Posts Tagged "healthcare"

December 4, 2012

Long-Term Care Policies Unpacked

The typical, elderly couple spends about $260,000 on health care and long-term care services during retirement – for the unlucky ones, the amount can be double. No wonder sales of long-term care policies this year will increase nearly 10 percent, according to the American Association for Long Term Care Insurance. At the same time, major insurers are pulling out of the market in droves, and premiums are surging due to higher demand by aging baby boomers, record-low interest rates, and rising medical costs.

To help navigate this increasingly treacherous market, Squared Away interviewed Larry Minnix Jr., chief executive of LeadingAge, a non-profit consumer organization in Washington.

Q: Is there anyone for whom long-term care insurance does not make sense?

A: Not many. I’ve seen too much of the consequences for too many age groups and too many families – long-term care just needs to be insured for. A majority of the American public is going to face the need for some kind of long-term care in their family. The only people it doesn’t make sense for are poor people – they have Medicaid coverage, mostly for nursing homes. And for people who are independently wealthy, if they face a problem of disabling conditions they can pay for it themselves. You find out at age 75 you have Parkinson’s or Alzheimer’s, but it’s too late to insure for it. Think about it like fire insurance. I don’t want my house to burn down, and very few houses do. But if mine burns down, I do have insurance.

Q: The Wall Street Journal reported that GenWorth Financial next year will charge 40 percent more to women who buy individual policies. Why?

A: Among the major carriers, private long-term care insurers have either limited what they’re doing or backed out of the market entirely. You’d have to get GenWorth’s actuarial people [to explain], but let me venture a guess. I’ve had private long-term care insurance for 12 to 15 years, but my wife couldn’t get it. She’s got some kind of flaw in the gene pool, and she was denied coverage. She may be the bigger risk, because I’m more likely to stroke out and die, but she’s more likely to live with two to three conditions for a long period of time.

Q: Your wife wasn’t healthy enough to get coverage? …

Learn More

October 4, 2012

The Long-Term Care Insurance Gamble

A good friend in Houston recently emailed me to ask whether she should buy long-term care insurance. Let me be very clear about my answer: I have no idea.

This writer is like baby boomers everywhere trying to get a grip on this long-term care stuff. Where to start?

First, let’s look at the prices for long-term care. Squared Away used data from Genworth, one of the nation’s largest insurers in this market, to generate a U.S. map with the median cost in each state of a semi-private room in a nursing care facility.

Genworth’s goal is obviously to sell insurance. But I ran its data by a few people, and it held up well, with a few observations and caveats discussed later…Learn More

September 6, 2012

Campaign Discourse Misses Major Issue

Retirement-income security is receiving little attention as the presidential campaign heats up, despite a mound of evidence that Americans’ retirement prospects are stagnating – or worse.

While Medicare has been at the center of the debate, there has been little emphasis on the broader topic of income security for what remains the largest demographic bulge in U.S. history – the baby boomer generation – and now the largest block of retirees.

In the retirement community, however, debate swirls constantly about how bad the situation really is. These debates are slicing the onion awfully thin when one research paper or report after another contains a new aspect of the troubling fallout from the final years of a transition from secure, employer-guaranteed pensions to DIY retirement. Sometimes it seems that Wall Street’s collapse in 2008 was just the kickoff for the bad news on the retirement front.

A new report from Boston College’s Center for Retirement Research, which funds this blog, finds that just 42 percent of workers in the private sector had pension coverage in their current jobs in 2010 – that’s coverage of any kind, including the defined-contribution plans that now dominate. Yikes!…Learn More

August 16, 2012

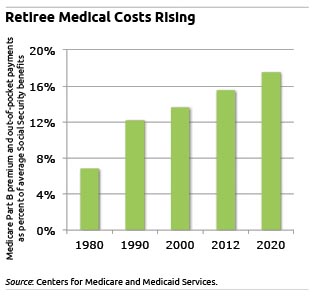

Out-of-Pocket Medicare Costs Bite Deep

The bite taken out of Social Security checks to pay Medicare premiums and co-payments for doctor visits has more than doubled, from just 7 percent of benefits in 1980 to 15.5 percent currently.

The bite taken out of Social Security checks to pay Medicare premiums and co-payments for doctor visits has more than doubled, from just 7 percent of benefits in 1980 to 15.5 percent currently.

