Posts Tagged "low income"

February 18, 2020

Electric Bills and Financial Survival

Timing is everything for low-income people who rely on federal benefits to survive.

For example, retirees who receive their Social Security checks early in the month and spend the money before the bills come in are more prone to fill the gap with high-cost payday loans than people who get their checks a few weeks later, a 2018 study found. New research in a similar vein shows that timing also matters for individuals who receive food aid under the federal Supplemental Nutrition Assistance Program, or SNAP.

When the electricity bill arrives on or within a day of the monthly SNAP benefit, the lowest-income customers in this study were much less likely to have a past due bill or to have their power cut off than customers whose bills arrive well after their benefits.

When the electricity bill arrives on or within a day of the monthly SNAP benefit, the lowest-income customers in this study were much less likely to have a past due bill or to have their power cut off than customers whose bills arrive well after their benefits.

The timing is crucial, because SNAP supplies between 10 percent and 25 percent of household incomes up to 35 percent above the federal poverty level. When the government loads each month’s food benefit onto the card, it frees up money for high-priority bills coming due at the same time, including utilities.

This study took place in an unidentified New England state where recipients’ SNAP debit cards are refilled on the first day of every month.

After following the SNAP recipients for a full year, the researchers also found that the unpaid balances they had accumulated after 12 months were smaller if the bills coincided with the SNAP-card deposits. The advantages of a well-timed electricity bill were greatest in the poorest neighborhoods, the researchers said. …

Learn More

January 23, 2020

Medicaid Expansion has Saved Lives

The recent rise in Americans’ death rates is a crisis for the lowest-earning men. They are dying about 15 years younger than the highest-earners due to everything from obesity to opioids. Women with the lowest earnings are living 10 years less.

But healthcare policy is doing what it’s supposed to in the states that expanded their Medicaid coverage to more low-income people under the Affordable Care Act (ACA): helping to stem the tide by making low-income people healthier.

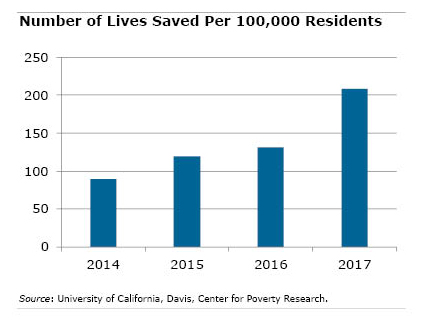

An analysis by the Center for Poverty Research at the University of California, Davis, found that death rates have declined in the states that chose to expand Medicaid coverage. The study focused on people between ages 55 and 64 – not quite old enough to enroll in Medicare.

Medicaid has “saved lives in the states where [expansion] occurred,” UC-Davis researchers found. They estimated that 15,600 more lives would have been saved nationwide if every state had covered more of their low-income residents.

Medicaid has “saved lives in the states where [expansion] occurred,” UC-Davis researchers found. They estimated that 15,600 more lives would have been saved nationwide if every state had covered more of their low-income residents.

This is one of many studies that takes advantage of the ability to compare what is happening to residents’ well-being in states that expanded their Medicaid programs with the states that did not. Progress has come on many fronts.

In expansion states, rural hospitals, which are struggling nationwide, have had more success in keeping their doors open. By covering more adults, more low-income children have been brought into the program, which one study found reduces their applications for federal disability benefits as adults. And low-income residents’ precarious finances improved in states where Medicaid expansion reduced their healthcare costs. …Learn More

October 31, 2019

Boomers at 80: Housing Issues to Grow

The baby boom generation is continuing to work its way up the age ladder. The number of Americans over 80 will more than double to nearly 18 million over the next two decades.

And that’s partly because baby boomers are healthier and are living longer – they are also enjoying more of their retirement years free of disability than previous generations. But unfortunately, boomers can’t avoid the inevitability of their growing vulnerabilities and the impact this will have on their day-to-day lives. A new report by Harvard’s Joint Center for Housing Studies makes some sobering predictions about the issues the oldest retirees can expect to face in the future, from widening income inequality to more people living alone and in isolation.

The findings, taken together, point to a range of potential trouble spots revolving around housing our aging population.

- As people get old, their spouses die, their bank accounts dwindle, and their rents keep rising. For these and other reasons, housing creates more of a cost burden at 80 than at 65. The Harvard housing center defines someone as cost-burdened if they spend more than 30 percent of their income on housing. Today, nearly 60 percent of households over 80 fit this definition, and their absolute numbers will increase as more baby boomers reach that age. One place the financial strain shows up is food budgets: retirees who spend disproportionate amounts on housing spend half as much on food as people whose housing costs are under control. …

October 1, 2019

Financial Survival of Low-Income Disabled

A monthly disability check from the federal government is a lifeline for poor and low-income persons with disabilities, but they still face a daily struggle to meet their basic needs and cover their expenses.

