Posts Tagged "baby boomers"

January 28, 2020

Education Could Shield Workers from AI

Not so long ago, computers were incapable of driving a car or translating a traveler’s question from English to Hindi.

Artificial intelligence changed all that.

Computers have advanced beyond the routine work they do so efficiently on assembly lines and in financial company back offices. Today, major advances in artificial intelligence, namely machine learning, have opened up a new pathway to expanding the tasks computers can do – and, potentially, the number of workers who may lose their jobs to progress over the next 20 years.

Machine learning works this way. A computer used to identify a cat by following explicit instructions telling it a cat has pointy ears, fur, and whiskers. Now, a computer can rapidly analyze and synthesize vast amounts of data to recognize a cat, based on millions of images labeled “cat” and “not-cat.” Eventually, the machine “learns” to see a cat.

But is this technological leap fundamentally different than past advances in terms of what it will mean for workers? And what about older workers, who arguably are more vulnerable to progress, because they have less time to see the payoff from updating their outmoded skills?

The answer, according to a third and final report in a series on technology’s impact on the labor market, is that advances in machine learning are likely to affect all workers – regardless of age – in the same way that computers have over the past 40 years.

And the dividing line, according to the Center for Retirement Research, will not be age. The dividing line will continue to be education: job options are expected to narrow for workers lacking a college degree or other specialized training, while jobs requiring these credentials will expand. …Learn More

January 21, 2020

Denied Disability, Yet Unemployed

Most people have already left their jobs before applying for federal disability benefits. The problem for older people is that when they are denied benefits, only a small minority of them ever return to work.

Applicants to Social Security’s disability program who quit working do so for a combination of reasons. They are already finding it difficult to do their jobs, and leaving bolsters their case. However, when older people are denied benefits after the lengthy application process, it’s very challenging to return to the labor force, where ageism and outdated skills further complicate a disabled person’s job search.

A new study looked at 805 applicants – average age 59 – who cleared step 1 of Social Security’s 5-step evaluation process: they had worked long enough to be eligible for benefits under the disability program’s rules. The researchers at Mathematica were particularly interested in the applicants rejected either in steps 4 and 5.

Of the initial 805 applicants, 125 did not make it past step 2, because they failed to meet the basic requirement of having a severe impairment. In step 3, 133 applicants were granted benefits relatively quickly because they have very severe medical conditions, such as advanced cancer or congestive heart failure.

The rest moved on to steps 4 and 5. Their applications required the examiners to make a judgment as to whether the person is still capable of working in two specific situations. In step 4, Social Security denies benefits if an examiner determines someone is able to perform the same kind of work he’s done in the past. In step 5, benefits are denied if someone can do a different job that is still appropriate to his age, education, and work experience.

In total, just under half of the 805 applicants in the study did not receive disability benefits. …Learn More

December 31, 2019

Boomers Want to Make Retirement Work

The articles that our readers gravitated to over the course of this year provide a window into baby boomers’ biggest concerns about retirement.

Judging by the most popular blogs of 2019, they were very interested in the critical decision of when to claim Social Security and whether the money they have saved will be enough to last into old age.

Nearly half of U.S. workers in their 50s could potentially fall short of the income they’ll need to live comfortably in retirement. So people are also reading articles about whether to extend their careers and about other ways they might fill the financial gap.

Here is a list of 10 of our most popular blogs in 2019. Please take a look!

Half of Retirees Afraid to Use Savings

How Long Will Retirement Savings Last?

The Art of Persuasion and Social Security

Social Security: the ‘Break-even’ Debate

Books: Where the Elderly Find Happiness

Second Careers Late in Life Extend Work …Learn More

December 24, 2019

Happy Holidays!

Next Tuesday – New Year’s Eve – we’ll return with a list of some of our readers’ favorite blogs of 2019. Our regular featured articles will resume Thursday, Jan. 2.

Thank you for reading and posting comments on our retirement and personal finance blog. We hope you’ll continue to be involved in the new year. …

