Posts Tagged "debt"

July 12, 2012

How Can Debt Enhance Self-Esteem?

The media went crazy last month over research determining that debt – whether college loans or credit cards – is a major source of self-esteem for young adults.

Judging by the tone of these articles, the reporters were so flabbergasted that they didn’t think to ask the logical follow-up question: Why? Credit cards aren’t inherently bad, though they can get people who abuse them in trouble. But equating self-esteem with debt seems to turn the notion of financial judgment on its head.

So Squared Away consulted therapist Dave Jetson and financial planner Rick Kahler, both of Rapids City, South Dakota. They often work together with clients on their financial issues but offered different explanations for this puzzling phenomenon.

Because debt is increasingly required to get a college education, Kahler said it may benefit from the glow of what an education represents. Debt has become a mark of being “smart enough to get through college.”

Jetson sees a dramatic cultural shift that is influencing today’s young adults. This shift coincides with shrinking economic opportunity for many college graduates. …

Learn More

July 10, 2012

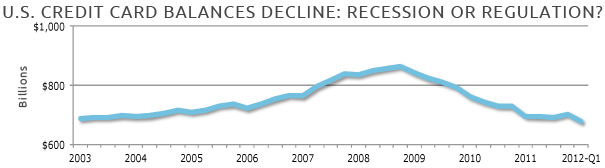

Credit Card Act Increased Payoffs

Government policies often seek to alter human behavior: a 2009 tax credit for first-time homebuyers, for example, encouraged more people to buy houses.

Now research has determined that the first federal update since 1968 to the interest rate disclosures on credit card statements has changed card users’ behavior for the better.

The Credit Card Accountability, Responsibility and Disclosure Act of 2009 (CARD) increased the number of users who pay off their bills each month, from about 60 percent prior to the act, to between 64 and 69 percent currently, concluded Cornell University doctoral student Lauren Jones, Ohio State University professor Cäezilia Loibl, and Cornell professor Sharon Tennyson.

They also found that the size of card holders’ payments, relative to their debt levels, increased, and that fewer card users are paying only the minimum. Their findings, though somewhat mixed, provide support for the increasingly popular notion that more precision and clarity in financial-product disclosures can be effective.

Their research controlled for the effects of the Great Recession and its aftermath, when consumers slashed their debt; in other words, card holders improved their behavior on top of the belt tightening forced upon them by lower wages, unemployment and other recessionary impacts. A previous report also suggested that other provisions of the CARD Act that made it more difficult for college students to obtain credit cards have curbed card use on campus.

However, Jones cautioned against being complacent about CARD’s impacts, because they are “positive and significant” only for a subset of credit card users. …

Learn More

June 5, 2012

College Loans: A Punitive System?

News emerging on several fronts points to what increasingly looks like a student-loan system stacked against young adults fresh out of college.

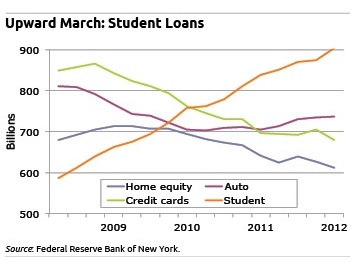

The Federal Reserve Bank of New York last week said college debt outstanding surged to a record $904 billion – the figure, from a new and improved Fed data set, was higher than had previously been thought. What was also noteworthy was that the central bank said a $300 billion spike in college debt since 2008 has occurred during a time other U.S. households slashed $1.5 trillion from their loan balances in a massive, post-recession belt tightening.

The Federal Reserve Bank of New York last week said college debt outstanding surged to a record $904 billion – the figure, from a new and improved Fed data set, was higher than had previously been thought. What was also noteworthy was that the central bank said a $300 billion spike in college debt since 2008 has occurred during a time other U.S. households slashed $1.5 trillion from their loan balances in a massive, post-recession belt tightening.

Student loan debt “continues to grow even as consumers reduce mortgage debt and credit card balances,” Fed senior economist Donghoon Lee said.