In in-depth interviews, 35 low-income people in Worcester, Massachusetts, described how they make ends meet on the disability benefit they get from Social Security, which averages $912 a month and is their largest source of income. Another $300 comes from other forms of public assistance, family support, or minimum-wage jobs, according to a new issue brief by Mathematica’s Center for Studying Disability Policy.

The daily struggles that each individual faces are as unique as they are. Here are a few excerpts from the study:

“My rent is subsidized. Plus I work 20 hours a week which is pretty good. I bring home more than one hundred something dollars a week and I get a few dollars in food stamps. So it’s okay.”

“I’m stringing it, managing it, and just barely staying above water. I’ve been treading that water for a long time.”

“My situation is challenging. I sometimes just don’t have enough coming in to make what’s going out.”

Three out of four people in the study told interviewers that they find it very difficult to pay for their housing, food and other basic expenses. A bright spot is that people on federal disability insurance (DI) are also covered by Medicare and/or Medicaid and spend very little on medical care. “I’m getting everything I need,” one individual said about her healthcare. …Learn More

July 30, 2019

Why are White Americans’ Deaths Rising?

Rarely does academic research make a splash with the general public like this did. A grim 2015 study, prominently displayed in The New York Times, showed death rates increasing among middle-aged white Americans and blamed so-called “deaths of despair” like opioid addiction, suicide, and liver disease.

Rising mortality, especially for white people with low levels of education, ran counter to the falling death rates the researchers found for Hispanic and black Americans. The husband and wife team who did the study proposed that “economic insecurity” might be an avenue for research into the root cause of white Americans’ deaths of despair.

A 2018 study took up where they left off and found a connection between economic conditions and some types of deaths. Researchers from the University of Michigan, Claremont Graduate University, and the Urban Institute said poor economic conditions – in the form of local employment losses – have played a role in the rising deaths since 1990 from chronic health problems like cardiovascular disease, particularly among 45 to 54 year olds with a high school education or less. However, they could not establish a connection to the rise in deaths of despair.

In a 2019 study in the Journal of Health and Social Behavior, these same researchers instead focused on what is driving the growing educational disparity in life expectancy trends among whites: life expectancy is rising for those with more education but stagnating or falling for less-educated whites.

As for the health reasons behind this, they found that chronic conditions like cardiovascular disease and even cancer are critical to explaining less-educated whites’ life expectancy, and they warned against putting too much emphasis on deaths of despair. In the medical literature, they noted, cardiovascular disease, and some cancers are consistently linked to the “wear and tear” on the body’s systems due to the stress that disadvantaged Americans experience over decades, because they earn less and face adversities ranging from a lack of opportunities and inadequate medical care to substandard living environments. …Learn More

