Posts Tagged "psychology"

November 13, 2012

Women Don’t Ask

Why do men earn more than women? Attitude!

Last week on Squared Away, Francine Blau, a Cornell University labor economist, discussed the economic and other external reasons behind why women earn less than men. But there’s another way to look at it: women’s behavior differs from men’s – and that plays a role in how much they’re paid.

A woman earns 77 cents for every dollar that a man earns. This disparity undermines women’s well-being, reducing their standard of living and affecting everyone’s retirement – including their husband’s.

The following is an excerpt from a June 2003 article I wrote as a Boston Globe a reporter about an experiment by researcher Lisa Barron, a professor of organizational behavior at the Graduate School of Management at the University of California, Irvine. It involved 38 future MBAs – 21 men and 17 women – who participated in mock job interviews with a fictitious employer.

In the mock interviews, the students were offered $61,000 for a new position. Here’s what I wrote about the differences in men’s and women’s approaches to their pay negotiations:

Men, responding to the salary offer, asked for $68,556, on average, while women requested $67,000 for the same job.

More revealing were differences in fundamental beliefs men and women expressed about themselves when Barron questioned them: 70 percent of the men’s remarks indicated they felt entitled to earn more than others, while 71 percent of women’s remarks showed they felt they should earn the same as everyone else. Also, 85 percent of men’s remarks asserted they knew their worth, while 83 percent of women’s remarks indicated they were unsure. …Learn More

October 23, 2012

401(k)s “Top” Financial Priority. Really.

A large majority of people in a survey released last week identified saving for retirement as their top financial priority. If that’s the case, then why aren’t Americans saving enough?

Stuart Ritter, senior financial planner for T. Rowe Price, the mutual fund company that conducted the survey, has some theories about that. Squared Away is also interested in what readers have to say and encourages comments in the space provided at the end of this article.

But first the survey: about 72 percent of Americans identified saving for retirement as “their top financial goal,” with 42 percent saying that a contribution of at least 15 percent of their pay is “ideal.”

Yet 68 percent said they are saving 10 percent or less, which Ritter called “not very much.” The average contribution is about 8 percent of pay, according to Fidelity Investments, which tracks client contributions to the 401(k)s it manages.

The Internal Revenue Service last week increased the limit on contributions to 401(k) and 403(b) retirement plans from $16,500, to $17,000. The so-called “catch-up” contribution available to people who are age 50 or over remains unchanged at $5,500.

The question is: why do Americans give short shrift to their 401(k)s, even as people become increasingly aware that their dependence on them for retirement income grows? Ritter offered a few theories in a telephone interview last week:

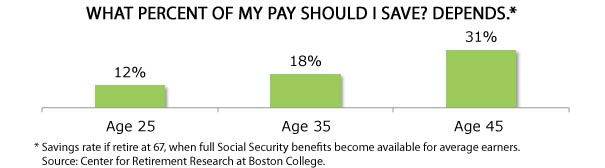

- The financial industry is partially to blame. “We have done a really good job of conveying to people how important saving for retirement is,” he said, “but what we haven’t done as good a job of is telling them how much to save.”

Employers may also share blame. Further confusing the issue, the savings rate depends on when the employee starts saving – the percent of pay is lower for those who start in their 20s than for someone who waits until they’re 45. …

September 25, 2012

401(k) Fund Choices: Less is More

New research suggests that the more mutual funds your 401(k) offers, the more likely you are to take the easy way out to escape the mental gridlock.

The typical 401(k) has seven mutual fund investment options, but some have as many as 21 funds. We may think we like choices, but behavioral research has shown that people simply can’t handle so many options – that’s why some employers have turned to auto enrollment in their 401(k)s or picking investments for workers who can’t or won’t make the decision.

A new study building on prior research finds that the more investment options an employee has the more likely he or she is to simply divide the money evenly among those options. This can potentially reduce the diversification in employees’ retirement portfolios, with long-term consequences.

“We find that considering a larger number of funds to invest in may be overwhelming for many investors,” said the research, by Gergana Nenkov and colleagues at Boston College, as well as Rutgers University, the University of Pittsburgh, and the University of Texas, Austin. Splitting the money evenly is how we cope.

