Posts Tagged "debt"

August 1, 2013

Student Debt May Slow Home Buying

First-time buyers are currently responsible for about 29 percent of all U.S. house sales, down from historical levels of 40 percent, according to the National Association of Realtors. The share of young adults who own a house has also declined sharply.

There’s debate about whether buying a house is a good financial move. But the waning of this coming-of-age ritual is a significant change in behavior for young adults in this country.

One culprit may be student debt, which is becoming more prevalent – 43 percent of young adults have some, compared with 25 percent a decade ago. The average borrower’s balance has also doubled in the past decade, to more than $20,000 in 2012.

One culprit may be student debt, which is becoming more prevalent – 43 percent of young adults have some, compared with 25 percent a decade ago. The average borrower’s balance has also doubled in the past decade, to more than $20,000 in 2012.

Researchers at the Federal Reserve Bank of New York believe these unprecedented student debt levels may be dampening house purchases by first-time buyers. Student loans cause individuals to do poorly under two of the primary tests by Freddie Mac and Fannie Mae that lenders use to approve standard home loans. …Learn More

July 16, 2013

Underwater Homeowners Stuck in Place

Packing up and moving across state lines is a time-honored tradition in this country. Settlers headed to the Great Plains in the 1800s, retired snowbirds have flocked to the Sun Belt for decades, and roughnecks today are pouring into North Dakota for the shale-oil boom.

But moves like these became extremely difficult for an unprecedented number of Americans after U.S. house prices plunged, suddenly trapping millions of homeowners in houses that were worth less than what they owed on their mortgages.

The phenomenon, called “house lock,” was more pervasive during the recent housing market downturn, because the downturn was national in scope – prior housing declines had largely been isolated in regional markets.

Some 110,000 to 150,000 fewer Americans relocated each year from 2006 through 2009, reducing interstate migrations nationwide by 2 percent to 3 percent annually, according to the first study using data on individual house prices and mortgage balances to confirm that an increase in a state’s homeowners with “negative equity” affected migrations out of that state. …Learn More

June 20, 2013

Older Patients Tell Doctors, “Charge It!”

New research has uncovered one reason for the alarming rise in credit card use among older Americans: medical bills.

When people age 50 or older experience “health shocks” – newly diagnosed medical conditions – their credit card balances rise, according to research published in the Journal of Consumer Affairs. The worse the medical condition, the more they charge.

A mild, new medical problem, for example, adds $230 to credit card bills – that’s a 6.3 percent increase on a starting balance of $3,654. If the new condition is severe, balances increase by $339, or 9.3 percent.

Separately, the researchers looked at the effect of out-of-pocket medical costs, such as copayments for doctor visits and prescriptions not covered by private insurance or Medicare. For each $100 that those costs increase, about $4.50 winds up on the cards, according to Hyungsoo Kim at the University of Kentucky, WonAh Yoon at the Samsung Life Retirement Research Center in Seoul, Korea, and Karen Zurlo at Rutgers University.

Their findings shed new light on why more older Americans, who have the greatest medical needs, are becoming reliant on credit cards with their high interest rates. …Learn More

June 11, 2013

Too Many Homeowners Still Underwater

With house prices rising smartly, homeowners should be celebrating. Right?

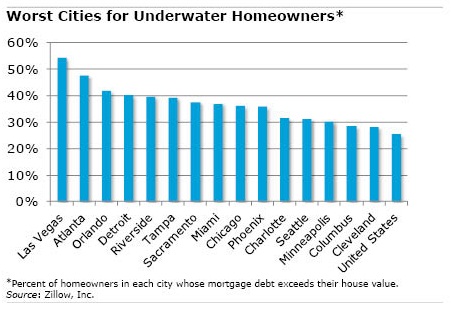

Wrong. To be sure, a 10 percent jump in house prices in the first quarter, compared with a year earlier, pushed more people out of the red and into the black. But one in four U.S. homeowners with a mortgage still has “negative equity:” the mortgage exceeds the value of the home, according to new data from Zillow.

These 13 million U.S. homeowners will need more price appreciation before they can feel that the housing-market downturn of the previous decade is truly over.

Negative equity is prevalent not just in obvious places like Las Vegas, once the poster child for the go-go real estate market that went bust. The painful aftermath lingers in Chicago and Minneapolis, where about one in three owners has negative equity.

Seattle, Cleveland, and Baltimore also each have a larger share of owners in negative territory than the national average.

Seattle, Cleveland, and Baltimore also each have a larger share of owners in negative territory than the national average.

