June 4, 2019

Husbands Ignore Future Widow’s Needs

The amount of money a widow receives from Social Security can mean the difference between comfort and hardship.

Husbands have a lot of control over how this will turn out. Each additional year they postpone collecting their own Social Security adds another 7.3 percent to the amount a future widow will receive every month from the program’s survivor benefit.

But husbands can be a stubborn lot.

Previous research has shown that a large minority fail to take their wives into account when deciding to start their Social Security. A new study confirms this in an online experiment designed to raise husbands’ awareness of the financial impact their claiming age could have on a spouse. The men’s ages ranged from 45 to 62.

In the experiment, the researchers displayed Social Security’s benefit information to the men three different ways. In the first format, a control group saw the basic information: the husband’s full retirement benefit, and then a link to a second page displaying his benefits for various claiming ages. A second format also displayed his full benefit, but the link went to a page with estimates of his widow’s survivor benefits, based on the husband’s various claiming ages – the later he files, the more she would receive. The third format had the same information as the second format, but it was presented on a single web page.

Regardless of the way the survivor benefits were displayed, the men weren’t persuaded to postpone their own benefits to one day help their widows. Potential explanations include their feelings about work, existing health issues, and whether they will get a defined benefit pension from an employer.

Whatever their motivation, simply educating husbands on the financial impact of choosing a claiming age “is unlikely to improve widows’ economic outcomes,” concluded the study by the Center for Retirement Research at Boston College.

The impact of widowhood is often significant. An average widow’s total income drops 35 percent when a husband passes away, the researchers estimated from financial data for married men who had retired. The earlier the husband had started his benefits, the larger the drop in the widow’s income after the couple’s second Social Security check stops coming in. …Learn More

May 30, 2019

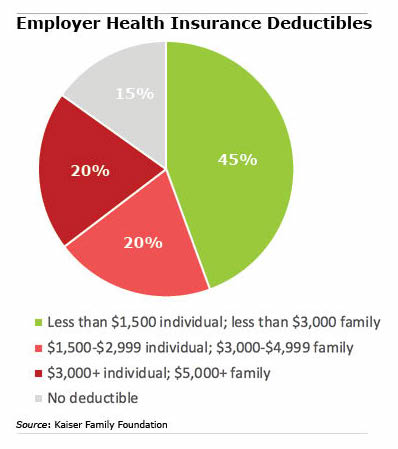

Health Plan Deductibles Triple in 10 Years

The evidence continues to pile up: workers are having a very hard time affording their high-deductible health plans, which have gone from rare to covering nearly a third of U.S. workers.

Between 2008 and 2018, the deductibles in employer health plans more than tripled – growing much faster than earnings. Workers’ full insurance coverage doesn’t kick in until they pay the deductibles, which now exceed $3,000 for individuals and $5,000 for families in the highest-deductible plans. Add to that a 50 percent hike in premiums during that time.

Some 156 million people get health insurance through work, and they’re largely grateful to have it. They blame rising medical costs on insurers and pharmaceutical companies – and not their employers and healthcare providers – a new Kaiser Family Foundation survey said.

Some 156 million people get health insurance through work, and they’re largely grateful to have it. They blame rising medical costs on insurers and pharmaceutical companies – and not their employers and healthcare providers – a new Kaiser Family Foundation survey said.

One in four said medical bills or copayments for drugs and doctor visits are severely straining their budgets, and the Commonwealth Fund, another healthcare researcher, estimates that the typical worker spent about 12 percent of his income on deductibles and premiums in 2017, compared with 8 percent in 2008 – the figure is closer to 15 percent in Louisiana and Mississippi.

The solution is often to forgo or postpone care. And the higher an employee’s deductible – no surprise – “the more likely they are to experience problems affording care or putting off care due to cost,” Kaiser said. Inadequate medical care is especially dangerous for people with chronic conditions. …Learn More

May 28, 2019

Cars Separate U.S. Retirees from Germans

Retired Germans spend more days outdoors than retirees in this country. But when older Americans leave the house, they stay out longer.

What makes the difference? The car. Americans love their automobiles and overwhelmingly rely on them, according to a new study by MIT’s AgeLab. If they’re going grocery shopping, they might as well run their other errands.

Only about half of Germans, on the other hand, say driving is their favorite way to get around. And they venture out more frequently, because they can walk – or bike – to the market, which tends to be closer to home.

As people age and recognize the inevitability of their limitations, they begin to think more carefully about whether they will be able to remain in their homes. To gain insight into this issue, the AgeLab surveyed older Germans and Americans to compare their retirement experiences and satisfaction with their lifestyles – the AgeLab calls it “residential mastery.”

This goal is achievable for seniors everywhere, if they can find a way to continue to live healthily in a particular cultural and social environment. “Americans may reach residential mastery by having access to a car, ride-sharing or taxi services, while Germans may reach residential mastery by having shops and amenities in walking distance,” concluded an article in the Journal of Environmental Psychology.

In the survey, retirees in each country were asked what they need and what their neighborhoods provide. Both Germans and Americans put the most value on living close to healthcare facilities and their family and friends, who can provide the day-to-day support they need. They agreed on 12 of 17 aspects of their lifestyles – affordability, places to sit and rest, cultural institutions, green spaces, etc. – as being critical to them. …Learn More

May 23, 2019

Student Loan Payments Linked to 401ks

Student loans or the 401(k)?

Young adults have a tough time finding the money for both. Unless they work for Abbott Laboratories.

