Posts Tagged "education"

July 3, 2012

Fourth of July Quiz

Just over two-thirds of Americans were able to answer the questions below correctly. Given their “simplicity,” Annamaria Lusardi and Olivia Mitchell called the results “discouragingly low” in their 2011 research published by the National Bureau of Economic research.

Just over two-thirds of Americans were able to answer the questions below correctly. Given their “simplicity,” Annamaria Lusardi and Olivia Mitchell called the results “discouragingly low” in their 2011 research published by the National Bureau of Economic research.

Women did worse than men: 59 percent of women got it right, compared with 71 percent of men.

Take the test to see how you do.

1. Suppose you had $100 in a savings account and the interest rate was 2 percent per year. After five years, how much do you think you would have in the account if you left the money to grow?

a. More than $102

b. Exactly $102

c. Less than $102

d. Do not know

e. Refuse to answer

2. Imagine that the interest rate on your savings account was 1 percent per year and inflation was 2 percent per year. After one year, how much would you be able to buy with the money in this account?

a. More than today

b. Exactly the same

c. Less than today

d. Do not know

e. Refuse to answer

To see the answers, click “Learn more” below. And happy Fourth of July!Learn More

April 26, 2012

Pennsylvania Strong in Fin Ed – For Now

Talking to teenagers taking personal finance at Panther Valley High School in Pennsylvania made me wonder why these classes aren’t a top priority everywhere.

These kids are even teaching their parents a thing or two about money. Jordan Kulp saved her mother $30 by finding a scooter for a cousin’s baby that her mother had wanted to buy on a shopping channel. Now that Jake Gulla’s mother sits in on his personal finance class, she is “spending [money] a little more wisely.”

And William Digiglio’s father wanted to sell a shield for $100 that Chris Evans apparently carried in the “Captain America” movie. William put it up for sale on eBay and snared $20,000 for the shield, which his father had won in a contest. For class projects, “we had to research rather than taking them for face value,” he explained.

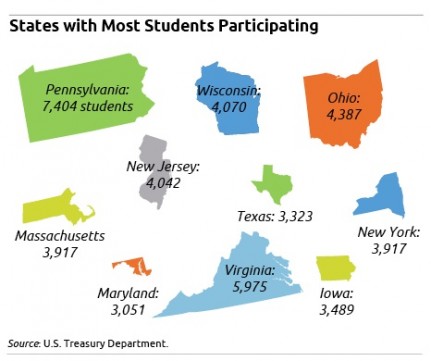

These Panther Valley students have helped make Pennsylvania, for a third year running, the state with the highest number of students scoring in the top 20 percent on the federal government’s 2012 test for the National Financial Capability Challenge (NFCC), according to Mary Rosenkrans, financial education director for the state’s Department of Banking.

These Panther Valley students have helped make Pennsylvania, for a third year running, the state with the highest number of students scoring in the top 20 percent on the federal government’s 2012 test for the National Financial Capability Challenge (NFCC), according to Mary Rosenkrans, financial education director for the state’s Department of Banking.

Pennsylvania also had the highest number of students who took the test (7,404) and the highest number of participating schools (123). (Oregon had the highest average test score: 79.5 percent, compared with 69 percent nationwide.)Learn More

April 19, 2012

Middle Schools Vie in Video Contest

The Massachusetts Financial Education Collaborative (MFEC) had one big reason for targeting its video contest to middle school kids: advertising.

“Hey, you gotta have a cell phone. You gotta have these jeans. The contest seemed like a great way to bring awareness” to the issue of kids and our consumer culture, said Andrea Wrenn, mother of five, education consultant, and the MFEC volunteer who oversees the contest.

Two Massachusetts middle schools submitted videos exploring kid consumerism in the first year of MFEC’s contest: the Norwell Middle School and the Hill View Montessori Charter Public School in Haverhill.

Squared Away encourages readers to support the new effort by clicking here to vote for your favorite video! The voting deadline is April 27.

The contest is among the creative ways communities are encouraging children and teenagers to learn about the money issues they deal with – a play recently staged by Cambridge high school students was another.Learn More

April 5, 2012

The Family That Dines Together…

New research adds a dash of spice to our understanding of how people handle their personal financial matters: families who dine together grow wealthy together.

Three professors at the University of Georgia have discovered that families who commit to gather regularly around the dinner table – or, presumably, dine out or cook together – are better prepared financially and will accumulate more wealth faster.

As with any statistical analysis, their research can’t prove cause and effect. Is it that dining together causes wealth to go up, or is that families who know how to handle their finances also tend to be the type of people who enjoy meals together?…Learn More

October 25, 2011

CFPB Integrates Outreach, Regulation

A top official in the federal Consumer Financial Protection Bureau (CFPB) said educational outreach to four vulnerable populations – college students, seniors, members of the military, and low-income earners – will be integral to the bureau’s research, regulatory, and legal enforcement efforts.

CFPB’s consumer division will “work with regulators to make sure people know what they are signing” and to help “clean up the marketplace” by ridding it of abusive products, Gail Hillebrand, who heads the consumer division, said at a Massachusetts Financial Education Collaborative conference held Friday at the Federal Reserve Bank of Boston.

CFPB’s consumer division will “work with regulators to make sure people know what they are signing” and to help “clean up the marketplace” by ridding it of abusive products, Gail Hillebrand, who heads the consumer division, said at a Massachusetts Financial Education Collaborative conference held Friday at the Federal Reserve Bank of Boston.

Citing the subprime mortgage crisis, Hillebrand said it began “one mortgage at a time” – in large part due to poor disclosure by salesmen or on mortgage forms. Many borrowers who ultimately went into foreclosure failed to realize that their payments would rise sharply after the period of the initial, discounted interest rate ended. … Learn More

June 28, 2011

Hubris Hampers Education Efforts

Most people think they’re above average when it comes to financial knowledge. And it’s not easy to educate people who think they know more than they actually do.

But hubris – or something like it – is what financial educators are up against, indicates research by professors Annamaria Lusardi at the George Washington School of Business and Olivia Mitchell at the University of Pennsylvania’s Wharton School. Their paper used data from 1,200 respondents to a survey they conducted for the Investor Education Foundation or FINRA, the self-regulatory agency for the securities industry. It may be the most comprehensive study on Americans’ financial literacy.

Seventy percent of the survey’s respondents believe they know more about basic financial concepts than most other people. But they scored poorly on the survey’s three rudimentary financial literacy questions. One-third to one-half of them answered the questions incorrectly or indicated they didn’t know the answers.

The results “paint a troubling picture of the current state of financial knowledge in the United States,” the authors said.

Further, this low level of knowledge, when combined with overconfidence about that knowledge, does not bode well for attempts to educate people about money and their personal finances.

Before I provide more detail about Lusardi and Mitchell’s findings, take the quiz yourself. Here are the questions1:

Learn More

June 8, 2011

Preschool Children Learn about Saving

Paul Solman, a business reporter in Boston for the NewsHour on PBS, put together an excellent piece about educating preschool children about saving. In it, Solman interviews Grover and the children of behavioral economist David Ariely of Duke University, among others.

The piece discusses a research study on self-control among young children, which was covered recently by Squared Away.

The video is worth checking out.