Posts Tagged "baby boomers"

December 7, 2017

How Social Security Gets Fixed Matters

As more baby boomers retire, Social Security’s impending financial shortfall will become more pressing.

As more baby boomers retire, Social Security’s impending financial shortfall will become more pressing.

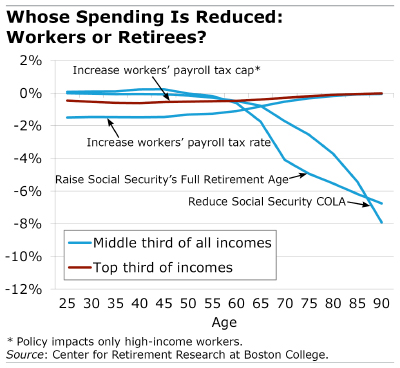

To restore solvency, Congress can either cut Social Security’s pension benefits or increase the payroll taxes deducted from workers’ pay.

Both policies would impact how much is available for households to spend. Researchers at the Center for Retirement Research find that the benefit reductions would have an appreciably larger annual impact on retirees than would the higher taxes on workers. But the taxes would be spread over a longer time period.

The new study looks at four specific policies, two that cut retirement benefits and two that raise taxes. Each policy analyzed would equally benefit Social Security’s finances.

Gauging their separate effects required using a model to predict workers’ behavior. This was necessary because some workers might feel they should retire earlier if more taxes are being taken out of their paychecks. On the other hand, if their future pension benefits will be trimmed, they might decide to work a few more years to increase the size of their monthly checks.

One option for reducing Social Security payouts would be to delay the full retirement age (FRA) at which retirees are eligible to collect their “full” benefits. A second option is trimming Social Security’s annual cost-of-living (COLA) increases.

A two-year increase in the FRA, to 69, would reduce annual consumption in retirement by 5.6 percent for low-income, 4 percent for middle-income, and 2.2 percent for high-income retirees. …Learn More

