September 24, 2013

Nearly Retired, Lugging a Mortgage

Traditionally, the picture-perfect retirement included a paid-off house. But the Me Generation isn’t sticking to the script.

Snapshots of three generations of U.S. households on the cusp of retirement – people born in the Depression, at the beginning of World War II, and after the war – show that more of the most recent generation, the baby boomers, are still carrying mortgages as they head into their retirement years.

About 40 percent of households who were between the ages of 56 and 61 in 1992 – the Depression-era parents of baby boomers – held mortgages at that age. This share had increased to 48 percent by 2008, as the front wave of baby boomers were reaching their late 50s and early 60s

“The current generation has bought larger, more expensive homes, and they arrive at retirement with more mortgage debt,” concluded George Washington University business professor Annamaria Lusardi, who presented the findings of her study with Olivia Mitchell of the Wharton School during an August meeting of the Retirement Research Consortium. …Learn More

September 19, 2013

Make-up of Non-Bank Customers Changes

Having cashed her McDonald’s paycheck at a check cashing outlet in Boston’s South End neighborhood, Nicole DeConinck has completed one half of her Friday afternoon ritual.

She will now walk to a nearby pharmacy to purchase a debit card, which she’ll use to make her purchases.

More Americans like DeConinck say they have used non-traditional financial services, such as check cashing, or are getting loans from places like pawn shops, payday lenders, or firms that offer advances on IRS refunds. In 2011, 41 percent had, up from 36 percent in 2009, according to the Federal Deposit Insurance Corp., which insures U.S. commercial banks.

One thing fueling this growth is that non-bank loans, which are ready sources of cash, are reaching new segments of the American public, according to a recent analysis of the FDIC’s data by Gregory Mills and William Monson of the Urban Institute in Washington. Once associated with minorities, immigrants and low-income workers, they found they’re more prevalent among non-Hispanic whites, college graduates, and people who earn more than $50,000.

“It’s a measure of the extent of distress throughout the American economy that more and more individuals regarded as insulated from having to turn to these kinds of borrowed funds are now having to access them,” Mills said. …Learn More

September 17, 2013

Workers Struggle Day to Day

There’s a growing concern that working people aren’t saving for the future, but the reality is that many of them can barely get by in the here and now.

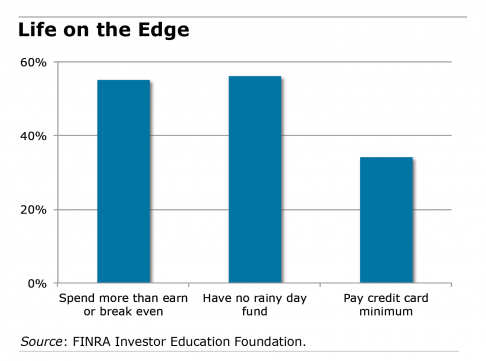

A sizable minority of Americans say they are spending more than they earn, have overdue medical bills, or pay only the minimum on their credit cards. These were among the findings in the 2012 National Financial Capability Study (NFCS) conducted by the FINRA Investor Education Foundation, its second survey to illuminate the day-to-day financial issues facing average working people.

Pulling together $2,000 may seem like only a modest challenge for someone with good pay and benefits. But 40 percent of the people surveyed also indicated they would be hard-pressed to find that much money if they needed it, according to a September report on the NFCS survey.

FINRA identified indicators of what it called the “financial fragility” of the average American:

FINRA identified indicators of what it called the “financial fragility” of the average American:

• More than half of those surveyed were in a poor position to save: 19 percent spend more than they earn, and 36 percent just break even.

• More than half have no rainy day fund and live paycheck-to-paycheck. …Learn More

September 12, 2013

Swedish Retirees Spend More Freely

Americans are known for being reluctant to spend their life savings after they retire. The burning question has always been why.

New research comparing tight-fisted Americans with more free-spending Swedes found that U.S. retirees tend to hold on to their savings, because they face more risk of having to pay high out-of-pocket costs in the future for their medical and long-term care.

U.S. households, by the time they’re in their late 80s, have tapped only about one-third of the net worth they held in their late 60s, according to the study. Swedish households in their late 80s have spent more than three-fourths.

In preliminary findings presented at an August meeting of the Retirement Research Consortium in Washington, researcher Irina Telyukova said her study with Makoto Nakajima found that nearly 70 percent of the difference in the way Swedish and U.S. retirees spend down their financial assets can be explained by differences in their potential future medical costs.

Sweden’s healthcare system reduces the uncertainties for retirees in two ways. Sweden has national health care for everyone. Swedish municipalities are responsible for providing long-term care to the elderly in their communities, limiting a cost that can be enormous for U.S. retirees who need these services. …Learn More

September 10, 2013

Making the Case for Working Longer

Remaining on the job for a few more years may not appeal to many older Americans who long to retire.

But in the above video, a compelling case for working longer is made by Steven Sass, an economist with the Center for Retirement, who also edits this blog.

Sass explains that delaying retirement improves a retiree’s financial security in three critical ways:

- The worker can continue to save money for a few more years and will have more time to earn investment income on his savings.

September 3, 2013

Money Concerns Sap Mental Capacity

Poor and working people’s continual worries about money cloud their thinking and make it more difficult to perform simple tasks, concludes new research in Science magazine.

This finding came out of two very different experiments – one at a New Jersey shopping mall, the other in India’s sugar cane fields – by an international team of economists and psychologists.

In the first experiment, wealthy and low-income shoppers – $70,000 in household income was the cutoff between high and low – were seated in front of computers and quizzed about a variety of financial scenarios designed to trigger thoughts of their own money concerns.

For example, they might have been asked whether to pay for a car repair with a loan or cash or to forgo the work altogether. Some of these scenarios were relatively easy to resolve – say, the car repair cost only $150. In a difficult scenario, it might cost $1,500.

After answering a series of easy and hard financial questions, the shoppers performed simple tasks often administered by psychologists, such as picking the shape that best fits into a group of other shapes. Rich and poor performed similarly on the tasks after they were presented with the low-cost scenarios. But the high-cost scenarios caused the poor to perform significantly worse.

A brain distracted by financial problems is “like a computer slowing down when you run too many things at once,” said Eldar Shafir, a Princeton University professor of psychology and public affairs. …Learn More

August 29, 2013

Financially Mismatched Couples at Risk

Financial planners say it happens all the time: couples who don’t see eye to eye on money matters often break up or divorce.

One reason they run into trouble is that a financial mismatch makes it more difficult for them to achieve important goals, said financial adviser Bonnie Sewell of Leesburg, Virginia.

“They’re working against the tide. People who pick like-minded partners get there faster,” said Sewell, who’s written a book about money and divorce.

Her contention is backed up by the preliminary results of a study of more than 30,000 married and cohabiting couples between 1999 and 2012 by Federal Reserve Board researchers Jane Dokko and Geng Li. Their study compared the partners’ individual credit scores to gauge their financial compatibility and found that the larger the disparity between the two of them, the higher the incidence of break-ups.

The authors said credit scores are a proxy for financial behavior and also can measure trustworthiness. The link between poor financial matches and household dissolution, they wrote in their paper, was “quite strong.”

To prevent unhappy endings, Sewell, the financial planner, has three suggestions for new couples: …Learn More