Zillow computes a second, broader measure of underwater homeowners. It adds together people with negative equity and those who have some equity, though not enough to pay a real estate agent and related costs to sell their house and move. When this second group is included, the share of home borrowers in a financial bind increases to 44 percent, from 25 percent, Zillow said. …Learn More

June 4, 2013

Earnings Growth: Better at the Top

U.S. inequality can be measured two ways – by wealth or by earnings. Either way, most working Americans are losing out.

It’s the 1920s again for the richest 1 percent of Americans, and a recent analysis of the wealth gap illustrates why they’re able to live like the fictional Jay Gatsby, portrayed by Leonardo DiCaprio in the new movie, “The Great Gatsby.”

The value of their wealth rises and falls with the stock market. But since the 1960s, they have consistently held 33 percent to 39 percent of the wealth owned by all Americans, including their stock, mansions, commercial real estate, and businesses, according to economist Edward Wolff at New York University. In 2010, the last year examined by Wolff, the richest 1 percent’s share was 35 percent – that was before the Dow flew past 15,000.

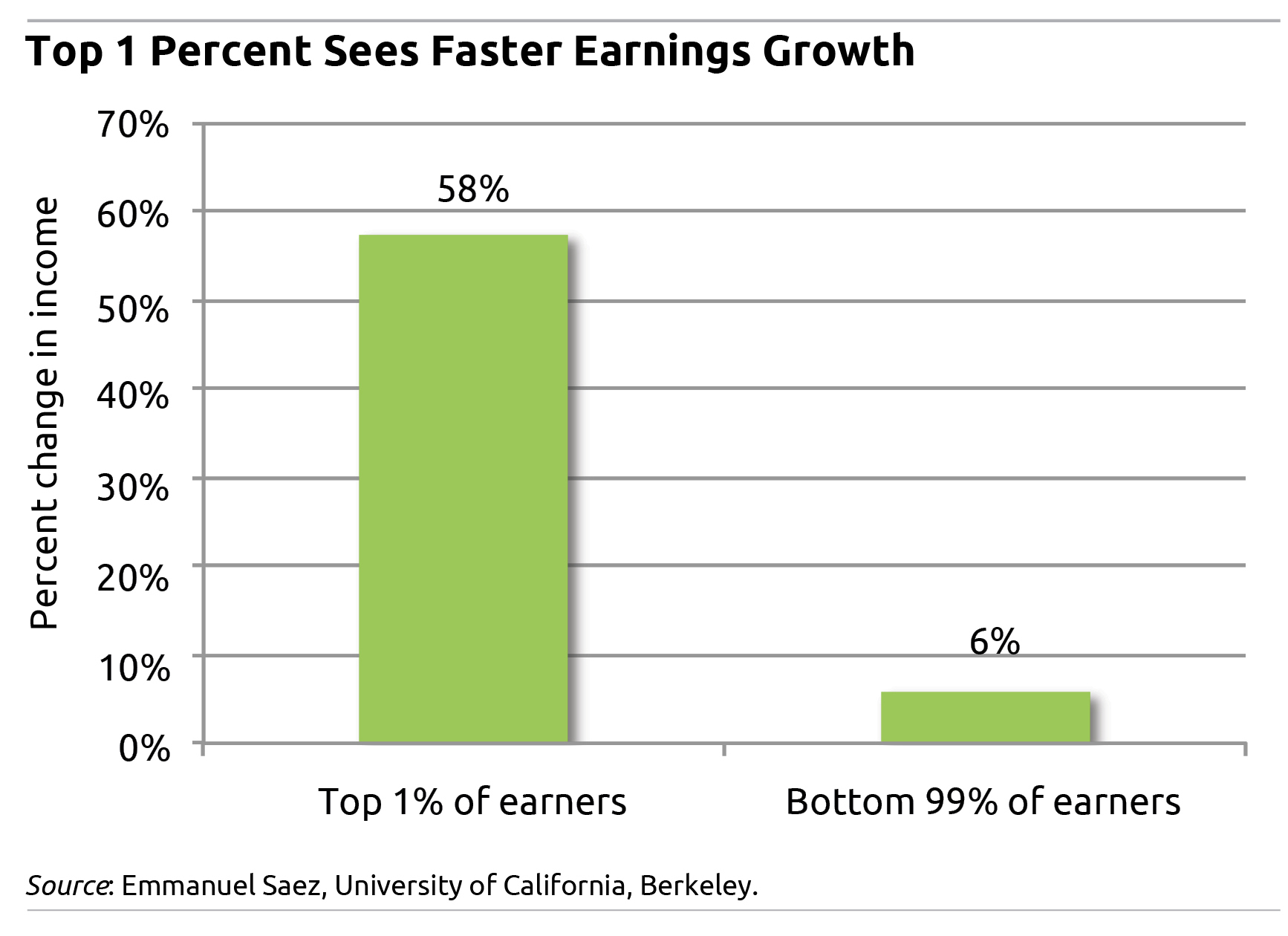

The U.S. wealth gap is enormous, partly because most Americans have little wealth to speak of. Most people instead gauge their financial well-being by the size of their paychecks, and income inequality is rising sharply.

