Posts Tagged "older workers"

April 9, 2020

Social Security Tapped More in Downturn

It happened after the 2001 and 2008-2009 recessions, and it will happen again. Some older workers who lose their jobs will turn, in desperation, to a ready source of cash: Social Security.

In the wake of a stock market crash like the one we just experienced, baby boomers’ first inclination will be to remain employed a few more years to make up some of the investment losses in their 401(k)s. But as the economy slows and layoffs mount, that may not be an option for many of the unemployed boomers, who will need to get income wherever they can find it.

Age 62 is the earliest that Social Security allows workers to start their retirement benefits. In 2009, one year after the stock market plummeted, 42.4 percent of 62-year-olds signed up for their benefits, up sharply from 37.6 percent in 2008, according to the Center for Retirement Research (CRR).

Social Security is a critical source of income even in good times. One out of two retirees receives half of their income from the program, and they can also count on it when times get tough.

But the financial cost of starting Social Security prematurely is steep, because it locks in a smaller monthly benefit for the rest of the retiree’s life. For those who can wait, the size of the monthly check increases an average 7 percent to 8 percent per year for each year claiming is delayed up until age 70.

Unfortunately, the people who claimed Social Security early in the wake of the 2001 recession had fewer financial resources to begin with – namely, their earnings were lower, they had less wealth, and they were less likely to have a spouse to fall back on – according to the CRR study.

“These simple characteristics suggest that those hardest hit by recessions are most likely to use Social Security as an income-insurance policy,” the researchers concluded. …Learn More

March 3, 2020

Pre-Retirement Debt is Rising Over Time

Baby boomers have a lot more debt than their parents did.

Baby boomers have a lot more debt than their parents did.

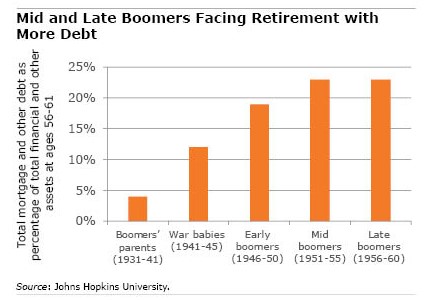

By all accounts, the parents were in pretty good shape for retirement because they held their debt levels down to a mere 4 percent of their total assets in the years immediately before retiring – ages 56 to 61 – according to a new study.

At those same ages, the typical baby boomers’ debt has ranged from 19 percent to 23 percent of their assets, thanks in large part to the 2008 drop in stock portfolios and in the housing market.

Generational trends in debt levels are difficult to analyze, and the issue is far from settled among researchers. This study notes, for example, that the situation might not be as grim as the rising debt indicates.

The broad numbers hide the positive step boomers have taken – just as earlier generations did – to reduce their debt as they moved through their 50s. And although the younger boomers have fewer assets than older boomers had at that stage of life, the younger boomers are also working to improve their finances by paying down their mortgages at an accelerated pace.

But the analysis also uncovered another troubling trend for the baby boomers born in the middle of the demographic wave: about 10 percent of them had more debt during their late 50s than their assets were worth. When their parents were that age, some of the most indebted of them still had more assets than debts.

In his study, Jason Fichtner of Johns Hopkins University compared debt-to-asset ratios for five different age groups, starting with the boomers’ parents, who were born during the Great Depression, and running through the people who were born toward the tail end of the baby boom. The chart above is a financial snapshot of rising debt-to-asset ratios for each group when they were between ages 56 and 61. …Learn More

January 7, 2020

Credit Cards are the Most Stressful Debt

Debt is stressful. But did you know your stress level depends on the type of debt you have?

Credit cards cause far more stress than first mortgages and lines of credit, a study by Ohio State researchers finds. The more striking finding is that reverse mortgages, which allow people over age 62 to tap the equity in their homes, may reduce stress – at least temporarily.

The researchers used a simple example to illustrate the magnitude of credit card stress. Charging $640 on a card is as stress-producing as adding $10,000 to a mortgage. Credit cards are more stressful than home loans, because the balances on high-rate cards increase quickly when they’re not paid off, and the debt is not backed by an asset.