Employees who put at least 2 percent of their income toward student loan payments will qualify for Abbott’s

5 percent contribution to their 401(k) account – without the worker having to put his own money into the 401(k).

From the company’s point of view, it’s an innovative recruitment tool – and it worked for Harvir Humpal, a 2018 biomedical engineering graduate of the California Polytechnic State University in San Luis Obispo. He joined Abbott’s northern California office in February.

Humpal said his student loans weighed on him after graduation. “It’s very empowering that Abbott is willing to tackle an issue that’s near to my heart,” said the 24-year-old, who works on medical devices used in heart transplants.

He estimates he will pay off his $60,000 student loans about four years early and save $7,000 in interest – without completely sacrificing his retirement savings.

As the cost of college continues to rise and U.S. student loan balances hit $1.5 trillion, an increase in the number of private and even government employers offering student loan assistance is a response to the growing financial burden. An Abbott survey found that 87 percent of college students and 2019 graduates want to find an employer offering student loan relief.

The magnitude of the problem “forces us to focus on our employees’ greatest needs and how we, as an employer, can help them,” said Mary Moreland, an Abbott vice president of compensation and benefits. …Learn More

May 21, 2019

Retirement Dates Don’t Always Fit Plan

Today, half of U.S. workers say they want to work past age 65 – in the 1990s, only 16 percent did.

Apparently, people are getting the message that, if they want to be comfortable in retirement, they will need to work as long as possible. However, good intentions don’t pan out for more a third of workers closing in on retirement age. And the older the age they had planned to retire, the more they fall short of the goal.

Researchers at the Center for Retirement Research, which sponsors this blog, wanted to uncover why people do not follow through. Their study was based on a survey that asked people in their late 50s when they planned to retire and then watched them over the next several years to see what they did and why.

Two factors – the researchers call them shocks – play important roles in pushing people to retire early. The big factor is health. One health-related reason is intuitive: when older people develop a new condition, they become more likely to retire earlier than they’d planned. A second reason is that, when setting a date, they over-estimate how long they’ll be able to work if they have already developed health conditions like arthritis, heart disease, or emphysema. …Learn More

May 16, 2019

Social, Economic Inequities Grow with Age

Retirement, as portrayed in TV commercials, is the time to indulge a passion, whether tennis, enjoying more time with a spouse, frequent socializing, or civic engagement.

Boston University sociologist Deborah Carr isn’t buying this idealized picture of aging.

“This gilded existence is not within the grasp of all older adults,” she argues in “Golden Years? Social Inequality in Later Life.” “For those on the lower rungs of the ladder,” she writes, retirement is “marked by daily struggle, physical health challenges and economic scarcity.”

“This gilded existence is not within the grasp of all older adults,” she argues in “Golden Years? Social Inequality in Later Life.” “For those on the lower rungs of the ladder,” she writes, retirement is “marked by daily struggle, physical health challenges and economic scarcity.”

Her book, which mines multidisciplinary research on aging, reaches the distressing conclusion that economic inequality not only exists but that it becomes more pronounced as people age and become vulnerable. And this problem will grow and affect more people as the population gets older.

Poverty has actually declined among retirees since the 1960s. But by every measure – health, money, social and family relationships, mental well-being – seniors who have a lower socioeconomic status are at a big disadvantage. They have more financial problems, which creates stress, and they are more isolated and die younger.

Throughout the book, Carr documents the myriad ways the disparities, which begin at birth, reinforce each other as people grow up and grow old.

“Advantage begets further advantage, and disadvantage begets further disadvantage,” Carr concludes. For the less fortunate, “old age can be the worst of times,” she said. …Learn More

May 14, 2019

20,000 Savers So Far in New Oregon IRA

About a third of retired households end up relying almost exclusively on Social Security, because they didn’t save for retirement. Social Security is not likely to be enough.

![]() To get Oregon workers better prepared, the state took the initiative in 2017 and started rolling out a program of individual IRA accounts for workers without a 401(k) on the job. The program, OregonSaves, was designed to ensure that employees, mainly at small businesses, can save and invest safely.

To get Oregon workers better prepared, the state took the initiative in 2017 and started rolling out a program of individual IRA accounts for workers without a 401(k) on the job. The program, OregonSaves, was designed to ensure that employees, mainly at small businesses, can save and invest safely.

Employers are required to enroll all their employees and deduct 5 percent from their paychecks to send to their state-sponsored IRAs –1 million people are potentially eligible for OregonSaves. But the onus to save ultimately falls on the individual who, once enrolled, is allowed to opt out of the program.

More than 60 percent of the workers so far are sticking with the program. As of last November, about 20,000 of them had accumulated more than $10 million in their IRAs. And the vast majority also stayed with the 5 percent initial contribution, even though they could reduce the rate. This year, the early participants’ contributions will start to increase automatically by 1 percent annually.

The employees who have decided against saving cited three reasons: they can’t afford it; they prefer not to save with their current employer; or they or their spouses already have a personal IRA or a 401(k) from a previous employer. Indeed, baby boomers are the most likely to have other retirement plans, and they participate in Oregon’s auto-IRA at a lower rate than younger workers.

Despite workers’ progress, the road to retirement security will be rocky. Two-thirds of the roughly 1,800 employers that have registered for OregonSaves are still getting their systems in place and haven’t taken the next step: sending payroll deductions to the IRA accounts.

The next question for the program will be: What impact will saving in the IRA have on workers’ long-term finances? …Learn More