Posts Tagged "baby boomers"

April 9, 2020

Social Security Tapped More in Downturn

It happened after the 2001 and 2008-2009 recessions, and it will happen again. Some older workers who lose their jobs will turn, in desperation, to a ready source of cash: Social Security.

In the wake of a stock market crash like the one we just experienced, baby boomers’ first inclination will be to remain employed a few more years to make up some of the investment losses in their 401(k)s. But as the economy slows and layoffs mount, that may not be an option for many of the unemployed boomers, who will need to get income wherever they can find it.

Age 62 is the earliest that Social Security allows workers to start their retirement benefits. In 2009, one year after the stock market plummeted, 42.4 percent of 62-year-olds signed up for their benefits, up sharply from 37.6 percent in 2008, according to the Center for Retirement Research (CRR).

Social Security is a critical source of income even in good times. One out of two retirees receives half of their income from the program, and they can also count on it when times get tough.

But the financial cost of starting Social Security prematurely is steep, because it locks in a smaller monthly benefit for the rest of the retiree’s life. For those who can wait, the size of the monthly check increases an average 7 percent to 8 percent per year for each year claiming is delayed up until age 70.

Unfortunately, the people who claimed Social Security early in the wake of the 2001 recession had fewer financial resources to begin with – namely, their earnings were lower, they had less wealth, and they were less likely to have a spouse to fall back on – according to the CRR study.

“These simple characteristics suggest that those hardest hit by recessions are most likely to use Social Security as an income-insurance policy,” the researchers concluded. …Learn More

April 7, 2020

Our Parents Were Healthier at Ages 54-60

Baby boomers aren’t as healthy as their parents were at the same age.

This sobering finding comes out of a RAND study that took a series of snapshots over a 24-year period of the health status of Americans when they were between the ages of 54 and 60.

The researchers found that overall health has deteriorated in this age group, and they identified the specific conditions that are getting worse, including diabetes, pain levels, and difficulty performing routine daily activities.

Obesity is an overarching problem: the share of people in this age group with class II obesity, which puts them at very high risk of diabetes, tripled to 15 percent between 1992 and 2016.

In addition to declining health, the study for the Retirement and Disability Research Consortium uncovered strong evidence of growing health disparities among 54 to 60-year-olds: the poorest people are getting sicker faster than people with more wealth.

The increase in women’s pain levels has been starkest over the past 24 years. The wealthiest women have seen an increase of 6 percentage points in the share experiencing moderate to severe pain from conditions like joint or back pain. But the poorest women saw a 21-point leap. The disparity for men was also large: up 7 points for the wealthiest men versus 15 points for the poorest men.

The bottom line: today’s 54 to 60-year-olds are not as healthy as their parents were, and the study suggests that the disparities between rich and poor will continue to grow.

To read this study, authored by Peter Hudomiet, Michael D. Hurd, and Susann Rohwedder, see “Trends in Health and Mortality in the United States.”Learn More

March 31, 2020

Boomers Facing Tough Financial Decisions

For baby boomers who thought they were on the path to retirement, the road is shifting beneath their feet.

Danielle Harrison, a financial planner in Columbia, Missouri, sees a raft of problems stemming from the COVID-19-induced economic slowdown.

Many older workers getting close to retirement age are taking big hits to nest eggs that were already too small. Some boomers who lacked pensions and were behind on saving tried in recent years to make up for lost time with a riskier portfolio in the rising stock market – now they’re experiencing the downside of that risk. Others are scrambling to pay expenses or maintain debt payments as their income drops, altering their financial security now and changing their calculations for the future.

“It’s really going to hurt people,” said Harris, who believes that some baby boomers who had planned to retire in the near-term may be rethinking those plans.

And she’s talking about the boomers who still have jobs. The layoffs have already begun and will continue. Economists estimate GDP will contract in the second quarter at an unprecedented 10 percent to 24 percent annual rate.

Evan Beach, a financial planner in Alexandria, Virginia, predicted that “People are going to get fired, and the people who get fired are not the 25-year-olds making $60,000. They’re going to be the 50- and 60-year-olds making $120,000.”

The economic stimulus package Congress passed last week could help, because it was designed to mitigate some job losses by extending loans to businesses that preserve their payrolls. It will do nothing to repair investment portfolios, however.

Beach and other financial advisers worry that panic decisions in this tumultuous time will only make things worse for boomers who, now more than ever, need to preserve their retirement resources.

Just as they did in the years after the 2008 financial market crash, some unemployed boomers will pound the pavement for a job and will scrape by – through odd jobs, short-term contracts, and unemployment benefits – rather than be forced into a premature retirement.

But Beach anticipates that many of them may have no other option than to claim their Social Security – the program’s earliest claiming age is 62. The problem with starting Social Security now is that it would permanently lock in a smaller monthly check. This goes against a central tenet of retirement planning, which is that many people would be better off delaying the date they sign up to increase a retirement benefit they will need for the rest of their lives.

