social Security. This woman, age 76, had to go to work at a grocery store to supplement her income. …Learn More