Posts Tagged "retirement"

March 12, 2019

How Does Your Wealth Compare?

Depressing or eye-opening?

An online tool tells you where you stand financially by stacking up your net worth against other Americans.

The calculator compares a family’s net worth – financial and other assets minus debts – with all other U.S. families. Homeowners can choose to include the value of their home equity in their total net worth – or not.

Older people have had more time to accumulate wealth, so the rankings are based on the age of the household’s primary wage earner. The comparison is made with 2016 data from the Federal Reserve Board’s triennial Survey of Consumer Finances, which is the gold standard for personal financial data.

Since family – not individual – data are being compared, people who live alone are at a disadvantage. They will be measured against households with more than one person working and accumulating assets.

The calculator is on the DQYDJ financial blog written by a computer programmer and a financial professional. The validity of the results was confirmed by an economist formerly with the Center for Retirement Research, which sponsors this blog.

It might be fun to find out how you’re doing. But use this online tool at your own risk! …Learn More

February 21, 2019

High Drug Prices Erode Part D Coverage

Medicare Part D, passed in 2003, has significantly reduced seniors’ spending on prescription drugs. But the coverage hasn’t protected Leslie Ross from near calamity.

The 72-year-old diabetic needs insulin to stay alive. The prices of these drugs have skyrocketed, forcing her to supplement her long-lasting insulin, Lantus, with more frequent use of a less-expensive insulin. This one remains in her body only four hours, requiring more vigilance to control her blood sugar.

To cut her Lantus bills – nearly $1,700 this year – she has sometimes resorted to buying unused supplies from other diabetics on eBay. “You take your chances when you do stuff like that,” she said. “I checked that the vial hasn’t been opened. It still had the lavender cap on it.” She also reuses syringes.

The issue facing retirees like Ross is an erosion of financial protections under their Part D prescription drug coverage because of spiraling drug prices. New medications are hitting the market at very high initial prices, and the cost of older, once-affordable drugs increase year after year, said Juliette Cubanski, director of Medicare policy for the Henry J. Kaiser Family Foundation.

“A fundamental problem when it comes to people’s ability to afford their prescription drugs is the high prices charged for many of these medications,” she said.

Part D has no annual cap on how much retirees have to pay out of their own pockets for prescriptions. A new Kaiser report finds that retirees’ spending on specialty drugs – defined as costing more than $670 per month – can range from $2,700 to $16,500 per year. Specialty drugs include Lantus, Zepatier for hepatitis C, Humira for rheumatoid arthritis, and cancer drugs like Idhifa, which treats leukemia.

They “can be a real retirement savings drainer,” especially for very sick seniors, said Mary Johnson of the Seniors Citizens League, a non-profit advocacy group. …Learn More

February 19, 2019

Tweaking Social Security for the Future

Social Security remains as vital today as it was after its 1935 passage. But advocates for the nation’s most vulnerable retirees have proposed ways to enhance their benefits.

Consider the minimum benefit. Put on the books in the early 1970s, its goal was to prevent poverty among retirees who had worked for decades in low-paying jobs. The benefit’s value has diminished due to a design flaw that rendered it largely ineffective.

A recent policy brief by the Center for Retirement Research analyzed various modest proposals to increase the minimum benefit and improve low-income retirees’ financial security.

This brief was the last in a series on modernizing Social Security. The relatively low cost of these proposals, many of which have bipartisan support, could be offset by benefit reductions for less-vulnerable retirees. The House of Representatives is planning hearings later this year looking into ways benefits might be enhanced.

The following are synopses of the policy problems and proposals discussed in the other briefs and covered in previous blogs: …Learn More

February 14, 2019

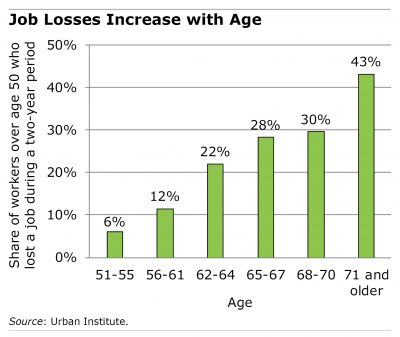

Careers Become Dicey After Age 50

A new study lays out all the difficulties older workers have holding onto a job so they can retire on their own terms – even when the economy is doing well.