November 30, 2017

Boomers’ Mortgage Debt Predicament

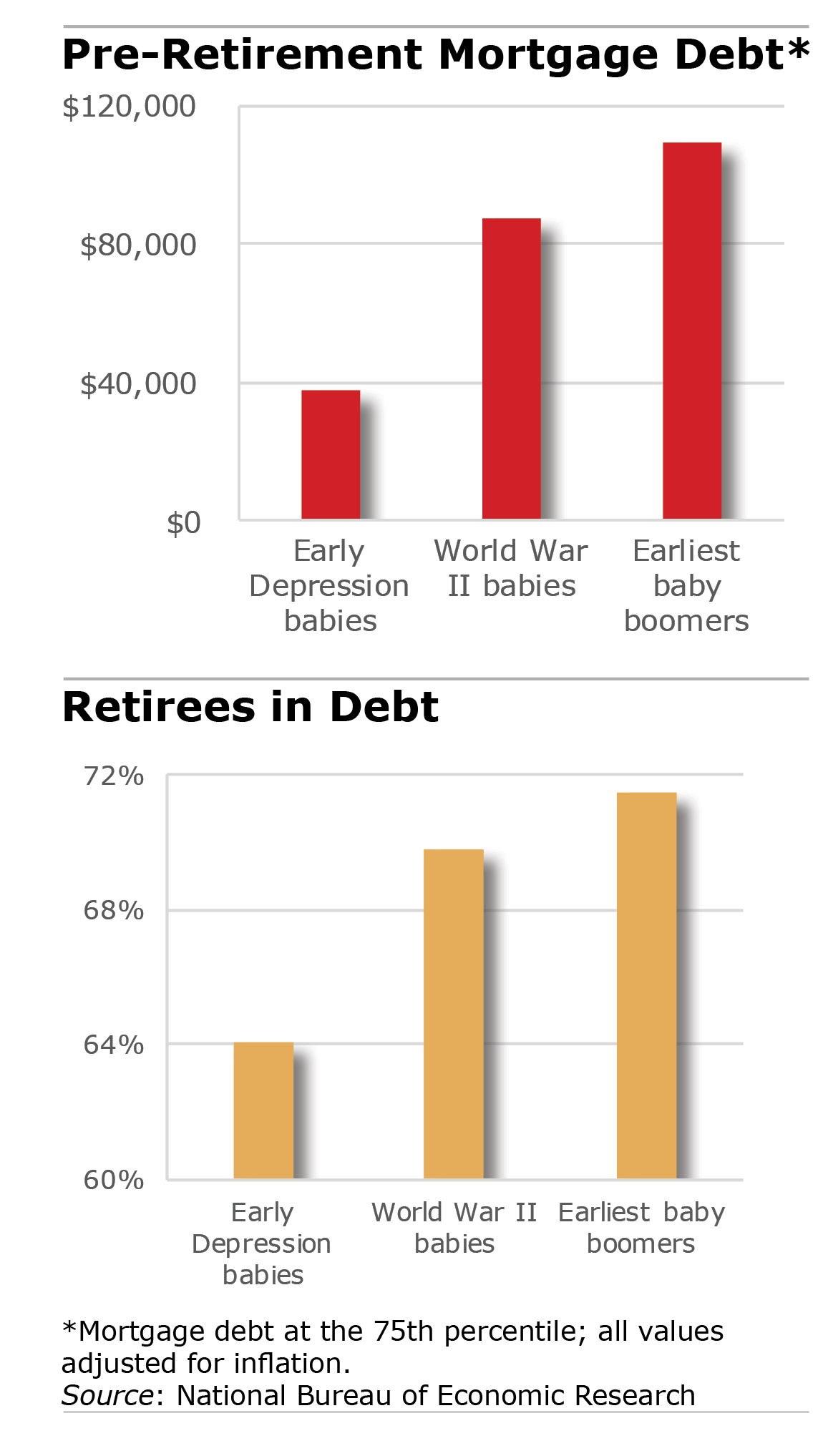

You’re not going to like this, baby boomers.

You have more debt than the two generations born during the early Depression and World War II, much of it compliments of the mortgage bubble that financed your larger, more expensive houses. The housing bubble popped in 2008, but the mortgage on the new house or perhaps a second mortgage continues to plague many.

It should be no big surprise that a new study finds the “substantial” debts taken on specifically by those born in the late 1940s and early 1950s will gobble up more of their not-always plentiful retirement income.

“The evidence clearly shows that many Americans” on the cusp of retiring “continue to be burdened by debt and to be financially vulnerable,” the researchers said.

The lead researcher, Annamaria Lusardi at the George Washington University School of Business, is a national expert in financial literacy. As part of her study, she also wanted to understand how these early boomers manage their debts. It turns out that people overburdened with debt more often have lower levels of financial literacy. However, debt is also an issue among older workers in poorer health or those who’ve seen their incomes decline, which is fairly common over 50. …Learn More

