Posts Tagged "manage money"

November 10, 2015

Men Save More – Women Save Better

This will not surprise you: men have more money saved for retirement than women.

Men averaged $123,262 in their defined contribution plans, compared with $79,572 for women, according to a new report by Vanguard based on its 2014 recordkeeping data.

Men averaged $123,262 in their defined contribution plans, compared with $79,572 for women, according to a new report by Vanguard based on its 2014 recordkeeping data.

But these figures hide a larger truth: women are actually better at saving for retirement.

“Overall, women are better at this but men earn more money so they have higher wealth accumulation,” says Vanguard researcher Jean Young, author of the new report, “Women versus Men in DC Plans.”

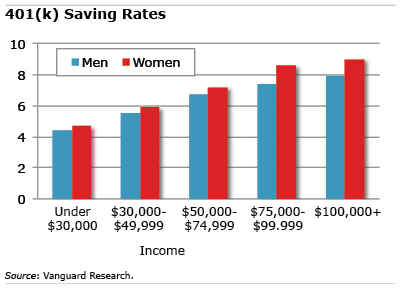

Young’s research found that women are 14 percent more likely to enroll in a voluntary workplace retirement savings plan. Women save 7 percent of pay, compared with 6.8 percent for men, controlling for wages, job tenure, and plan design. They also save at higher rates than men at every income level.

Her findings also refute the old wive’s tale that women don’t like risky investing. …Learn More

October 22, 2015

Polishing the EITC on its 40th Birthday

The Earned Income Tax Credit is a critical lifeline that lifts some 9 million low-income Americans out of poverty – half of them children.

But the federal tax refund program isn’t perfect. The large refunds come just once a year, in the spring tax filing season. A cash crunch is a year-round problem for working families with low or erratic incomes who can’t always pay their bills.

A new study by the Center for Economic Progress identified additional financial benefits from the Earned Income Tax Credit (EITC) when participants in a Chicago pilot project received smaller, regular EITC payments throughout the year.

For example, workers who received the quarterly payments – in May, August, October, and December – were much less likely to have high-rate payday loans than people whose EITCs came all at once, helping program participants to avoid expensive late fees on payday loans. There was also evidence that workers in the EITC pilot accumulated less total debt, though the sample size was small.

The participants surveyed overwhelmingly said they preferred the periodic payments, and they reported lower stress levels than the control group. Shirley Floyd explained why in a previous blog post:

When Floyd receives a one-time tax refund in February, “the entire thing is gone” by March. But each payment she received in the pilot program, she said, allowed her “to do what you need to do.”

The program was run by the Center for Economic Progress, which provides financial services to low-income families. David Marzahl, president, was disappointed that about one-third dropped out of the research pilot, leaving only 217 participants who saw it through to the end. Nevertheless, he feels the pilot confirmed the concept’s potential to help low-income working persons with children and would like to see it expanded into a nationwide program, administered by the IRS. …Learn More

October 15, 2015

High-deductible Health Plans on the Rise

Health insurance is really starting to hurt.

Health insurance is really starting to hurt.

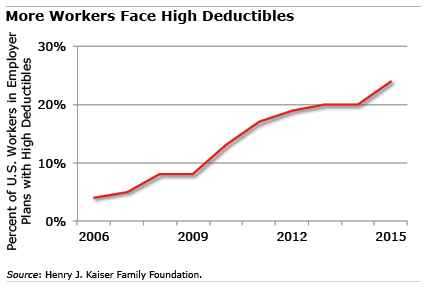

Premium increases and deductible creep, documented in the Kaiser Family Foundation’s comprehensive annual survey of employer health benefits, are eye-popping figures. Although there has been a slowdown in medical inflation and health care spending overall, the growing prominence of high-deductible plans is evidence that more of these costs are shifting to employees.

- One in four workers today is enrolled in a health insurance plan with a high deductible – up from 4 percent a decade ago – exposing them to larger out-of-pocket expenses than traditional health plans if they become ill. [Kaiser’s definition of high-deductible plans is that they are accompanied by a tax-preferred savings plan to help workers pay their medical bills.]

- These deductibles average around $2,000 for single coverage, but they exceed $3,000 for about 20 percent of single workers. Deductibles average $4,350 for a family plan, but nearly 20 percent face deductibles exceeding $6,000.

- Average annual premiums for single workers in these plans range from $773 to $1,021, while family plan premiums are $3,660 to $4,407.

- Everyone’s deductibles are rising much faster than premiums. For example, the share of the annual premium paid by all single workers with health coverage has increased 19 percent since 2010, to $1,071. But their deductibles have risen 67 percent, to $1,077.

- Retiree health care trends, in contrast, might be stabilizing. Since 2009, the share of larger companies offering the coverage to retirees has bounced around between 23 percent and 28 percent.

Employers are also paying more for annual premiums, according to Kaiser – about $1,000 more per single worker than they paid in 2010 and about $2,800 more for a family plan.

But it’s clear from the data that this shared burden falls heavily on employees.

To stay current on our Squared Away blog, we invite you to join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. Learn More

October 6, 2015

Your Aging Parents or Clients: 7 Tips

When Bob Mauterstock asked how many financial advisers in the room had elderly clients showing signs of diminished mental capacity, a few hundred raised their hands.

