February 6, 2018

Health Coverage Varies Widely by State

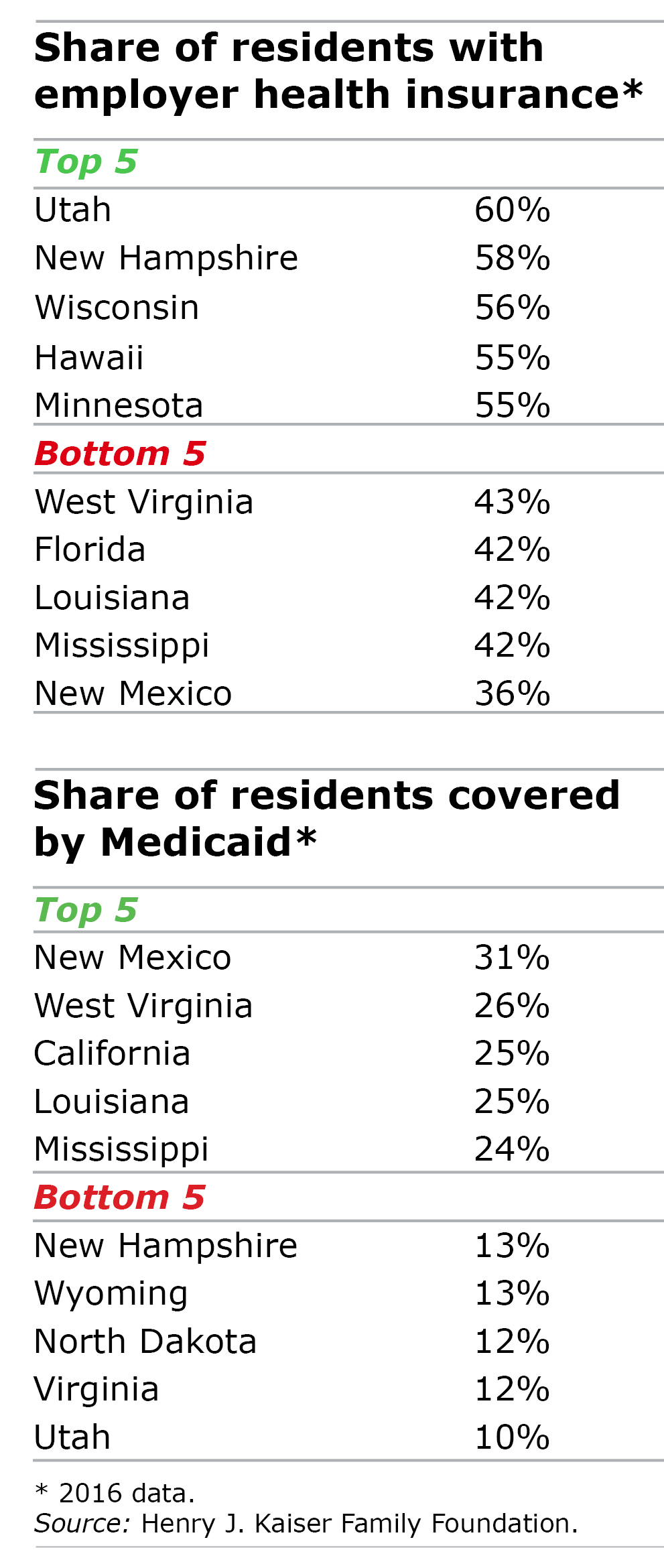

When it comes to state residents’ health insurance coverage, Utah and New Mexico are polar opposites.

Sixty percent of Utah residents are covered at work – the most nationwide. New Mexico employers cover only 36 percent – the lowest coverage rate.

Sixty percent of Utah residents are covered at work – the most nationwide. New Mexico employers cover only 36 percent – the lowest coverage rate.

It follows that their Medicaid populations also differ. In Utah, the federal-state health insurance program covers the nation’s smallest share (10 percent) of poor and low-income workers. New Mexico’s Medicaid population is triple that (31 percent of residents), and its poverty rate is among the highest nationwide.

“Where you live can play an important role in what coverage options are available to you and how affordable they are,” said Rachel Garfield, the Henry J. Kaiser Family Foundation’s senior researcher and associate director of its Medicaid and uninsured program. The Kaiser data are from 2016.

The factors driving the two indicators – employer vs. Medicaid coverage – are intertwined. A larger presence of big, successful companies ensures more employer coverage, raising the standard of living and reducing the need for federal aid. These are, in turn, influenced by other cross-currents in each state, Garfield said: the nature of its industry, whether retail, industrial, high-tech, or agricultural; population demographics, such as the number of immigrants; whether the state expanded Medicaid eligibility under the Affordable Care Act (ACA); and the ebbs and flows of regional recessions and recoveries.

