Posts Tagged "manage money"

June 27, 2013

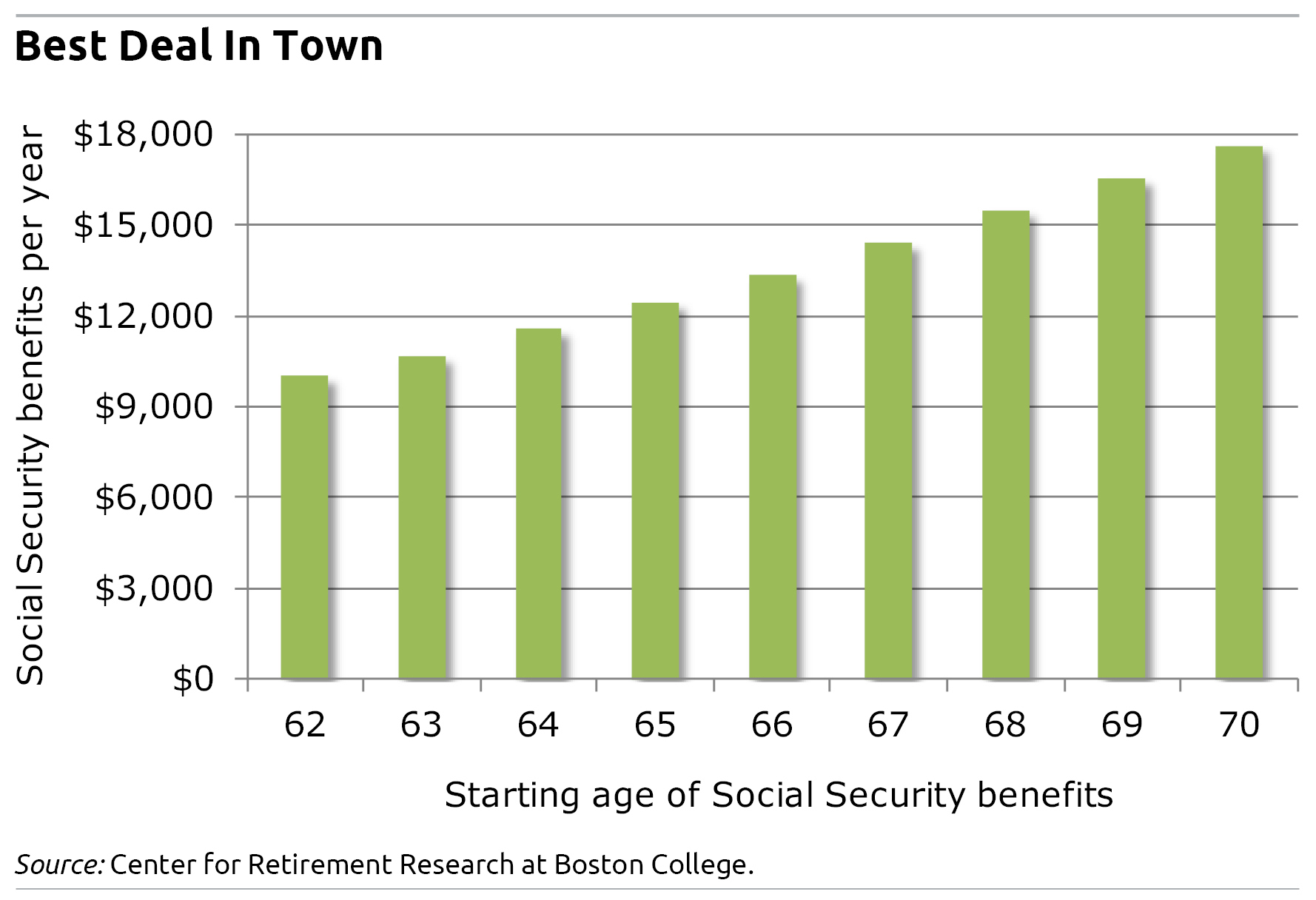

62YO Men File Social Security; Wives Pay

My father was never more in love with my mother than on the day he died in 2004, days before their 50th anniversary.

But he made one bad financial decision that she lives with today: he started up his Social Security benefits at age 62.

He felt he needed the money sooner than later. He had an inadequate pension from his first career, as an Air Force flyboy, and none from his Rust Belt business that went bust. But waiting to claim his Social Security would’ve increased the size of his check – and, after he died at 70, the money that’s still deposited into my mother’s bank account every month.

This happens to a significant share of couples, because almost 40 percent of all Americans claim their benefits the same year they turn 62. But a husband who waits until age 65 can increase his widowed wife’s future benefits by up to $170 a month, according to new research by Alice Henriques, an economist with the Federal Reserve Board in Washington.