“We just don’t have enough capacity to sift through the options that are out there,” Nenkov explained in an interview. Employees aren’t financial experts, and asking them to make these decisions is often “too much,” she said, and may even be “making us unhappy.”

The focus is on 401(k) choices in this study, recently published in the Journal of Marketing Research, But the argument may apply to the proliferation of all kinds of complex financial products, including credit cards charging different rates for balance transfers, purchases and cash advances, as well as debit cards with hidden fees and mortgages with complicated terms.

Multiple products act to prevent consumers from comparison shopping. But the demise of the defined benefit plan and the sudden responsibility thrown on employees to manage tens or hundreds of thousands of dollars in their personal investment portfolios is clearly more than many of us can handle. Don’t feel bad either – Nenkov, who has a PhD in marketing, admits to feeling overwhelmed by the choices. (As does this blog writer.) …Learn More

September 4, 2012

Flatline: U.S. Retirement Savings

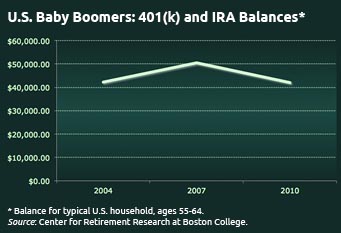

Baby boomers’ balances in 401k and IRA accounts have barely budged for most of the past decade.

In 2004, the typical U.S. household between ages 55 and 64 held just over $45,000 in their tax-exempt retirement plans. Plan balances for people who fell in that age group in 2007 rose but settled back down after the biggest financial crisis in U.S. history. In 2010, they were $42,000, a few bucks lower than 2004 balances.

These are among the reams of sobering data contained in the Federal Reserve’s 2010 Survey of Consumer Finances released in June. The $42,000 average balance is for all Americans – it includes the more than half of U.S. workers who do not participate in an employer-sponsored savings program.

There’s more bad news buried in the SCF: the value of other financial assets such as bank savings accounts dropped in half, to $18,000. And hardship withdrawals from 401(k)s have increased, to more than 2 percent of plan participants, from 1.5 percent in 2004.

There’s more bad news buried in the SCF: the value of other financial assets such as bank savings accounts dropped in half, to $18,000. And hardship withdrawals from 401(k)s have increased, to more than 2 percent of plan participants, from 1.5 percent in 2004.

So, where did all that wealth created by the longest economic boom in U.S. history go? The 2008 financial collapse didn’t help. But we can also blame the baby boom culture. Click here to read a year-ago article that examines the cultural reasons for the troubling condition of our retirement system.

To receive a weekly email alerts about new blog posts, click here.

There’s also Twitter @SquaredAwayBC, or “Like” us on Facebook!Learn More

August 28, 2012

What’s Up With Women?

The share of women enrolled in college is increasing, and more women are breaking into the top tier of business, government and non-profits.

But at the same time that women are achieving more status than at in any time in history, we still know much less than men about money and finance. What’s up with that?

Financial literacy is important to women, because they live longer and need more retirement savings. Another reason this matters is that women are, according to a recent federal report, more financially vulnerable than men, particularly when they become divorced, widowed, or retired.

Anyone who is not savvy “will have a much tougher time preparing themselves for retirement,” Roger Ferguson, the president of the TIAA-CREF retirement system, said at the retirement research conference in Washington.

In a now-famous survey designed by Annamaria Lusardi, a professor at the George Washington University School of Business, and Olivia Mitchell at The Wharton School, only one in five American women who were asked three simple financial questions got them all right.

And the problem of financially illiterate women is universal. Lusardi recently fielded her survey on a global scale and found the same abysmal results. “Whether you look at the Netherlands or Sweden or Italy or the U.S. – these are very different countries – women know less than men,” she said.

She is, nevertheless, optimistic, because women are also more likely to admit what they do not know. Half of women in a separate U.S. study said they didn’t know the survey answers, while only one-third of men did. This admission can be viewed as “a good thing for women,” Lusardi said.Learn More

July 24, 2012

Little Thought Put Into Retirement Date

When to make the break and apply for Social Security benefits is one of the biggest financial decisions an individual will make. But new research suggests that people may put more thought into buying a car or a mattress.