November 28, 2017

Tax Cuts, Medicare, and the Kids

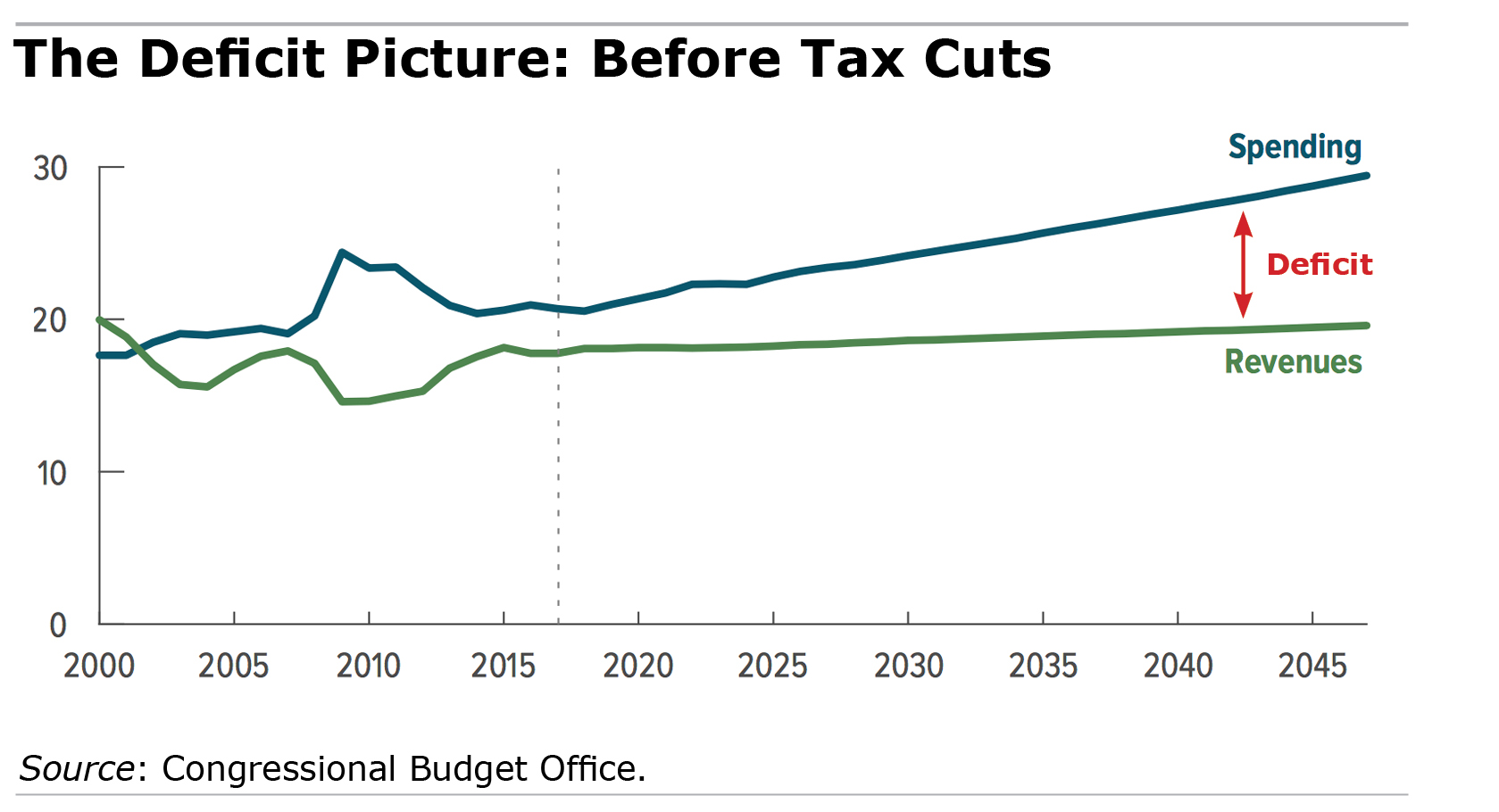

Federal Medicare spending will increase sharply as baby boomers, with their longer life spans than previous generations, sign up in droves. The Social Security Trust Fund also reports that its reserves will be depleted in 2034, requiring either benefit cuts or new revenues to replenish a program that keeps millions of older Americans either out of poverty or just above water.

Federal Medicare spending will increase sharply as baby boomers, with their longer life spans than previous generations, sign up in droves. The Social Security Trust Fund also reports that its reserves will be depleted in 2034, requiring either benefit cuts or new revenues to replenish a program that keeps millions of older Americans either out of poverty or just above water.

These two programs currently account for about 40 percent of the federal government’s $3.7 trillion budget. Most people agree that we need to deal with the financial shortfalls in Medicare and Social Security. And there is precedent. Remember the bipartisan 1983 reform that put Social Security on firmer footing by increasing the program’s revenues and gradually raising its Full Retirement Age?

But there is growing concern among retirement experts and advocates for the elderly that the proposed $1.5 trillion in tax cuts will make future reductions to these critical retiree programs all the more likely in order to rein in growing federal budget deficits.

