July 9, 2013

Aging U.S. Workers: The Fittest Thrive

By the time people reach their mid-60s, two out of three have retired, either voluntarily or because they’re unable to keep or find a job. By age 75, nine out of ten are out of the labor force.

But the minority who do continue working aren’t just survivors – they’re thrivers. Think novelist Toni Morrison, rocker Neil Young, or the older person who still comes into your office every day.

The earnings of U.S. workers in their 60s and 70s are rising faster than earnings for people in their prime working years, according to a new study. Defying the stereotype that they’re marking time, today’s older workers are also just as productive as people in their prime working years.

Driving these trends is education: far more older Americans now have a college degree than they once did.

There’s a “perception that the aged are less healthy, less educated, less up-to-date in their knowledge and more fragile than the young,” but this does “not necessarily describe the people who choose or who are permitted to remain in paid employment at older ages,” Gary Burtless, a senior fellow at the Brookings Institution, concluded in his study.

The experience of age 60-plus workers is becoming increasingly important, because there are more of them in this country than there ever have been – a rising trend that will continue. …Learn More

July 3, 2013

Happy Fourth of July

Squared Away will return next Tuesday with a new blog post and more news and research on financial behavior and retirement.Learn More

July 2, 2013

Readers Call Gen-X to Action

A recent blog article, “Retirement Tougher for Boomer Children,” did not elicit much sympathy for Generation X.

Many readers who commented expressed a sentiment something like this: Yes, things are tougher for young adults. So deal with it.

Members of Generation X, as well as Millennials, are largely on their own with their 401(k)s, in contrast to their parents and grandparents who may’ve had a guaranteed pension at work. But the evidence indicates young adults are not preparing for retirement: well over half of 30- and 40-somethings are on financial path to a lower standard of living once they retire, according to an analysis cited in the article.

They need to find “the discipline to save for retirement through all the means available,” said a Squared Away reader named Paul. …Learn More

June 27, 2013

62YO Men File Social Security; Wives Pay

My father was never more in love with my mother than on the day he died in 2004, days before their 50th anniversary.

But he made one bad financial decision that she lives with today: he started up his Social Security benefits at age 62.

He felt he needed the money sooner than later. He had an inadequate pension from his first career, as an Air Force flyboy, and none from his Rust Belt business that went bust. But waiting to claim his Social Security would’ve increased the size of his check – and, after he died at 70, the money that’s still deposited into my mother’s bank account every month.

This happens to a significant share of couples, because almost 40 percent of all Americans claim their benefits the same year they turn 62. But a husband who waits until age 65 can increase his widowed wife’s future benefits by up to $170 a month, according to new research by Alice Henriques, an economist with the Federal Reserve Board in Washington.

What’s interesting about this study of nearly 14,000 older couples is that she teased out how much the husband’s decision was determined by the filing date’s impact on his own benefits, versus the financial impact on his wife’s spousal and, later, her survivor benefits. Similar research in the past had examined the impact of a filing date on their combined benefits during all their years of retirement.

Henriques was able to show that the husbands, when they made their decisions, took into account the impact on themselves of the claiming date they selected. But they showed virtually “no response to the large incentives” of having the ability to provide their widowed wives with more income in the future, she said. …Learn More

June 25, 2013

401(k)s Stall, Post-Auto Enrollment

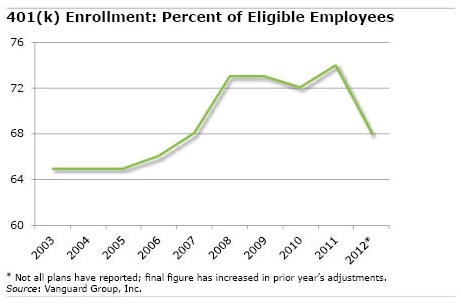

Seven years after Congress encouraged employers to automatically enroll their workers in the company 401(k), the retirement fix has run out of steam.

Corporate America rushed in to adopt the feature in their 401(k) plans after the Pension Protection Act (PPA) made auto enrollment more attractive by giving employers that used it a safe harbor from non-discrimination rules governing their benefits.

Immediately after the PPA provision became effective in December 2007, employee participation in 401(k)s increased. But since that initial bump, it’s been virtually flat for years.

In 2008, participation increased to 73 percent of all employees in workplaces that offered 401(k)s, up from 68 percent in 2007, according to Vanguard Group Inc.’s new “America Saves 2013” report, which provides a decade of participation rates for its large data base of clients.

Fast forward to 2011: participation was 74 percent. It has barely budged. (Last year, participation was 68 percent, but Vanguard said past experience indicates this figure will rise to roughly the same level when all of its clients turn in their data). …Learn More

June 20, 2013

Older Patients Tell Doctors, “Charge It!”

New research has uncovered one reason for the alarming rise in credit card use among older Americans: medical bills.

When people age 50 or older experience “health shocks” – newly diagnosed medical conditions – their credit card balances rise, according to research published in the Journal of Consumer Affairs. The worse the medical condition, the more they charge.

A mild, new medical problem, for example, adds $230 to credit card bills – that’s a 6.3 percent increase on a starting balance of $3,654. If the new condition is severe, balances increase by $339, or 9.3 percent.

Separately, the researchers looked at the effect of out-of-pocket medical costs, such as copayments for doctor visits and prescriptions not covered by private insurance or Medicare. For each $100 that those costs increase, about $4.50 winds up on the cards, according to Hyungsoo Kim at the University of Kentucky, WonAh Yoon at the Samsung Life Retirement Research Center in Seoul, Korea, and Karen Zurlo at Rutgers University.

Their findings shed new light on why more older Americans, who have the greatest medical needs, are becoming reliant on credit cards with their high interest rates. …Learn More

June 18, 2013

Are You An Ostrich About Investing?

As the stock market approached and then broke through the 15,000 mark, did you get a little obsessed with your 401(k) balance?

You would not be alone. A novel research project recently analyzed how often investors went online to check their 401(k) accounts and found that they did so more often when the Dow was rising. What could be more pleasant than watching your wealth grow?

The researchers quantified the emotional roller coaster that our investments can take us on by looking at log-on activity during 2007 and 2008 for 100,000 401(k)-style accounts at Vanguard Group Inc. To make sure they were properly measuring investor interest, the sample included only online customers who did not receive paper statements in the mail.

Their analysis gauged how responsive these investors were to stock market swings in either direction, based on the size of one-day market moves. If the Dow increased by 1 percent in a day, for example, the total number of log-ins rose nearly 2 percent. But if the Dow fell by 1 percent, then 2 percent fewer investors checked their accounts.

This human inclination to avoid the pain of losing money has been labeled the “ostrich effect,” because investors respond by putting their heads in the sand when the market is down. …Learn More