Next, he asked, how many have a protocol for these clients? Fewer than 10 put up hands.

With the U.S. population over age 85 growing at a rapid clip, advisers increasingly are facing this issue, he explained last week at the Financial Planning Association meetings in Boston. A 2009 Fidelity survey backs him up: 84 percent of advisers said they had clients touched by Alzheimer’s disease.

Mauterstock, the author of “Passing the Torch, Critical Conversations With Your Adult Children,” shared seven tips to help advisers, clients, and their families. While many of his suggestions apply to wealthier people receiving comprehensive financial services, they’re also useful to people dealing with a parent experiencing cognitive decline.

Recognize the symptoms. “Diminished mental capacity is a slow, gradual thing,” he explained. Don’t wait until the signs become crystal clear before taking action. He used the example of his own client – a Harvard-educated anesthesiologist – who started calling repeatedly and asking to speak with his accountant. Mauterstock’s staff gave him the accountant’s phone number – only to get the same call over and over again. Better to recognize the signs early, contact the client’s family, and devise a plan.

Do the Homework. Advisers should have a complete checklist of things to discuss with clients before they experience cognitive issues, from a durable power of attorney to the handling of trusts held in their name. He also recommended documenting client meetings once cognitive decline sets in. Having another adviser in these meetings is in the client’s interest – as well as the adviser’s – and helps ensure that good decisions are being made. An advocate for the client should also sit in, to help with decisions as they become increasingly difficult to work through.

Hold Family Meetings. The most important thing an adviser can do when cognitive decline starts setting in is to ask the client to call a family meeting. …Learn More

October 1, 2015

The Common Struggles of Working People

Brandi and Frank, the hypothetical couple in the above video, are drawn from extensive nationwide interviews with real Americans who work extremely hard, live modestly, and carry their financial anxiety through the day.

Ten of these families were also featured in written profiles by the U.S. Financial Diaries project. Like millions of working Americans, these families are buffeted by economic forces ranging from stagnating paychecks to a scarcity of employer benefits in low-wage jobs. The project identified common traits running through their financial lives.

They are continually trying to improve their lot, with education or by taking on extra jobs and by saving. Retirement saving, however, is a luxury – their saving is done to pay the unanticipated emergency or surprise expenses that inevitably crop up, according to the Diaries, a joint project of New York University’s Financial Access Initiative and the Center for Financial Services Innovation.

Saving for the short-term is also necessary because their sources of income can be erratic, requiring tricky rearrangements of their household resources. When they incur on-the-job expenses, employers’ reimbursements are often slow to arrive. Their monthly expenses often exceed monthly income, which can lead to late payments of utility bills or delays in medical treatment.

The following are short descriptions of some of the families profiled in the Diaries’ worthwhile project …Learn More

September 29, 2015

Don’t Worry About Money. Just Be Happy

The adage that money won’t buy happiness has been proved wrong – at least up to a point. One famous study found that one’s well-being increases as income rises, though the benefits subside around $75,000 per year.

But what about the reverse? Do people who are happy earn more money? Yes, say two British economists.

Their study in the Proceedings of the National Academy of Sciences concluded this after following American teenagers for a more than decade through the National Longitudinal Study of Adolescent Health. In 1994 and 1996, this survey asked high school students to react to statements like “You were happy” and “You felt hopeful about the future.” In a 2008 follow-up survey, when most of them were around age 30, they were asked how much money they were making.

People who reported having a happy adolescence earned about $3,400 more than the average gross income of all the survey respondents; the average was $34,642. However, the opposite effect was more consequential: young adults who had a “profoundly unhappy adolescence” were earning 30 percent less – equivalent to a $10,000 hit to their earning power. …Learn More

September 24, 2015

Changes to Reverse Mortgages Continue

The federal government continues to work out the kinks in its reverse mortgage program. The latest change allows a non-borrower to remain in her home after her spouse, who signed the reverse mortgage, has died.

The federal government established its reverse mortgage program in the 1990s to provide an alternative source of income for retirees over age 62. These Home Equity Conversion Mortgages (or HECMs) are secured by the equity in borrowers’ houses, and the loans are repaid only when they move or die. The loans are federally insured to ensure that borrowers get all the funds they’re promised, even if the lender fails, and that lenders are repaid, even if the value of the property securing the loan declines.

A June 2015 regulation effectively allows lenders to permit a surviving, non-borrowing spouse to remain in the home, postponing loan repayment until she moves or dies. To qualify, the original reverse mortgage must have been approved by the Federal Housing Administration prior to August 4, 2014, and the property tax and insurance payments must be up to date and other conditions met.

The spousal provision adds to earlier changes, detailed in a 2014 report by the Center for Retirement Research, aimed at improving the HECM program’s fiscal viability while protecting borrowers and lenders. These regulations were a response to riskier homeowners who had tapped their home equity to cope with the Great Recession. The regulations reduced the amount of equity that borrowers could extract upfront and also introduced financial assessments of homeowners to ensure they’re able to pay their taxes and insurance. …Learn More