Posts Tagged "college"

September 13, 2018

College Debt Can Limit 401(k) Saving

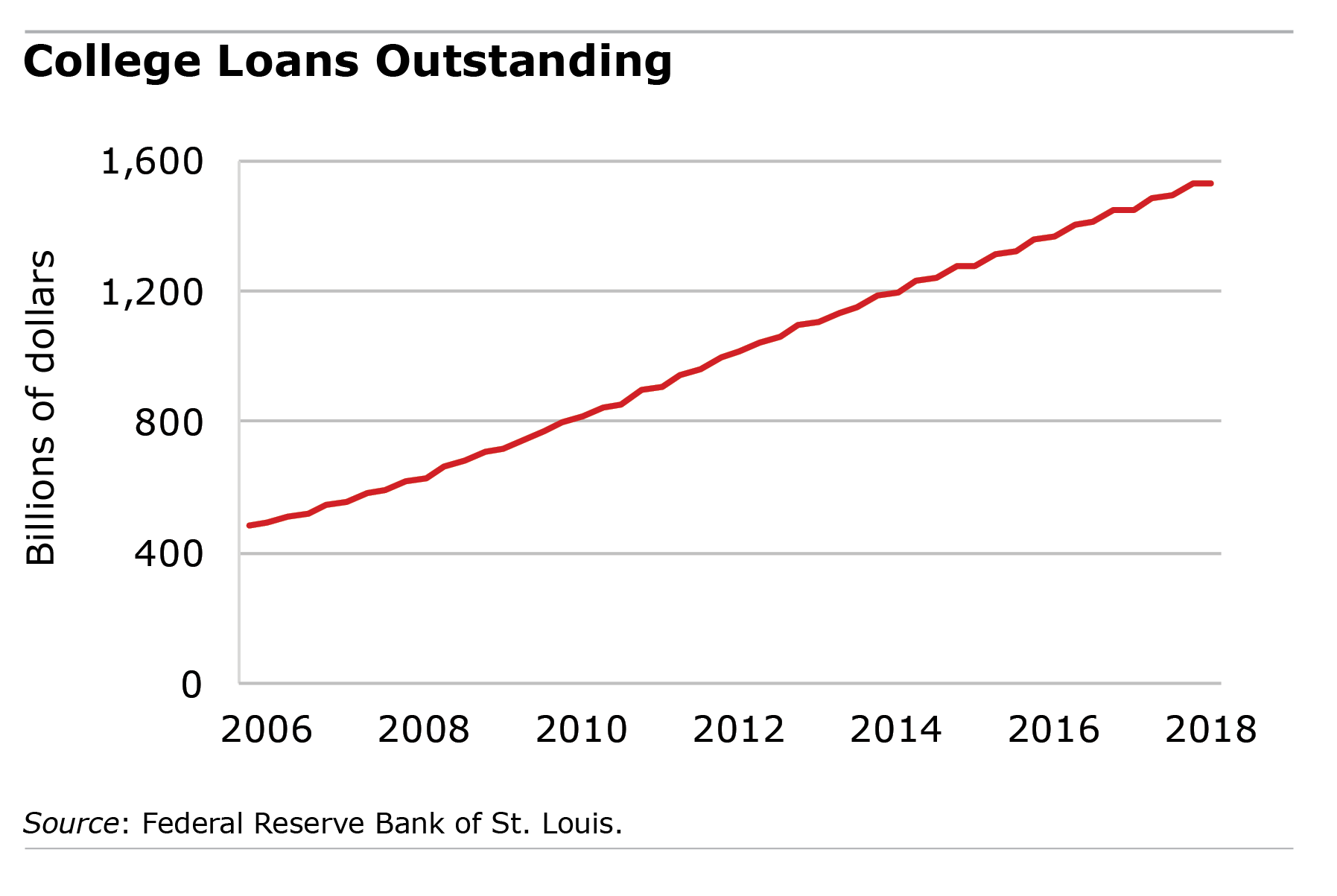

The share of students borrowing money to pay for college increases year after year, and they’re borrowing more every year. Total student debt, adjusted for inflation, has tripled in just over a decade.

