Posts Tagged "pension"

April 1, 2021

What the Research Can Tell us about Retiring

It’s difficult to envision what life will look like on the other side of the consequential decision to retire.

But research can help demystify what lies ahead – about the decision itself, the financial challenges, and even the taxes. Readers understand this, as evidenced by the most popular blog posts in the first three months of the year.

Here are the highlights:

The retirement decision. The article, “Retirement Ages Geared to Life Expectancy,” attracted the most reader traffic. Myriad considerations go into a decision to retire. But a sense of whether one might live a long time – because of good health or simply seeing that parents or neighbors are living unusually long – is a compelling reason to postpone retirement either to remain active or to build up one’s finances to fund a longer retirement.

A recent study found that as men’s life spans have increased, they have responded by remaining in the labor force longer, especially in areas of the country with strong job markets and more opportunity. This is also true, though to a lesser extent, for working women.

The planning. The second most popular blog was, “Big Picture Helps with Retirement Finances.” It described the success researchers have had with an online tool they designed, which shows older workers the impact on their retirement income of various decisions. When participants in the experiment selected when to start Social Security or how to withdraw 401(k) funds, the tool estimated their total retirement income. If they changed their minds, the income estimate would change.

The tool isn’t sold commercially. But it’s encouraging that researchers are looking for real-world solutions to the financial planning problem, since the insights from experiments like these often make their way into the online tools that are available to everyone.

The taxes. It’s common for a worker’s income to drop after retiring. So the good news shouldn’t be surprising in a study highlighted in a recent blog, “How Much Will Your Retirement Taxes Be?” Four out of five retired households pay little or no federal and state income taxes, the researchers found. But taxes are an important consideration for retirees who have saved substantial sums. …Learn More

March 10, 2020

Hypertension, Arthritis? Keep Working!

The growing list of effective medications available for managing a variety of chronic conditions seem to be changing the way we work and retire.

For example, older workers at one company who suffer from arthritis and high blood pressure – two relatively easy conditions to treat – are able to keep working just like their healthier co-workers, according to a new study from a research consortium funded by the U.S. Social Security Administration.

In fact, the two specific groups in this study – employees with hypertension or a combination of arthritis and hypertension – actually worked an average of four to 10 months longer, respectively, than the healthy workers. This counterintuitive finding might owe to the fact that people with chronic conditions are motivated to work longer to maintain their employer health insurance. Another possibility is that, because of their condition, they pay closer attention to their overall health and take better care of themselves.

The researchers, who are from Stanford University’s Medical School and Princeton University, had the advantage of access to nearly 4,700 employees’ detailed medical records, which allowed them to track how their health progressed over an 18-year period, until they retired.

A limitation of the study is that the employees aren’t representative of the general working population. They were mainly white men employed in Alcoa smelters and fabrication plants around the country. And because it was very common for them to join the company in their 20s and qualify for a 30-year pension, their average retirement age was only 58.

But older workers in a wide variety of professions are reckoning with the need to work longer than they might have planned so they can afford to retire.

A chronic medical condition doesn’t have to be a barrier to working as long – or even longer – than everyone else. …Learn More

September 3, 2019

Second Careers Late in Life Extend Work

Moving into a new job late in life involves some big tradeoffs.

What do older people look for when considering a change? Work that they enjoy, fewer hours, more flexibility, and less stress. What could they be giving up? Pensions, employer health insurance, some pay, and even prestige.

Faced with such consequential tradeoffs, many older people who move into second careers are making “strategic decisions to trade earnings for flexibility,” concluded a review of past studies examining the prevalence and nature of late-life career changes.

The authors, who conducted the study for the University of Michigan’s Retirement and Disability Research Center, define a second career as a substantial change in an older worker’s full-time occupation or industry. They also stress that second careers involve retraining and a substantial time commitment – a minimum of five years.

The advantage of second careers is that they provide a way for people in their late 40s, 50s, or early 60s who might be facing burnout or who have physically taxing jobs to extend their careers by finding more satisfying or enjoyable work.

Here’s what the authors learned from the patchwork of research examining late-life job changes:

People who are highly motivated are more likely to voluntarily leave one job to pursue more education or a position in a completely different field, one study found. But older workers who are under pressure to leave an employer tend to make less dramatic changes.