Beach conceded, however, that claiming the smaller benefit now is not irrational for a couple with one laid-off spouse, only $2,000 in income, and $3,000 in expenses. If the laid-off spouse can start getting $1,000 from Social Security, he said, “that’s not irrational. That’s desperate.” …Learn More

March 24, 2020

If People Can Work Longer, They Will

A majority of adults believe there’s better than a 50-50 chance they will still be working full-time after age 65, a new study found.

The evidence suggests this goal is fairly realistic.

In the study, adults ranging in age from 18 to 70 were asked to rate themselves on a 1-to-7 scale for 52 different cognitive, physical, psychomotor, and sensory abilities that determine their capacity to work. These abilities run the gamut from written comprehension, pattern recognition, and originality to finger dexterity, reaction time, and vision acuity.

Of course, physical abilities decline with age. But when the researchers compared older and younger participants in the study, they found that many self-assessments of their abilities were very similar. For example, psychomotor abilities – such as hand steadiness, manual dexterity, and coordination – were at peak levels for the people in their 30s. But these abilities were only slightly diminished for the people in their 60s. And despite concerns about cognitive decline among older workers, the difference between 50- and 60-year-olds was minor.

The heart of the research, funded by the U.S. Social Security Administration, was determining whether each individual’s distinct set of abilities affected his or her work capacity, as well as how long and how much the individual intends to work as they age. This issue is important, because extending a career is a powerful way to improve one’s financial security after retirement.

To determine this capacity for work, each individual’s self-assessed abilities were matched up with the skills required to do nearly 800 different U.S. occupations. The researchers then calculated the percentage of these occupations each person would be able to do, given their education and training level.

Here are three of the central findings:

The more occupations people can do, the more likely they were to say they would work past 65.

Workers over 60 with a higher capacity to work said they would be more likely to remain employed even after 70.

One in four of the retirees with a very high capacity for work would consider “unretiring” and returning to the labor force. …Learn More

March 3, 2020

Pre-Retirement Debt is Rising Over Time

Baby boomers have a lot more debt than their parents did.

Baby boomers have a lot more debt than their parents did.

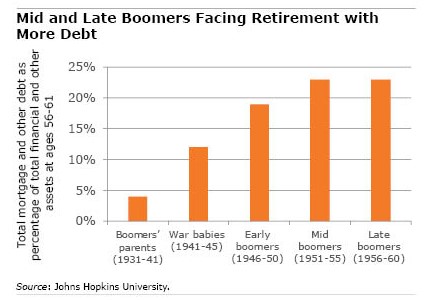

By all accounts, the parents were in pretty good shape for retirement because they held their debt levels down to a mere 4 percent of their total assets in the years immediately before retiring – ages 56 to 61 – according to a new study.

At those same ages, the typical baby boomers’ debt has ranged from 19 percent to 23 percent of their assets, thanks in large part to the 2008 drop in stock portfolios and in the housing market.

Generational trends in debt levels are difficult to analyze, and the issue is far from settled among researchers. This study notes, for example, that the situation might not be as grim as the rising debt indicates.

The broad numbers hide the positive step boomers have taken – just as earlier generations did – to reduce their debt as they moved through their 50s. And although the younger boomers have fewer assets than older boomers had at that stage of life, the younger boomers are also working to improve their finances by paying down their mortgages at an accelerated pace.

But the analysis also uncovered another troubling trend for the baby boomers born in the middle of the demographic wave: about 10 percent of them had more debt during their late 50s than their assets were worth. When their parents were that age, some of the most indebted of them still had more assets than debts.

In his study, Jason Fichtner of Johns Hopkins University compared debt-to-asset ratios for five different age groups, starting with the boomers’ parents, who were born during the Great Depression, and running through the people who were born toward the tail end of the baby boom. The chart above is a financial snapshot of rising debt-to-asset ratios for each group when they were between ages 56 and 61. …Learn More

February 20, 2020

Mapping Out a Fulfilling Retirement

One might say that baby boomers on the cusp of retiring come in two varieties. Some cannot wait to retire and already have a plan. For others, the unknowns fill them with dread.

How will I occupy my days? Should I do something meaningful, or is the goal just to have fun? And how do I figure this out? At 62, this writer really has no idea.

For the other boomers who are feeling this way, take some comfort in knowing you are in good company.

“I can’t say this strongly enough. There are some people who seem to literally not think about what their retirement might look like before they retire,” says Harvard Business School professor Teresa Amabile, whose research team interviewed 83 professionals in their pre- or post-retirement years (or both) to study how they navigate the transition years.

A big part of retiring is letting go of what can be a strong identification with work, and people are reluctant to give that up, she said. This identity might be attached to one’s profession – doctor, professor, carpenter – or to an employer, a specific experiment, or the team on your current project. For others, identity is tied to being the family breadwinner. For many people entering retirement, the basis of that identity is “profoundly shaken,” Amabile said.

Of course, not everyone confronts an identity crisis. Older people who are eager to start a new chapter of their life or are simply burned out by work may find that it’s liberating to shed that old identity and move on.

