Posts Tagged "debt"

May 27, 2014

Attending College if Your Parents Didn’t

Education has historically been the most powerful way for children of the U.S. working class to brighten their futures. But as the cost of college rises, they must climb taller and taller mountains to attend.

The ideal for college – an ideal still pursued by students whose parents can afford it – is to attend full-time and focus on one thing: their studies. But five untraditional students who were profiled in a new documentary say they must juggle their multiple pressing priorities:

- Work, sometimes full-time, to support themselves or help support parents or siblings.

- Maintain a high grade point average after poor high school preparation.

- Inadequate financial aid packages and parents who are unable to help.

- Parents who may not understand the college financial aid process.

- Complexities of transferring credits from a community college to a four-year institution.

Like many untraditional students, Sharon Flores is the first generation in her family to attend college. This top high school student and daughter of a single mother explains her struggle to attend King’s College in Pennsylvania in the documentary, “Redefining Access for the 21st Century Student,” which was produced by the Institute for Higher Education Policy in Washington. …Learn More

May 22, 2014

1 in 3 Late in Paying Student Debt

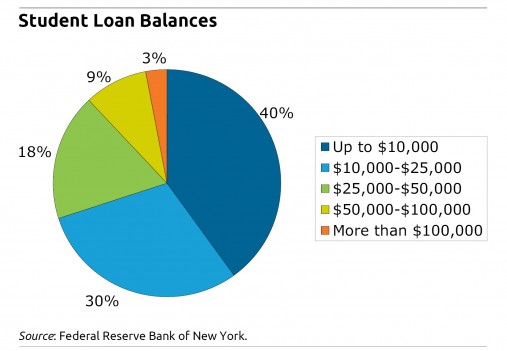

About one in three Americans trying to pay down their student loans is 90 days or more late on their payments, according to a new report by the Federal Reserve Bank of New York.

This is up sharply from a decade ago, when one in five people in repayment was that far behind.

The Federal Reserve estimates that 31% was the “effective” delinquency rate in 2012; it applies only to people who have actively been in repayment. The bank said this rate is a more accurate measure of the problem than the widely reported rate for 90-day delinquencies – 17 percent – which includes all borrowers, including current students and those who’ve been granted some type of loan payment deferral.

The report, “Measuring Student Debt and Its Performance,” provides more evidence that college debt is a major financial burden for a growing numbers of Americans. Between 2004 and 2012,  the number of people borrowing for college has nearly doubled to about 39 million, and the total debt outstanding has nearly tripled to $1 trillion and now exceeds the nation’s credit card debt.

the number of people borrowing for college has nearly doubled to about 39 million, and the total debt outstanding has nearly tripled to $1 trillion and now exceeds the nation’s credit card debt.

Delinquencies, by any measure, are higher for student debt than for any other type of U.S. consumer debt, including credit cards. The pace of delinquencies is also accelerating, according to the Federal Reserve.

Other trends highlighted in its report include: …Learn More

March 27, 2014

Post Recession: Strugglers vs Thrivers

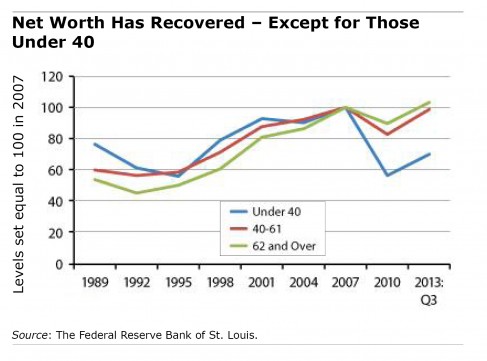

The Federal Reserve Bank of St. Louis, based on its analysis of data from the Survey of Consumer Finances, estimates that the recession has ended for only about one-quarter of the U.S. population – the thrivers, who have paid down their debts and restored their savings. That would leave three out of four Americans who are still struggling. Squared Away interviewed Ray Boshara, director of the Center for Household Financial Stability at the bank; Bill Emmons, senior economic adviser; and Bryan Noeth, policy analyst, for their insights into why most Americans’ net worth – their assets minus debts – hasn’t recovered.

Q: You distinguish “thrivers” from “strugglers.” Who are these two groups?

Boshara: The thrivers versus strugglers construct is a simple way to make the point that some demographically defined groups are doing better, on average, than others in terms of net worth – what you save, own, and owe, or your entire balance sheet. We found that age, race, ethnicity and education levels are pretty strong predictors of who lost wealth and who’s recovered wealth over the past few years, as well as over a longer period of time.

Q: Describe the typical thrivers.

