July 23, 2019

Expect Widows’ Poverty to Keep Falling

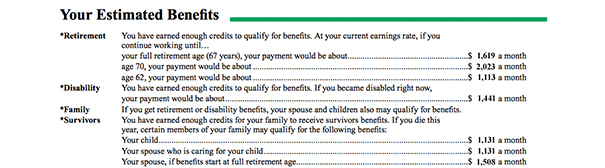

The poverty rate for widows has gone down over the past 20 years. This trend will probably continue for the foreseeable future.

The poverty rate for widows has gone down over the past 20 years. This trend will probably continue for the foreseeable future.

Women face the risk of slipping into poverty when a husband’s death triggers a drop in retirement income from Social Security and a pension (if he had one). But beginning in the 1970s and 1980s, women moved into the nation’s workplaces at an unprecedented pace.

Women now make up nearly half of the labor force and are more educated, which means better jobs – and better odds of having their own employer retirement plan. As a result, they have become increasingly financially independent.

This trend of greater independence is now showing up among older women. Widows between ages 65 and 85 put in 10 more years of work than their mother’s generation, which has helped push down the poverty rate from 20 percent in 1994 to 13 percent in 2014, according to the Center for Retirement Research. …Learn More

July 18, 2019

Why Americans Can’t Come Up with $400

In Beavercreek, Ohio, the cleanup from a recent tornado has begun. But debris is still piled high on many residents’ lawns.

“What we’re seeing following this tornado is people not having enough cash to pay upfront for house debris removal even though insurance companies will reimburse them,” former mayor Brian Jarvis said on Twitter. The debris cleanup comes on top of other costs like temporary housing in this city east of Dayton.

Much was made recently of a survey in which four of every 10 American families said they could not cover an unexpected $400 expense. But no one explained why. New research has some answers.

Even when people have $400 in their checking or savings accounts, they don’t always feel like they have the money to spend. That’s because they may have already committed the funds to paying off their credit cards, according to an analysis by Anqi Chen at the Center for Retirement Research.

This problem isn’t confined to low- and middle-income people either: 17 percent of households earning more than $100,000 would have to scramble to find the extra $400.

The study uncovered what cash-strapped families have in common. …Learn More

July 16, 2019

Spotlight on Our Research, Aug. 1-2

Topics for this year’s Retirement and Disability Research Consortium meeting include the opioid crisis, retirement wealth inequality over several decades, trends in Social Security’s disability program, and the impacts of payday loans, college debt, and mortgages on household finances.

Researchers from around the country will present their findings at the annual meeting in Washington, D.C. Anyone with an interest in retirement and disability policy is welcome. Registration will be open through Monday, July 29. For those unable to attend, the event will be live-streamed. The agenda lists all of the studies.

Here are a few:

- Why are 401(k)/IRA Balances Substantially Below Potential?

- The Impacts of Payday Loan Use on the Financial Well-being of OASDI and SSI Beneficiaries

- The Causes and Consequences of State Variation in Healthcare Spending for Individuals with Disabilities

- Forecasting Survival by Socioeconomic Status and Implications for Social Security Benefits

