May 3, 2012

Read That Social Security Statement!

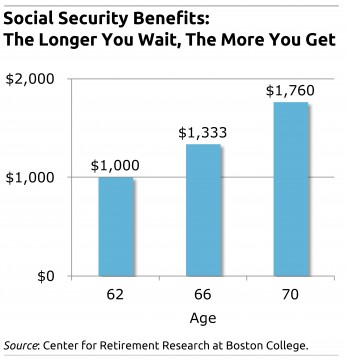

This week, the federal government put every worker’s Social Security statement online. But while most people look at their statements, research shows that more than one in three misses this major point: the longer one waits to file, the larger the monthly retirement check will be.

We’re talking big numbers: someone eligible to receive $1,000 a month at the popular retirement age of 62 can get $1,333 by waiting until 66 and $1,760 by waiting until 70. Of course, one’s health, financial resources, and life events may make filing later difficult or impossible. But getting the information is critical to making a smart decision, which plays a major role in one’s financial well-being in retirement.

We’re talking big numbers: someone eligible to receive $1,000 a month at the popular retirement age of 62 can get $1,333 by waiting until 66 and $1,760 by waiting until 70. Of course, one’s health, financial resources, and life events may make filing later difficult or impossible. But getting the information is critical to making a smart decision, which plays a major role in one’s financial well-being in retirement.

The Social Security Administration (SSA) put the statements online after creating a minor news flap last year when it stopped sending them via snail mail to workers. In February, SSA resumed the mailings to Americans age 60 and older. (Full disclosure: SSA funds this blog through the Center for Retirement Research at Boston College.)

Back to the point: The statements are now easily available on ssa.gov to individuals willing to provide some personal data – the site verifies the personal data they enter online against information held by the credit scoring company, Experian.

Here are a few other things about Social Security that might surprise you. According to various research papers that seek to understand how Americans view their benefits: …Learn More

May 1, 2012

Academics Question Stock Investing

The Standard & Poor’s 500 index has soared 27 percent since October! These times of strong market gains are the brass ring for a large swath of well-educated, well-off Americans.

But recent academic research on three topics – value investing, the record of individual investors, and the usefulness of investment advisers – raises serious questions about buying individual stocks or actively invested stock funds.

The upshot of this research, it seems, was neatly summed up by Nobel Prize-winning economist Daniel Kahneman’s bestseller, “Thinking, Fast and Slow:” stock picking “is more like rolling the dice than like playing poker.”

The papers are complex (though not difficult to read), so here are synopses and links to them: …Learn More

April 26, 2012

Pennsylvania Strong in Fin Ed – For Now

Talking to teenagers taking personal finance at Panther Valley High School in Pennsylvania made me wonder why these classes aren’t a top priority everywhere.

These kids are even teaching their parents a thing or two about money. Jordan Kulp saved her mother $30 by finding a scooter for a cousin’s baby that her mother had wanted to buy on a shopping channel. Now that Jake Gulla’s mother sits in on his personal finance class, she is “spending [money] a little more wisely.”

And William Digiglio’s father wanted to sell a shield for $100 that Chris Evans apparently carried in the “Captain America” movie. William put it up for sale on eBay and snared $20,000 for the shield, which his father had won in a contest. For class projects, “we had to research rather than taking them for face value,” he explained.

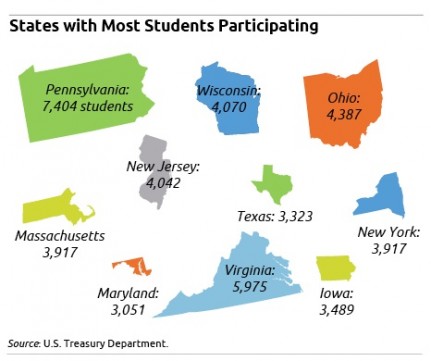

These Panther Valley students have helped make Pennsylvania, for a third year running, the state with the highest number of students scoring in the top 20 percent on the federal government’s 2012 test for the National Financial Capability Challenge (NFCC), according to Mary Rosenkrans, financial education director for the state’s Department of Banking.

These Panther Valley students have helped make Pennsylvania, for a third year running, the state with the highest number of students scoring in the top 20 percent on the federal government’s 2012 test for the National Financial Capability Challenge (NFCC), according to Mary Rosenkrans, financial education director for the state’s Department of Banking.

