Posts Tagged "labor force"

April 1, 2021

What the Research Can Tell us about Retiring

It’s difficult to envision what life will look like on the other side of the consequential decision to retire.

But research can help demystify what lies ahead – about the decision itself, the financial challenges, and even the taxes. Readers understand this, as evidenced by the most popular blog posts in the first three months of the year.

Here are the highlights:

The retirement decision. The article, “Retirement Ages Geared to Life Expectancy,” attracted the most reader traffic. Myriad considerations go into a decision to retire. But a sense of whether one might live a long time – because of good health or simply seeing that parents or neighbors are living unusually long – is a compelling reason to postpone retirement either to remain active or to build up one’s finances to fund a longer retirement.

A recent study found that as men’s life spans have increased, they have responded by remaining in the labor force longer, especially in areas of the country with strong job markets and more opportunity. This is also true, though to a lesser extent, for working women.

The planning. The second most popular blog was, “Big Picture Helps with Retirement Finances.” It described the success researchers have had with an online tool they designed, which shows older workers the impact on their retirement income of various decisions. When participants in the experiment selected when to start Social Security or how to withdraw 401(k) funds, the tool estimated their total retirement income. If they changed their minds, the income estimate would change.

The tool isn’t sold commercially. But it’s encouraging that researchers are looking for real-world solutions to the financial planning problem, since the insights from experiments like these often make their way into the online tools that are available to everyone.

The taxes. It’s common for a worker’s income to drop after retiring. So the good news shouldn’t be surprising in a study highlighted in a recent blog, “How Much Will Your Retirement Taxes Be?” Four out of five retired households pay little or no federal and state income taxes, the researchers found. But taxes are an important consideration for retirees who have saved substantial sums. …Learn More

January 21, 2020

Denied Disability, Yet Unemployed

Most people have already left their jobs before applying for federal disability benefits. The problem for older people is that when they are denied benefits, only a small minority of them ever return to work.

Applicants to Social Security’s disability program who quit working do so for a combination of reasons. They are already finding it difficult to do their jobs, and leaving bolsters their case. However, when older people are denied benefits after the lengthy application process, it’s very challenging to return to the labor force, where ageism and outdated skills further complicate a disabled person’s job search.

A new study looked at 805 applicants – average age 59 – who cleared step 1 of Social Security’s 5-step evaluation process: they had worked long enough to be eligible for benefits under the disability program’s rules. The researchers at Mathematica were particularly interested in the applicants rejected either in steps 4 and 5.

Of the initial 805 applicants, 125 did not make it past step 2, because they failed to meet the basic requirement of having a severe impairment. In step 3, 133 applicants were granted benefits relatively quickly because they have very severe medical conditions, such as advanced cancer or congestive heart failure.

The rest moved on to steps 4 and 5. Their applications required the examiners to make a judgment as to whether the person is still capable of working in two specific situations. In step 4, Social Security denies benefits if an examiner determines someone is able to perform the same kind of work he’s done in the past. In step 5, benefits are denied if someone can do a different job that is still appropriate to his age, education, and work experience.

In total, just under half of the 805 applicants in the study did not receive disability benefits. …Learn More

September 17, 2019

Readers Debate Retirement Issues

It’s always interesting to see which Squared Away blogs get the strongest reaction from our readers. The June blog, “Husbands Ignore Future Widows’ Needs,” was one of them.

Some readers felt that the results of the study described in the article don’t match up with their experiences. The researchers determined that husbands often are not sensitive to the fact that if they sign up for Social Security in their early 60s, they could be locking in a smaller survivor benefit one day for their widows.

“The elderly couples with whom I do retirement planning are typically very conscious of each other’s needs,” said a critic named Jerry.

But financial planner Kathleen Rehl has the opposite experience when working with couples. “Most couples hadn’t previously known their options and ramifications of those choices,” she said. “Such an important planning concept.”

The blog was based on a study conducted for the Retirement and Disability Research Consortium – consortium studies by researchers around the country are featured regularly on Squared Away.