What’s interesting about this study of nearly 14,000 older couples is that she teased out how much the husband’s decision was determined by the filing date’s impact on his own benefits, versus the financial impact on his wife’s spousal and, later, her survivor benefits. Similar research in the past had examined the impact of a filing date on their combined benefits during all their years of retirement.

Henriques was able to show that the husbands, when they made their decisions, took into account the impact on themselves of the claiming date they selected. But they showed virtually “no response to the large incentives” of having the ability to provide their widowed wives with more income in the future, she said. …Learn More

June 18, 2013

Are You An Ostrich About Investing?

As the stock market approached and then broke through the 15,000 mark, did you get a little obsessed with your 401(k) balance?

You would not be alone. A novel research project recently analyzed how often investors went online to check their 401(k) accounts and found that they did so more often when the Dow was rising. What could be more pleasant than watching your wealth grow?

The researchers quantified the emotional roller coaster that our investments can take us on by looking at log-on activity during 2007 and 2008 for 100,000 401(k)-style accounts at Vanguard Group Inc. To make sure they were properly measuring investor interest, the sample included only online customers who did not receive paper statements in the mail.

Their analysis gauged how responsive these investors were to stock market swings in either direction, based on the size of one-day market moves. If the Dow increased by 1 percent in a day, for example, the total number of log-ins rose nearly 2 percent. But if the Dow fell by 1 percent, then 2 percent fewer investors checked their accounts.

This human inclination to avoid the pain of losing money has been labeled the “ostrich effect,” because investors respond by putting their heads in the sand when the market is down. …Learn More

June 6, 2013

Nobel Winners Are Unsure Investors

A Los Angeles Times reporter once called up several Nobel laureates in economics to ask how they invest their retirement savings.

One of the economists was Daniel Kahneman, a 2002 Nobel Prize winner who would become more famous after writing “Thinking, Fast and Slow” about the difference between fast, intuitive decision-making and slow, deliberative thinking. Kahneman admitted to the reporter that he does not think fast or slow about his retirement savings – he just doesn’t think about it.

Kahneman’s confession in the 2005 article seems even more relevant in today’s 401(k) world. Americans are realizing the investment decisions imposed on them by their employers may be too complex for mere mortals. For example, three out of four U.S. workers in a 2011 Prudential survey said they find 401(k) investing confusing.

Readers might take comfort in learning that even some of the world’s great mathematical minds have admitted to wrestling with the same issues they do: How do I invest my 401(k)? Should I take some risk? How about international stocks?

Here are the Nobel laureates remarks, excerpted from the article, “Experts Are at a Loss on Investing,” by Peter Gosselin, formerly of The Los Angeles Times:

Harry M. Markowitz, 1990 Nobel Prize:

Harry M. Markowitz won the Nobel Prize in economics as the father of “modern portfolio theory,” the idea that people shouldn’t put all of their eggs in one basket, but should diversify their investments.

However, when it came to his own retirement investments, Markowitz practiced only a rudimentary version of what he preached. He split most of his money down the middle, put half in a stock fund and the other half in a conservative, low-interest investment. …Learn More

May 23, 2013

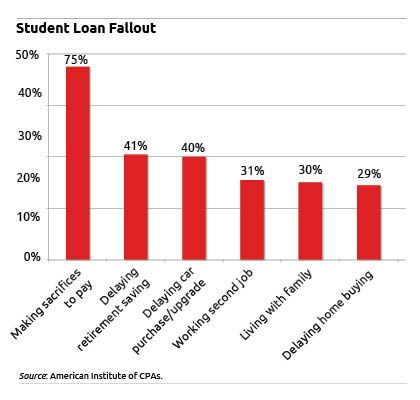

Student Loans = No House, No New Car

Here’s what Will Flannigan, 26, would rather do with the $401.58 he pays on his student loans every month.

• Save.

• Buy a house: the mortgage payment on a house he looked at was the same as his rent, but renovating or fixing anything would be unaffordable.

• Replace his 2006 Ford Focus – it’s red but he calls it a “lemon.”

• Buy new clothes – thrift shops are standard.

• Eat dinner out at someplace other than a fast food restaurant.

Flannigan is getting married in August – to a woman who pays about $250 per month for her college loans.

Flannigan is getting married in August – to a woman who pays about $250 per month for her college loans.

Three out of four people now paying off student debt – whether graduates or their parents – are just like Flannigan: they’re delaying important life goals in order to make their payments, according to a new survey by Harris Interactive sponsored by the American Institute of CPAs (AICPA). About 40 percent also said they have delayed saving for retirement or buying a car, to name just two deferred goals.

This survey, which was random and based on telephone interviews, illustrates the reason behind the growing concern among financial advisers, 20- and 30-somethings, and their parents that paying for a college education has become a burden with financial implications for years, even decades.

