October 13, 2011

Thaler: Employers Should Do More

The pioneering behavioral economist Richard Thaler said employers and the financial industry should increase their efforts to help people prepare financially for their retirement.

The pioneering behavioral economist Richard Thaler said employers and the financial industry should increase their efforts to help people prepare financially for their retirement.

“Making it easy isn’t the most profound thing anyone has said. But if we want people to do a better job saving for retirement, make that easier,” he said last week at a Retirement Income Industry Association conference, backed by a wide-angle view of Boston’s skyline.

Thaler is co-author of the bestselling “Nudge: Improving Decisions About Health, Wealth, and Happiness” and a pioneer in a branch of economics that rejects the convention that people are “rational” when it comes to making decisions. Behavioral economists acknowledge that people are psychological beings who don’t always act in their best interest and often do downright perplexing things. One prominent example is employees who do not sign up for their 401(k) retirement plan, leaving the money from their employer’s savings match on the table.

To nudge people to save, about half of U.S. corporations now automatically enroll their employees in their 401(k), according to consultants Callan Associates, though many offer it only to new employees. Before auto enrollment came into vogue, companies gave employees the option of signing up if they wanted to participate in the plans. With auto-enrollment, they must choose to opt out of saving, a strategy behavioral economists argue helps overcome the powerful inertia of doing nothing.

But employers typically deduct only 3 percent from employees’ paychecks. Thaler said this is nothing more an arbitrary percentage that a US Treasury Department official once mentioned in passing but that has now been accepted as gospel. It’s also too low by financial planners’ standards, particularly for mid- and late-career workers. “It’s time to get over that” and raise the rate, he said. …Learn More

October 11, 2011

Less is More

In this humorous Ted video, Graham Hill advocates minimalism as an alternative to consumerism and showcases his 420-square-foot apartment in Manhattan. His living arrangement may seem extreme but residents of Tokyo have been living small for years, and his main point is well taken: he has reduced both his living expenses and his environmental footprint.

Hill is a modern Renaissance man. He studied architecture, founded Treehugger.com to take environmental sustainability mainstream, and dreamed up the idea for those ceramic Greek coffee cups, a replica of the paper cups, found in art museum gift shops.

“From his New York home, he schemes daily about how he can help humanity avoid rapid extinction,” according to his bio.Learn More

October 6, 2011

Women Lag in Retirement Readiness

When it comes to retirement, we women are in lousy shape.

We live longer, so will need more money when we retire. Yet we work less over our lifetimes and earn 80 percent of what men earn while we are working. As a result, we’ve saved less in our 401(k)s and IRAs.

Not surprisingly, the rising economic insecurity among all Americans ushered in by the Great Recession is more pronounced among women, according to reports Monday by the Institute for Women’s Policy Research (IWPR) in Washington:

- 58 percent of women interviewed by IWPR were concerned they would not have enough to live on in retirement, compared with 43 percent of men;

- 47 percent of women lacked confidence that their resources would last throughout their retirement, compared with 35 percent of men;

- 51 percent of women worried they would not be able to afford retiree healthcare, compared with 44 percent of men.

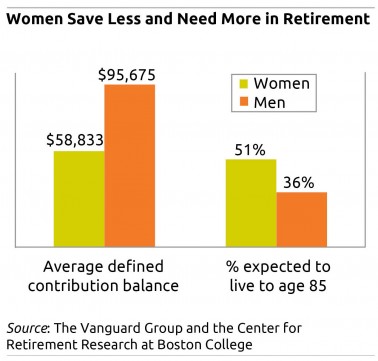

Financial data support women’s concerns. In 2010, the average balance in defined-contribution plans managed by Vanguard Group, one of the nation’s largest mutual fund companies, was $58,833 for women and $95,675 for men. The median balance was $21,499 for women and $33,547 for men.

Financial data support women’s concerns. In 2010, the average balance in defined-contribution plans managed by Vanguard Group, one of the nation’s largest mutual fund companies, was $58,833 for women and $95,675 for men. The median balance was $21,499 for women and $33,547 for men.