One seminal study, by the Urban Institute, that followed people over time estimated that 27 percent of full-time workers in their early 50s at some point moved into a new occupation – say from a lawyer to a university lecturer. However, the research review concluded that second careers are more common than that, because the Urban Institute did not consider another way people transition to a new career: making a big change within an occupation – say from a critical care to neonatal nurse. “Unretiring” is also an avenue for moving into a second career.

What is clear from the existing studies is that older workers’ job changes may involve financial sacrifices, mainly in the form of lower pay or a significant loss of employer health insurance. But they generally get something in return: more flexibility. …Learn More

July 11, 2019

Video: Retirement Prep 101

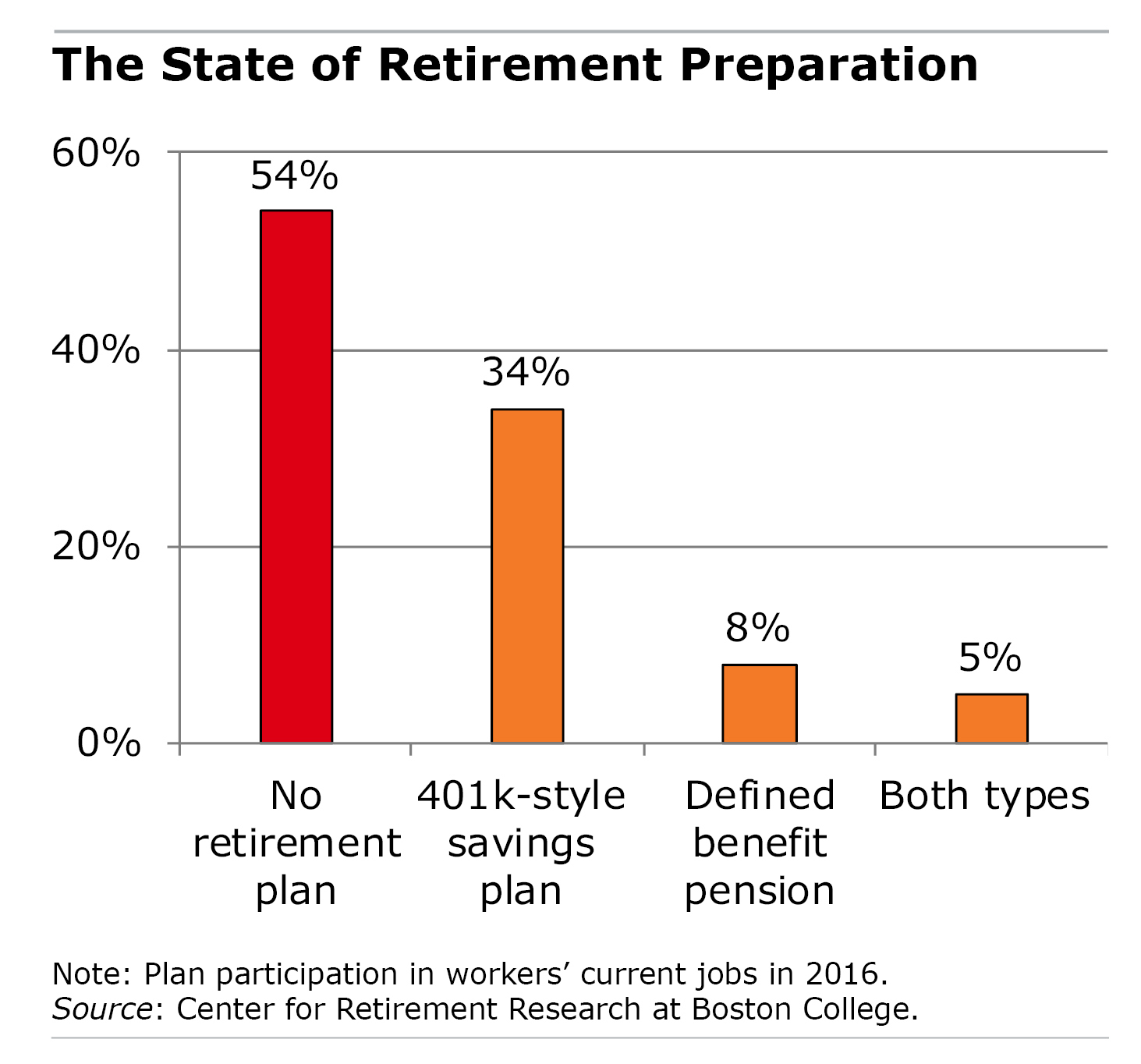

Half of the workers who have an employer retirement plan haven’t saved enough to ensure they can retire comfortably.