“It’s indentured servitude – that’s what it is,” said Flannigan, a Kent State graduate (2010), whose loan payments equal one-quarter of his salary as the online editor of Farm and Dairy, in Salem, Ohio, near Youngstown. Payoff horizon for his $62,000 loans: more than 25 years, according to his loan documents, he said….Learn More

May 16, 2013

Our Mission at Year 2

The best place to invest, the coolest cash back rewards, the smartest or cheapest or lowest-rate mortgage – infinite spin ushers out of the financial world every day, and it’s all aimed at you.

That’s among the reasons the Center for Retirement Research at Boston College started this blog in May 2011. The blog’s focus is not financial products but financial behavior: what people do, why we do it, and how we can do it better. At its two-year anniversary, the Squared Away Blog hopes that it has become a reliable source of information for a growing number of readers of all ages who struggle every day to save and invest for their own or their children’s futures.

It’s important to explain to readers what “reliable” means for a blog housed at a university think tank. First, it’s about credibility. We are not selling anything. The blog is supported by a grant from the U.S. Social Security Administration, which has an interest in making sure Americans get good financial information.

Second, Squared Away routinely covers the latest research – our own or others – about financial behavior, or we use it to inform other articles you’ll read here. That’s because empirical research, which uses statistical analysis to figure out what’s really going on, is critical to understanding and tackling our personal finance challenges. …Learn More

May 14, 2013

Getting What You Need for Retirement

You can’t always get what you want. But if you try sometimes you just might find you get what you need.

Rolling Stones, 1969.

There is nothing better that most people can do to get what they’ll need in retirement than delaying when they start collecting Social Security.

There is nothing better that most people can do to get what they’ll need in retirement than delaying when they start collecting Social Security.

The recent PBS documentary, “The Retirement Gamble,” sounded the alarm for many viewers who may be ill-prepared for the financial challenge of a long life – and not much retirement savings in the bank.

To address this growing issue, financial advisers often emphasize retirement-survival strategies to their baby boomer clients. These strategies revolve around the complexities of figuring out how much to save, how to invest, or the best way to spend one’s 401(k) assets post-retirement.

But the real problem facing most Americans is that they have meager balances in their 401(k)s – or none at all.

Putting off when one claims Social Security “is the best deal in town,” concluded an analysis by Steven Sass, program director at the Center for Retirement Research, which supports this blog. …Learn More

May 9, 2013

How Good Is Your 401(k)?

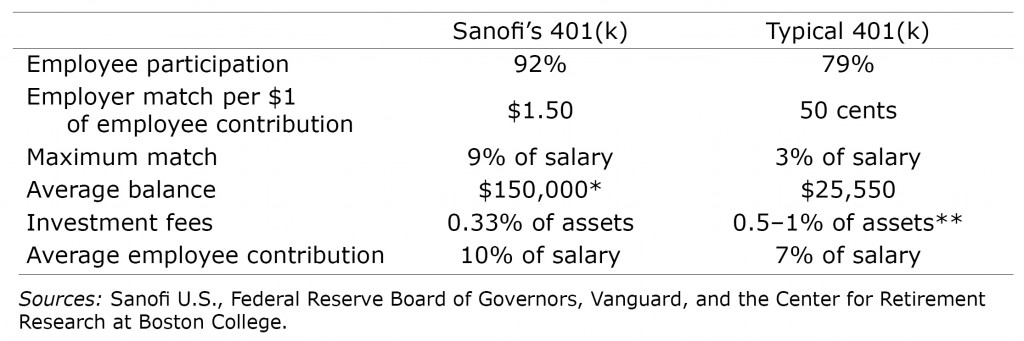

When Sanofi froze its defined benefit pension plan last year, the top brass wanted to make sure its 401(k) was seen as a worthy replacement by the company’s 24,000 U.S. employees and retirees.

Sanofi has succeeded, judging by Plan Sponsor magazine’s designation of the U.S. division of the French pharmaceutical giant as 2013 “Plan Sponsor of the Year.”

In corporate America, 401(k) plans are now the norm: in 2012, only 11 of Fortune magazine’s 100 largest companies still offered a traditional defined benefit pension, according to the consulting firm Towers Watson. But Sanofi U.S. had strong motivation for designing a 401(k) that is generous compared with typical 401(k)s.

The company has “highly technical, highly specialized, highly skilled [employees] that we have to recruit for and retain,” said Richard Johnson, senior director of benefits. “We wanted to ensure our employees had adequate retirement income.”

Squared Away recently interviewed Sanofi executives about their plan’s details, shown below, which readers can compare with 401(k) plans in their own workplaces. We hope you’ll post a comment on Facebook and let us know how, or whether, yours stacks up.

Here how Sanofi compares with other 401(k)s: