October 23, 2012

401(k)s “Top” Financial Priority. Really.

A large majority of people in a survey released last week identified saving for retirement as their top financial priority. If that’s the case, then why aren’t Americans saving enough?

Stuart Ritter, senior financial planner for T. Rowe Price, the mutual fund company that conducted the survey, has some theories about that. Squared Away is also interested in what readers have to say and encourages comments in the space provided at the end of this article.

But first the survey: about 72 percent of Americans identified saving for retirement as “their top financial goal,” with 42 percent saying that a contribution of at least 15 percent of their pay is “ideal.”

Yet 68 percent said they are saving 10 percent or less, which Ritter called “not very much.” The average contribution is about 8 percent of pay, according to Fidelity Investments, which tracks client contributions to the 401(k)s it manages.

The Internal Revenue Service last week increased the limit on contributions to 401(k) and 403(b) retirement plans from $16,500, to $17,000. The so-called “catch-up” contribution available to people who are age 50 or over remains unchanged at $5,500.

The question is: why do Americans give short shrift to their 401(k)s, even as people become increasingly aware that their dependence on them for retirement income grows? Ritter offered a few theories in a telephone interview last week:

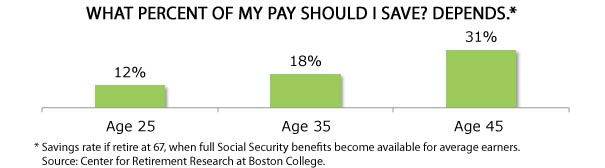

- The financial industry is partially to blame. “We have done a really good job of conveying to people how important saving for retirement is,” he said, “but what we haven’t done as good a job of is telling them how much to save.”

Employers may also share blame. Further confusing the issue, the savings rate depends on when the employee starts saving – the percent of pay is lower for those who start in their 20s than for someone who waits until they’re 45. …

October 18, 2012

College Educated Take On More Debt

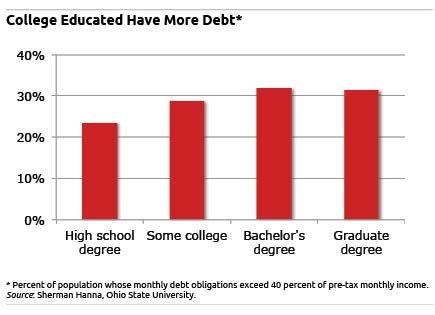

Americans with college degrees are more likely to overuse their credit cards, home equity loans and other debts than are people who didn’t attend college, according to research in the latest International Journal of Consumer Studies.

“I was really expecting the reverse,” Sherman Hanna, a professor of consumer sciences at Ohio State University in Columbus, said about the results of his research, conducted in conjunction with Ewha Womans University in Seoul and the University of Georgia in Athens.

The study also reveals the increasing fragility of Americans’ finances, particularly in the run-up to the 2008 financial crisis when overall debt levels surged amid what Hanna called a “democratization of credit” that made it easier – critics said too easy – to borrow.

The percent of all U.S. households with monthly debt payments exceeding 40 percent of their pretax income rose from 18 percent in 1992 to 27 percent in 2007. (Consumers have slashed their debt during the recent recession.)

Based on education levels, Americans with a bachelor’s or graduate degree had more than a 32 percent likelihood of being heavily in debt. That compared with 24.5 percent for people who graduated from high school and did not attend college, according to the study, which tracked U.S. households from 1992 through 2007. To make their comparison, the researchers controlled for the effect of incomes.

Based on education levels, Americans with a bachelor’s or graduate degree had more than a 32 percent likelihood of being heavily in debt. That compared with 24.5 percent for people who graduated from high school and did not attend college, according to the study, which tracked U.S. households from 1992 through 2007. To make their comparison, the researchers controlled for the effect of incomes.

The researchers designated households in their sample as being heavily in debt if their monthly loan payments and other debt obligations exceeded 40 percent of their pretax income. That is a high share of income to devote every month to paying off loans, rather than buying groceries, saving for retirement, or utilities…Learn More

October 16, 2012

20-Somethings Buck Pressure to Spend

Michael and Erin Gallagher are just 26 years old but have made a strong start financially, socking away $50,000 by maxing out their 401(k)s while honoring a $20,000 budget for their October 5 wedding in downstate Illinois.

Jennifer and John Lucido, both 32 years old, now have $250,000 in the bank and have built a 2,500-square-foot home near Detroit.

By comparison, the typical U.S. household had saved $42,000 for retirement in 2010, according to the Center for Retirement Research, which funds this blog.

Both couples are members of that rare species of 20-something super savers, spurning intense peer pressure to spend money on consumer items, go out for dinner a lot, and run up their credit cards. Neither couple got where they did the easy way either. They worked hard, but they were also quick to catch on to important lessons about being frugal and saving – from their parents or from each other.

“I have clients in their 30s and 40s who don’t even have $200,000 in their 401k,” said Naomi Myhaver, a financial planner at Baystate Financial Services in Worcester, Massachusetts.

An August article in The Journal of Consumer Affairs suggests one reason people like them are so hard to find. Young adults are extremely vulnerable to peer pressure to run up credit card debt so they can support a high lifestyle and social life.

