Posts Tagged "manage money"

October 9, 2014

Financial Guides Come in Many Languages

The federal government has added two Spanish-language guides to its multilingual library printed in languages ranging from French to Tagalog, the language of the Philippines.

The Spanish guides (previously available in English) – “Money Smart para Adultos Mayores” (“Money Smart for Older Adults”) and “Cómo Administrar el Dinero de Otras Personas” (“Managing Someone Else’s Money”) – teach seniors and their caregivers how to spot scams and frauds and help caregivers to understand their financial duties.

They are all free of charge and published by the Office for Older Americans in the Consumer Financial Protection Bureau (CFPB).

Other topics also appear in the CFPB’s online table of contents, which permits consumers and financial planners to search by language or by subjects including money management, credit, and mortgages.

Booklets in Chinese and other languages explain the safest ways to send money back home. Mortgage booklets are available in Chinese, French, Haitian Creole, Korean, Tagalog, and Spanish. They explain borrower’s rights, including the additional requirements for lenders’ disclosures to borrowers put in place in the wake of the subprime mortgage meltdown, which also affected immigrant neighborhoods. The Spanish booklets include one on reverse mortgages for retirees.

The library’s table of contents is available here – it requires clicking around to find out what’s available in each language.Learn More

October 7, 2014

Videos Critique Active Stock Investing

This is the sixth video featured in a series of seven that are worth watching.

The new series, “How to Win the Loser’s Game,” takes viewers on an in-depth tour of the financial industry landscape while managing not to be dull. It includes a history of academic research in the finance field and examines the issue of paying high fees for active investment managers.

The big message in the above video has also been covered on this blog: it’s virtually impossible for active managers to consistently outperform the overall market’s return. The solution: buy passive mutual funds and diversify. The evidence presented in the videos, sometimes by academic giants in the field, is compelling.

Click here to watch the remaining videos, which are produced by sensibleinvesting.tv, a non-profit founded by a U.K. financial company.Learn More

October 2, 2014

Primer: Home Equity → Retiree Income

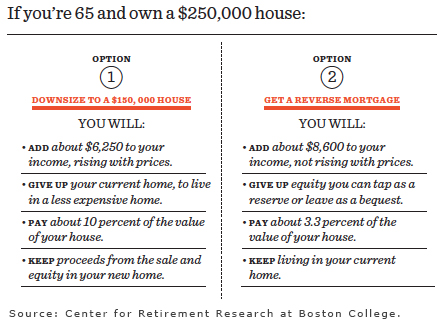

Americans who are 62 or older had an estimated $3.6 trillion in total equity locked up in their homes in the first quarter of 2014, according to the National Reverse Mortgage Lenders Association. A new primer suggests they should start thinking seriously about using it to generate some extra retirement income.

The primer, published by the Center for Retirement Research at Boston College, which sponsors this blog, discusses two ways retirees can use home equity to generate income: by downsizing into a less expensive house or condominium or by taking out a reverse mortgage.

Click here to read the booklet online and learn how these strategies work and how much money each can provide. Their pros and cons are detailed in the graphic below, excerpted from the booklet:

September 30, 2014

Debit Card Beats Cash as Budgeting Tool

Plastic or paper? Americans have spoken.

In 2013, they made $4.1 trillion in purchases on their credit and debit cards, according to the Nilson Report – and that figure keeps marching upward.

Some researchers view this as a dangerous trend. Plastic cards, they contend, put distance between a man and his bank account. Without the tactile sensation of handing over one’s hard-earned cash, it’s easy – too easy – to spend money and harder to save.

New research out of The Netherlands has an entirely different take on the cash versus plastic debate. The study, based on a detailed Internet survey of nearly 1,500 Dutch people about their financial habits, shows that they view the debit card “as the better expense monitoring tool.” (The study compared cash and debit cards, excluding credit cards.) …Learn More