The researchers considered households to be debt-stressed if they said in a survey that they have had recent difficulty paying bills or have generally experienced financial strains.

This study focused on people over 62. As the share of older Americans carrying debt into retirement has increased, so have the amounts they owe. Debt arguably is very stressful for older workers, who have a dwindling number of years to get their finances under control before retiring, and for retirees, who have to live on fixed incomes.

The findings for reverse mortgages were nuanced – and interesting. Reverse mortgages create less stress than a standard mortgage and are much less stressful than consumer debt. On average, four years after taking out a reverse mortgage, the household’s stress level is 18 percent lower than it was at the time of the loan’s origination, according to the researchers, who did the study for the Retirement and Disability Research Consortium.

But things can change over time. Retirees often use federally insured reverse mortgages to pay off debt or as a regular source of income. But the amount owed on a reverse mortgage increases over time, because retirees do not have to make payments, and the interest compounds. (The loans are paid off when the owner either sells the house or dies.) …

Learn More

February 26, 2019

Baby Boomer Labor Force Rebounds

One way baby boomers adjust to longer lifespans and inadequate retirement savings is to continue working. There’s just one problem: it can be more difficult for some people in their 50s and 60s to get or hold on to a job.

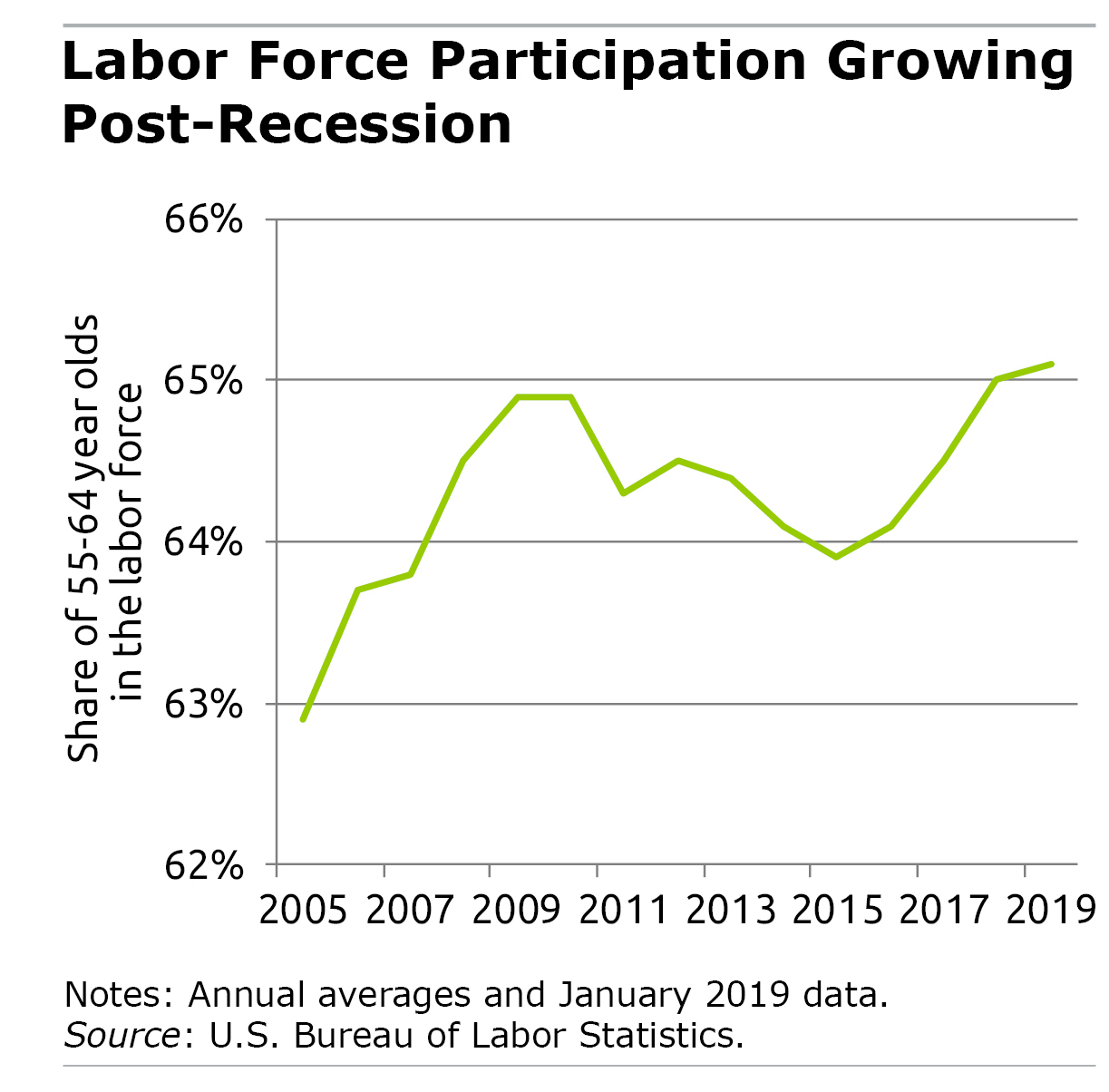

But things are improving. The job market is on a tear – 300,000 people were hired in January alone – and baby boomers are jumping back in. A single statistic illustrates this: a bump up in their labor force participation that resumes a long-term trend of rising participation since the 1980s.

But things are improving. The job market is on a tear – 300,000 people were hired in January alone – and baby boomers are jumping back in. A single statistic illustrates this: a bump up in their labor force participation that resumes a long-term trend of rising participation since the 1980s.

In January, 65.1 percent of Americans between ages 55 and 64 were in the labor force, up smartly from 63.9 percent in 2015. This has put a halt to a downturn that began after the 2008-2009 recession, which pushed many boomers out of the labor force. The labor force is made up of people who are employed or looking for work.

