November 21, 2017

Thankful for Squared Away Readers

Thank you for continuing to read and support Squared Away!

Our goal is to provide reliable information that is not influenced by the desire to sell a product or service, which we hope is a valuable service to you. And as a blog based at the Center for Retirement Research, we are particularly interested in covering what the current research (ours and many others’) can tell us about retirement, personal finance and the economic challenges that people face.

What could be better than a big turkey in the oven and family and friends all around? Happy Thanksgiving to all.

To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.Learn More

November 21, 2017

Retirees say ‘Ugh’ to Medicare Shopping

In terms of popularity, reviewing Medicare plans during the open enrollment, going on now, ranks right up there with doing taxes.

In terms of popularity, reviewing Medicare plans during the open enrollment, going on now, ranks right up there with doing taxes.

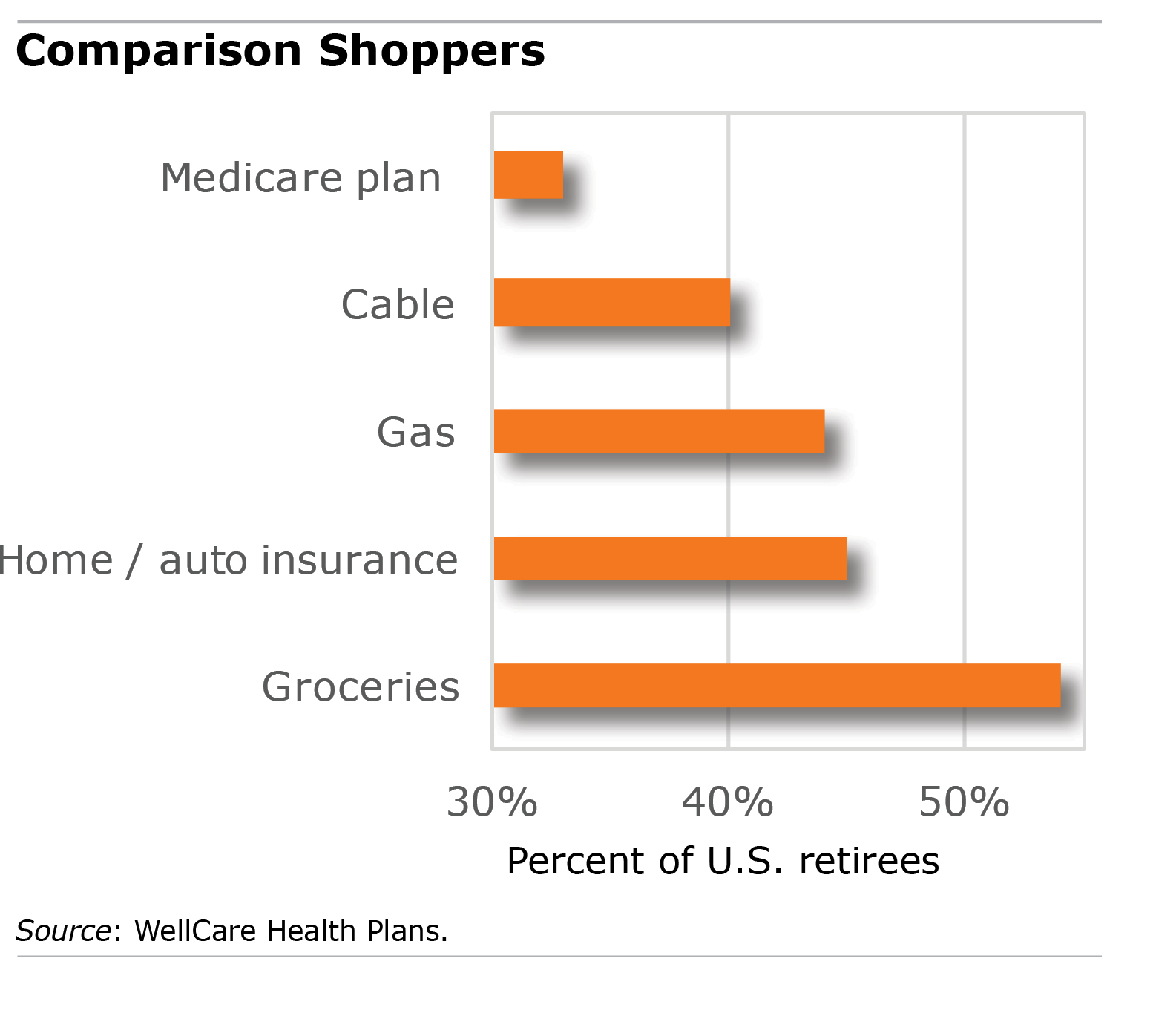

Retirees on Medicare view healthcare as their most burdensome expense. But they are less likely to comparison shop for Medicare plans than for their groceries and gas, even though plan shopping would probably save more money.

Deciding on a Medicare Advantage plan or deciding to switch to traditional Medicare, with or without a Medigap supplement, is “overwhelming, scary, and has consequences, so we put it off,” said Bart Astor, a spokesman for the insurer WellCare Health Plans, whose nationally representative survey quantified just how much retirees dread Medicare enrollment.

Selecting one path over another also necessitates predicting the impossible: their future health and how much coverage they will need.

Squared Away can’t predict your medical needs in 2018 either. But perhaps one of these blogs will help you decide which path to take:

- Free help navigating Medicare’s maze

- 10 rules for Medicare Advantage shopping

- Know the pitfalls of spotty hospital coverage in Advantage plans

- Advantage premiums reflect physician networks

- Fewer, clearer Medicare Part D choices

- Avoid initial Medicare enrollment mistakes

- Medicare primer: Advantage or Medigap?

If you haven’t shopped yet, why not get started on Black Friday?Learn More

November 16, 2017

To be Old is to be Happy

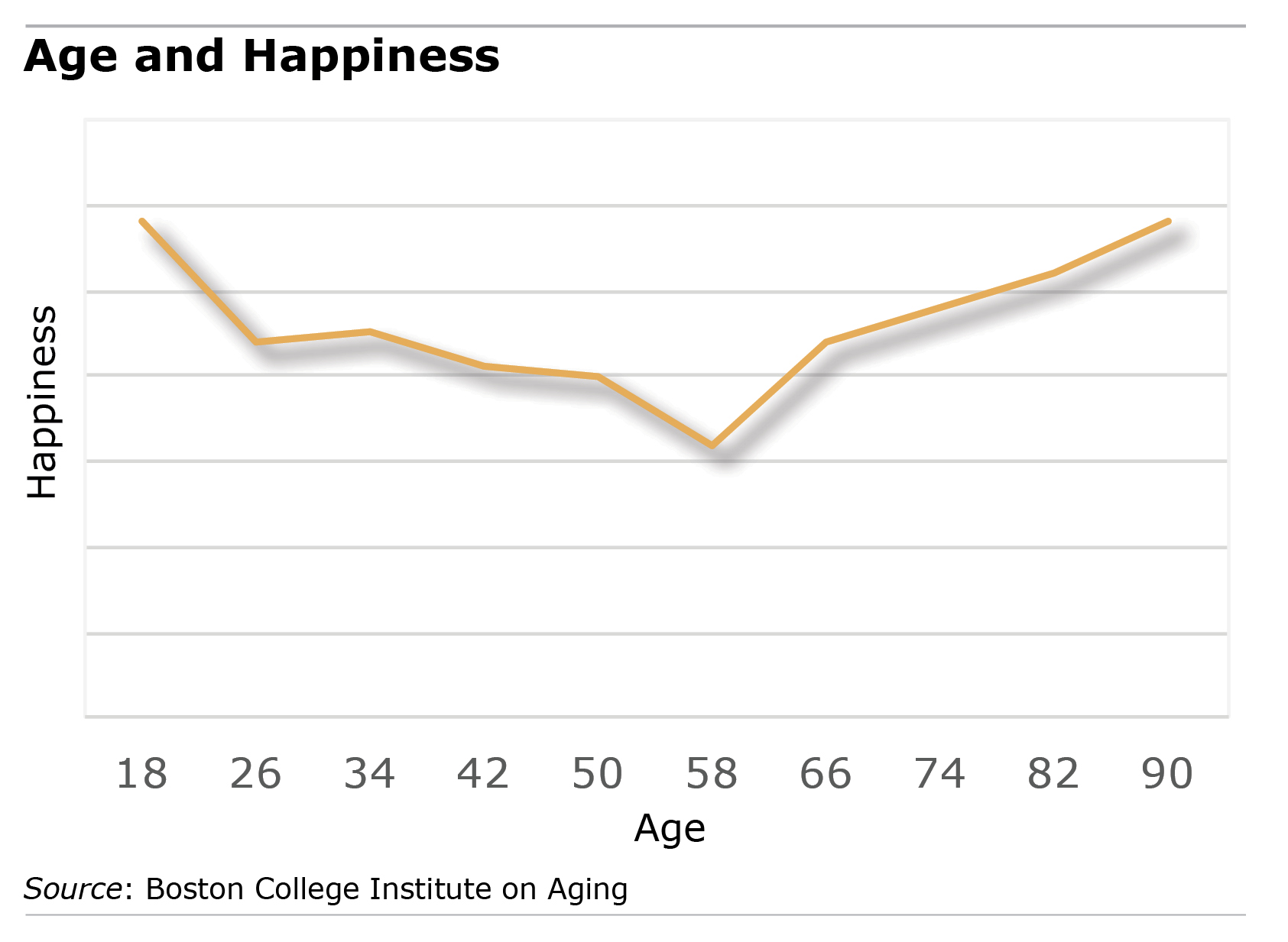

Around age 58, people start getting happier. That’s what the research shows, and this blogger can attest to it.

Around age 58, people start getting happier. That’s what the research shows, and this blogger can attest to it.

In the new video displayed below, Rocio Calvo, a Boston College professor of social work, offers up theories for the happiness phenomenon – financial security is one. She also has some particularly striking “happiness statistics” on Hispanics and immigrants.

All over Boston College, academics are studying aging issues, which complement the financial and economic research turned out by the Center for Retirement Research, which sponsors this blog. Calvo’s video is part of a series of videos by the multidisciplinary Institute on Aging at Boston College.

It’s interesting viewing for older people and their families, with apologies for the regression table (the significance of which quickly becomes clear if you stick with it).

November 14, 2017

Employers Chop Down College Loans

Edward Cash would really rather spend his hard-earned paychecks from the Memphis Police Department on his daughter than on humdrum necessities like student loans, replacing a broken-down car, or saving.

“I need money, as much money as I can to take care of this new human in my life,” Cash said about 4-year-old Kirby.

Of course, he and his wife, Ashley Cash, a Memphis city planner, pay their bills, in between doting on Kirby. But college loans are different: they get help. The city government pays down $50 a month on each of their loan balances – as it does for some 600 employees.

In May, Memphis joined Fortune 500 companies in the vanguard of employers offering this benefit, including to its police force, which requires some college education, and the fire department, where time in college is not required but also not uncommon.

With college debt exceeding $1.4 trillion nationwide, help with student loans appeals to young employees, who say in surveys that paying them off is their No. 1 financial priority. Recognizing this, major employers are using the tuition benefit to recruit talent, including Fidelity Investments, Live Nation, Natixis Global Asset Management, Pricewaterhouse Coopers, and Staples Inc., according to company and media reports. …Learn More

November 9, 2017

The Lyft Economy: it’s a Side Job

Driving around major U.S. cities, it seems like every other car has a Lyft or Uber logo in the back windshield.

Driving around major U.S. cities, it seems like every other car has a Lyft or Uber logo in the back windshield.

