January 17, 2013

401(k)s Bleeding Cash

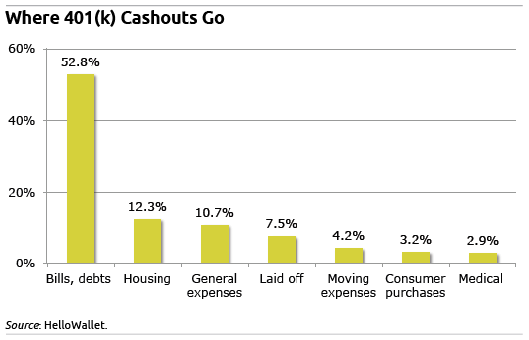

HelloWallet’s survey landed with a thud in the media this week: one in four U.S. households with a 401k or IRA raided it to cover necessities.

The vast majority of raids are cash withdrawals, not loans – $60 billion in cash in 2010. These grim statistics throw weight behind those who argue we are watching a retirement crisis unfold in slow motion. The pressures on saving are aggravated by stubbornly high long-term unemployment: layoffs explain why 8 percent pulled out cash. But the Great Recession isn’t the only culprit.

Wages, adjusted for inflation, have declined over the past decade, health costs have soared, and consumers remain heavily dependent on their credit cards. In this environment, no wonder saving is often viewed as a luxury.

The 2010 data reveal behavior at a time individuals were still smarting from Wall Street’s financial crisis. But back in 2004, the average 401k balance for all boomers age 55 to 64 was only $45,000 – it was only slightly lower by 2010.

To put that $60 billion in perspective, it is about half the amount U.S. employers put into 401(k) plans on their employees’ behalf that year.

Click “Learn More” to see more data on the cash withdrawals. Readers, what do you think is driving them higher?Learn More

January 15, 2013

401(k) Mutual Funds Mediocre

A spate of research in recent months shows that the mutual funds offered in employer 401(k)s have fairly unremarkable – though not disastrous – investment performance.

As with any academic study worth its salt, the various authors’ findings are complex and loaded with critical twists, turns, and footnotes. Descriptions of three research papers on 401(k) plan returns can be found by clicking “Learn More” below. But here’s the gist:

- So-called Target Date Funds – investments are based on each employee’s planned retirement age – perform better than investments guided by financial advisers hired by one Oregon employer to advise its workers. TDFs also outdo employees who go it alone.

- When the 401(k) plan’s trustee is also a mutual fund management company, it’s more reluctant to remove its own, poorly performing funds from the plans’ smorgasbord of funds.

- Employers select mutual funds that outperform a portfolio of randomly selected funds but underperform passive indexes.

There’s a common thread in many of these studies: the extra fees that investors pay for advice or the stock pickers who manage their mutual fund often don’t translate to better returns… Learn More

January 10, 2013

“Damn Right, I’ve Got the Blues”

This blues lyric by Buddy Guy probably sums up your reaction to news that debt can make you depressed.

But what’s also true is that one’s reaction to debt hinges on what type of debt the person has – and not all debt is depressing. Further, people approaching their retirement years and those with less education who are in debt are more likely to get the blues, according to new research.

Lawrence Berger, an associate professor of social work at the University of Wisconsin in Madison, determined that a 10-percent increase in the dollar amount of an individual’s debt increases his or her depressive symptoms by 14 percent.

To be clear, having debt does not lead to full-blown clinical depression. But it does trigger the garden variety blues that most people experience. Symptoms vary from losing one’s appetite or being unable to shake the blues to feeling lonely…Learn More

January 8, 2013

Healthy, Wealthy and Not Retiring

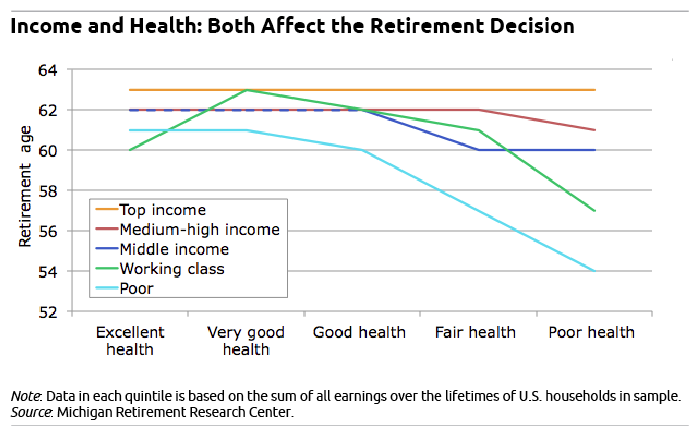

Rich and poor retire at vastly different ages – nine years in the most extreme case.

A rich man in excellent health works three years longer than a poor man in excellent health – that’s a fairly long time when one is talking about the decision to retire. But if both men are unhealthy, the difference is much larger. The rich man works nine years longer than his low-earning counterpart.

