Posts Tagged "manage money"

December 12, 2013

Navigating the Gift Card Thicket

Too many financial products are far too complex. The pre-loaded cards that people give as gifts during the holidays are a multi-billion-dollar example.

When buying these cards, it’s very hard to know what you’re getting and giving. The big things to watch out for are expiration dates and fees. This isn’t easy.

The federal CARD Act of 2009 covers cards issued by retailers for purchases in their stores and cards issued by banks for use in many places. The law bars these gift cards from expiring for five years after their purchase. They must also maintain their full value for a year. But after the first year, the CARD Act permits one fee per month, and a $5 monthly fee can chew up a $25 gift card’s value pretty fast.

It’s difficult to tell the difference between gift cards and prepaid cards, like Wal-Mart’s Bluebird or the RushCard, sold side by side on grocery store racks. But prepaid cards are not regulated at all by federal consumer protection law, while retail and bank cards are, said Christina Tetreault, an attorney for Consumers Union, the non-profit affiliated with Consumer Reports.

State regulations often offer further consumer protections – and add a layer of complexity for consumers. A card that works one way in a state with strong regulations, such as California, may have few protections if you mail it to a relative in Texas.

The following is just a sample of the intricacies of state regulations. …Learn More

December 3, 2013

Estate Planning 101: Who Knew?

Boston trust attorney Michael Puzo has seen it time and again: people procrastinate about writing a will or putting their estate in order.

“It forces them to face their mortality, and they don’t want to,” he said.

Even those with modest assets – a house, a 401k, and maybe a life insurance policy – should carefully make an estate plan. But are the nuts and bolts of wills and estate planning widely understood?

This question loomed as Puzo translated these legal complexities in a way anyone could grasp during his presentation to employees of Boston College, where Squared Away is based. For readers who may not know where to start, here are 10 fundamentals gleaned from his talk:

A good estate plan achieves four goals:

- Distributes one’s assets to the desired person or people.

- Ensures beneficiaries receive the money when you want them to.

- Makes appropriate bequests either directly or indirectly through a trust, rather than a will.

- Minimizes taxes.

When thinking about a will, get out a blank sheet of paper and write down everything of value that you own, whether it’s a checking account, the house, a wedding ring, or life insurance policy – and who you want to receive each of them.

Many people may be surprised to learn they “have more money than they think they have,” Puzo said.

The difference between probate and non-probate property is critical: …Learn More

November 21, 2013

CFPB Guidance for Financial Consumers

The Consumer Financial Protection Bureau is kicking into gear to help consumers safely navigate the increasingly complex world of financial products.

The Consumer Financial Protection Bureau is kicking into gear to help consumers safely navigate the increasingly complex world of financial products.

The federal agency in recent weeks has released information for homebuyers and for seniors seeking financial advisers. It also accepts complaints about a growing list of financial products.

Homebuyers Seeking Help:

Individuals can search CFPB’s website for experienced home-buying counselors, by state. These counselors are approved by the U.S. Department of Housing and Urban Development.

To find a counselor, click here.

Seniors Seeking Financial Advisers: To help protect older Americans from poor financial advice, CFPB has created a handy guide to help them find a trustworthy adviser. The guidance includes the right questions to ask and the importance of proper certification. …Learn More

November 19, 2013

Housing Market Adds to Seniors’ Equity

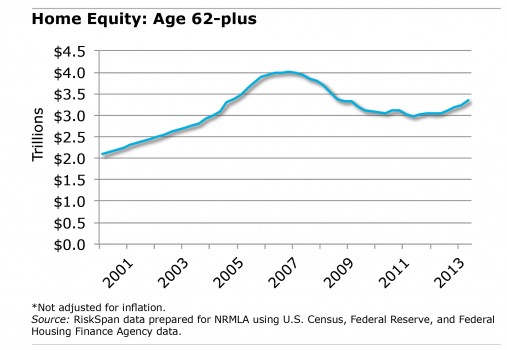

The equity in older Americans’ homes has risen smartly over the past year, fueled by the housing market rebound. But whether retirees will tap these gains to pay their bills remains in doubt.

Equity values for homeowners who are 62 or older was $3.34 trillion in the second quarter of this year – nearly 10 percent above its $3.05 trillion value a year earlier – according to new data released by the National Reverse Mortgage Lenders Association (NRMLA), a trade organization.

Equity values for homeowners who are 62 or older was $3.34 trillion in the second quarter of this year – nearly 10 percent above its $3.05 trillion value a year earlier – according to new data released by the National Reverse Mortgage Lenders Association (NRMLA), a trade organization.

Rising house prices are restoring equity even in places like Florida devastated by the housing market bust. Seniors’ home equity has surged 14 percent there over the past year, to $241 billion in the second quarter of 2013, though it remains far below the levels reached during the bubble.

The equity gains are not being propelled by homeowners paying off their home loans. U.S. seniors owed $1.07 trillion on their mortgages in the second quarter, compared with $1.09 trillion a year earlier, the trade organization said.

The housing market rebound is a reminder that equity is the largest single asset that older Americans hold – it’s worth more than their savings in their 401(k)s and IRAs. But the question remains: does this help them? …Learn More

November 12, 2013

Mortgages: the Closing Cost Minefield

When my new partner and I bought a condominium last month to accommodate our combined stuff, I remembered that borrowing so much money can be an emotional, even terrifying, ordeal.

It’s difficult to think clearly.

But attention should be paid to closing costs, which add to the cost of buying a house. So I decided to apply my skills as a veteran newspaper reporter and grilled my lender, attorney and real estate agent about these costs.

Despite my diligence, I was only modestly successful at reining them in. But I stepped on a few land mines that might help other homebuyers:

The HUD-1 matters:

Federal law requires prospective mortgage lenders to provide loan applicants with a “good faith estimate” of the closing costs within three days after they submit the application. This “GFE” is your lender’s best guess of the final fees they’ll charge for originating your loan.

My lender promptly sent the GFE. But the bank’s salesman promised to reduce the closing costs shown on the GFE, and I had to repeatedly nudge him to provide the more important document: the HUD-1 statement of my actual closing costs. …Learn More

November 7, 2013

Healthcare Credits Reach Middle Class

Individuals earning nearly $46,000 a year and families of four earning $94,000 may be eligible for federal tax credits under the new health care law.

Tax credits are the mechanism by which the federal government caps how much people pay for health insurance premiums, which are set by the private market. The premium caps are based on how much someone earns, relative to the federal government’s definition of poverty.

Here’s an example of how premiums are calculated for, say, young, single workers who earn between $17,236 and $22,980 per year, which is between one-and-one-half and two times the poverty level. The premiums, which range from 4 percent to 6.3 percent of their income, start at about $57 a month for those at the low end of this income range and up to $121 at the high end.

In the following charts, Squared Away converted into dollars the income and premiums that the Henry J. Kaiser Foundation, in its brief on the healthcare law, has expressed as percentages of the U.S. poverty thresholds: …Learn More

November 4, 2013

Affordable Care Act: Who Gets What

The Henry J. Kaiser Family Foundation just released an excellent interactive slide show explaining how the Affordable Care Act addresses the various health insurance and financial challenges facing 47 million uninsured Americans.

Kaiser divided the uninsured into 10 groups – 28 million part-time workers, 8 million adults in their early 20s, and 3.5 million self-employed people, among others – with details about the specific provisions pertaining to each.

There’s a lot of detail here, so focus on the profiles that interest you most. Advance through the slides by clicking the arrow at the bottom of the screen. To return to the home page, click the “house.” …Learn More