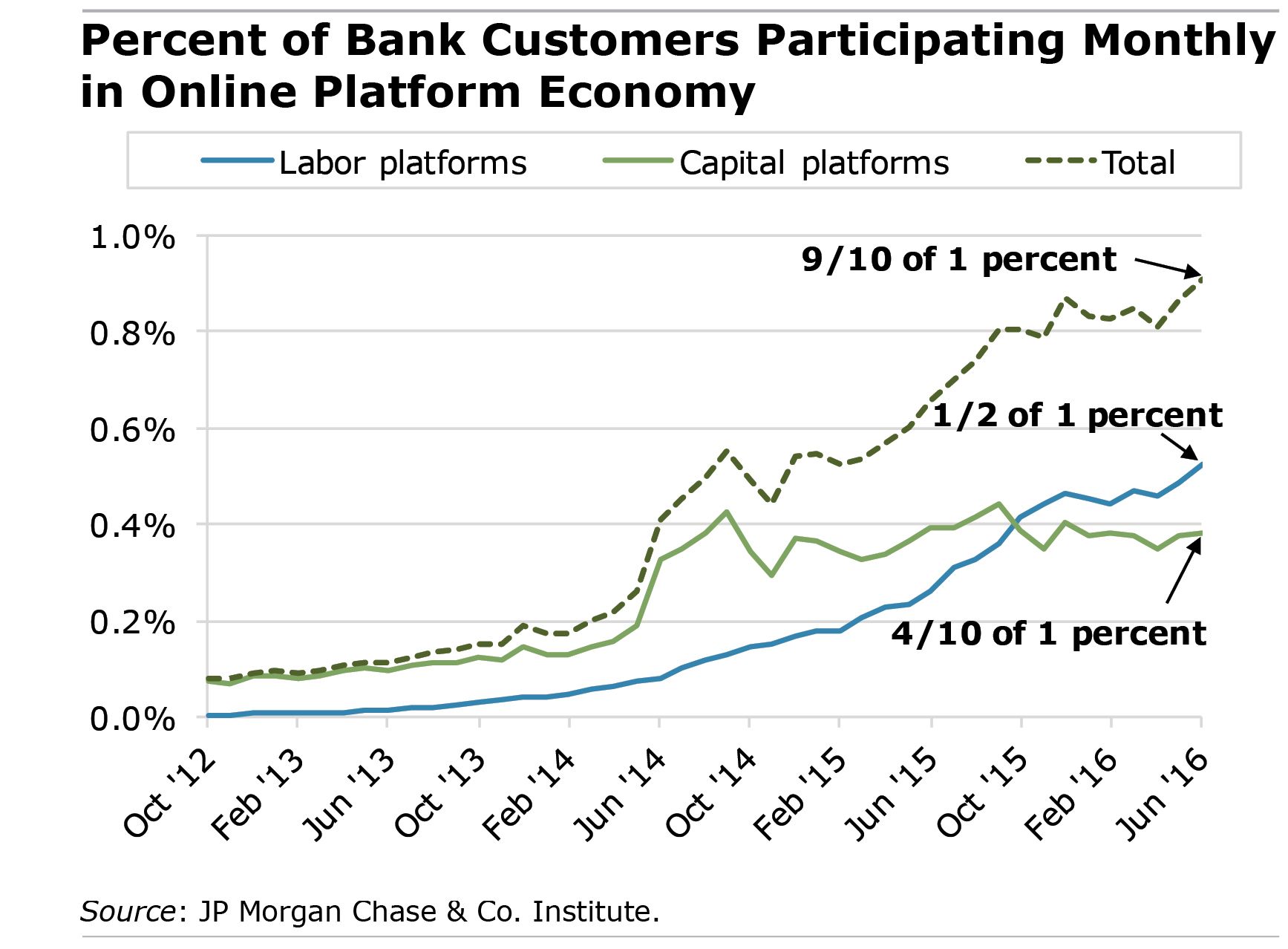

These ride-sharing apps are prominent players in the increasingly popular “platform economy,” which links sellers with buyers of their goods and services, from used couches and basement junk to handymen and car rides. This is one corner of the fast-growing gig economy, which also includes freelancers and the self-employed.

But who takes on these jobs, are they long-term or short-term endeavors, and how reliant are participants on the income they generate through online platforms or apps?

Scouring its database of transactions in the bank accounts of 240,000 bank customers who participate in the platform economy, the JP Morgan Chase & Co. Institute has put together a completely anonymous but interesting profile of the participants in this ever-present, but little-understood part of the economy.

Despite a proliferation in platforms, Fiona Greig, director of research at the JP Morgan Institute, said it’s fairly clear from these data this usually is not U.S. workers’ first choice for earning a living. Most people, “are not relying heavily on this,” she said. While users have to sell their wares on a piece-rate basis, “the flexibility that this offers makes for the perfect opportunity to add income.” …Learn More

November 7, 2017

Portlandia Trashes “Instant Garbage”

Hilarious examples of “instant garbage” are offered up in this Portlandia clip by the show’s characters, Bryce Shivers and Lisa Eversman (played by Fred Armisen and Carrie Brownstein).

The price point for an unwanted consumer product that becomes instant garbage is $4.99. “We found the exact point between price and hassle that guarantees you won’t bother returning” the product, Eversman explains in the video below.

Is the following theory a stretch? There seems to be a direct line between Americans’ relentless buying of stuff we do not need and our inadequate attempts at saving money.

Try walking into a craft superstore or browsing Target’s $1 shelf and suddenly imagining the stuff all piled up at its ultimate destination, the local landfill.

Then walk back out and save the money for retirement.