The goal of a new research study was to determine how people make this critical decision and how to possibly influence them to delay claiming – delaying is often the best thing financially for retirees, since doing so increases their monthly benefits.

But what’s striking is a basic finding of the research. Individual decisions about the timing of an application to start up Social Security benefits depend simply on the order in which the person thinks about the benefits of his actions: those who first think about the advantages of claiming early – before they consider the advantages of claiming at a later age – prefer to claim early, and vice versa. That’s it!

This finding, which comes out of the Columbia Business School’s Center for Decision Sciences, complements one survey that found that close to half of all people contemplate their date of retirement for no more than 12 months. …Learn More

July 19, 2012

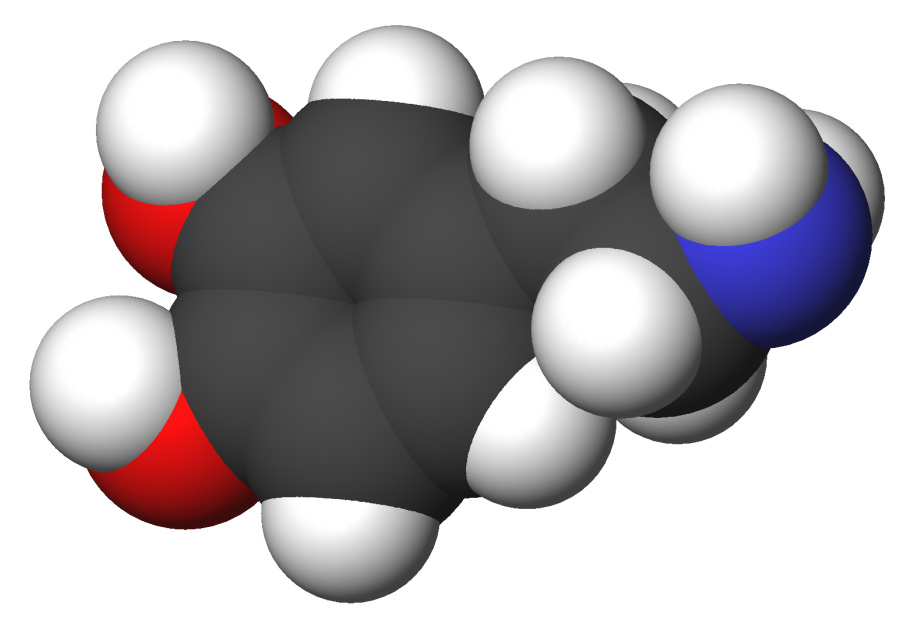

Discovery: Dopamine as ‘Risk Avoider’

Famously known as the brain’s “feel-good chemical,” dopamine is no longer associated only with thrilling activities: it can have the opposite effect.

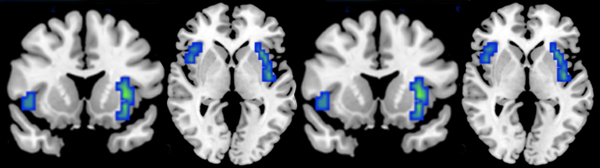

Past research has linked dopamine to risk-taking – it can explain the thrill of sky-diving or venturing out on the Grand Canyon’s glass-bottom walkway. But new research on the brain has uncovered dopamine’s role in the tendency of people to avoid risks. The new findings, by Harvard Medical School researcher Michael Treadway and colleagues at Vanderbilt University, have implications for all types of human behavior – including whether we’re willing to take financial risks.

Different people exhibit “different appetites for a certain amount of risk and how they experience risk and how gun shy they are,” Treadway said. This may depend on where the effects of dopamine take place in the brain.

That’s a dopamine molecule. We typically talk about financial behavior and psychology or use terms like motivation and decision making. The truth may be hard to grasp, but it all comes down to gooey chemical interactions in our gray matter. … Learn More

That’s a dopamine molecule. We typically talk about financial behavior and psychology or use terms like motivation and decision making. The truth may be hard to grasp, but it all comes down to gooey chemical interactions in our gray matter. … Learn More