But, according to Amabile, a more arduous process is common. Many older workers begin to realize, “My identity as a person and my work are really bound up together, so I need to work through that.” A crucial part of planning for retirement is determining “what life is going to be like without work, because work structures your life,” she said.

Amabile described the problems one couple in the study encountered because they didn’t have a solid plan. After retiring, they moved out of the community they’d lived in for 25 years and relocated near some family members. But two years later, they still hadn’t settled comfortably into their new life and “felt at loose ends all the time,” she said.

To prevent this from happening to you, consider that boomers typically must go through four tasks as they transition to a satisfying retirement; Amabile and her team members – Lotte Bailyn, Douglas Hall, Kathy Kram, Marcy Crary, and Jeff Steiner – saw these four tasks in many of their interviews with baby boomers.

The tasks – described below and in a follow-up blog – don’t have to happen in any particular order, though the most common sequence is: Decide to retire. Detach from work. Explore a new life structure. Consolidate a new life structure. …Learn More

February 6, 2020

Can’t Afford to Retire? Not All Your Fault

Three out of four members of Generation X wish they could turn back the clock and get another shot at planning for retirement. One in three baby boomers say don’t think they’ll ever be able to retire.

“Overwhelmingly, Americans are stressed about their current – and future – financial situation,” the National Association of Personal Financial Advisors said about these new survey results.

Regrets about not planning and saving enough are enmeshed in our thinking about retirement. But it is really all your fault that you’re not getting it done?

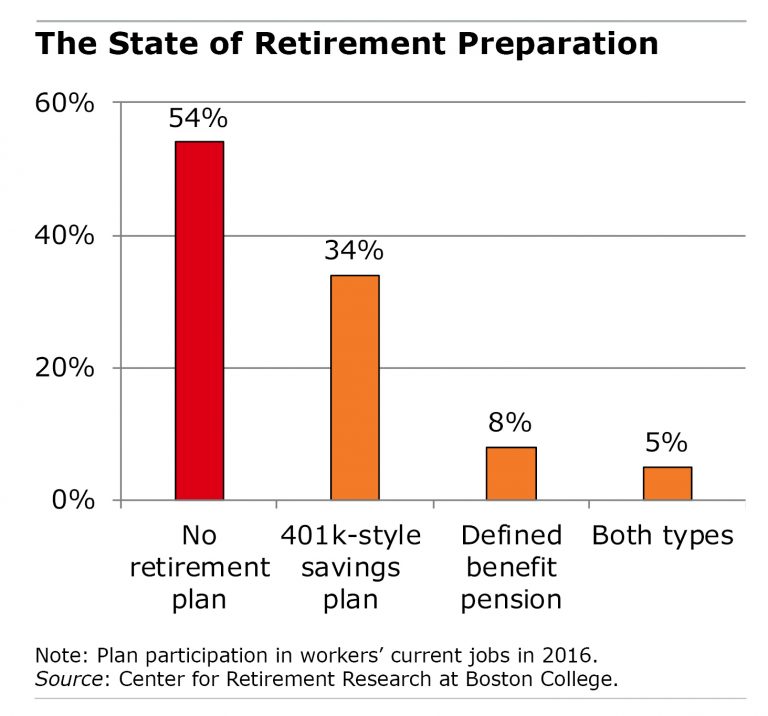

The honest answer to that question is “no.” There are big gaps in the U.S. retirement system that make it very difficult for many to carry the responsibility it places on workers’ shoulders.

I predict some of our readers will send a comment into this blog saying, “I worked hard and planned and am comfortable about my retirement. Why can’t you?”

Granted, we should all strive to do as much as possible to prepare for old age, and many people have made enormous sacrifices in preparation for retiring. The hard truth is that some people are much better-positioned than others. Obvious examples include a public employee with a pension waiting for him at the end of his career, or a well-paid biotechnology worker with an employer that contributes 10 percent of every paycheck to her retirement savings account. These workers frequently also have employer-sponsored health insurance, which limits their out-of-pocket spending on medical care. This leaves more money for retirement saving than someone who pays their entire premium and has a $5,000 deductible.

Sure, we could all do a better job of planning out our careers when we’re first starting out. But my husband, as a Boston public school teacher, started accruing pension credits before he could’ve imagined ever getting old. He recently retired, and his pension, accumulated during 27 years of teaching, is making our life a lot easier.

Sure, we could all do a better job of planning out our careers when we’re first starting out. But my husband, as a Boston public school teacher, started accruing pension credits before he could’ve imagined ever getting old. He recently retired, and his pension, accumulated during 27 years of teaching, is making our life a lot easier.

But pensions are on the wane in the private sector, and more than half of U.S. workers have neither a pension nor a 401(k) in their current job – this makes it pretty hard to save. IRAs are an option available to anyone, but human inertia makes that an imperfect solution to the problem, because people tend to procrastinate and don’t set them up. Further, working couples in which only one spouse has a 401(k) aren’t saving enough for both of them, one analysis found. …Learn More