September 2, 2014

Sorting Out Medicare Enrollment Dates

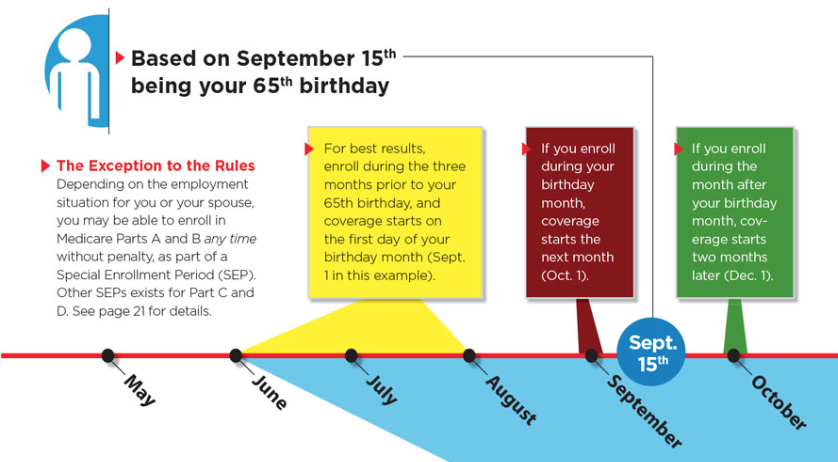

Failing to meet one of Medicare’s many enrollment deadlines can be costly to new or imminent 65 year olds.

The Journal of Financial Planning helps aging baby boomers start out on the right foot with a clear run-down of at least five different enrollment windows for various parts of Medicare.

Getting these dates right is “very tricky,” and people often make mistakes that lead to higher out-of-pocket medical costs and gaps in their coverage, said Katy Votava, president of the consulting firm, Goodcare.com, and author of “Making the Most of Medicare: A Guide for Baby Boomers.”

“They often receive well-meaning but mistaken advice, and then they’re really in a pickle,” she said. “They aren’t eligible to apply when they want to or face penalties down the road. Coverage gaps can be a tremendous financial burden.”

The image displayed was extracted from the Journal’s enrollment timeline, and the entire graphic and a Journal article by Votava can be viewed here. The graphic is worth 1,000 words but here are some important don’t-miss dates: …Learn More

August 26, 2014

A Financial Plan for Alzheimer’s

First, the facts from the Alzheimer’s Association. At age 65, one in nine individuals has Alzheimer’s disease. At 85, the risk exceeds one in three. Its victims are more often women.

In the Ted video above, the global health consultant and writer Alanna Shaikh disclosed that her professor-father had Alzheimer’s. Since it can be hereditary, she’s preparing to possibly share his fate, by keeping her mind active and by learning to do things with her hands, such as knitting.

Shaikh doesn’t discuss financial preparations. But experts have some suggestions, chief among them getting one’s will, health care directive, and perhaps a power of attorney in order. Paramount in this process is finding trustworthy people to handle your affairs. You can also arrange for a lawyer or outside mediator if family members disagree about your care.

The Alzheimer’s Association recommends putting a financial plan in place as soon as there is a diagnosis. “Financial planning often gets pushed aside because of the stress and fear the topic evokes,” the association said in this new booklet. “The sooner planning begins, the more the person with dementia may be able to participate in decision making.” …Learn More

August 19, 2014

Retirees Live on Less

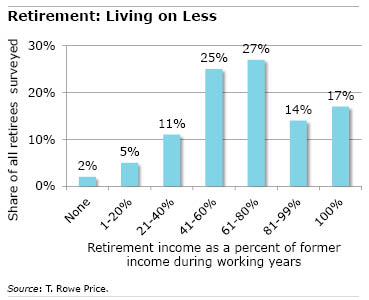

Many recent U.S. retirees in a new survey receive less than two-thirds of what they earned during their working years, and they’ve made significant adjustments along the way.

That finding for baby boomers who’ve retired in the past five years is contained in a larger national survey conducted by T. Rowe Price, the Baltimore mutual fund company. The full survey covered some 2,500 working and retired individuals, age 50 and over. All of them have at least some savings in a 401(k) account.

The majority of the recent retirees reported their annual income is between $25,000 and $100,000. Social Security is the largest single source of that income, and smaller but equal shares come from defined benefit pensions and from retirement savings plans.

Many of the retirees report their households are managing to get by on less than the 70 percent to 80 percent of their pre-retirement income that most financial planners and retirement experts estimate they need. And four out of 10 are living on 60 percent or less.

The retirees surveyed said they’ve had to lower their living standards, and four out of 10 described their situation as adjusting “a great deal.” …Learn More