The share of students borrowing money to pay for college increases year after year, and they’re borrowing more every year. Total student debt, adjusted for inflation, has tripled in just over a decade.

The loan payments, which can be a few hundred dollars a month, take a big bite out of young adults’ still-low levels of disposable income. The debt makes them more prone to bankruptcy and lower homeownership rates.

A key question is whether this pressing financial obligation might affect their preparation for a retirement that is several decades away. Here’s what researchers Matt Rutledge, Geoff Sanzenbacher, and Francis Vitagliano of the Center for Retirement Research learned about student debt:

- By age 30, the college graduates who are loan-free have saved two times more in their retirement plans than the graduates who are paying off debt. (Perhaps surprisingly, the presence of student loans do not seem to affect the amount saved by students who didn’t graduate, though they do have substantially less in their 401(k)s than the graduates.)

- The amount owed by college graduates with loans does not matter. The mere existence of the debt is enough to constrain saving. …

September 11, 2018

Personality Influences Path to Retirement

Only about a third of the older people who are working full-time will go straight into retirement. Most take zigzag paths.

These paths include gradually reducing their hours, occasional consulting, or finding a new job or an Uber stint that is only part-time. Other people “unretire,” meaning that they retire temporarily from a full-time job only to decide to return to work for a while.

A new study finds that the paths older workers choose are influenced by their personality and by how well they’re able to hold the line against the natural cognitive decline that accompanies aging.

Researchers at RAND in the United States and a think tank in The Netherlands uncovered interesting connections between retirement and cognitive acuity and, separately, and a variety of personality traits. To do this, they followed older Americans’ work and retirement decisions over 14 years through a survey, which also administered a personality and a cognition test.

Here’s what they found:

- Cognitive ability. The people in the study who had higher levels of what’s known as fluid cognitive function – the ability to recall things, learn fast, and think on one’s feet – are much more likely to follow the paths of either working full-time or part-time past age 70.

The probable reason is simply that more job options are available to people with higher cognitive ability – whether fluidity or sheer intelligence – so they have an easier time remaining in the labor force even though they’re getting older. …

August 7, 2018

Game Show Pays Off Student Loans

The student loan problem has gotten under our collective skin – so much so that a new game show revolves around it.

“Paid Off,” on TruTV, promises to pay off a share of the winning contestant’s student debt – 20 percent, 50 percent, or 100 percent – depending on how many answers he or she gets right in the final round of questioning.

“Paid Off” is as inane as any television game show. The format is more “Family Feud” than “Jeopardy,” with softball questions designed to spark as much faux competition as possible among the former students who compete. One example: name the most romantic date costing under $10: picnic, walk, Netflix movie, etc.

The show’s host, Michael Torpey, who also plays a corrections officer in “Orange is the New Black,” explains in the first episode of “Paid Off” that he created it because he and his wife struggled with student loans. He was only able to pay them off because he landed a long-shot acting job for a television commercial.

Torpey says his goal is to help debt-laden students “achieve their dreams by paying off their student loans.” He’s right that college debt is, indeed, standing between many Millennials and the adult milestones of buying a house, saving some money, or getting married.

The average amount of debt owed by college graduates increased again last year, to more than $39,000, according to Student Loan Hero.