People born on the tail end of the baby boom wave are suddenly waking up to retirement, which is barreling towards them. While many have no idea how Medicare works or how much they will pay for health care, the program’s future has emerged as a key issue in a presidential campaign with competing notions of how best to slow Medicare’s growth to a more sustainable level.

Whatever your political stripe, the costs of retirement health care are rising “significantly,” according to a forthcoming report by the Center for Retirement Research, which sponsors this blog.

Medicare covers a large portion of health costs, but retirees must pay Medicare premiums, which are deducted from their monthly Social Security checks, as well as copayments for doctor visits and other medical services such as some tests. These additional expenses are often, though not always, covered by employer-sponsored or private “Medigap” insurance policies, which smooth out these expenses for retirees…Learn More

November 8, 2011

Long-Term Care: To Buy or Not to Buy

Let’s face it: thinking about long-term care insurance, nursing homes and home health aides is depressing.

It’s no wonder that just 10 percent to 12 percent of America’s elderly population has purchased a long-term care policy.

More are thinking about it though: New research shows that 40 percent of people 50 years or older who were surveyed had “thought a lot about needing long-term care” if they were to become ill in old age.

This research delved into the factors driving individual decisions about whether to buy long-term care coverage – or not buy. The decision “depend(s) on a complex amalgam of many different factors,” concluded a conference paper based on research conducted by the NBER Retirement Research Center.

Here are some of the findings in the paper, by Jeffrey Brown at the University of Illinois, Gopi Shah Goda at Stanford University, and Kathleen McGarry at the University of California at Los Angeles: …Learn More

October 20, 2011

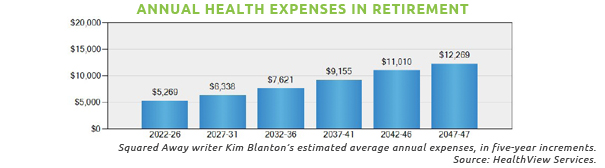

Calculate Your Retirement Health Costs

Mid- and late-career professionals staring into their futures, eyes glazed, often don’t have a clue how much their health care will cost them during retirement.

Few pre-retirees know how many holes exist in Medicare coverage. One MetLife survey this year found that 42 percent of pre-retirees age 56 to 65 believe, incorrectly, that their health coverage, Medicare or disability insurance will pay for their long-term care. Such knowledge gaps make it virtually impossible for most people to take a stab at tallying their total costs, out of pocket, for Medicare, Medigap, and private premiums and copayments over years of retirement.

Retiree healthcare is “the elephant on the table,” said Dan McGrath, vice president of HealthView Services outside Boston. The omission amounts to hundreds of thousands of dollars per retiree.

Calculators that estimate retiree health expenses are scarce, according to a 2008 AARP brief. But HealthView’s calculator, recently upgraded, estimates total out-of-pocket health expenses, which are tailored to an individual’s specific medical traits – diabetes, cholesterol, blood pressure etc. – and health habits – smoking, exercise etc.

Squared Away readers can obtain a free trial by emailing McGrath at dmcgrath@hvsfinancial.com. …Learn More

September 27, 2011

Medicare: the Future is Now

When health care is factored in, more than half of Americans haven’t saved enough money for retirement.

But that price tag could become more unattainable under President Obama’s proposal last week to cut $248 billion from Medicare by raising premiums, copayments, and other health costs. With Republicans also talking reform, the impact of Beltway belt-tightening is coming into sharper focus for more than 45 million Americans covered by the federal program.

It’s a good time to revisit 2010 research by Anthony Webb, an economist with the Center for Retirement Research at Boston College, which hosts this blog. Webb calculated how much a “typical” retired couple, both age 65, needs today to cover out-of-pocket expenses over their remaining lives. The numbers are shocking:

- A couple needs $197,000 for future Medicare and other premiums, drugs, copayments, and home health costs;

- There is a 5-percent risk they need more than $311,000;

- Including nursing-home costs, the amount needed increases to $260,000;

- There is a 5-percent risk that will exceed $517,000.

To arrive at the estimates, Webb simulated lifetime healthcare histories by drawing on a national survey of older Americans. The difficulty for individual retirees who might want to use these estimates, however, is that their actual spending will vary widely depending on how long they live and their health outcomes. That’s where the risk comes in.

In this video, Alicia Munnell, director of the Center, interviews Webb about his research. To read a research brief, click here.