Posts Tagged "manage money"

April 25, 2013

Student Debt Binge: How Will It End?

This recent Huffington Post headline captured the march of shocking data about our growing societal burden: “12 Student Loan Debt Numbers That Will Blow Your Mind.”

Here’s a sample:

- The student debt balance has hit $1 trillion and is still rising – it is now exceeded only by mortgage balances, according to the Federal Reserve Bank of New York;

- Student debt is held by 26 percent of households headed by someone between the ages of 35 and 44, and 44 percent of under-35 households, and it’s concentrated in poorer households, according to the Pew Research Center;

- 80 percent of bankruptcy lawyers said student loans were driving more clients through their doors for relief.

It remains unclear where this era of student debt is taking society. Sure, college graduates will bring in another $1 million in earnings over a lifetime. But anyone who’s thought about it can’t help worrying this nationwide borrowing binge may end badly.

To help those grappling with how to pay for the fall semester, feeling the emotional fallout of debt, or trying to understand the larger issues, Squared Away pulled together some relevant blog posts published over the past 18 months.

Click “Learn More” below to read more. …Learn More

April 23, 2013

Financial Boot Camp Helps Army Enlisted

A U.S. Army requirement that newly enlisted men and women complete an ambitious personal finance course is having some impressive results.

At a time when financial education is increasingly being criticized as an ineffective way to raise Americans’ low saving rate, an 8-hour course held on 13 Army bases is significantly boosting how much military personnel are saving for their retirement – among both big and small savers. They also trimmed their debts.

The strong results, described in a new study by William Skimmyhorn, an assistant professor at the U.S. Military Academy at West Point, are also sending a ripple through the financial literacy community.

“The reason this study is so interesting is because it’s so unusual,” said Harvard University’s Brigitte Madrian, co-director of the household finance working group for the National Bureau of Economic Research. “There aren’t a lot of other scientific studies one can point to” that show empirically that financial education can improve an individual’s well-being, she said. …Learn More

April 16, 2013

Women “Reactive,” Not Planning Finances

What motivates women to get to work on their personal finances? Change.

Emotions are also important motivators. But “the most compelling factor” spurring most of the women interviewed in a focus group to take action was a significant life change, Utah State University researchers write in the Journal of Financial Counseling and Planning.

Since April is financial literacy month, Squared Away is again making an appeal to women, who continue to make strides professionally, yet lag men in understanding how to manage their money.

“Major life changes like a premature death of a spouse or divorce are often the wake-up call to people to reassess their lives,” said Utah State researcher Jean Lown, who also teaches a workshop, Financial Planning for Women.

This tendency isn’t necessarily a good thing for women. Rather than being “reactive,” she said, women need to learn to plan ahead and prepare for the future.

For Megan Rowley, who conducted the focus group, the women’s stories hit home. While Rowley pursued her master’s and worked full-time at Utah State, her husband left a part-time job to complete his MBA. After they graduated, he found employment at a pipeline company in Salt Lake City, and she became a stay-at-home mother, said Rowley, who wants to become a financial counselor when her three young children are older. …Learn More

March 28, 2013

Store, Online Browsing Can Be Dangerous

Impulse purchases – new spring clothes or an expensive dinner out – can create a rush. But a few minutes of pleasure can blow a hole in the budget for a month. If it’s chronic, it can eat into savings for a down payment or retirement.

The reason for these rash decisions is obvious: see it, want it. But for people who want to better understand – and prevent – their impulse buys and remain on budget, FinCapDev, which is hosting an online competition for a financial literacy app, recently posted a reading list of three research papers that explain why we can’t resist buying stuff.