Unfortunately, the weekly show won’t make a dent in this growing problem. …

Learn More

July 26, 2018

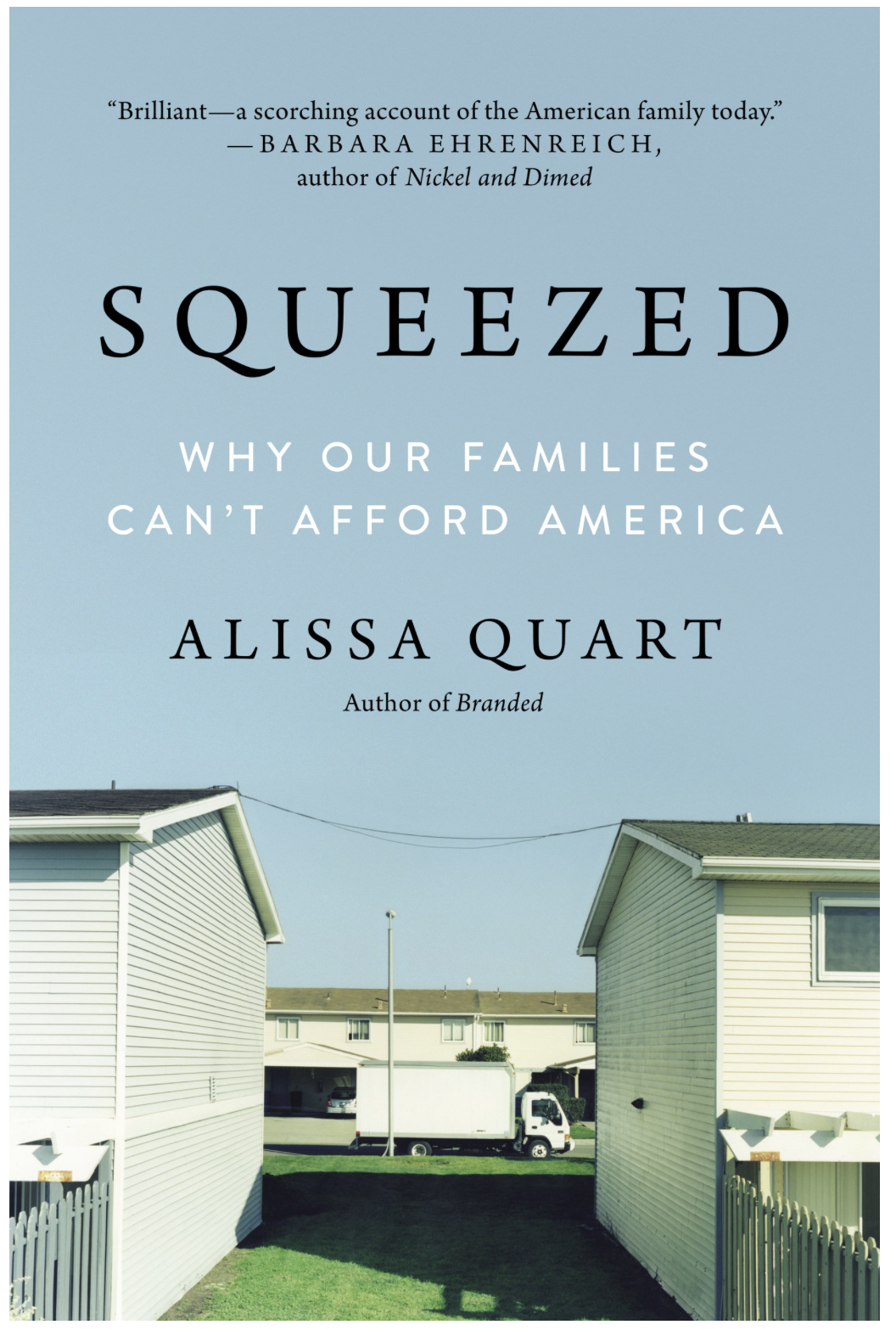

Book Review: the Middle-class Squeeze

Marketplace recently estimated that a family’s common expenses have increased 30 percent since the 1990s. This was based on the inflation-adjusted prices for 11 necessities and small luxuries, from food, housing, college, and medical care to movie tickets and air fare.

Marketplace recently estimated that a family’s common expenses have increased 30 percent since the 1990s. This was based on the inflation-adjusted prices for 11 necessities and small luxuries, from food, housing, college, and medical care to movie tickets and air fare.