Women’s personal retirement savings are even lower, relative to men’s, when one considers that women live much longer. Among women born in 1935, 51 percent are expected to live until age 85 – just 36 percent of men will, according to the Center for Retirement Research at Boston College, which hosts this blog. Fully 13 percent of women will make it all the way to 95 – only 6 percent of men will. …Learn More

October 4, 2011

One Savings Goal Better Than Many

Saving money. No financial behavior is more important in this era of DIY retirement planning. And yet few things are more difficult for more people.

To prod low-income people to save a little, foundations and the government design clever financial products or incentives – some work, some don’t. Academic researchers divine psychological tricks or behavioral mechanisms that might spur saving. Automatic enrollment in employer-supported 401(k)s is one such success story.

A different solution to the savings conundrum comes from two marketing professors at the University of Toronto. Experimenting on subjects around the world – residents of a small town in India, Canadian college students, parents in Hong Kong – they found that individuals are more successful savers if they identify and work toward a single goal. Setting multiple, competing goals – college, retirement, summer vacation, a new kitchen, and the Christmas fund – was less effective and even counterproductive.

“When people have multiple goals, they cannot decide which one is more important,” said author Min Zhao, whose paper with Dilip Soman is forthcoming in December’s Journal of Marketing Research. “They say, ‘I cannot decide. Maybe I’ll just do this later, and I might not do anything.’ ” …Learn More

September 29, 2011

Spenders Yield to ‘What the Hell Effect’

We all know the feeling. While mentally savoring the appetizers on the menu, our resolve to diet slips away. That same feeling has already hit by the time we slap our credit card down on the counter at Macy’s.

It’s so common that psychologists have named it the “what the hell effect.” Once poised at the edge, we might as well leap, right? But after the leap, people who usually try to maintain a certain level of self-control in their everyday lives feel awful.

Three marketing professors have now teased out the conditions that trigger this during the act of charging something on a credit card. They have found that people spend more money if they already have a balance on their credit card. But, oddly, a high-dollar credit limit on the card can mitigate that effect and help to restrain the cardholder’s spending.

Their findings are counterintuitive and a bit difficult to grasp. Here’s how Keith Wilcox, a marketing professor at Babson College in Boston, explained them in a recent interview with Squared Away: … Learn More

September 27, 2011

Medicare: the Future is Now

When health care is factored in, more than half of Americans haven’t saved enough money for retirement.

But that price tag could become more unattainable under President Obama’s proposal last week to cut $248 billion from Medicare by raising premiums, copayments, and other health costs. With Republicans also talking reform, the impact of Beltway belt-tightening is coming into sharper focus for more than 45 million Americans covered by the federal program.

It’s a good time to revisit 2010 research by Anthony Webb, an economist with the Center for Retirement Research at Boston College, which hosts this blog. Webb calculated how much a “typical” retired couple, both age 65, needs today to cover out-of-pocket expenses over their remaining lives. The numbers are shocking:

- A couple needs $197,000 for future Medicare and other premiums, drugs, copayments, and home health costs;

- There is a 5-percent risk they need more than $311,000;

- Including nursing-home costs, the amount needed increases to $260,000;

- There is a 5-percent risk that will exceed $517,000.

To arrive at the estimates, Webb simulated lifetime healthcare histories by drawing on a national survey of older Americans. The difficulty for individual retirees who might want to use these estimates, however, is that their actual spending will vary widely depending on how long they live and their health outcomes. That’s where the risk comes in.

In this video, Alicia Munnell, director of the Center, interviews Webb about his research. To read a research brief, click here.

September 22, 2011

Squared Away : A Review

Since going live in May, Squared Away has posted articles about everything from saving for retirement to educating children and young adults.

Fall officially starts tomorrow, so it’s a good time to review where we’ve been. These are among the articles that got the most responses from readers or that we thought were especially worth repeating. The link to the article is at the end of each description.

Mobilizing to Plan for Retirement

- Baby boomers are paralyzed when it comes to retirement planning.

- Cultural and economic forces are behind why baby boomers can’t retire.

Reaching Young People

- Financial success begins with self-control and marshmallows.

- Teaching young adults about compound interest may persuade them to save.