- One study has confirmed that store browsers actually are vulnerable to impulsive purchases, because the act of browsing through a store’s merchandise produces positive feelings. “It is a state of high energy, full concentration, and pleasant engagement,” researchers wrote in a 1998 paper that is probably relevant to online browsing. Can you relate? …

March 26, 2013

Long-Term Care Needs Sneak Up On Us

As I sat in an orthopedist’s office last week watching the doctor poke and prod my mother’s legs – an irritated nerve may be causing her severe pain – this thought struck me: long-term care is often an unspoken topic but one of enormous magnitude.

I’ve always taken for granted that my active mother, who plays a killer game of bridge, wouldn’t need much medical attention for another 15 years. I have evidence of this, I’d convince myself: her mother lived to age 92 and some uncles lived even longer. The pain makes it difficult for my mother to walk her dog, though she gamely hobbles through her day and even insists on league bowling on Wednesdays.

It’s so much easier to shove aside worries about long-term care for the elderly – our own or our parents’ – than it is to contemplate the financial and deeply emotional issues required to care for an aging parent. The video below tells a true story about what happens when the requirements of care slam us hard, as they often do.

Violet Garcia is a single mother of Filipino descent living in Kodiak, Alaska, which is situated on an enormous island south of Anchorage. The public school worker cares for her elderly mother, who can’t be left alone. Garcia aspires to send her middle son away to college soon, but that will create a problem on Sundays, when he takes care of his grandmother so his mother can run errands. …

March 19, 2013

2008-09: Investors Really Did Sell Low

Repeated loud warnings by financial advisers fail to reverse the human tendency to panic when the market plunges and to rush in after it’s gone up.

Withdrawals from 401(k)s and IRAs surged between 2001 and 2003 after high-tech stocks declined, but the money went back in in 2005 through 2007 after the S&P500 index had soared nearly 27 percent in 2003 and 9 percent in 2004, according to new research by Thomas Bridges, a graduate student in economics, and Professor Frank Stafford, for the University of Michigan Retirement Research Center.

“They think I have $500,000, and if I don’t take it out now it’s going to be $50,000. It’s a panic mentality,” said Stafford, who was surprised by what they found.

Withdrawals increased again after the 2008-2009 market collapse pummeled investors stock portfolios. The Michigan researchers found they withdrew their retirement savings for a variety of reasons, but primarily to pay mortgages and medical bills and also to make major home repairs.

His take on these grim findings: “These are the guys from Main Street trying to figure out Wall Street, and they can’t do it.”Learn More

February 28, 2013

The IRA Tax Deduction Beckons

At tax time, many Americans think, often fleetingly, about spending less and socking away more for retirement.

Until April 15, the IRS permits people who do not have a pension plan at work to deduct up to $6,000 for money placed in an IRA; taxpayers who do have an employer pension can also receive the IRA deduction if their earnings fall under the IRS’ income limits.

The tough question that trips people up is: How much will I need?

The easy way to think about this is in terms of the income necessary to maintain your current standard of living after the paychecks stop coming in. Click here for a tool that estimates both how much you’ll need and how much you’ll have if you continue on your current path.

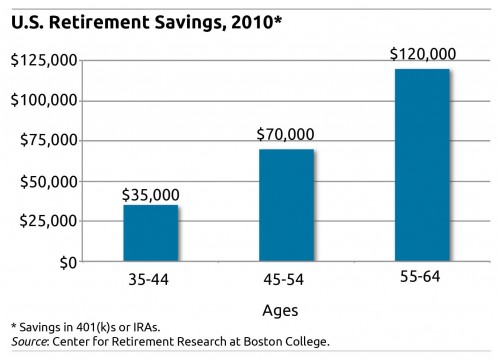

The calculator, created by the Center for Retirement Research, which supports this blog, was designed for people over 50 and on the retirement runway. Younger people can also get a ballpark idea of how they’re doing using the calculator. Or click here for the percent of your wages to put into a tax-deferred retirement fund.

This is a beta website with a few kinks, and it works smoothly only on the Safari and Google Chrome browsers. But the results are sound and backed by academic research. Here’s how to read the results. …Learn More