On the income side of the household ledger, one well-known study estimates that the lifetime, inflation-adjusted income of a typical 60-year-old man today is substantially less than it was for a man who turned 60 back in 2002. Women, who have benefitted from getting more education, are earning more, but they started out at much lower pay levels and still trail men.

These trends – rising expenses and shrinking paychecks – get to the essence of the middle-class struggle described in Alissa Quart’s new book, “Squeezed: Why Our Families Can’t Afford America.”

Putting faces to the numbers, she had no trouble finding workers who feel they are losing their tentative grip on the middle class. Her focus is the 51 percent of U.S. households earning between $40,000 and $125,000.

That’s not to say that Americans’ quality of life hasn’t improved in some ways. Consider the dramatic increase in the square footage of U.S. houses over the past 30 years or the enormous strides in medical technology. In today’s strengthening economy, the Federal Reserve Board reports that a majority of adults say they are doing okay or even living comfortably, and they are feeling more optimistic. Yet this doesn’t entirely square with another of the Fed’s findings: a large majority of adults would not be able to cover an unexpected $400 expense without selling something or borrowing money. …Learn More

June 12, 2018

Luck – or a Deliberate Path to Wealth

It’s usually not talent or street smarts or brains that make people wealthy and comfortable. It’s the luck of having rich parents.

It’s usually not talent or street smarts or brains that make people wealthy and comfortable. It’s the luck of having rich parents.

But there is another way to get there, one that is within reach: becoming the first generation in the family to earn a college degree.

