Posts Tagged "retirement savings"

April 1, 2021

What the Research Can Tell us about Retiring

It’s difficult to envision what life will look like on the other side of the consequential decision to retire.

But research can help demystify what lies ahead – about the decision itself, the financial challenges, and even the taxes. Readers understand this, as evidenced by the most popular blog posts in the first three months of the year.

Here are the highlights:

The retirement decision. The article, “Retirement Ages Geared to Life Expectancy,” attracted the most reader traffic. Myriad considerations go into a decision to retire. But a sense of whether one might live a long time – because of good health or simply seeing that parents or neighbors are living unusually long – is a compelling reason to postpone retirement either to remain active or to build up one’s finances to fund a longer retirement.

A recent study found that as men’s life spans have increased, they have responded by remaining in the labor force longer, especially in areas of the country with strong job markets and more opportunity. This is also true, though to a lesser extent, for working women.

The planning. The second most popular blog was, “Big Picture Helps with Retirement Finances.” It described the success researchers have had with an online tool they designed, which shows older workers the impact on their retirement income of various decisions. When participants in the experiment selected when to start Social Security or how to withdraw 401(k) funds, the tool estimated their total retirement income. If they changed their minds, the income estimate would change.

The tool isn’t sold commercially. But it’s encouraging that researchers are looking for real-world solutions to the financial planning problem, since the insights from experiments like these often make their way into the online tools that are available to everyone.

The taxes. It’s common for a worker’s income to drop after retiring. So the good news shouldn’t be surprising in a study highlighted in a recent blog, “How Much Will Your Retirement Taxes Be?” Four out of five retired households pay little or no federal and state income taxes, the researchers found. But taxes are an important consideration for retirees who have saved substantial sums. …Learn More

January 30, 2020

A Cost in Retirement of No-Benefit Jobs

Only about one in four older Americans consistently work in a traditional employment arrangement throughout their 50s and early 60s. For the rest, their late careers are punctuated by jobs – freelancer, independent contractor, and even waitress – that do not have any health or retirement benefits.

Some older people are forced into these nontraditional jobs, while others choose them for the flexibility to set their own hours or telecommute. Whatever their reasons, they will eventually pay a price.

The Center for Retirement Research estimates their future retirement income will be as much as 26 percent lower, depending on how much time they have spent in a nontraditional job. During these stints, the issues are that they were not saving for retirement or accruing a pension and may have had to pay for health care out of their own pockets.

The researchers estimated the losses in retirement income to these workers by comparing them with people who have continuously been in traditional jobs with benefits. The workers in their analysis were between the ages of 50 and 62 and were grouped based on how their careers had progressed. The groups included people whose careers were primarily traditional but were interrupted by periods of nontraditional, no-benefit work, and people who spent most of their time in nontraditional jobs.

This last group lost the most: they had accrued 26 percent less retirement income by age 62 than the people who consistently held a traditional job. Who are these workers? They are a diverse mix that includes people who dropped out of high school and are marginally employed and people who are married to someone who is also employed and has benefits. …Learn More

December 12, 2019

Caregiving Disrupts Work, Finances

What do groceries, GPS trackers, and prescription drug copayments have in common?

They are some of the myriad items caregivers may end up paying for to help out an ailing parent or other family member. And these are just the incidentals.

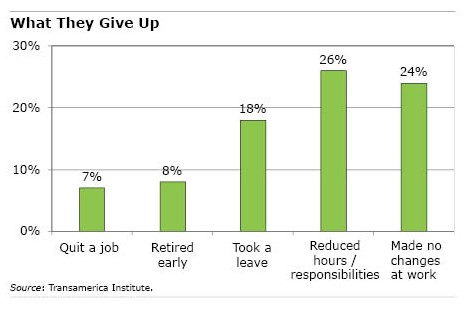

Three out of four caregivers have made changes to their jobs as a result of their caregiving responsibilities, whether going to flex time, working part-time, quitting altogether, or retiring early, according to a Transamerica Institute survey. To ease the financial toll, some caregivers dip into retirement savings or stop their 401(k) contributions. Not surprisingly, caregiving places the most strain on low-income families.

Three out of four caregivers have made changes to their jobs as a result of their caregiving responsibilities, whether going to flex time, working part-time, quitting altogether, or retiring early, according to a Transamerica Institute survey. To ease the financial toll, some caregivers dip into retirement savings or stop their 401(k) contributions. Not surprisingly, caregiving places the most strain on low-income families.

People choose to be caregivers because they feel it’s critically important to help a loved one, said Catherine Collinson, chief executive of the Transamerica Institute.

But, “There’s a cost associated with that and often people don’t think about it,” she said. “Caregiving is not only a huge commitment of time. It can also be a financial risk to the caregiver.”

The big message from Collinson and the other speakers at an MIT symposium last month was: employers and politicians need to acknowledge caregivers’ challenges and start finding effective ways to address them.

Liz O’Donnell was the poster child for disrupted work. As her family’s sole breadwinner, she cobbled together vacation days to care for her mother and father after they were diagnosed with terminal illnesses – ovarian cancer and Alzheimer’s disease – on the same day, July 1, 2014.

Her high-level job gave her the flexibility to work outside the office. But work suffered as she ran from place to place dealing with one urgent medical issue after another. She made business calls from the garden at a hospice, worked while she was at the hospital, and learned to tilt the camera for video conferences so coworkers wouldn’t know she was in her car.

“I felt so alone that summer,” said O’Donnell, who wrote a book about her experience. “We’ve got to do better, and I know we can do better.” …Learn More