Between 1993 and 2011, the earnings of the top 1 percent of U.S. earners grew by nearly 58 percent, after adjusting for inflation. Earnings include salaries, bonuses, stock options, dividends, and capital gains on stock portfolios. That far outpaced the 6 percent rise for the rest of U.S. workers during the same 18-year period, according to a new analysis by economist Emmanuel Saez at the University of California, Berkeley. …Learn More

Between 1993 and 2011, the earnings of the top 1 percent of U.S. earners grew by nearly 58 percent, after adjusting for inflation. Earnings include salaries, bonuses, stock options, dividends, and capital gains on stock portfolios. That far outpaced the 6 percent rise for the rest of U.S. workers during the same 18-year period, according to a new analysis by economist Emmanuel Saez at the University of California, Berkeley. …Learn More

May 30, 2013

Layoffs After 50 Cause Severe Losses

For the average older worker who loses his job, his income a decade later is 15 percent lower than if he had escaped the layoff.

It gets worse: His pension wealth is worth 20 percent less, and his financial assets are 30 percent smaller.

The enormous financial hit delivered to older workers who experienced a layoff sometime during the 1990s was reported recently by researchers at the Center for Retirement Research, which supports this blog. First, the researchers pinpointed all workers in the data set who were over age 50 and lost a job between 1992 and 2000. They then examined their financial outcomes – earnings and assets – a decade later and compared them with outcomes for those who avoided layoffs during that time.

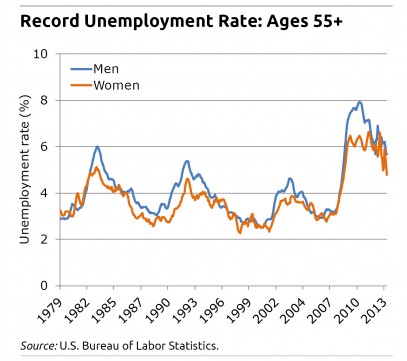

If the financial fallout during the 1990s was that dramatic for unemployed older workers, it will be even worse for many of the 3.2 million jobless baby boomers at the peak of the Great Recession, the longest downturn in post-war U.S. history.

If the financial fallout during the 1990s was that dramatic for unemployed older workers, it will be even worse for many of the 3.2 million jobless baby boomers at the peak of the Great Recession, the longest downturn in post-war U.S. history.

The Great Recession hit just as members of the biggest demographic bulge ever were either hitting retirement age or lining up on the runway. Record numbers of them sustained severe hits to their financial security, because the jobless rate for older workers reached record highs.

The research suggests that the recession’s effects may last into old age for many boomers. One key reason for their grim prospects is that older workers have more difficulty snaring new jobs than do young adults. Many boomers never found employment and are being forced to retire grudgingly, simply because they lack options. …Learn More

April 25, 2013

Student Debt Binge: How Will It End?

This recent Huffington Post headline captured the march of shocking data about our growing societal burden: “12 Student Loan Debt Numbers That Will Blow Your Mind.”

Here’s a sample:

- The student debt balance has hit $1 trillion and is still rising – it is now exceeded only by mortgage balances, according to the Federal Reserve Bank of New York;

- Student debt is held by 26 percent of households headed by someone between the ages of 35 and 44, and 44 percent of under-35 households, and it’s concentrated in poorer households, according to the Pew Research Center;

- 80 percent of bankruptcy lawyers said student loans were driving more clients through their doors for relief.

It remains unclear where this era of student debt is taking society. Sure, college graduates will bring in another $1 million in earnings over a lifetime. But anyone who’s thought about it can’t help worrying this nationwide borrowing binge may end badly.

To help those grappling with how to pay for the fall semester, feeling the emotional fallout of debt, or trying to understand the larger issues, Squared Away pulled together some relevant blog posts published over the past 18 months.

Click “Learn More” below to read more. …Learn More