This complex interplay between one’s financial and physical conditions can be seen in the above chart, which shows retirement ages for American households in five income groups, rich to poor. Among financial planners and prospective retirees, as well as academics, any discussion about the retirement decision is typically dominated by how much a person earns and saves during his or her lifetime. Health and medical expenses are usually a given.

That is “too simplistic,” said Ananth Seshadri, an economist at the University of Wisconsin in Madison.

The chart, taken from a paper by Seshadri and his Wisconsin colleague, John Karl Scholz, for the Retirement Research Consortium, also dramatizes the complex impacts on various groups that would occur if Congress were to raise the eligibility age for Medicare, which it is considering among dozens of other deficit-reduction proposals.

Think about the working man in heavy industry. Research has shown that men in physically demanding jobs, such as aluminum workers, often are forced to retire earlier out of poor health or sheer exhaustion.

But as a wealthy man ages, he is able to pay for good medical care for his heart or hip problem, which enables him to delay retiring. Some people, not entirely consciously, also may choose higher-paying employment – or they may save more – in anticipation that they will have big medical bills when they’re older, Seshadri said.

“People get earnings shocks, but more importantly people get health shocks,” he said. “Medical expenses are a big deal later in life.”

And a primary consideration when one is thinking ahead about when to retire.

Click here for another research paper by the Retirement Research Consortium showing that access to Medicare is a primary consideration when one is thinking ahead about when to retire.

Full disclosure: The research cited in this post was funded by a grant from the U.S. Social Security Administration (SSA) through the Retirement Research Consortium, which also funds this blog. The opinions and conclusions expressed are solely those of the blog’s author and do not represent the opinions or policy of SSA or any agency of the federal government. Learn More

January 3, 2013

Happy Retirement?

This article was originally posted on Squared Away on October 23.

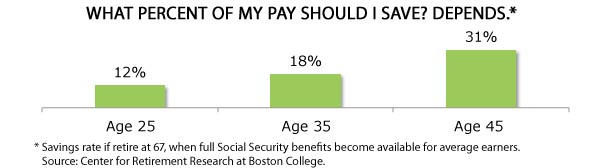

A large majority of people in a survey released last week identified saving for retirement as their top financial priority. If that’s the case, then why aren’t Americans saving enough?

Stuart Ritter, senior financial planner for T. Rowe Price, the mutual fund company that conducted the survey, has some theories about that. Squared Away is also interested in what readers have to say and encourages comments in the space provided at the end of this article.

But first the survey: about 72 percent of Americans identified saving for retirement as “their top financial goal,” with 42 percent saying that a contribution of at least 15 percent of their pay is “ideal.”

Yet 68 percent said they are saving 10 percent or less, which Ritter called “not very much.” The average contribution is about 8 percent of pay, according to Fidelity Investments, which tracks client contributions to the 401(k)s it manages.

The Internal Revenue Service last week increased the limit on contributions to 401(k) and 403(b) retirement plans from $17,000 to $17,500. The so-called “catch-up” contribution available to people who are age 50 or over remains unchanged at $5,500.

The question is: why do Americans give short shrift to their 401(k)s, even as people become increasingly aware that their dependence on them for retirement income grows? Ritter offered a few theories in a telephone interview last week: …Learn More

December 20, 2012

Money Still Can’t Bring Happiness

The vast majority of us wouldn’t dream of trading time with our children for a 50 percent pay hike.

Then why, when asked to give up evenings off from work – presumably family time – for the big pay raise, would more than half of us go for it?

In short, how can the same people – more than 2,000 adults surveyed in August by New York Life – so flatly contradict themselves?

“We’re not even conscious of how our behavior conflicts with our values,” said Christine Carter, director of the parenting program at University of California’s Berkeley’s Greater Good Science Center, which studies happiness, compassion and social bonding.

This lack of awareness is especially true when money is involved. The human brain lights up like a Christmas tree when money is offered as the reward in neurological experiments, as the prospect of the reward releases dopamine that sets off a burst of pleasure.

But Carter, an expert in happiness, said the research also shows that, over the long-term, “our social connections” – not money – will bring us true happiness.

To stay on top of news about financial behavior, readers may want to sign up for e-alerts – just one a week – by clicking here. Or like us on Facebook!Learn More

December 18, 2012

Music as Money Metaphor

To get a grip on retirement worries, overwhelming student loans, or squeaking by, it always helps to get more money or make a plan.

But finding a way to think about how to manage your money is also useful. It’s like making music, says Timothy Maurer, a Baltimore financial planner. At first, you have to master the “boring stuff, but eventually real songs start being produced.”

p.s. Maurer said that his brother Jon Maurer, who is “a far more accomplished musician than I,” is the pianist in this video.

To support our blog, readers may want to sign up for e-alerts – just one a week – by clicking here. Or like us on Facebook!

Learn More