This 17-minute video might be just the ticket for them.

Kevin Bracker, a finance professor at Pittsburg State University in Kansas, presents a solid retirement strategy to workers with limited resources who need to get smart about saving and investing.

While not exactly a lively speaker, Bracker explains the most important concepts clearly – why starting to save early is important, why index funds are often better than actively managed investments, the difference between Roth and traditional IRAs, etc.

Some of his figures are somewhat different than the data generated by the Center for Retirement Research, which sponsors this blog. But both agree on this: the retirement outlook is worrisome.

Some of his figures are somewhat different than the data generated by the Center for Retirement Research, which sponsors this blog. But both agree on this: the retirement outlook is worrisome.

The Center estimates that the typical baby boomer household who has an employer 401(k) and is approaching retirement age has only $135,000 in its 401(k)s and IRAs combined. That translates to about $600 a month in retirement.

Future generations who follow Bracker’s basic rules should be better off when they get old. …Learn More

May 24, 2018

Public Pension Cuts Hit Recruitment

West Virginia teachers started the wave of strikes over pay.

Photo courtesy of Janet Bass, American Federation of Teachers

Teachers’ strikes and walkouts over inadequate pay – in Arizona, Kentucky, Louisiana, North Carolina, Oklahoma, and West Virginia – are making news this spring. In Oklahoma, half the people who’ve left teaching recently said pay was their top reason for moving on.

A wave of reductions in another significant form of compensation – pensions – also appear to be making state and local governments a less appealing place to work, according to researchers Laura Quinby, Geoffrey Sanzenbacher, and Jean-Pierre Aubry at the Center for Retirement Research, which publishes this blog.

Pensions have traditionally been the great equalizer for governments trying to recruit people from the higher-paying private sector. But benefit cuts, which had been fairly uncommon, gained momentum after the 2008 stock market crash that battered pension funds’ already declining finances.

The pace of cost-cutting reforms peaked in 2011, when 134 state and local government plans made some type of cuts that year. They run the gamut from increasing the tenure requirement or retirement age applied to new employees’ future pensions to trimming the cost-of-living adjustment on all pensions. …Learn More

May 3, 2018

‘Do I Have a Pension?’ Sleuths Can Find it

Betty Taylor is 74 and retired from a job she held for more than a decade filling Spiegel catalog orders and packing them up for shipping – she left in 1984. Diane Taylor, 70, was a packer and then a keypunch operator there between 1982 and 1995.

But the sisters, who live together in their late mother’s house on Chicago’s Southwest Side, couldn’t track down anyone who could confirm that their low-paying jobs entitled them to Spiegel pensions.

This is more common than one might think.

When a single employer or union has continued to maintain its pension plan over several decades, retiring workers know where to go to sign up for their benefits. But the sisters’ pensions got lost amid the confusion and paperwork shuffle around a series of mergers, bankruptcies, and name changes at Spiegel.

The confusion dates back to 1988, when the catalog company, which was founded by Joseph Spiegel after the Civil War, purchased Eddie Bauer. By 2003, Spiegel, loaded down with debt, was filing for bankruptcy protection and was subsequently acquired by the investors in Spiegel’s sole remaining asset, Eddie Bauer. The investors later transferred Spiegel’s pensions to Eddie Bauer’s corporate entity. In 2009, Eddie Bauer also went into bankruptcy, sending the pension funds to their final resting place: the federal Pension Benefit Guaranty Corporation (PBGC), which insures the pensions of failing companies.

Diane felt that a pension, if it existed, could really help out with her precarious finances. And she was pretty certain she remembered a pension from her years at Spiegel. So she started calling around.

“I got the runaround for four years,” she said. “I was persistent, and I was going to keep on until I had one foot in the grave,” Diane said. …Learn More