If cuts to Medicare and other social programs follow a tax cut, it would fly in the face of what regular folks said are their top priorities in a new Kaiser Family Foundation poll: Only a small minority of Americans support tax cuts if they involve cuts to Medicare, Social Security, and Medicaid. …Learn More

October 31, 2017

Older Savers Inch Ahead: $135,000 in 401k

The typical baby boomer couple had $135,000 in retirement savings last year, up from $111,000 in 2013 amid a rising stock market and a strong job market that has kept them employed, according to a report on the new Survey of Consumer Finances (SCF) by the Federal Reserve.

Yet $135,000 – the balance for working couples who have a 401(k) – won’t go very far. This amount, held in both their 401(k)s and IRAs, will generate about $600 per month, said the SCF analysis by the Center for Retirement Research, which supports this blog. That’s obviously not enough to supplement most retirees’ primary source of income: their Social Security benefits, which are slowly eroding for various reasons. The purchasing power of the $600 will also be eroded by inflation over time.

Another way to assess retirement preparedness for 60-year-olds couples hoping to retire in five years is that they need assets equal to 8.5 times their household income at age 60. They actually have around 2.5 times income, on average, the researchers found. This assumes a replacement rate of 75 percent, a reasonable target for how much of a working couple’s income they will need to maintain their standard of living into retirement.

It’s Halloween today, and here is more evidence of just how scary Americans’ retirement prospects are: the $135,000 applies only to older people with retirement savings – about half don’t have a retirement plan at all at work. …

Learn More

October 12, 2017

Before Retiring, Do this Homework

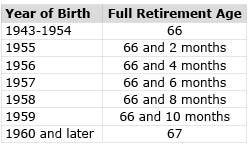

If you don’t know this chart on the Social Security website, you should:

The chart shows the so-called Full Retirement Age (FRA), which is the age at which you’re entitled to your full monthly Social Security benefit, a pension based on your earnings history.

Many boomers see their FRA as the time they ought to retire. But the question they should be asking themselves is: will the monthly benefit I’ll get at my FRA be enough?

At a time when many Americans are in danger of not having enough money for retirement, the answer is frequently no. …Learn More

October 3, 2017

Older Americans Handling Work Demands

Older workers face fewer headwinds and better working conditions than their younger co-workers, according to the first analysis of a new survey of 3,900 blue- and white-collar workers between ages 25 and 71.

The U.S. workplace overall is “very physically and emotionally taxing,” according to the study – that’s why they call it “work.” Two out of three workers of all ages reported in the 2015 survey that they are often required to move at high speeds under tight deadlines, feeling intense pressure to accomplish too much in too little time.

But after people pass the age of 50, things get a little easier. Older workers report having more flexible work schedules, more predictable hours, fewer scheduling changes, less stress, and greater ease in arranging time off to take care of personal matters, the analysis found.

Their workplace situation isn’t all rosy. Larger shares of older workers feel under-employed or have unsupportive bosses – this held true whether they had college degrees or not.

The analysis of the new American Working Conditions Survey (AWCS), by researchers led by Nicole Maestas at Harvard Medical School and recently published in an e-book, is an introduction to what will inevitably be more research using this new, publicly available data. The AWCS might, for example, provide new fodder for studying the factors that influence older Americans to continue working or to retire.

The new study found some striking differences between older and younger workers – and among different groups of older workers: …Learn More