Learn More

November 5, 2019

401k Balances are Far Below Potential

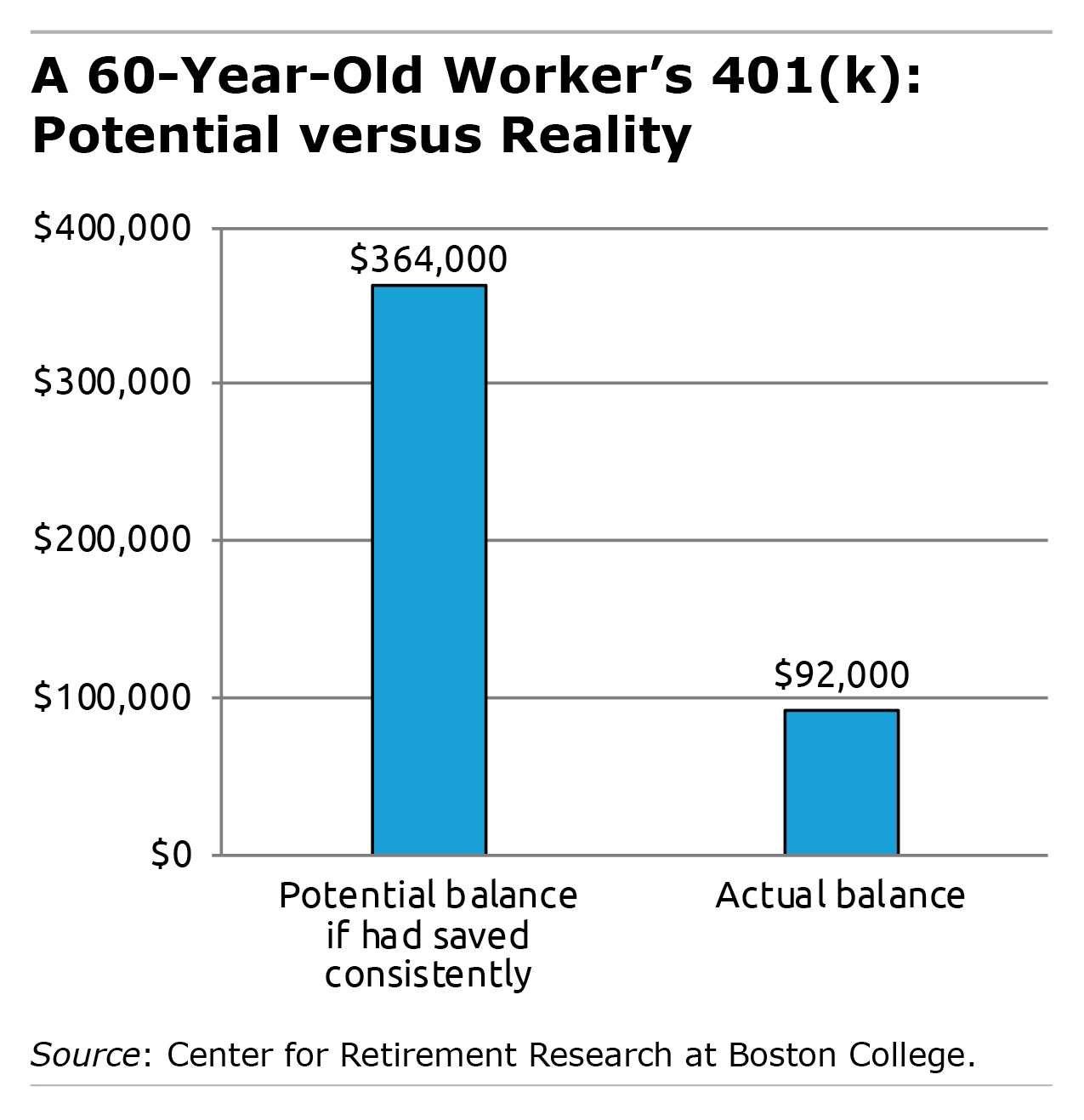

If a 60-year-old baby boomer started saving consistently at the beginning of his career back in the 1980s, he would have some $364,000 in his 401(k)s and IRAs today.

How much does he actually have? One-fourth of that, according to a new study from the Center for Retirement Research at Boston College (CRR).

One obvious explanation for the enormous gap is that the 401(k) system was in its infancy in the 1980s, and it took time for employers to widely adopt the plans and for young adults to get into the habit of saving for retirement.

Another likely reason is the large share of workers who do not have any type of employer-sponsored retirement plan. This coverage gap, which predates the introduction of 401(k)s, persists today and leaves about half of private-sector workers without a plan at any given point in time.

And this gap isn’t just a problem for baby boomers. A majority of young workers are not saving in a retirement plan, despite their advantage of having entered the labor force after the 401(k) system was more mature. …Learn More

October 3, 2019

The Secret to Feeling Younger

You’re as young as you feel!

This cliché is meant to be uplifting to older people. But it really just begs the question: what, exactly, is it that makes a person feel young?

Having a sense of control over the events in one’s life is the answer that emerged from a 2019 study of 60- to 90-year-olds in the Journal of Gerontology. “[B]elieving that your daily efforts can result in desired outcomes” lines up nicely with what the researchers call “a younger subjective age.”

This makes a lot of sense. Feeling in control becomes important as we age, because it counteracts our growing vulnerabilities – we can’t move as fast, hear as well, or remember as much. Wresting back some control can rejuvenate older people, instill optimism, and improve memory and even longevity, various studies have found. …Learn More

September 3, 2019

Second Careers Late in Life Extend Work

Moving into a new job late in life involves some big tradeoffs.

What do older people look for when considering a change? Work that they enjoy, fewer hours, more flexibility, and less stress. What could they be giving up? Pensions, employer health insurance, some pay, and even prestige.

Faced with such consequential tradeoffs, many older people who move into second careers are making “strategic decisions to trade earnings for flexibility,” concluded a review of past studies examining the prevalence and nature of late-life career changes.

The authors, who conducted the study for the University of Michigan’s Retirement and Disability Research Center, define a second career as a substantial change in an older worker’s full-time occupation or industry. They also stress that second careers involve retraining and a substantial time commitment – a minimum of five years.

The advantage of second careers is that they provide a way for people in their late 40s, 50s, or early 60s who might be facing burnout or who have physically taxing jobs to extend their careers by finding more satisfying or enjoyable work.

Here’s what the authors learned from the patchwork of research examining late-life job changes:

People who are highly motivated are more likely to voluntarily leave one job to pursue more education or a position in a completely different field, one study found. But older workers who are under pressure to leave an employer tend to make less dramatic changes.

One seminal study, by the Urban Institute, that followed people over time estimated that 27 percent of full-time workers in their early 50s at some point moved into a new occupation – say from a lawyer to a university lecturer. However, the research review concluded that second careers are more common than that, because the Urban Institute did not consider another way people transition to a new career: making a big change within an occupation – say from a critical care to neonatal nurse. “Unretiring” is also an avenue for moving into a second career.

What is clear from the existing studies is that older workers’ job changes may involve financial sacrifices, mainly in the form of lower pay or a significant loss of employer health insurance. But they generally get something in return: more flexibility. …Learn More