- What is the Extent of Opioid Use among Disability Applicants? …

July 11, 2019

Video: Retirement Prep 101

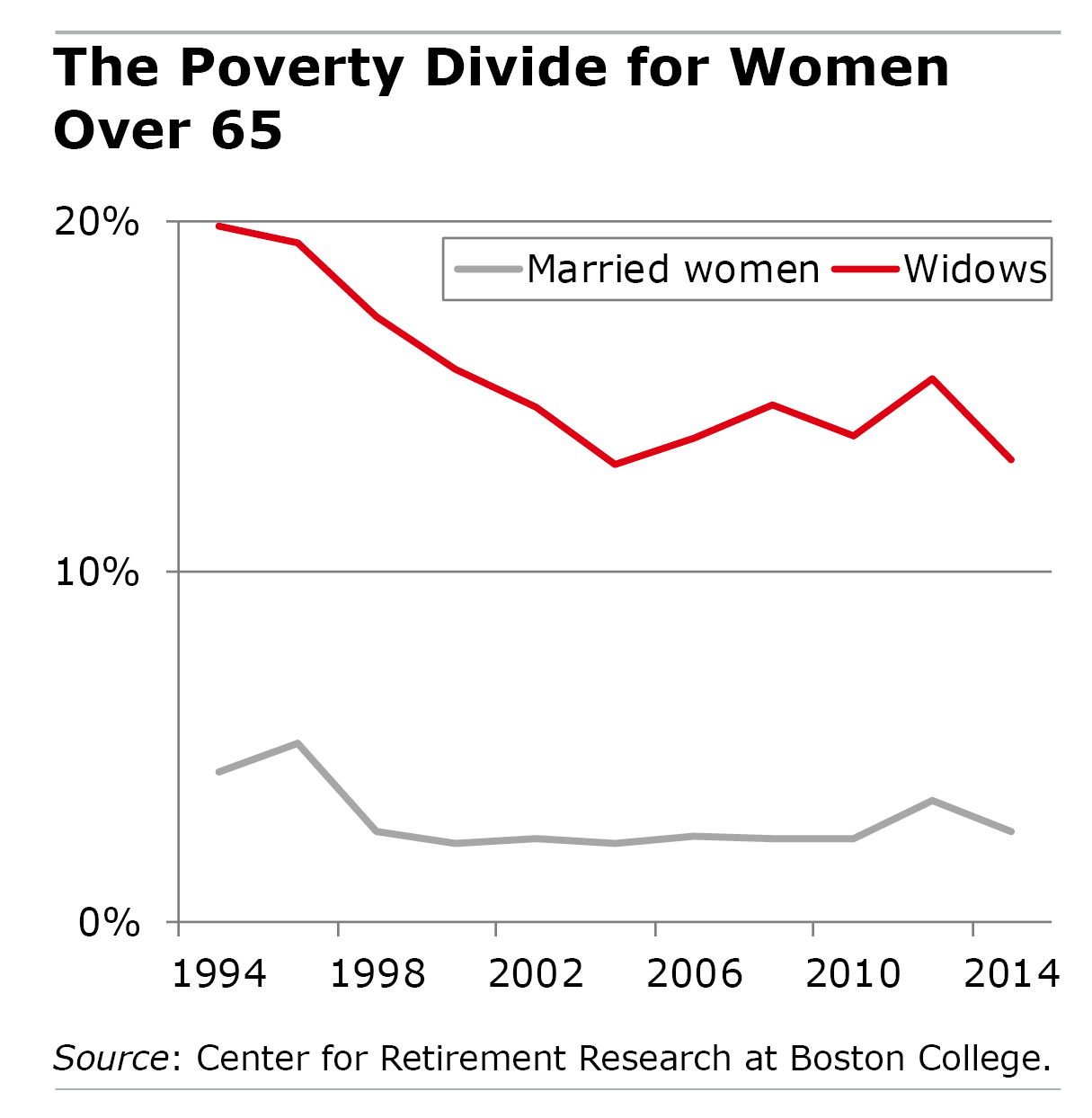

Half of the workers who have an employer retirement plan haven’t saved enough to ensure they can retire comfortably.

This 17-minute video might be just the ticket for them.

Kevin Bracker, a finance professor at Pittsburg State University in Kansas, presents a solid retirement strategy to workers with limited resources who need to get smart about saving and investing.

While not exactly a lively speaker, Bracker explains the most important concepts clearly – why starting to save early is important, why index funds are often better than actively managed investments, the difference between Roth and traditional IRAs, etc.

Some of his figures are somewhat different than the data generated by the Center for Retirement Research, which sponsors this blog. But both agree on this: the retirement outlook is worrisome.

Some of his figures are somewhat different than the data generated by the Center for Retirement Research, which sponsors this blog. But both agree on this: the retirement outlook is worrisome.

The Center estimates that the typical baby boomer household who has an employer 401(k) and is approaching retirement age has only $135,000 in its 401(k)s and IRAs combined. That translates to about $600 a month in retirement.

Future generations who follow Bracker’s basic rules should be better off when they get old. …Learn More

