December 13, 2012

Financial Planners Diversify: Four Types

Brokers, registered investment advisers, fee-only, commission-based, dual license – the labels for financial planners can be intimidating.

In a consumer-friendly article, the Retirement Income Journal (RIA) in November identified four adviser types, based on what they do for their clients.

Most advisers still fall into the traditional Technician category. But the rise of other types – Strategist, Behaviorist, and Life Coach – partly reflects a profession rocked by the 2008 financial crisis. The number of advisers nationwide fell 3 percent last year, according to Cerulli Associates in Boston.

“[T]he combined impact of the financial crisis, boomer retirement, the advent of behavioral economics and fee compression is forcing more advisers to evolve,” RIA explained.

The following is an adaptation of RIA’s article, which was based on a presentation to the University of Pennsylvania’s Wharton School of business by fee-only advisers Paula Hogan in Milwaukee and Rick Miller in Boston.

The new year is around the corner, and perhaps you’ll want to hire a planner. But which of the following four types suits you? …Learn More

December 11, 2012

Black Families Struggle to Build Wealth

It is extremely difficult for black Americans to accumulate wealth they can pass on to their children.

Getting to the heart of this concern is new research by the Urban Institute. The Washington think tank found that while blacks excel at converting the gifts and inheritances they receive into even more wealth, the size and frequency of these bequests are much smaller than for whites, perpetuating a wealth gap that has existed since emancipation.

“In the news, you hear about the racial income gap, but the racial wealth gap is so much larger, and it’s not improving,” said Signe-Mary McKernan, a senior fellow at the Urban Institute and co-author of the new study. Smaller inheritances and gifts in African-American families “are hindering their opportunity and wealth accumulation,” she said, about her findings.

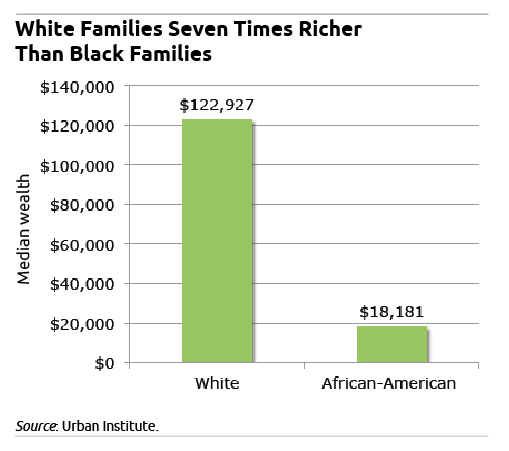

Median wealth for black families is $18,181 – white family wealth is $122,927, and Hispanic wealth is $33,619.

Median wealth for black families is $18,181 – white family wealth is $122,927, and Hispanic wealth is $33,619.

But the real question is, why is white wealth seven times larger than black wealth? The researchers found that blacks are five times less likely to receive family bequests than are whites, and their inheritances are $5,013 smaller.

McKernan’s research employed standard statistical methods by holding factors such as income and education constant in order to highlight the racial aspect of differences in wealth.

But Lester Spence, a political science professor at Johns Hopkins University who sometimes conducts statistical analysis in his research, said such analysis fails to fully capture the significant impact of factors such as the social and cultural barriers facing black Americans. …Learn More

December 6, 2012

Readers’ Picks for 2012

Squared Away readers’ favorite articles during the year reflect America’s biggest financial challenges: paying for college and retirement.

The following are the Top 10, according to an online analysis of blog articles with the most unique visits by readers. A link to each article is embedded in the last word of each headline:

It Pays More Than Ever to Delay

The Long-Term Care Insurance Gamble

Boomer Moms, Here’s a Radical Idea

For Many Elderly, Little Left at Life’s End

Why Baby Boomers Can’t Retire …Learn More

December 4, 2012

Long-Term Care Policies Unpacked

The typical, elderly couple spends about $260,000 on health care and long-term care services during retirement – for the unlucky ones, the amount can be double. No wonder sales of long-term care policies this year will increase nearly 10 percent, according to the American Association for Long Term Care Insurance. At the same time, major insurers are pulling out of the market in droves, and premiums are surging due to higher demand by aging baby boomers, record-low interest rates, and rising medical costs.

To help navigate this increasingly treacherous market, Squared Away interviewed Larry Minnix Jr., chief executive of LeadingAge, a non-profit consumer organization in Washington.

Q: Is there anyone for whom long-term care insurance does not make sense?

A: Not many. I’ve seen too much of the consequences for too many age groups and too many families – long-term care just needs to be insured for. A majority of the American public is going to face the need for some kind of long-term care in their family. The only people it doesn’t make sense for are poor people – they have Medicaid coverage, mostly for nursing homes. And for people who are independently wealthy, if they face a problem of disabling conditions they can pay for it themselves. You find out at age 75 you have Parkinson’s or Alzheimer’s, but it’s too late to insure for it. Think about it like fire insurance. I don’t want my house to burn down, and very few houses do. But if mine burns down, I do have insurance.

Q: The Wall Street Journal reported that GenWorth Financial next year will charge 40 percent more to women who buy individual policies. Why?