Here are other 2019 articles about the consortium’s research on various retirement and labor market issues that readers weighed in on: …Learn More

July 5, 2018

Boomer Bulge Still Impacts Labor Force

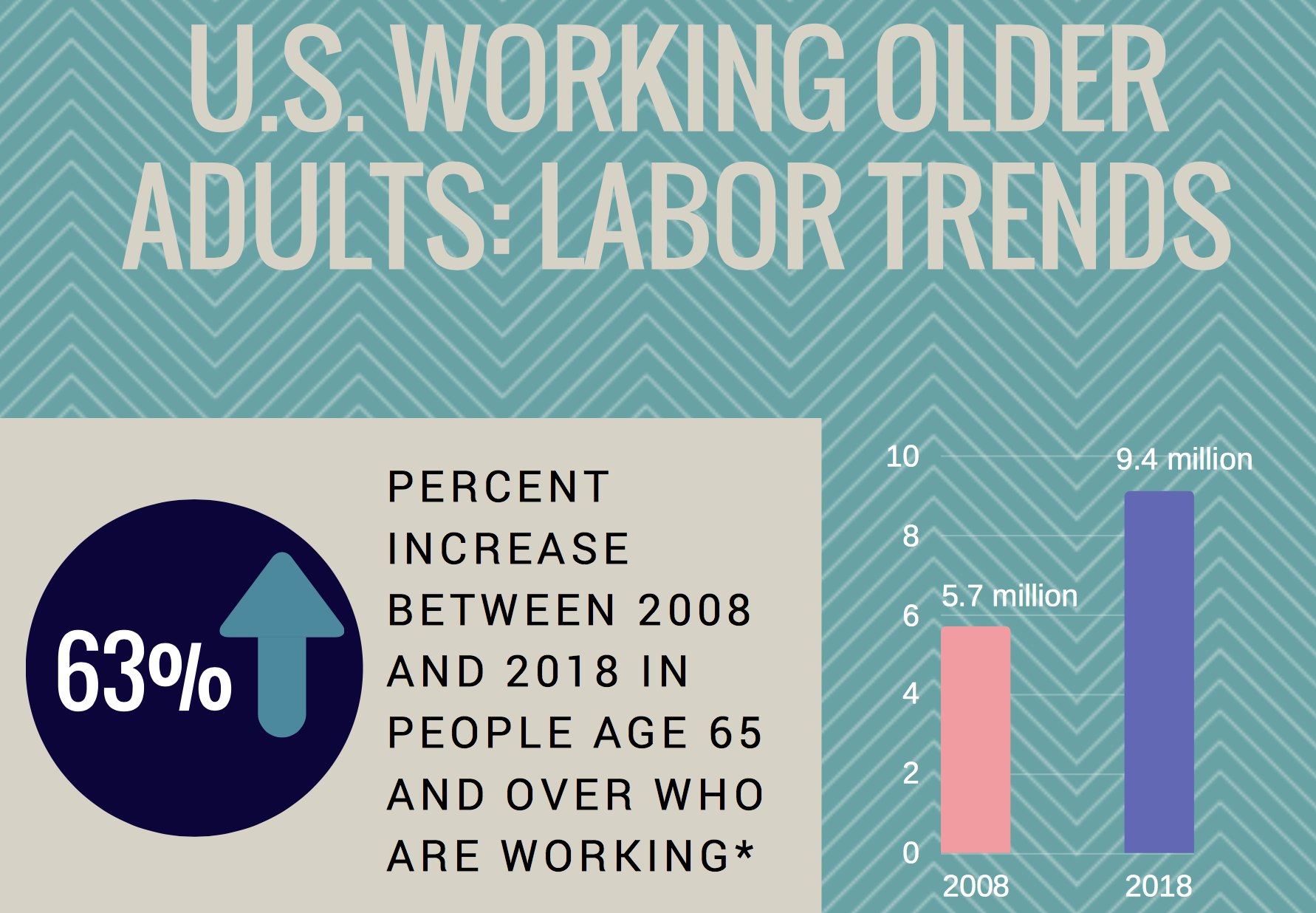

A theme runs through the infographic below: aging baby boomers are still a force of nature.

Created by Georgetown University’s Center for Retirement Initiatives, the infographic uses demographic data to show that boomers remain important to the labor market even as they grow older.

More than 9 million people over 65 work – a steep 65 percent increase in just a decade.

Two things primarily explain this increase. One reason is hardly surprising: the post-World War II baby boom that created the largest generation in history also created the largest living adult population (though Millennials will soon catch up).

On top of this, baby boomers are working longer for myriad reasons – among them, better health, inadequate retirement savings, and more education – which drives up their participation in the labor force.

To see boomers’ other impacts on work, click here for the entire infographic.