July 9, 2019

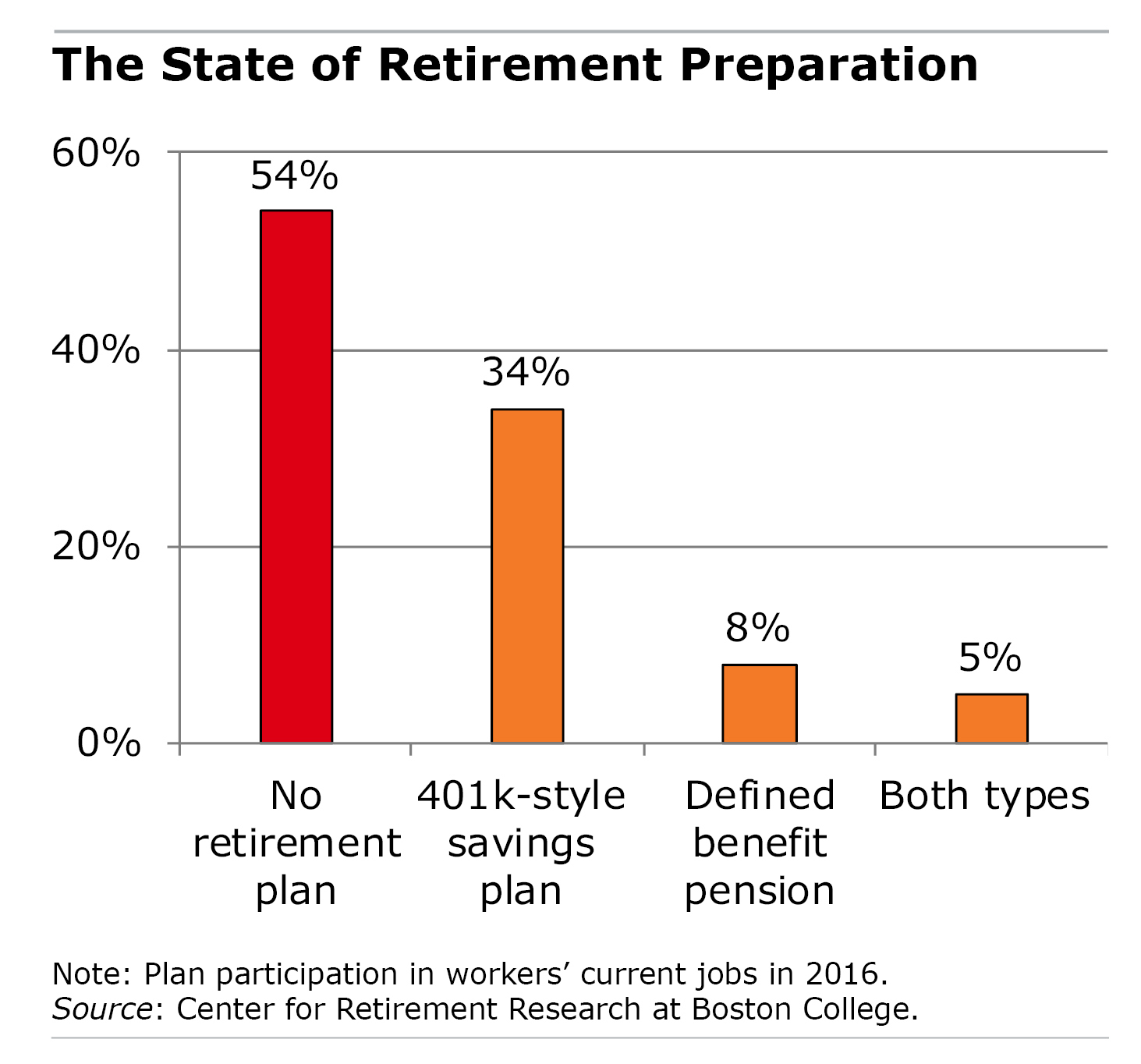

Social Security Statement Has Impact

When a Social Security statement comes in the mail, most people do not, as one might suspect, throw it on the pile of envelopes. They actually open it up and read it.

But are they absorbing the statements’ detailed estimates of how much money they’ll get from Social Security? RAND researcher Philip Armour tested this and found that the statement does, in fact, prompt people to stop and think about retirement: workers said their behavior and perceptions of the program changed after seeing the statement of their benefits.

The study was made possible after Social Security introduced a new system for mailing out statements. Workers used to get them in the mail every year. In 2011, the government took a hiatus and stopped sending them out. The mailings resumed in 2014 – but now they go out only before every fifth birthday (ages 25, 30, 35 etc.).

Armour was able to use the infrequent mailings to compare the reactions of the workers who had received a statement with those who had not during a four-year period, 2013-2017.

The statements bolstered their confidence that they could count on Social Security when they retire. More important, receiving them in the mail spurred some people to work more. To be clear, this is what they said – it isn’t known what they actually did.

Those who had been out of the labor market were much more likely, after getting a statement, to say they had returned to work. Working people under age 50 increased their hours of work.

Social Security benefits, on their own, usually are not enough to live on in retirement, and half of U.S. working-age households are at risk of falling short in retirement. But unfortunately, the study wasn’t able to detect another critical aspect of their retirement preparation: saving. …Learn More

July 3, 2019

Happy Independence Day!

Here’s the back story to your barbecued chicken and grilled hamburgers.

On July 4, 1777, Philadelphians marked the first anniversary of independence from the British with a spontaneous celebration. Future president John Adams described the ships parading on the Delaware River that day as “beautifully dressed in the colours of all nations.” In the aftermath of the Civil War, freed slaves turned the Fourth into a celebration of their emancipation.

If you have the day off from work, thank Congress for declaring the Fourth a federal holiday in 1870. Enjoy! …Learn More

July 2, 2019

When Your Health, Job Demands Clash

Home health aides, nurses, teacher assistants and servers do a lot of lifting or standing for long periods, which takes a toll on their bodies.

For a middle-aged waitress, it might be a bad knee. For a baby boomer caring for an elderly person, it might be the strain of lifting a patient out of a chair.

In a new study, researchers calculated the percentage of workers who cite health-related obstacles to performing their jobs for nearly 200 occupations. A ranking of these percentages proved a fairly reliable indicator of what one would expect workers to do. Workers in the occupations with the largest share of people having difficulty performing their jobs were more likely to quit work and file for Social Security Disability Insurance (SSDI).

The chart below shows the occupations with the highest percentages of health-related obstacles. For example, some of the most hazardous jobs are welders and brazers, who assemble equipment made of aluminum. …Learn More