Take Utah. Despite being a primarily rural state with its “Mighty Five” national parks, it is chock full of major employers. Utah’s three largest have 20,000-plus workers each: Intermountain Healthcare, the University of Utah, and state government. Many more employ at least 5,000. Utah’s relatively slim Medicaid population is no doubt influenced by both its employer base and the state’s decision not to participate in the ACA’s Medicaid expansion, which increased the program’s income limits to make more workers eligible. …Learn More

January 30, 2018

WSJ Recognizes our Retirement Blog

I was honored to be in the company of some excellent retirement writers recognized in a recent article in The Wall Street Journal, “My Favorite Writers on Retirement Planning.” Since I started writing this blog in May 2011 for the Center for Retirement Research, which is funded by the U.S. Social Security Administration (SSA), retirement writers have come out of the woodwork to help the swarms of retiring baby boomers – and many of us need it!

Others featured in the article by the Journal’s Glenn Ruffenach – some new, some veterans – include financial planner Michael Kitces, whom I’ve interviewed about tax strategies for retirement plan withdrawals. Most everyone knows Jonathan Clements, a former long-time Journal reporter now editing and writing a blog. Last but not least, I’ll mention Mike Piper, a certified public accountant – someone new to interview! – and Christine Benz of Morningstar, a Chicago firm that is a long-time source of data and information for this blog.

Each writer is distinct. So, what do we try to do here at Squared Away? …Learn More

January 4, 2018

New Yorker Cartoon Considers 401(k)s

This New Yorker cartoon by Trevor Spaulding is cute, but – spoiler alert – it’s not quite right.

A company offering a 401(k) retirement savings plan to its workers is a good thing, but it’s no “favor,” noted my long-time editor Steve Sass, an economist with a hawk eye for inaccurate retirement information. Setting up and funding a 401(k) is a big expense for employers. But many think it is worthwhile, because 401(k)s – and, more so, employers’ matching contributions – help them attract and retain the sharpest, most productive, or most-skilled workers.

Another employer calculation is that the income tax deduction employees get for saving, which costs the employer nothing, is especially valuable for those on the payroll who earn the most money and, by definition, pay more taxes. It’s a neat outcome that the tax deduction most helps those presumably doing the most for the bottom line, though the government does limit how much highly compensated employees can contribute based on how much the rank-and-file workers are contributing.

But, it’s no fun to criticize a cartoon!Learn More

January 2, 2018

Baker’s Dozen: Popular Retirement Blogs

Appropriately, the most popular blogs over the past six months were about retirement, among both the young adults looking ahead to it and the later baby boomers heading toward it.

Based on page view counts, here were the most-read blogs on Squared Away during the last six months of 2017:

Retirement Calculators: 3 Good Options

Why Many Retirees Choose Medigap

Reverse Mortgage: Yes or No?

Why Most Elderly Pay No Federal Tax

The 411 on Roth vs Regular 401ks

Medicare Advantage Shopping: 10 Rules …Learn More

December 21, 2017

Happy Holidays

However you celebrate, we wish you a wonderful holiday season and coming new year – from the staff here at the Squared Away blog at Boston College.Learn More

December 12, 2017

Financial Videos’ Message: Please Deal

Reflecting a lofty ambition to educate Delaware residents about financial management, state government officials put together some terrific videos.

This is not high-level finance – the speakers tell stories about real people facing up to the dimensional challenges of money and retirement. Viewers outside Delaware might find one of the 10 online Tedx talks valuable to them. Here are three:

Javier Torrijos, assistant director of construction, Delaware Department of Transportation:

His take on the immigrant experience in a nutshell: “The parents’ sacrifice equals the children’s future,” said Torrijos, who has two sons and whose own father left Columbia for a tough neighborhood in Brooklyn, New York, in 1964 so his children would have a shot at escaping poverty. Today’s immigrants are no different. But the pervasive ethos of family above all else, he argues, is responsible for some of the Latino immigrant community’s financial instability.

When required to make the impossible choice between going to college or straight to work to support family, family usually wins. “That mentality still exists” but needs to change if Latinos are to improve their lot, he said. …Learn More

November 21, 2017

Thankful for Squared Away Readers

Thank you for continuing to read and support Squared Away!

Our goal is to provide reliable information that is not influenced by the desire to sell a product or service, which we hope is a valuable service to you. And as a blog based at the Center for Retirement Research, we are particularly interested in covering what the current research (ours and many others’) can tell us about retirement, personal finance and the economic challenges that people face.

What could be better than a big turkey in the oven and family and friends all around? Happy Thanksgiving to all.

To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.Learn More