In the study, 225 college students were asked questions such as whether they have “very strong” connections to their friends or “feel the need to spend as much as [friends] do on activities we do together.” College students have an average of 4.6 credit cards and $4,100 in debt…

Learn More

October 11, 2012

Boomer Moms, Here’s A Radical Idea

Research shows that when children leave the nest, married couples spend 50 percent more on discretionary spending like eating out and vacations. But whether you’re ready or not, retirement is bearing down hardest on women.

Here’s a radical concept for moms whose children have suddenly grown up: focus on your own financial needs. Women usually out-live their husbands and need to be on top of the situation. So getting a handle on your financial priorities should be at the top of your list.

Squared Away interviewed financial experts to come up with five priorities for baby boomer women whose kids have flown the coop.

Get Smart. If you haven’t had time to pay attention to the household finances, start simple. Financial expert Wendy Weiss, on her blog, Hot Flash Financial, said the first thing to do is track down and inventory the types of accounts and the financial institutions that hold your money: savings, retirement plans, insurance documents, your and your husband’s latest Social Security statements – add them up and determine what you’ve got. Then get a handle on the size of the credit card debts and mortgage.

“Just find out what you have,” Weiss says. “There are questions you can ask later.”

Talk to Your Kids. You’ve poured your heart into nurturing your offspring. So turn the tables and ask them to have a conversation about your needs once you retire.

Financial advisers swear by these wide-ranging discussions, the content of which reflects the diversity in families. The children will be reassured if you’ve saved enough or will share your concern if you haven’t. Perhaps they’ll have opinions about whether you should purchase long-term care insurance. They should also know the beneficiaries on your financial and pension accounts and insurance…Learn More

October 9, 2012

401(k) Education Missing A Target

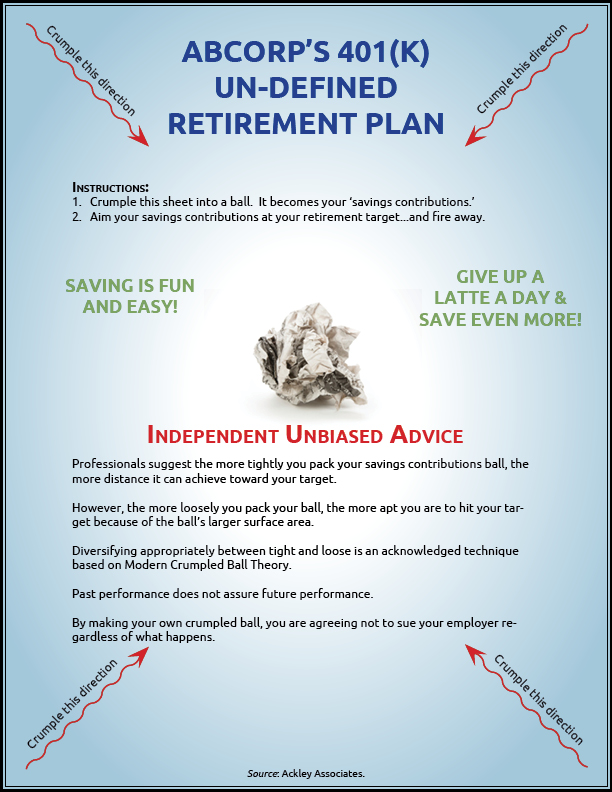

Dennis Ackley says he doesn’t get a lot of holiday cards from the mutual fund industry.

The Kansas City, Missouri, consultant has become a well-known critic of the 401(k) materials that funds provide to employers, which usually leave the complex job of retirement planning to the workers to figure out. When speaking to a room full of 401(k) plan sponsors, he has a unique way of getting his point across. Ackley hands out sheets of paper similar to what’s shown here and asks them to wad them up and throw them at the target.

The problem – for the plan sponsors in the audience – is that Ackley doesn’t give them a target.

“Most of them are just kind of befuddled by the whole thing.” Befuddlement, he tells is audience, “is what young employees experience sitting in a 401(k) meeting.” …Learn More

October 4, 2012

The Long-Term Care Insurance Gamble

A good friend in Houston recently emailed me to ask whether she should buy long-term care insurance. Let me be very clear about my answer: I have no idea.

This writer is like baby boomers everywhere trying to get a grip on this long-term care stuff. Where to start?

First, let’s look at the prices for long-term care. Squared Away used data from Genworth, one of the nation’s largest insurers in this market, to generate a U.S. map with the median cost in each state of a semi-private room in a nursing care facility.

Genworth’s goal is obviously to sell insurance. But I ran its data by a few people, and it held up well, with a few observations and caveats discussed later…Learn More

October 2, 2012

How Smart Are Smart Phones?

Nearly half of people who have cell phones pay more than $100 per month for the service and 13 percent pay $200 or more, according to a survey by an online coupon company.

That doesn’t include the cost of the physical phone, the app and music downloads, the extra data plans. A certified public accounting organization in Oregon, Oregon Saves, estimates that the total cost for a two-year contract can easily reach $3,000.

And then there are the rogue teenagers who go over the monthly limits on minutes set by their parents’ cell plans – eventually, the parents relent and buy an unlimited data/text plan, which drives up their monthly charges permanently.

Wow, this habit is getting expensive.

The cell phone isn’t the only electronic habit that’s costing us. We also pay hundreds for cable TV, the Internet on our home computers, the land line. The automatic withdrawals for these services suck hundreds from our bank accounts each month – and we may not notice how much we’re spending since the transactions are electronic…Learn More