May 20, 2014

Medicare Advantage Enrollment Doubles

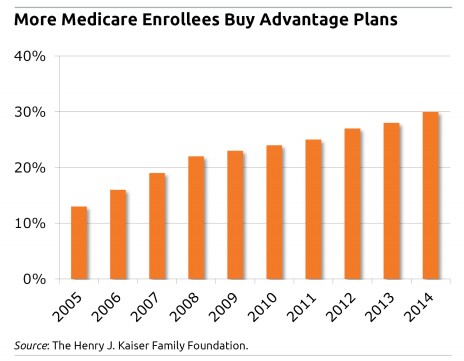

Enrollment in the Medicare Advantage plans that private insurers offer as an alternative to traditional Medicare coverage has more than doubled over the past decade, the Kaiser Foundation reports.

The share of the Medicare population enrolled in these private plans is 30 percent, up from 13 percent in 2005, the non-profit foundation said.

The reason for this dramatic growth: Medicare Advantage became a better deal for older Americans in the wake of a 2003 increase in federal subsidies to insurance companies offering the plans.

The federal government subsidizes insurers through its reimbursements for the care they cover for older Americans enrolled in Medicare Advantage. Those payments were increased in 2003. Insurers responded by reducing beneficiaries’ copayments and cost-sharing in the plans and by providing medical services not always available to people who enroll directly in Medicare and purchase Medigap policies, said Gretchen Jacobson, an associate director of Kaiser’s Medicare policy program.

The extra services include gym memberships, eye glasses, dental care, and preventive medical care. To rein in their overall medical costs, Medicare Advantage plans restrict the hospitals and doctors that patients can use. …Learn More

May 14, 2014

Low Income: Why Only 12% Save to Retire

A new study estimating that just 12 percent of low-income older Americans save in a 401(k) or similar employer retirement plan also suggests that many more would save – if only they could.

The researchers – April Yanyuan Wu, Matt Rutledge, and Jacob Penglase of the Center for Retirement Research – focused on individuals between ages 50 and 58 with household incomes below three times the poverty line. That was less than $36,357 in 2010 for a one-person household, for example, and less than $46,800 for two people. The period studied spans 1992 through 2010.

Retirement saving primarily takes place in workplace plans. But to participate in a plan, workers must clear four hurdles. First, they need a job. Next, their employer must offer a retirement savings plan. If there is a plan, they must be eligible to participate. And if eligible, they must sign up and contribute.

A failure to sign up can’t be blamed for the dismal savings rate of this low-income group. Instead, the problem is that many never get the chance. …Learn More

May 13, 2014

Spending Cut When Job Threats Rise

A new study provides important insights into American workers’ household budgets.

The study found that when workers sensed a growing likelihood they might lose their jobs, they quickly pared their spending on a large and diverse basket of discretionary consumer goods. These included both standard purchases and big-ticket items, from gardening supplies and vacations to cars and dishwashers.

The analysis was based on a survey of some 2,500 workers who were asked about their spending patterns and also asked to estimate their own chances of becoming unemployed over the coming year. The survey was conducted between 2009 and 2013, when the U.S. jobless rate at one point approached 10 percent. …Learn More

May 8, 2014

Where We Live: the Mom Magnet

Despite the growing tendency of Americans to migrate around the country for a job or retirement, half of all adults still live less than 25 miles from their mothers.

Such details about basic family living patterns were described in this video featuring Janice Compton, an economist with the University of Manitoba, who conducts research on the relationship between geographic proximity to older parents and who cares for them.

The vast majority of hands-on caregivers are family members. And elderly women, who tend to live longer than men, are more often the ones who receive care from their children.

To determine who’s most likely to stay near mom – and be in a position to assume care-giving duties – Compton and Robert Pollak at Washington University analyzed data from the U.S. Census and the National Survey of Families and Households for adults over age 25. Here’s what they found: …Learn More

May 6, 2014

Half Say Retirement Saving Is Top Goal

Half of all American adults view their top financial goal as making sure they have enough money to retire, finds a survey conducted in early April and released last week by the National Endowment for Financial Education (NEFE).

That’s barely changed from 47 percent who said so in NEFE’s 2011 survey. These figures are unimpressive if one considers that most everyone eventually retires. Further, fewer than one in five U.S. workers has the luxury of a traditional defined benefit plan that will send them a pension check every month.

Saving for retirement hasn’t gotten any easier either: two of three adults in the NEFE survey identified an inability to save enough as a major financial obstacle. That sentiment may be one reason why only about half of private-sector U.S. workers participate in a retirement savings plan at work. …Learn More

April 29, 2014

Pay Gap: Depends on Woman’s Age

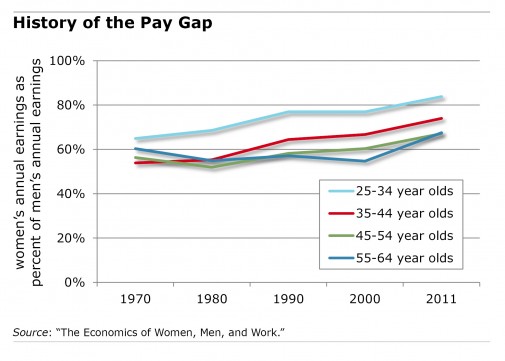

The earnings gap between working men and women has narrowed somewhat over time, but it’s considerably wider for older women.

Women who are now on the cusp of retirement and working full-time earn 67.5 cents for every dollar men their age earn – or 8 cents more than working women who were the same age (in their late 50s and early 60s) during the 1970s.

Women who are now on the cusp of retirement and working full-time earn 67.5 cents for every dollar men their age earn – or 8 cents more than working women who were the same age (in their late 50s and early 60s) during the 1970s.

For younger women, the pay gap persists but things are brighter. Women in their late 20s and early 30s today earn 84 cents for every dollar a young man earns. That’s a 20 cent gain over women who were their age back in 1970.

These are among the myriad statistics documenting the history of the pay gap in the new (7th) edition of the economics textbook, “Economics of Women, Men, and Work.”

The pay gap affects women’s ability to save, buy a house, and invest. There are several explanations for why younger women have made more progress, relative to men, say the textbooks’ authors, Francine Blau, Anne Winkler, and Marianne Ferber: …

Learn More

April 24, 2014

Should a Will Even the Score?

Consider this difficult situation: An elderly woman lends her oldest son $20,000 to help pay for some expensive medical care for his teenage son – her grandson – who’s stricken with cancer.

When the woman writes her will, a different son who is also her executor – and happens to be an accountant – advises her to deduct the $20,000 loan, never repaid, from the oldest son’s modest inheritance.

This happened in my family, and I was of two minds at the time. Technically, the money was a loan – not a gift – so not paying it back was unfair to the other siblings who didn’t receive $20,000. But it seemed uncompassionate to take the money out of a bequest, given the graveness of the teenager’s illness.

Financial planner Rick Kahler discusses a similar situation in this video and proposes something that may seem radical: evenly dividing up your estate isn’t necessarily fair.

The way Kahler explains his argument in the video, it makes sense – at least in the particular instance he’s discussing. But does it depend on the situation? …Learn More