December 13, 2018

Reducing Poverty for Our Oldest Retirees

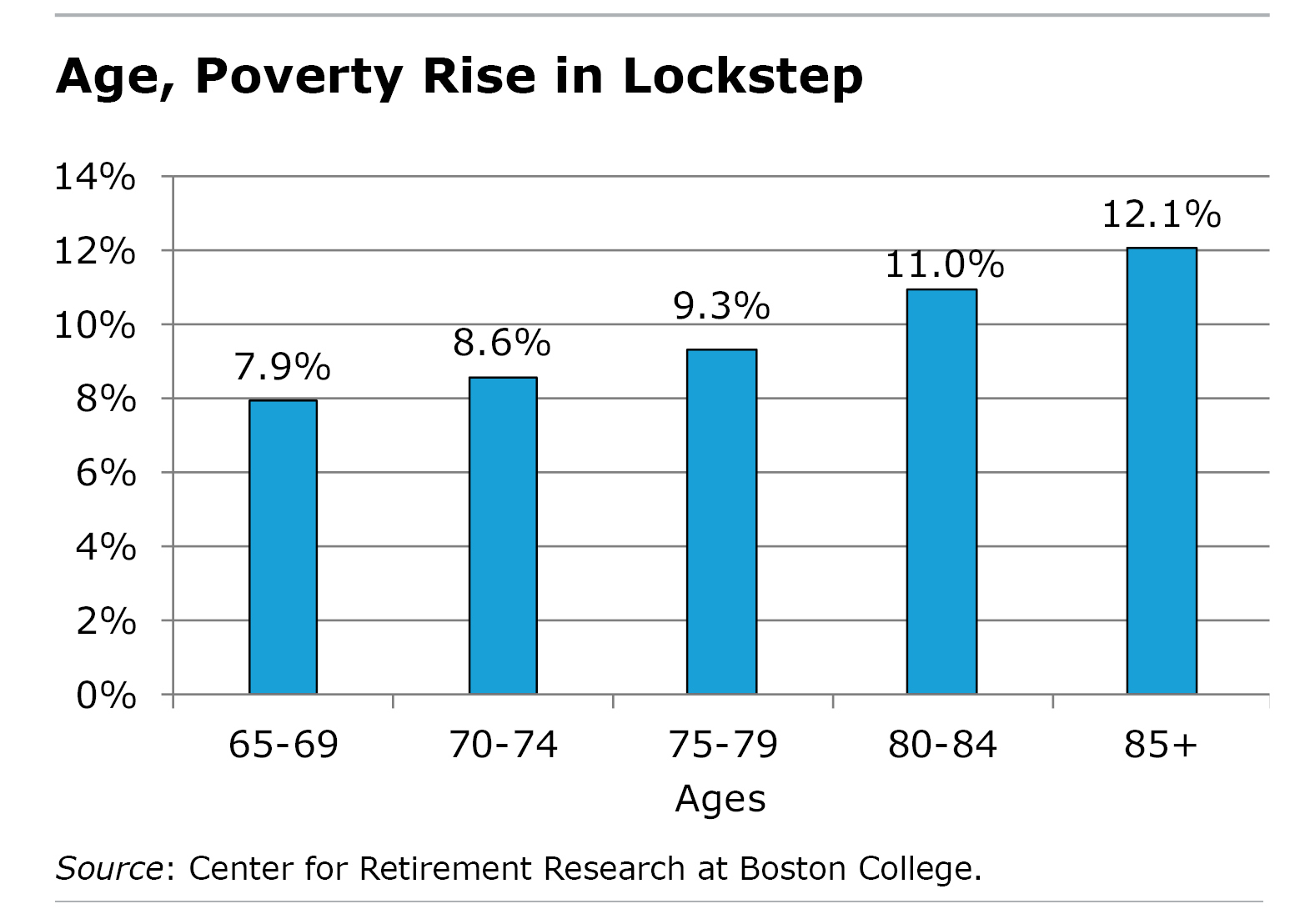

With more Americans today living into their 80s and beyond, the elderly are becoming more vulnerable to slipping into poverty.

To reduce the poverty risk facing the oldest retirees, some policy experts have proposed increasing Social Security benefits for everyone at age 85. Under one common proposal analyzed by the Center for Retirement Research in a new report, the current benefit at this age would increase by

5 percent.

The poverty rate for people over 85 is 12 percent, compared with 8 percent for new retirees. But more elderly people may actually be living on the edge, because the income levels that define poverty for them are so low: less than $11,757 for a single person and less than $14,817 for couples.

One reason the oldest retirees are especially vulnerable is that their medical expenses are rising as their health is deteriorating, yet they’re too old to defray the expense by working. This is occurring at the same time that the value of their employer pensions – if they have one – has been severely eroded by inflation after many years of retirement.

One reason the oldest retirees are especially vulnerable is that their medical expenses are rising as their health is deteriorating, yet they’re too old to defray the expense by working. This is occurring at the same time that the value of their employer pensions – if they have one – has been severely eroded by inflation after many years of retirement.

Further, elderly women are more likely to be poor than men, because wives usually outlive their husbands, which triggers a big drop in income that is generally not fully offset by a drop in their expenses.

Limiting the 5 percent benefit increase to the oldest retirees would ease poverty while containing the cost. …Learn More

September 27, 2018

Medicaid Expansion Reduces Unpaid Debt

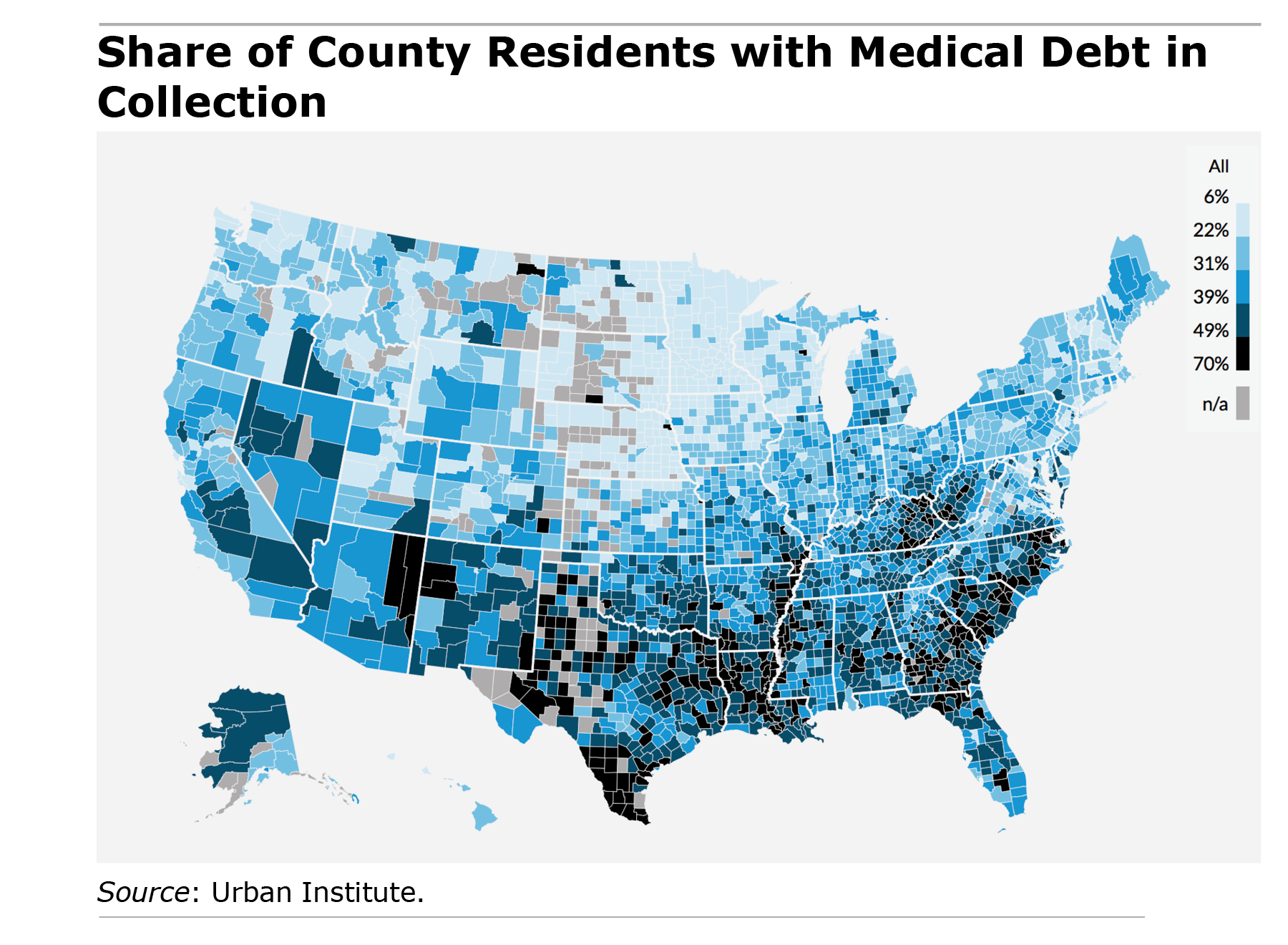

One in five Americans is burdened by unpaid medical bills that have been sent to a collection agency. Medical debt is the most common type of debt in collections.

This burden falls hardest on lower-paid people, who have little money to spare between paychecks. These are the same people the 2014 Medicaid expansion under the Affordable Care Act (ACA) was designed to help. Some 6.5 million additional low-income workers were getting insurance coverage just two years after Medicaid’s expansion, which increased the program’s income ceiling for eligibility in the states that chose to adopt the expansion.

The evidence mounts that this major policy has improved the precarious finances of vulnerable households.

The evidence mounts that this major policy has improved the precarious finances of vulnerable households.

A new study of the regions of the country with the largest percentage of low-income residents found that putting more people on Medicaid has reduced the number of unpaid bills of all kinds that go to collection agencies and cut by $1,000 the amounts that individuals had in collections.

The impact in states that did not expand Medicaid is apparent in Urban Institute data. Five of the 10 states with the highest share of residents owing money for medical bills – North Carolina, South Carolina, Oklahoma, Tennessee and Texas – decided against expanding their Medicaid-covered populations under the ACA option. About one in four of their residents have medical debt in collections.

That’s in contrast to Minnesota, which has one of the most generous Medicaid programs in the country and the lowest rate of medical debt collection of any state (3 percent of residents), said Urban Institute economist Signe-Mary McKernan.

“Past due medical debt is a big problem,” she said. “When [people] have high-quality health care, it makes a difference not only in their physical health but in their financial health.” …

Learn More