September 7, 2017

Why Many Retirees Choose Medigap

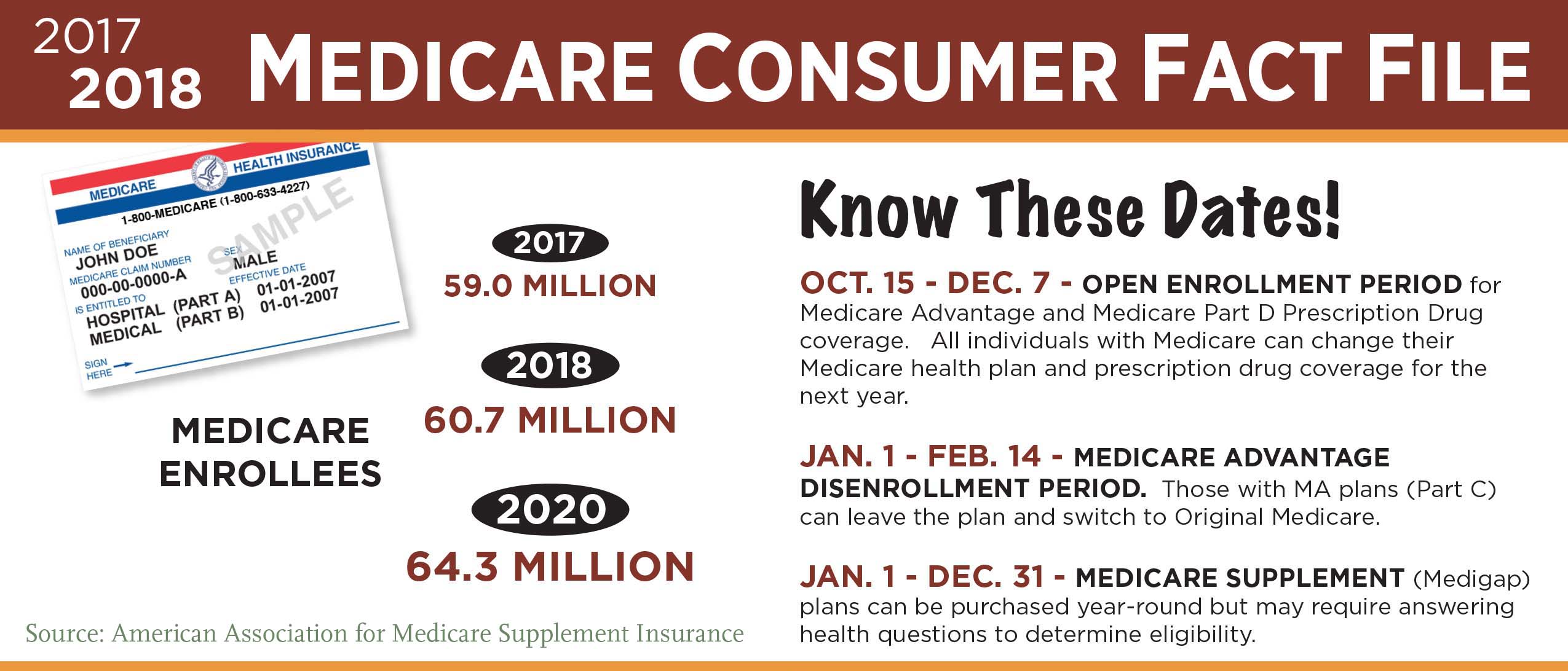

The Medicare open enrollment period starting Oct. 15 applies only to two specific insurance plans: Part D prescription drug coverage and Medicare Advantage plans.

But before choosing among various plans sold in the insurance market, the first – and bigger – decision facing people just turning 65 is whether to hitch their wagons to Medicare-plus-Medigap or Medicare Advantage. Squared Away spoke with insurance broker Garrett Ball, owner of Secure Medicare Solutions in North Carolina, who sells both. Most of his clients buy Medigap, and he explains why.

In a second blog post, we’ll interview a broker who deals mainly in Advantage plans. Another source of information about Medigap and Advantage plans are the State Health Insurance Assistance Programs.

Q: Let’s start with explaining to readers what your company does.

We’re an independent Medicare insurance broker that works with some 2,000 clients on Medicare annually who are shopping for supplemental plans. My company began in 2007, then in 2015 I launched a website tailored to people just turning 65 to answer the questions I get every day. We’re not contractually obligated to just one insurance company. When we work with someone, we survey the marketplace where they live, assess their needs, and help them pick a plan. We get paid by the insurance companies when someone signs up for a plan. Different states have different commission levels, and there is more variation state-by-state than company-by-company. Insurers typically pay fees of $200-300 per person per year.

Q: What share of your clients buy Medigap policies, rather than Medicare Advantage plans?

Approximately 10 percent of my clients end up with Medicare Advantage vs 90 percent with Medigap. Some states have a higher percentage in Medicare Advantage. I do business in 42 states, so this depends on the insurance markets in individual states.

Q: Why do you sell more Medigap plans? …Learn More