Pennsylvania also had the highest number of students who took the test (7,404) and the highest number of participating schools (123). (Oregon had the highest average test score: 79.5 percent, compared with 69 percent nationwide.)Learn More

April 24, 2012

Marriage Negotiation: Of Chimp and Man

We human beings are close evolutionary cousins of the apes, closest of all to the chimpanzee and the bonobo. But economist Paul Seabright explains in his new book, “The War of the Sexes,” that male-female relationships differ from ape relationships. Squared Away asked Seabright to explain how evolution shapes financial negotiations between marriage or other partners. It all comes down to competition and cooperation, he says.

Q: Human behavior is determined by evolution?

Seabright: Yes. When Charles Darwin wrote “Origin of Species,” he was very, very cautious about saying too much about human behavior, because it was such a big thing to get people to swallow [that] we’d descended from animals. To talk about how human behavior was physically shaped, he didn’t do that until he wrote “The Descent of Man.” My book takes up the question of how much relations between men and women in modern society are shaped by our great ape inheritance.

Q: What is our evolutionary connection to the chimpanzee?

Seabright: The chimpanzee and the bonobo are like our two cousins. We share grandparents with them, a species that no longer exists, and all of us share great grandparents with gorillas. But we [humans] did this funny thing, which is we went into having kids who took much longer to raise. That’s relevant to financial behavior, because we have to look out for the future including the future of our kids, and there’s something especially human about that. Other species look after their kids, of course, but it’s a much bigger deal for us. …

Learn More

April 19, 2012

Middle Schools Vie in Video Contest

The Massachusetts Financial Education Collaborative (MFEC) had one big reason for targeting its video contest to middle school kids: advertising.

“Hey, you gotta have a cell phone. You gotta have these jeans. The contest seemed like a great way to bring awareness” to the issue of kids and our consumer culture, said Andrea Wrenn, mother of five, education consultant, and the MFEC volunteer who oversees the contest.

Two Massachusetts middle schools submitted videos exploring kid consumerism in the first year of MFEC’s contest: the Norwell Middle School and the Hill View Montessori Charter Public School in Haverhill.

Squared Away encourages readers to support the new effort by clicking here to vote for your favorite video! The voting deadline is April 27.

The contest is among the creative ways communities are encouraging children and teenagers to learn about the money issues they deal with – a play recently staged by Cambridge high school students was another.Learn More

April 17, 2012

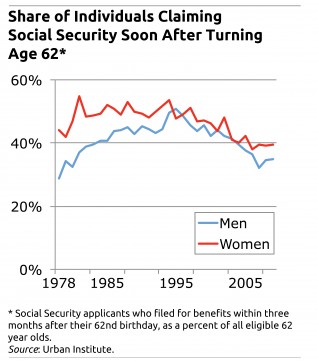

Fewer Claiming Social Security Right at 62

New research shows that the share of Americans who sign up to receive their Social Security pensions at age 62 has declined sharply over the past decade.

This trend is expected to continue despite a temporary spike in applications by 62-year-olds during the Great Recession, said Richard Johnson, a senior fellow who conducted this research at the Urban Institute, a Washington think tank. This is a major shift in retirement behavior, and it reflects sweeping cultural changes that range from more flexible employment options for older workers to the baby boomer health and fitness craze.

“Over the past 10 years, we saw the share of people claiming at 62 fall about 10 percent for men and 8 percent for women,” he said. “That’s a pretty big decline in 10 years’ time.”

Sixty-two year olds still constitute the largest single group of new applicants every year, regardless of age. That’s why the significant decline in their application rate is notable. Those who sign up for their Social Security checks when they first become eligible – within days or weeks of their 62nd birthday – are known as “early claimers.” People with physically demanding jobs are more likely to do so, because of health problems or unpleasant and exhausting work. …Learn More

April 12, 2012

Fraud Against Elderly Documented

Chilling. That sums up a documentary about financial fraud against elderly people premiering tomorrow at the Quad Cinema on 13th Street in Manhattan.

“Last Will and Embezzlement” is about fraudsters who seek out vulnerable elderly people suffering from cognitive decline for no other purpose than to exploit their trust and steal their money. It’s not uncommon for these con men and women to be family.

By first-time producers Pamela Glasner and Deborah Louise Robinson, the film would’ve benefitted from more reporting and more focus – they try to do too much when they get into court systems and solutions. But the film does what journalism does best: It finds people willing to tell personal gripping stories – not easy to do – and gives them a voice.

- Mickey Rooney, 91, relived his searing emotional pain on screen, as he recounted how his own nephew “swindled” his money years ago.

- An elderly woman with Alzheimer’s was persuaded by a mortgage broker to take out a complex reverse mortgage, which resulted in foreclosure on her home and a legal battle waged by her children. “My mother was incapable of understanding any of this,” her daughter said. …