Emmons: Whites and Asians with a college degree who are over 40 – that’s the typical thriver. Remember, this is a construct, and it’s not 100 percent foolproof. But you would tend to say these groups are more likely to have outcomes consistent with recovering.

Q: How about the typical strugglers?

Emmons: By age – they’re younger – and they’re African-American or Latino. They also do not have a college degree, and they have too much debt. They’re the other three-fourths of the population. They are not holding enough liquid assets, so they’re just one paycheck away from a crisis. They do not have a diversified portfolio and aren’t benefitting from the stock market gains. They’ve got too much in the house, which has declined in value.

Q: What have you learned about young adults and their wealth – or lack of it?

Q: What have you learned about young adults and their wealth – or lack of it?

Emmons: It jumps off the page in our analysis: It doesn’t matter if you’re white or college educated. If you’re young, you’re vulnerable, and you’ve made the same portfolio mistakes as people with less education: low levels of liquid assets, too much in the house, an issue that is related to portfolio diversification, and more leverage. …Learn More

March 25, 2014

Do Incentives Create Lax Loan Standards?

The answer to the above question is definitely “yes,” according to new research by professors Sumit Agarwal at the National University of Singapore and Itzhak Ben-David at Ohio State.

They examined 30,000 small business loans made in 2004 and 2005 to compare the loans made by salaried bank officers with those made by officers working under a commission system. The commissioned lenders were paid 80 percent of their former salary, plus commissions based on the number of loans they originated, their dollar amount, and how quickly they were approved.

Not surprisingly, the researchers found that commissioned officers, responding to these incentives, originated 31 percent more loans and the dollar amounts per loan were nearly 15 percent greater – they were also often larger than what their clients had requested. …Learn More

March 11, 2014

Students Take Charge of College Loans

Tatiana Andrade (standing), an ambassador for American Student Assistance, hosts a Jeopardy match to educate classmates about their student debt.

College students usually plan on repaying their loans after graduation, when they’ve landed a full-time job. Freshman Tatiana Andrade is making payments while she’s still in school.

Andrade is already $14,500 in debt. She’s on track to owe some $60,000 when she completes her four-year degree at Stonehill College outside Boston, even though her parents are sharing the cost. To chip away at her debt, she pays off between $100 and $150 per month from her earnings in a part-time job.

Andrade is among a slim but growing minority of students and recent graduates becoming proactive to get control of their student debt – before it controls them. She advises classmates to do the same as Stonehill College’s ambassador for the non-profit American Student Assistance (ASA), which has a program and website – SALT – aimed at educating and counseling students on strategies to minimize how much they borrow and to manage their loan payments.

Making loan payments today minimizes the total amount she’ll pay in the future for three reasons. Loans paid immediately carry a lower interest rate than loans that permit her to defer payment until after graduation. She’s cutting down the total amount she’ll have to pay back after graduation. She said she also avoided a loan-origination fee required on deferred loans equal to 4 percent of the loan.

“Every dollar counts,” she said. Waiting until graduation “is the worst thing you can do.” …Learn More

February 11, 2014

Financial Survey: Americans Unsatisfied

The Great Recession is receding into the past, but many people may still be feeling the strain in their personal finances.

Post-recession, “the fact remains that Americans are fairly unsatisfied about where they are financially,” Gerri Walsh, president of the FINRA Investor Education Foundation, said in a recent video in which she discussed her organization’s 2012 National Financial Capability Study.

The study, the nation’s most comprehensive survey of financial literacy and well-being, reported some areas of progress for average workers. Compared with 2009 – the depths of recession – more people felt they were better able to make ends meet in 2012. But a substantial minority of Americans were still living paycheck to paycheck.

A previous blog post provides other FINRA findings. To view the state-by-state data, as well as the national results, click here.Learn More

January 23, 2014

Retirement Delayed to Pay the Mortgage

Older Americans who are in debt are choosing to delay their retirement, researchers conclude in a new working paper.

In earlier findings released last summer, the researchers, Barbara Butrica and Nadia Karamcheva of the Urban Institute, documented the growing prevalence of borrowing since the late 1990s among adults ages 62 through 69. Median debt levels among those who owe also surged from $19,000 to $32,100, adjusted for inflation – and debts as a share of their assets increased.

Now comes the rest of the story. When the researchers controlled for health, financial assets, home values, and other forms of wealth, as well as spouses’ earnings and other factors that play into decisions about retiring, they found that individuals with debt, especially mortgages, behave differently than those who are debt-free.

Here are their main findings:

- Nearly half of all people in their 60s with debts continue to work, compared with only one-third of those who have no debt. …