The recent gains don’t seem transitory either. According to a 2024 projection by the U.S. Bureau of Labor Statistics, the older labor force will continue to grow. The biggest change will be among the oldest populations: a 4.5 percent increase in the number of 65- to 74-year olds in the labor force, and a 6.4 percent increase over age 75. …Learn More

February 14, 2019

Careers Become Dicey After Age 50

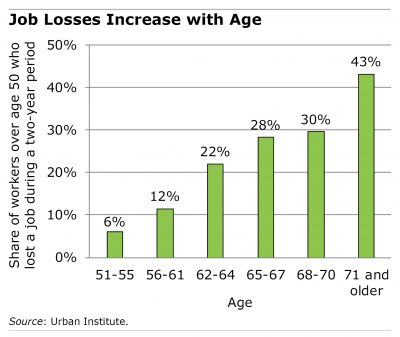

A new study lays out all the difficulties older workers have holding onto a job so they can retire on their own terms – even when the economy is doing well.

Over the past quarter of a century, more than half of the older Americans who had been employed in stable jobs have been pushed or nudged out of employment at some point late in their careers. This could’ve happened due to a layoff, a bad supervisor, difficult or dangerous working conditions, inadequate pay or a missed promotion.

Over the past quarter of a century, more than half of the older Americans who had been employed in stable jobs have been pushed or nudged out of employment at some point late in their careers. This could’ve happened due to a layoff, a bad supervisor, difficult or dangerous working conditions, inadequate pay or a missed promotion.

This finding from a Urban Institute study throws into question “the notion that most seasoned workers who are strongly attached to the labor force can remain at work and earn a stable income until they choose to retire,” the researchers said.

The study details the many challenges older workers are dealing with: …Learn More

February 12, 2019

Check Out Our Retirement Podcasts

Thousands of baby boomers retire every day and sign up for Social Security. Yet the payroll tax that funds their benefits is being levied on a shrinking share of workers’ aggregate earnings.

You might not know this but inequality and growing U.S. trade with China are among the forces that are behind this trend, Gal Wettstein explains in a new podcast about his research for the Center for Retirement Research (CRR).

This is the latest in a series of podcast interviews in which CRR researchers talk about their work on issues related to work, aging, and retirement. The podcasts are hosted by yours truly.

Others explore how motherhood reduces women’s Social Security benefits, the limited impact of cognitive decline on older workers, and the disparate impact of the same retirement age on different types of workers.

The podcasts – “CRR essentials” – are available in iTunes and online on the Center’s website. …Learn More