November 2, 2017

Report: Healthcare a Middle Class Crisis

The state of the nation’s health care system includes these incredible facts:

The state of the nation’s health care system includes these incredible facts:

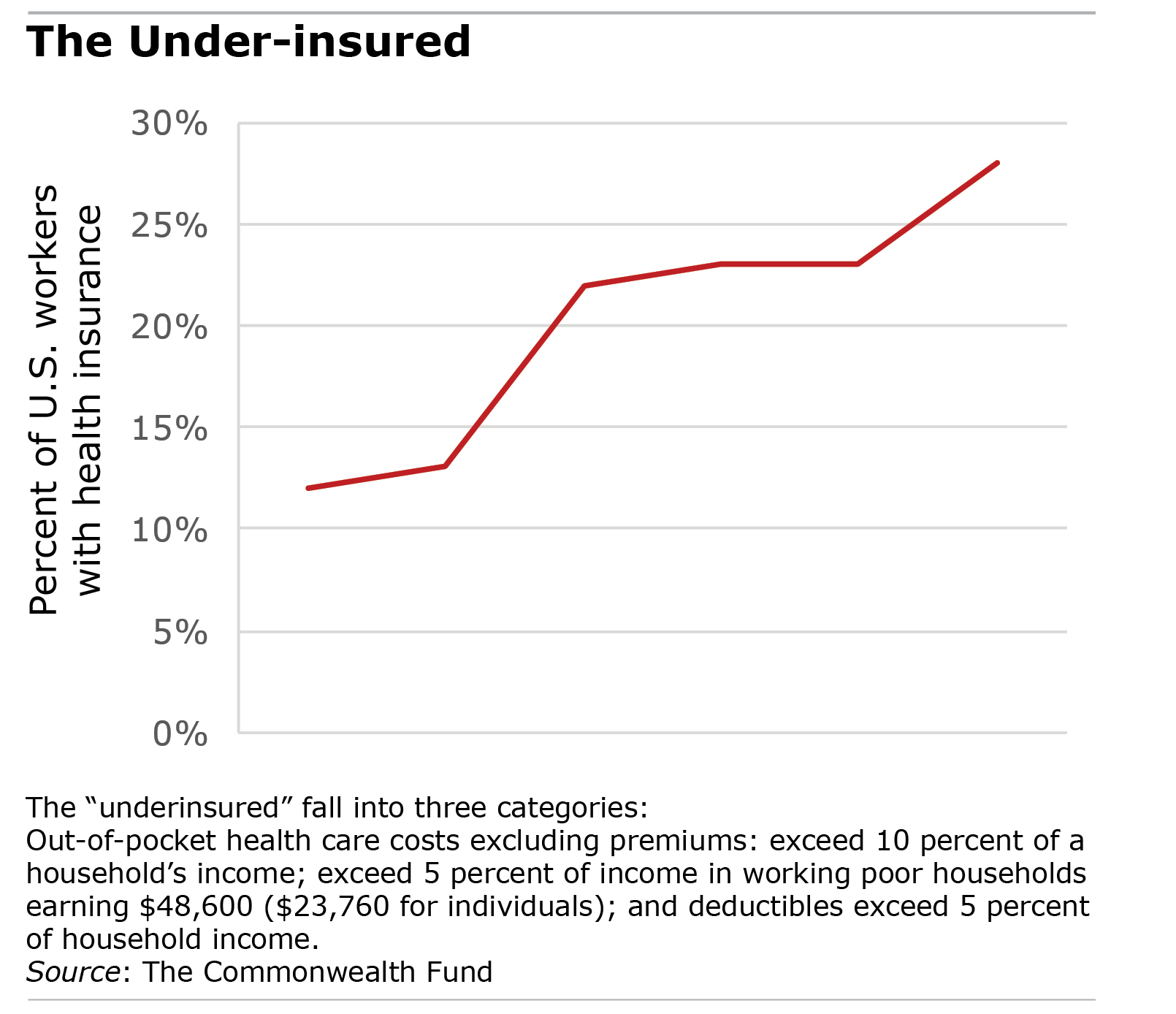

- Americans with health insurance who are “under-insured” have more than doubled to 41 million since 2013. They now make up 28 percent of adults.

- Geographic disparities can be stark. Nearly one in three Floridians and Texans is under-insured, compared with one in five in California and New York. Not surprisingly, insurance deductibles are higher in Florida and Texas.

Much has been made of the fact that many Americans can’t afford their deductibles and out-of-pocket costs when purchasing polices under the Affordable Care Act (ACA). The new report by the healthcare advocacy organization, The Commonwealth Fund, indicates that both ACA-insured and employer-insured Americans are frequently stretched to the limit.

Middle-class incomes for a family of four range from about $58,000 to $115,000. The definition of middle-class people who have health insurance but cannot afford it is well-established in the research: their deductibles or other annual out-of-pocket costs exceed 10 percent of their annual household income. (For the poor, the threshold is 5 percent.) …Learn More