A: Among the major carriers, private long-term care insurers have either limited what they’re doing or backed out of the market entirely. You’d have to get GenWorth’s actuarial people [to explain], but let me venture a guess. I’ve had private long-term care insurance for 12 to 15 years, but my wife couldn’t get it. She’s got some kind of flaw in the gene pool, and she was denied coverage. She may be the bigger risk, because I’m more likely to stroke out and die, but she’s more likely to live with two to three conditions for a long period of time.

Q: Your wife wasn’t healthy enough to get coverage? …

Learn More

November 29, 2012

13% Haven’t Paid Off Christmas 2011

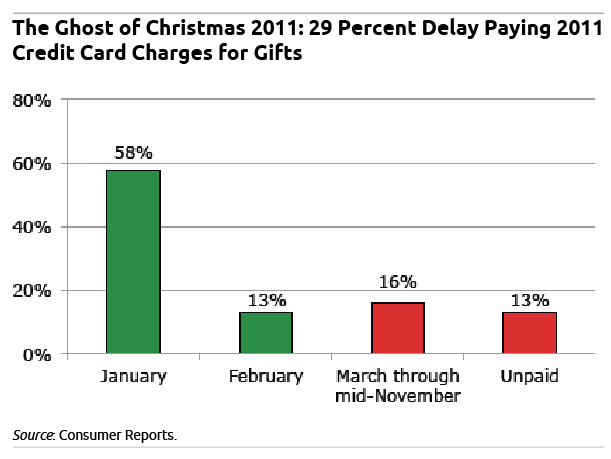

Consumer Reports says 13 percent of Americans are still paying off credit cards that they ran up to buy 2011’s holiday gifts.

That may be one reason more Americans plan to budget this holiday season – 52 percent – compared with last year’s 41 percent, according to Consumer Reports’ national survey. Among those who bought their 2011 gifts with credit cards, 58 percent paid them off by the end of January and another 13 percent in February – hats off to them. But the rest waited. Some are still waiting.

That may be one reason more Americans plan to budget this holiday season – 52 percent – compared with last year’s 41 percent, according to Consumer Reports’ national survey. Among those who bought their 2011 gifts with credit cards, 58 percent paid them off by the end of January and another 13 percent in February – hats off to them. But the rest waited. Some are still waiting.

I can relate.

In the interest of encouraging Squared Away readers to reveal their financial failings in the comments area below, here’s one of mine: a credit card balance averaging $2,500 for more than 20 years. It’s embarrassing, and yes, this personal finance blogger knows why it’s important to pay off a credit card charging nearly 15 percent interest – what a waste of a few thousand dollars I could’ve put in my 401(k), for instance…Learn More

November 27, 2012

Overconfidence Linked to Senior Fraud

The seniors who are most confident of their knowledge about money and investments are also the most likely to fall victim to fraud.

The seniors who are most confident of their knowledge about money and investments are also the most likely to fall victim to fraud.

That conclusion, by Chicago researchers at DePaul University and the Rush University Medical Center, is among the first to explain the underlying reason for an alarming trend being detected by law enforcement and financial experts: a rise in fraud committed against an enormous and rapidly aging baby boom generation.

Fraud against the elderly can arise from “that combination of not knowing but thinking you know,” Keith Gamble, an assistant finance professor in DePaul’s Driehaus College of Business, said in an interview in which he explained his new study. “That’s what we call overconfidence,” which he and his co-authors determined was “a risk factor for being victimized by fraud.”

The U.S. incidence of fraud has exploded in recent years. Complaints of financial fraud compiled by the Federal Trade Commission surged more than 60 percent in just three years, to 1.5 million last year.

There is growing concern nationwide that boomers, due to what can be a dangerous combination of cognitive decline and having some money socked away for retirement, are extremely vulnerable to con men peddling financial products that make big promises and deliver nothing – or, worse, rob retirees of money they need to live comfortably or even survive.

Declining cognition is associated with lower financial literacy – that’s nothing new. The concern is that seniors do not recognize the problem, Gamble said. “They are actually more confident in their financial decision-making capabilities. The problem is they don’t have the decision-making ability they once had.”

The Chicago researchers focused on seniors who have not acquired actual dementia or Alzheimer’s disease. Rather, they examined whether fraud could be linked to the cognitive decline that is a natural part of aging. …Learn More

November 20, 2012

Financial Education Strategies Need Work

In a September paper distributed by the National Bureau of Economic Research, Professor Brigitte Madrian and her co-authors reviewed the current state of U.S. financial education. In an interview, Madrian, a professor in Harvard University’s John F. Kennedy School of Government, provided some fresh insights into education, regulation, and the role of the financial industry.

Q: Besides low financial literacy, why do people make bad financial decisions?

A: Procrastination. Inattention – one reason people accrue credit card late fees is that they forget to pay their bills on time. Advertising – people are swayed by the marketing of financial services and products. Not all products pushed by financial advisers or financial-services companies are appropriate for everyone, and sometimes people are swayed into purchasing products that may be right for someone else but aren’t right for them.

Q: Does financial education even work?

A: I believe the jury is out. We do not have a lot of compelling evidence on the impact of financial literacy programs. There have been lots of studies on programs, but many of them are of dubious scientific validity. Of the ones that are more credible in terms of methodology, some find very little impact on financial education and a handful find financially positive effects. …