February 21, 2012

Investment Humor Not an Oxymoron

You have to admire a financial writer and editor with the guts to put this on his LinkedIn profile: “While many Wall Street people go to Harvard or Yale University to learn about business, Ron went to art school.”

The cartoons shown here are in a humorous financial book by Ronald DeLegge 2d, who said he first earned his chops as an insurance salesman at a small Midwestern company that eventually became part of AIG. His cartoons appear in “Gents with no ¢ents: A closer look at Wall Street, its customers, financial regulators, and the media.” Dave Clegg was the illustrator.

Enjoy.Learn More

February 16, 2012

Impulse Saving May Be ‘New’ New Thing

You’ve heard of impulse purchases. But how about impulse saving?

It’s purely an idea at this stage, and it may not work. But a New York City check-cashing firm plans to start a program that will allow customers to throw $20, $10, even $1 into savings – on impulse – when they’re cashing a check or flush with cash.

“I know my customers,” said Joseph Coleman, president of RiteCheck Cashing Inc., which has 12 stores open 24/7 in Harlem and the Bronx. “If they could put $5 away or $20 away for a television they wanted, to buy a car, or for Christmas, they would do it.”

“I know my customers,” said Joseph Coleman, president of RiteCheck Cashing Inc., which has 12 stores open 24/7 in Harlem and the Bronx. “If they could put $5 away or $20 away for a television they wanted, to buy a car, or for Christmas, they would do it.”

Key to making the program work is simplicity, operating on the theory that barriers and red tape thwart savings deposit; if a customer wants to open a savings account, RiteCheck will print an application that’s already filled out and needs only a signature. RiteCheck teamed up with long-time business partner Bethex Federal Credit Union to open and manage the accounts.

“People have intensions to save” but “get derailed by the lack of a clear, easy path to start saving,” said Innovations for Poverty Action’s (IPA) Jonathan Zinman, a Dartmouth College economist who worked with Coleman to create the product. The non-profit IPA granted $15,000 this month to set up RiteCheck’s program…Learn More

February 13, 2012

Will Saying “I Do” Affect Your Saving?

The single-married divide is dramatic: single adults between the ages of 22 and 35 are far less likely to have retirement savings accounts than are married people their age.

This difference, which is most pronounced for women but also true for men, highlights a conflict between two mega-trends. The number of single Americans has surged to nearly 100 million – 43 percent of the adult population. Yet they are less likely to save at a time that all young Americans face greater responsibility for funding their own retirement than any prior generation.

About 22 percent of single women have employer-sponsored retirement accounts, compared with 44 percent of married women. For single men, only 28 percent have employer accounts, while 44 percent of married men do, according to a February paper in the Journal of Marriage and Family by researchers at the Social Security Administration (SSA).

“By highlighting the link between marriage and retirement savings in young adulthood, our analysis identifies an often-overlooked economic outcome related to marriage,” SSA researchers Melissa Knoll, Christopher Tamborini, and Kevin Whitman write. Data for their sample of 3,894 people came from the Federal Reserve’s Survey of Consumer Finances in 2001, 2004, and 2007.Learn More

February 9, 2012

The Science Fiction of Financial Markets

A lot of us feel when we look at the Dow Jones plunging [that] we’re in the grip of some alien force that slips human control. — Novelist Robert Harris

The stock market in May 2010 seemed to “come alive” when it swooned 1,000 points within minutes, Harris said in a bone-chilling radio interview that’s worth a listen for Main Street investors.

His new thriller, “The Fear Index,” which the London Telegraph called “unputdownable,” is about a hedge fund manager. But in the interview, Harris expressed his desire to take readers beyond the business reporter’s technical explanations for the market’s wild swings up or down. A solitary, $4 billion trade, the media widely reported, caused the 2010 Flash Crash that left an impression on the novelist. As Europe teeters on recession, it’s anyone’s guess how the Standard & Poor’s 500 stock market index has managed to soar more than 7 percent since Jan. 1.

Wall Street experts may be able to make sense of a hair-trigger market, but Harris’s sci-fi explanation is appealing to the rest of us. He invokes the imagination – or, perhaps I should say, the artificial intelligence lab at the Massachusetts Institute of Technology.

To hear Harris’ interview on National Public Radio, click here.Learn More

February 7, 2012

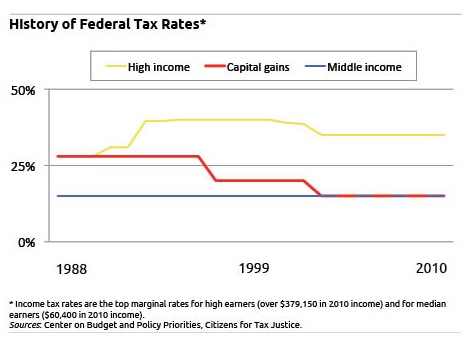

Taxing Behavior

Taxes, politicians and economists say, can either encourage or discourage human behavior. This chart landed on my desk, so I thought I would share it.

The capital gains tax rate has declined sharply over the past 14 years. The marginal tax rate for high-income individuals has plotted a very different course than the marginal rate for the middle class.

What does this chart say to you?

Please post a comment by clicking below, on “Learn More.” …Learn More

February 2, 2012

Teen Play about Money is “Eye Opening!”

“Money Matters,” a play that opened last weekend in Cambridge, Mass., demonstrated the financial wit of its teenage actors at the same time that they – and the audience – embraced the complexities of money.

“Money Matters,” a play that opened last weekend in Cambridge, Mass., demonstrated the financial wit of its teenage actors at the same time that they – and the audience – embraced the complexities of money.

Credit versus debt, income differences among classmates, money and relationships, certificates of deposit, needs versus wants – this only scratches the surface of the subject matter in the Youth Underground theater production, which begins touring the Boston area in February.

The actors clearly were having fun, but their performance served as an educational tool that might be replicated. For example, the screenplay was based on the actors and other teenagers’ 80-some interviews of community residents about their financial viewpoints and mishaps. The stories generated ideas for the vignettes that were stitched into a screenplay.

“Very eye-opening!” audience member Cameron Netland, 16, said after the performance.

“I learned the difference between saving and spending and between debit and credit!” said Aaliyah Nathan, 14, who, wearing black suede boots to the performance, admitted a weakness for new shoes. …Learn More

January 31, 2012

Reports Explain Key Retirement Issue

The Society of Actuaries released a series of very readable reports dealing with specific issues, from how to handle a forced retirement to whether to withdraw savings incrementally.

“Around the time of retirement, there are so many decisions,” said Joseph Tomlinson, chairman of the working group that produced the new reports. The goal of the two-year project was to provide “friendly and unbiased” information, said Tomlinson, a Maine actuary and financial planner.

He said members of the professional organization also felt the public needed information that wasn’t from “someone trying to sell something – and we’re not.”

The online reports are free. Click here. …Learn More