Washington is the first place to look for one Kafkaesque aspect of the college loan system. Politicians are engaged in brinksmanship over whether to allow the expiration of a temporary interest rate reduction for the Stafford Loan program put in place in 2007. This would cause the rate to double, returning to its previous level of 6.8 percent.

That’s a nice interest-rate spread for the federal government, which currently pays historic lows of about 1.5 percent on 10-year U.S. Treasury Bonds and 2.5 percent for 30 years. Even taking into account the sky-high default rate on student loans, is 6.8 percent a fair price for recent graduates to pay? …Learn More

May 22, 2012

New Financial Tools Backed by Research

The Center for Retirement Research at Boston College has created a prototype personal finance website with tools and information on topics ranging from how to reduce spending or refinance a mortgage to the best way to draw down savings during retirement.

The website offers a comprehensive set of tools backed by impartial academic research – not sales pitches. Individuals can use each calculator, “Learn More” lesson, or “How To” guide individually or as the building blocks for an overall financial plan, which they can construct in a step-by-step process that begins on the homepage.

The website, also called Squared Away, was created by the Financial Security Project (FSP), a financial education initiative of the Center. It was funded (also like this blog) by the Social Security Administration.

The Center plans to distribute the site through various organizations, such as credit counselors, financial planners, employers, credit unions, and non-profits involved in helping low-income people build up their savings.

The website is still in the “beta” phase and will be improved over the coming months. We invite readers to try out the tools and comment on them by clicking “Learn More” below. All comments – good and bad – are welcome.Learn More

March 29, 2012

Mortgage Refi Dilemma: 15 or 30 years?

My mortgage broker is a patient man.

I kept changing my mind, because this refinancing was about so much more than whether to go with a 15- or a 30-year fixed rate. Now that the loan is about to close, I worry that I made the wrong decision.

As a baby boomer, all financial decisions suddenly spin around retirement. Many boomers now own their homes free and clear. I am not one of them, and it seems critical to get this refinancing right, since mortgage interest rates may not hit these historic lows again for a long time. For this reason, and because house prices have plummeted, the 15-30 dilemma may prove important for cash-strapped, first-time homebuyers too.

“I don’t think [rates] are going to race up in the next 6 months, or even year and a half, but things are definitely headed upwards,” predicted Susan Honig, owner of Veritana Financial Planning Inc. in Burbank, Calif. “And after that I think rates are going to fly.” …Learn More

January 3, 2012

Research Illuminates Credit Card Habit

It’s 2012, so kiss the money spent last month goodbye. But if any skeptics out there still need confirmation, here it is:

Academic research shows that compulsive purchases are more likely with credit cards, which put distance, in space and time, between the act of buying the item and paying for it.

“The pain of paying is somewhat dulled” by using plastic, Priya Raghubir at New York University and Joydeep Srivastava at the University of Maryland, show in their research paper titled, “Monopoly Money: The Effect of Payment Coupling and Form on Spending Behavior.”

If reducing your use of credit cards – even converting to a cash budget – is a New Year’s resolution, click “learn more” at the bottom of this post to see six previous articles on Squared Away about credit card behavior and psychology. They might help readers better understand a bad habit many of us share. …Learn More

November 15, 2011

Student Loans Derail Life Plans

Christi Longlois of New Orleans only slightly exaggerates when she says she and her partner “will be retired before we pay off our student loans.”

Longlois, who works at Tulane University, and Geneva Marney, who works at a non-profit, together owe $80,000 in student loans. Both in their 30s, they have more than 25 years of monthly payments ahead of them.

On their financial planner’s advice, they sold their house and began renting so they could make their $453 monthly loan payments, some of which funded Longlois’ graduate school, and pay their credit cards. They’d like to eventually send their infant twins to private school but don’t feel that’s very realistic.

In interviews with a dozen college seniors and young adults in their 30s, it became painfully clear that loan payments have blasted holes in many life plans – something their baby boomer parents didn’t even worry about. …Learn More