Over the past quarter of a century, more than half of the older Americans who had been employed in stable jobs have been pushed or nudged out of employment at some point late in their careers. This could’ve happened due to a layoff, a bad supervisor, difficult or dangerous working conditions, inadequate pay or a missed promotion.

Over the past quarter of a century, more than half of the older Americans who had been employed in stable jobs have been pushed or nudged out of employment at some point late in their careers. This could’ve happened due to a layoff, a bad supervisor, difficult or dangerous working conditions, inadequate pay or a missed promotion.

This finding from a Urban Institute study throws into question “the notion that most seasoned workers who are strongly attached to the labor force can remain at work and earn a stable income until they choose to retire,” the researchers said.

The study details the many challenges older workers are dealing with: …Learn More

February 12, 2019

Check Out Our Retirement Podcasts

Thousands of baby boomers retire every day and sign up for Social Security. Yet the payroll tax that funds their benefits is being levied on a shrinking share of workers’ aggregate earnings.

You might not know this but inequality and growing U.S. trade with China are among the forces that are behind this trend, Gal Wettstein explains in a new podcast about his research for the Center for Retirement Research (CRR).

This is the latest in a series of podcast interviews in which CRR researchers talk about their work on issues related to work, aging, and retirement. The podcasts are hosted by yours truly.

Others explore how motherhood reduces women’s Social Security benefits, the limited impact of cognitive decline on older workers, and the disparate impact of the same retirement age on different types of workers.

The podcasts – “CRR essentials” – are available in iTunes and online on the Center’s website. …Learn More

February 7, 2019

Women’s Wealth Gap Exceeds Pay Gap

If the difference in men and women’s pay is a gap, then the wealth difference can only be described as a chasm.

Women earn 80 cents for each dollar a man earns. But a woman has 32 cents of net worth to a man’s dollar.

One byproduct of the #MeToo movement is the fresh light it has put on the age-old women’s issues of unequal professional status and pay. But Elena Chavez Quezada, senior director of the San Francisco Foundation, explains in this video that wealth – home equity and financial assets minus debts – provides a more accurate picture of financial stability over the long-term.

A 2018 report found that net worth for older women, adjusted for inflation, has actually declined over the past two decades.

“If we are going to build women’s economic security, we have to talk about income and wealth inequality,” said Quezada, whose foundation promotes economic security for women and minorities.

Of course, wealth can’t be separated from pay. Women are able to save less, because they earn less and are more likely to have part-time jobs. A smaller share of them have a retirement plan at work than men, and the typical female worker saves 6 percent of her pay, compared with 10 percent for men, according to the Transamerica Center for Retirement Studies.

Although single women have slightly higher rates of homeownership than single men, if a woman can’t afford as large a down payment as a man, she starts out with less home equity.

Older women of color saw the largest decline in their net worth, according to the 2018 report, which was conducted by the University of Pennsylvania’s School of Social Work and the non-profit Asset Funders Network. …Learn More

February 5, 2019

Oregon’s IRA Gets Workers to Save

Luke Huffstutter felt a great sense of relief when the employees of his Portland hair salon started putting money into a state retirement program designed to make saving easy.

This is much better than the “guilt” he felt over many years of desperate attempts – and not much luck – to convince his stylists and other employees to save on their own. He even brought in a financial adviser once to nudge them.

“I have a responsibility to provide them a path to retirement,” Huffstutter said.

Today, 39 of the Annastasia Salon’s 45 employees have joined some 22,000 others across the state of Oregon who’ve accumulated a total of $10 million for retirement through OregonSaves, a state government program being rolled out over time for residents who don’t have savings plans at work.

Oregon was the first state to introduce this type of program, and California, Connecticut, Illinois, and Maryland are following. New York may be next. Mayor Bill de Blasio is proposing a similar program, because more than half of working New Yorkers lack a retirement savings plan at work.

The absence of a retirement plan is a particular problem at small firms, which often lack the money or staff to set up the 401(k) plans common at major employers. OregonSaves, which is mandatory for employers, provides a very low-cost way to automatically enroll workers and send their payroll deductions to personal IRA accounts.

The main stumbling block appears to be that not everyone is as enthusiastic as Huffstutter. Some employers are taking a very long time – more than six months – to set up the payroll deductions, and others that enrolled are showing lower participation rates than the salon. …Learn More