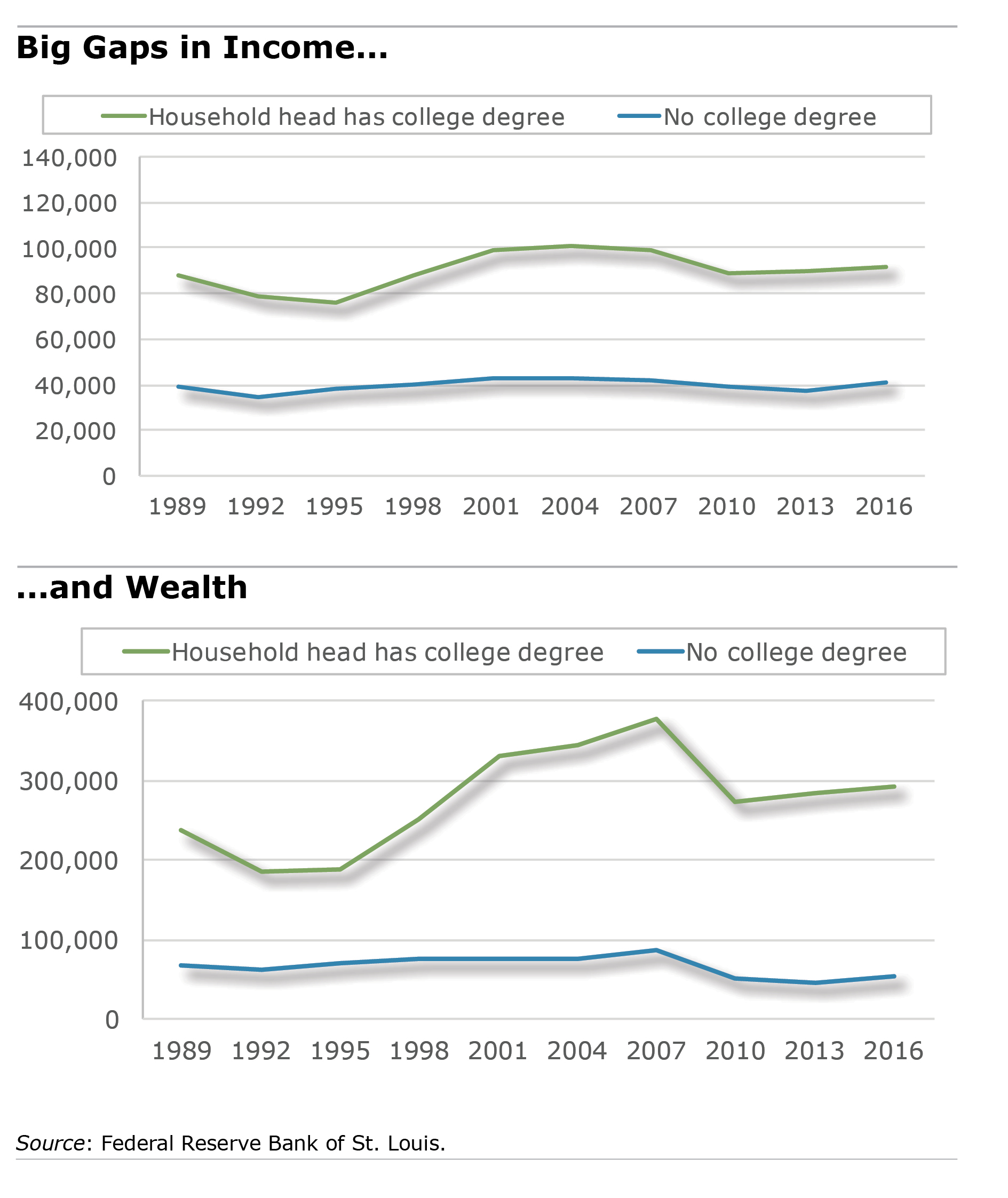

A new study by the Federal Reserve Bank of St. Louis, using the latest federal data on household finances, measures the impact of having that degree – or not having one – on wealth and income.

Although the ranks of college-educated Americans have grown over the past quarter century, people lacking a degree still make up a substantial majority – two out of three Americans. …Learn More

June 7, 2018

Be Optimistic. You Might Live Longer!

People who have a college education are known to live longer. But could a sunny disposition also help?

Yes, say two researchers, who found that the most optimistic people – levels 4 and 5 on a 5-point optimism scale – live longer than the pessimists.

But this effect works both ways. The biggest declines in optimism have occurred among older generations of Americans who didn’t complete high school at a time when this was far more common. It’s no coincidence, their study concluded, that the white Americans in this less-educated group in particular are also “driving premature mortality trends today.”

The finding adds new perspective to a 2015 study that rocked the economics profession. Two Princeton professors found that, despite improving life expectancy for the nation as a whole, death rates increased for a roughly similar group: white, middle-aged Americans – ages 45-54 – with no more than a high school degree. They suggest that addiction and suicide play some role, both of which have something to do with the deterioration in the manufacturing industry that once provided a good living, especially for white men.

To make the link between mortality and optimism, Kelsey O’Connor at STATEC Research in Luxembourg and Carol Graham at the Brookings Institution examined whether heads of households surveyed back in 1968 through 1975 were still alive four to five decades later. They controlled for demographic characteristics and socioeconomic factors, such as education, which also affect longevity. …Learn More

June 5, 2018

First-Generation ‘Imposter Syndrome’

Education is the fastest ticket to a higher income, more opportunities, and a better quality of life. But four-year college is often a tough road for the pioneering first in their families to attend.

They have at least two big disadvantages – apart from the well-known financial one. Unlike the teenagers of the highly educated professionals who usually take for granted that their children will go to college, first-generation students might not have the benefit of high expectations at home. College is outside their comfort zone, which creates psychological barriers to attending and succeeding.

A second disadvantage is that they aren’t always going to learn, through a sort of parental osmosis, to cope with higher education’s mores and attitudes or be as resilient to its challenges.

UCLA student Violet Salazar says in this video that she used to feel she didn’t fully belong, “because I am first generation or because I am Latina, and also coming from a low socioeconomic background.” She went on to organize an entire dormitory floor specifically for first-generation students to make them feel more at home. …Learn More